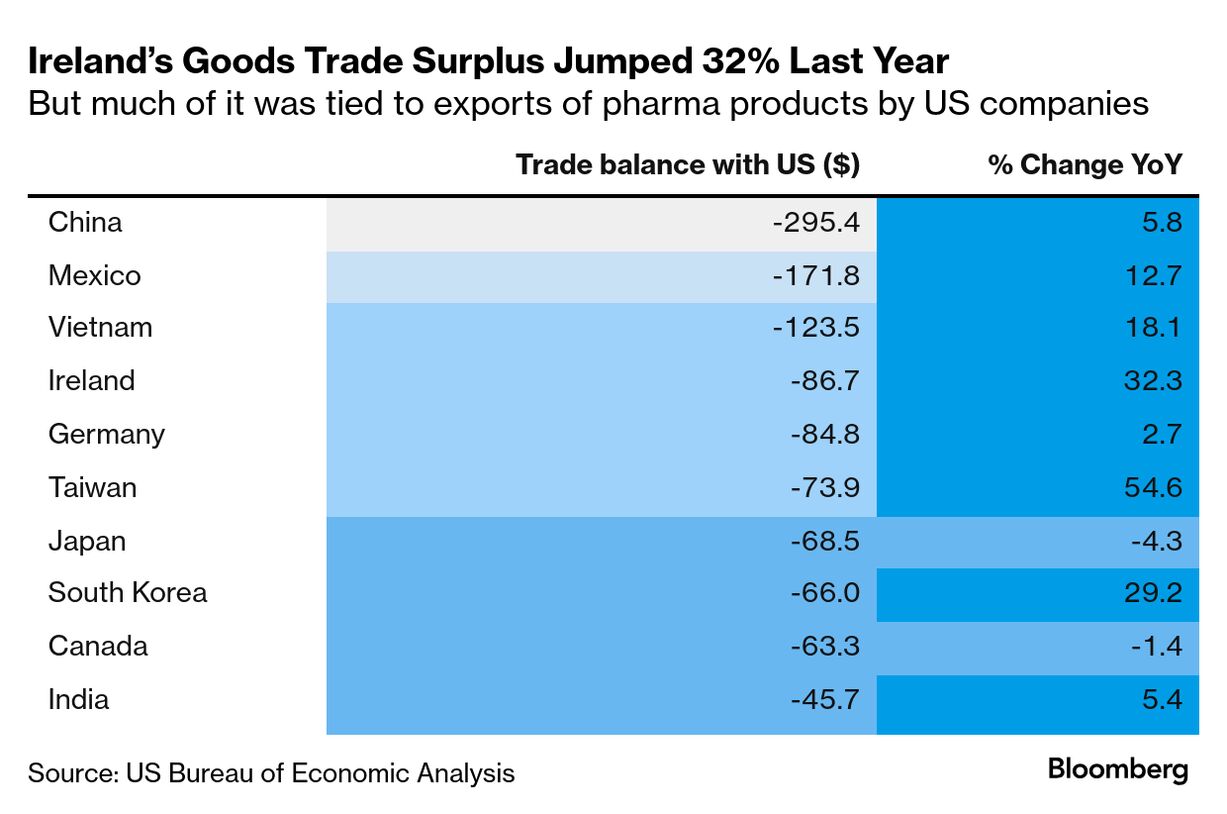

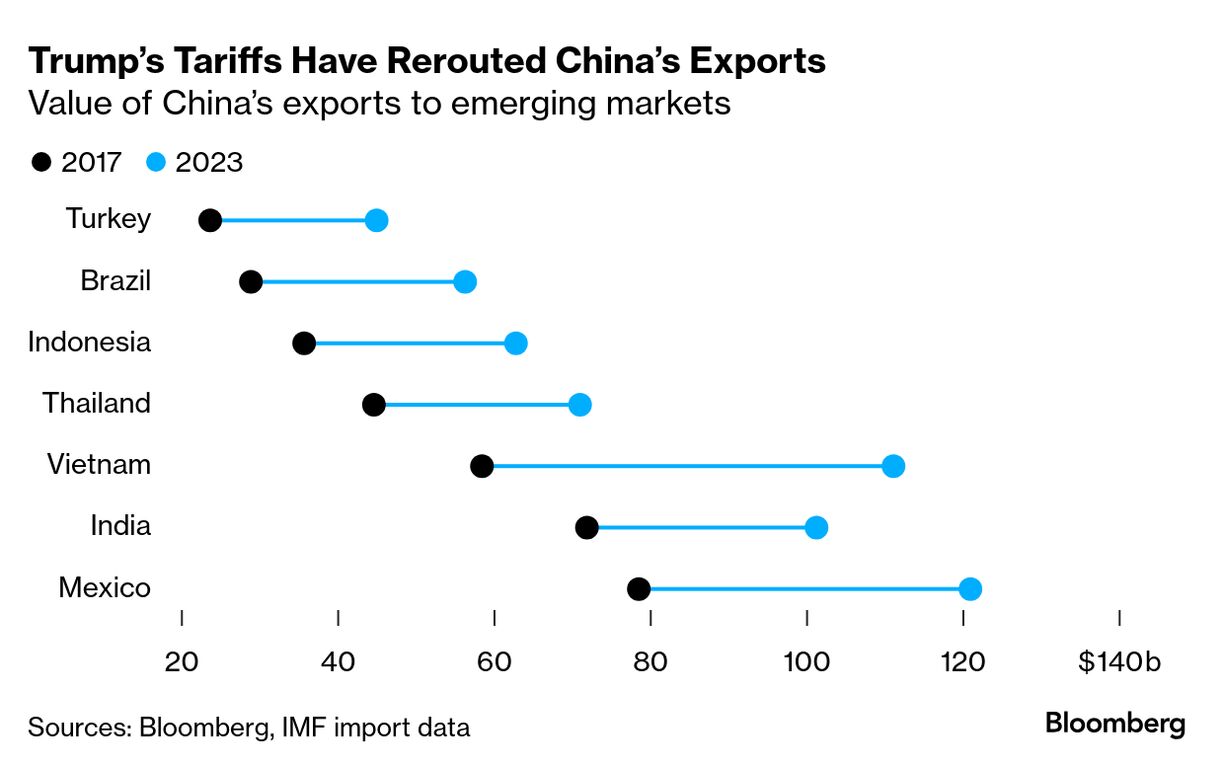

| President Donald Trump has made it very clear he wants to change "unfair" trade balances, singling out countries with which the US maintains wide deficits. So it was only a matter of time before one of Europe's biggest imbalances and a relative newcomer atop the list caught his attention. Ireland's trade surplus with the US is one of the largest of any member of European Union. Buoyed by pharmaceuticals, Ireland exported €72.6 billion worth of goods to the US last year, up 34% on 2023, according to statistics office estimates. That adds up to a trade surplus in goods of €50.1 billion. Playing an outsized role in those exports is the harbor town of Kinsale, but it's no longer a port and garrison for trade battles waged by navies centuries ago. It is home to a sprawling campus where Eli Lilly produces an active ingredient for its blockbuster Mounjaro and Zepbound drugs. What's made in Kinsale goes to the US for a second step, before being sent to one of two further US facilities for finishing, boosting Ireland's exports to the US. (Read the full story here.) "This beautiful island of 5 million people has got the entire US pharmaceutical industry in its grasp," Trump said at a White House meeting with Irish Prime Minister Micheal Martin for the annual Irish government visit to the White House for St Patrick's Day last week. While saying he "does not want to do anything to hurt Ireland," Trump insisted that the trade relationship must be based on "fairness." US Outreach To help spread the word about the mutual benefits of transatlantic commercial harmony, a group of Irish politicians and business people spent much of last week around St Patrick's Day in the US participating in a key sector for services trade: business tourism. Read More: EU Open to Talks With Trump on Tariffs, Ireland's Harris Says In the US state of Georgia, local leaders from Wexford