| Bloomberg Evening Briefing Americas |

| |

| Stocks whipped around today thanks to some wild new tariff threats and reversals from Donald Trump. But when markets closed, the color on the board was still red as investors continued to flee equities amid growing uncertainty over the US president's economic broadsides. Trump sent out an all caps post on social media threatening Canada with even bigger steel tariffs than the ones he threatened last week, but then promptly started backpedaling after Ontario announced it would suspend a largely symbolic 25% surcharge on electricity sent to the US.  Canada's Mark Carney speaks after being elected as the new Liberal Party leader on March 9. Photographer: Dave Chan/AFP Trump has a series of tariff threats and counter-threats pending against America's neighbor to the north, some supposedly set to take effect tomorrow, others contingent on Canada reversing its own retaliatory levies. For its part, Canada said it will keep its trade retaliation in place until the US lifts its own tariffs and commits to free trade. This from Mark Carney, who will succeed Justin Trudeau as Canada's prime minister within days. But the latest tariff drama also sent the Canadian dollar to a weekly low before once again rising. And while some experts increased the odds Trump will bring an end to America's post-pandemic success story, the US isn't the only country looking at a potential recession. With the trade war threatening to send its economy into a downturn, the Bank of Canada is likely to cut interest rates tomorrow for a seventh straight meeting. —Jordan Parker Erb and David E. Rovella | |

