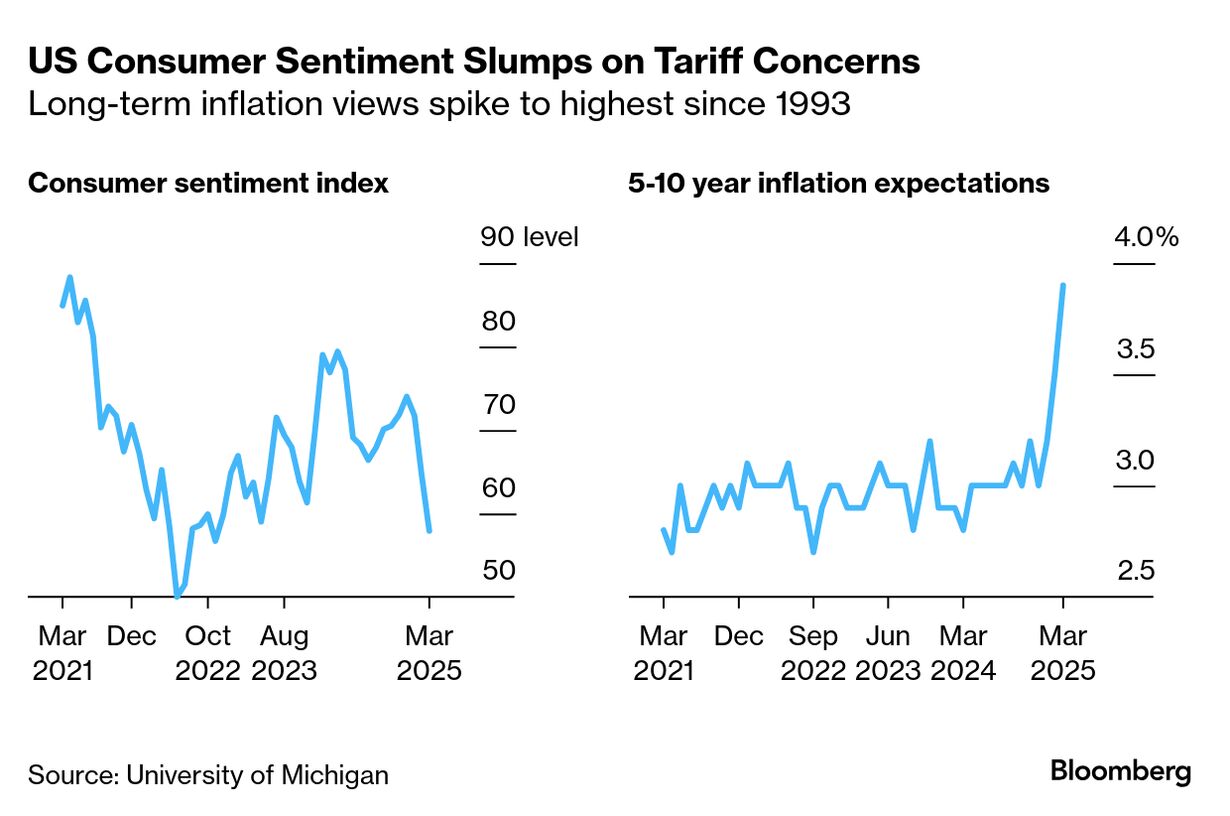

| Here's a question for you to ponder as we count down to more tariffs and what President Donald Trump has called "Liberation Day" April 2: Is the US economy good at innovation? It's a question that isn't as unrelated to tariffs as you may think. It's also one that helps explain why anyone hoping Trump may temper the broad swathe of tariffs he has promised should revisit their assumptions. As Bloomberg colleague Josh Wingrove first reported over the weekend, the White House is refining the targets of his so-called "reciprocal" tariffs and putting sectoral duties on autos, semiconductors and other industries on hold for a bit. That doesn't mean those tariffs coming April 2 won't be significant. Of the $317 billion of goods imported by the US in January, $251 billion, or 79%, came from just the top 15 countries, according to Census data. Which means even a refined set of targets would have a much broader economic impact than those rolled out already, which caused the Federal Reserve to downgrade US growth expectations last week. We're also learning more about the stated purpose of Trump's tariffs. Which matters for how long they will be in place and how disruptive they will be. And this is where innovation comes into play. Read More: Trump Plans His Tariff 'Liberation Day' With More Targeted Push For a long time the argument from some Trump advisers and those eager to tamp down concerns over the potential disruptive impact of the duties has been that they are just meant as leverage in negotiations. But that Art of the Deal argument is fading as it becomes increasingly clear the Trump administration really is pursuing significant structural changes in the US economy. Innovation Capacity In a speech last week to venture capital firm Andreessen Horowitz's "American Dynamism Summit," Vice President JD Vance argued the whole point of repatriating manufacturing isn't just to create jobs, it's to bring back the capacity to innovate. "Real innovation makes us more productive," Vance said. "It boosts our standard of living. It strengthens our workforce and the relative value of its labor." The speech didn't get very much attention beyond social media. But it's worth reading in full. Vance's key point is that the offshoring of production has threatened America's lead in innovation. Which, he said, has also been undermined by companies chasing cheap labor and locating factories overseas. Cheap labor is "a drug that too many American firms got addicted to" and "if you can make a product more cheaply, it's far too easy to do that rather than to innovate." Read More: China Says It's Prepared for Shocks as US Tariffs Loom In Vance's telling the goal of tariffs – alongside tax breaks and deregulation – is to encourage companies to bring not just production but innovation home. Which does not bode well for anyone betting on short-term tariffs since for that mix to work you would have to make higher costs of importing a permanent fixture. Plenty of economists and CEOs would tell you that throwing up a tariff wall wouldn't just threaten the model innovative companies like Apple have honed over decades. It would cut off the US from access to vital components and machinery. There are other significant questions about Vance's argument. As Bloomberg's Stephanie Flanders pointed out in a social media post over the weekend "the talk of massive government support for innovation rings a little hollow when DOGE is defunding basic research." Then there is the Trump crackdown on immigration, which has long brought innovators and entrepreneurs to the US, including Elon Musk for what it's worth. But set all that aside. Has the offshoring of manufacturing really been bad for innovation in America? US Ranks Third The World Intellectual Property Organization ranked the US third on its 2024 global innovation index. China, for all its manufacturing might, came in 11th. Yes, there are signs that China is learning to innovate. But even Vance in his speech hailed the US's lead in AI and other tech spheres. The truth remains many of China's breakthroughs amount to signs it is catching up with the US rather than running away with it. And does producing something in the US really bolster innovation? Chip giant Nvidia and Musk's SpaceX both qualify as among the world's most innovative companies and both are led by immigrant CEO founders. But there is a key difference. Most of Nvidia's chips are manufactured overseas. SpaceX's rockets, including the capsule that brought home two stranded astronauts last week, are made in America. Is one a better reflection of US innovation than the other? Or perhaps more pertinently this week: Would tariffs make either company more likely to innovate now or in the future? Related Reading: —Shawn Donnan in Washington Click here for more of Bloomberg.com's most-read stories about trade, supply chains and shipping. Bloomberg's tariff tracker follows all the twists and turns of global trade wars. |

No comments:

Post a Comment