in southeastern Ireland met a week ago with officials at the Port of Savannah. It's run by the Georgia Ports Authority, which also oversees the Port of Brunswick, one of the nation's busiest gateways for autos and heavy industrial vehicles. Trump is threatening higher tariffs on US car imports. With a €94 million expansion finished in 2022, Ireland's Port of Cork is reaching markets for pharmaceuticals and other products shipped to North Carolina and to Indiana, where Eli Lilly is based. Ireland is currently Indiana's largest import source, with shipments valued at $20.9 billion, according to Conor Mowlds, chief commercial officer at the Port of Cork.  An Irish delegation at the Port of Savannah last week/Source: Georgia Ports Authority Source: Georgia Ports Authority Yet Ireland's well-honed strategy of relying on the soft power of personal engagement and the large diaspora in the US is unlikely to shield it. Ireland's economy is built — and thrives — upon its attractiveness to US multinationals, playing host to the European headquarters of companies including Apple, Salesforce and Intel. Read More: Ireland's Outlook Raised to Positive by S&P on Tax Receipts If Washington slaps broader levies on EU goods of even 10%, which is at the lower end of the spectrum floated, they would still have an impact and the country's central bank has revised its economic outlook down citing an unprecedented rise in geopolitical uncertainty. - On the new episode of the Trumponomics podcast: Bloomberg Economics Chief Economist Tom Orlik explains the Trump administration is possibly more strategic than it seems. He offers historical perspective on Trump's moves and says the bumpy road may take the economy to a better long-term destination. Listen on Apple, Spotify, or wherever you get your podcasts.

—Jennifer Duggan in Dublin Click here for more of Bloomberg.com's most-read stories about trade, supply chains and shipping. |

No comments:

Post a Comment