What You Need to Know Today | |

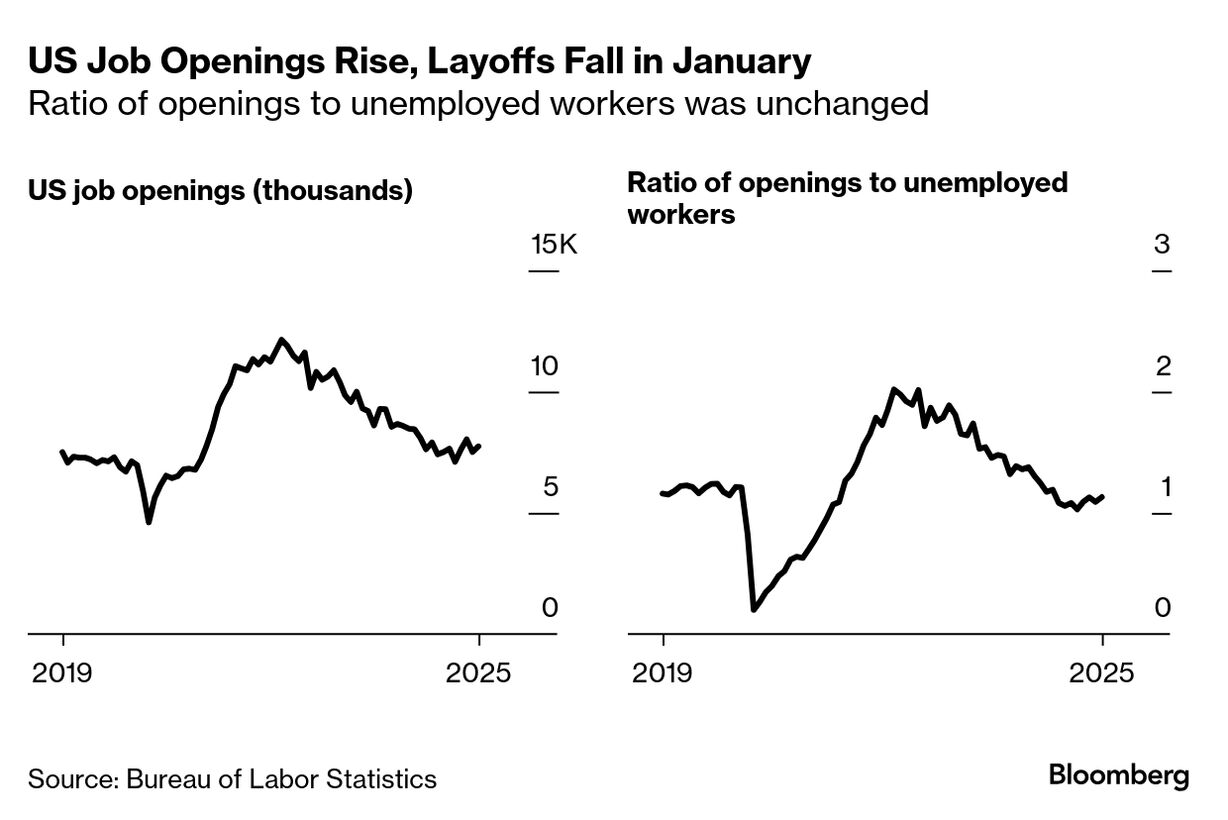

| US job openings rose in January while firings fell and people quitting picked up, a rare bit of good economic data amid a recent sea of bad tidings. Available positions increased to 7.74 million from a revised 7.51 million reading in December, according to the US government's Bureau of Labor Statistics. Job openings remain above pre-pandemic averages despite a downward trend over the last three years, suggesting employers are still looking to hire. The so-called quits rate, on the other hand, which measures the percentage of people voluntarily leaving their jobs each month, rose to 2.1%—the highest since July. | |

|

| But worries about corporate credit defaults rose in the US for a second straight day on Tuesday. In derivatives markets, the cost of protecting corporate credit against default rose to some of the highest levels in nearly seven months. The spread on the Markit CDX North American Investment Grade Index widened as much as 2.4 basis points to its highest reading since mid-August. In junk, the Markit CDX North American High Yield Index, which falls as credit risk rises, declined as much as 0.45 point Tuesday to its lowest on an intraday basis since August. "A lack of certainty around tariffs alongside concerns around growth have caused investor angst," said Blair Shwedo, head of fixed income sales and trading at U.S. Bank. | |

| |

|

| As Trump's tariff wars risk driving the US economy south, and with House Republicans largely unwavering in their fealty to the 78-year-old president, Democrats sought to put GOP members on record with a very uncomfortable vote. House Republicans however weren't too keen and managed to block the effort, since a vote on Trump's tariffs would have been politically difficult, to say the least. Voting against them would have put GOP lawmakers at odds with the president, his far-right base and of course Elon Musk, who has threatened to use his billions to primary Republicans who step out of line. Meanwhile voting for the tariffs would have forced House Republicans, with their four-vote majority, to shoulder blame for the economic fallout. Not to vote at all seems to have been the consensus. But now, we're moving on to brand new fight over a government shutdown. | |

|

| |

|

| After the White House cut off its military aid, satellite and some intelligence access, Ukraine buckled to Trump's demands that it accept a US proposal for a 30-day truce in Russia's war. Trump, who has expressed a desire to end the conflict largely on Kremlin terms, including by forcing a democratic Ukraine to give up territory to an authoritarian Russia, will now go to Vladimir Putin for his agreement. But the Russian leader has made deliberately "maximalist" demands ahead of negotiations. Putin, who in 2022 launched his full-scale invasion in a botched effort to take all of Ukraine, is said to likely know Trump's terms will be unacceptable to Ukrainians and other Europeans. | |

|

| It's not just tariffs that are coming between the US and Canada. Trump has additional plans to put more daylight between the two former friends. Indeed, his administration is preparing rules to make life much more difficult for Canadian visitors. A draft rule, which is set to take effect April 11, could force Canadians planning to stay in the country for more than 30 days to register with the US government and submit to fingerprinting. Affected people would have to create an account with US Citizenship and Immigration Services and schedule an appointment as part of a background check. But it may be a moot point, since Canadians apparently don't want to visit America much anymore. | |

|

| |

What You'll Need to Know Tomorrow | |

| |

| |

| |

| Enjoying Evening Briefing Americas? Get more news and analysis with our regional editions for Asia and Europe. Check out these newsletters, too: Explore all newsletters at Bloomberg.com. | |

| |

Like getting this newsletter? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and subscriber-only insights. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Evening Briefing: Americas newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment