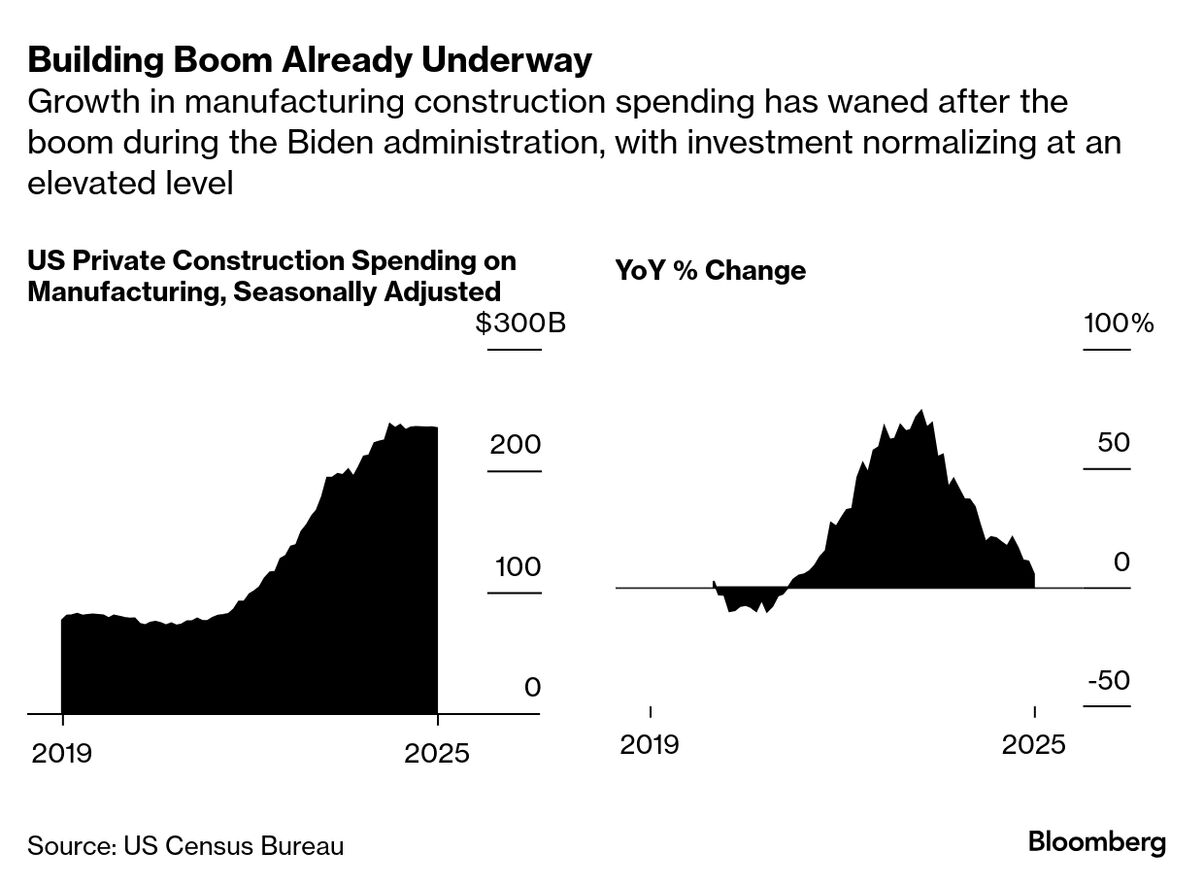

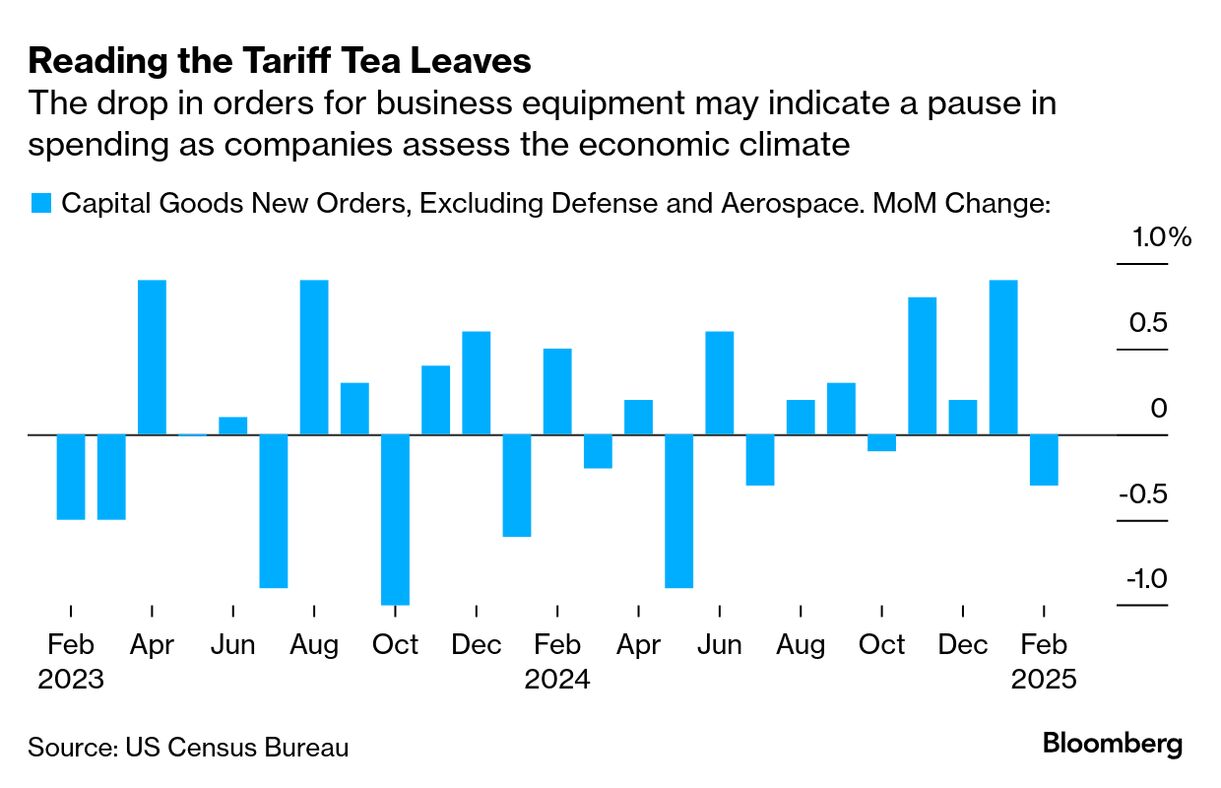

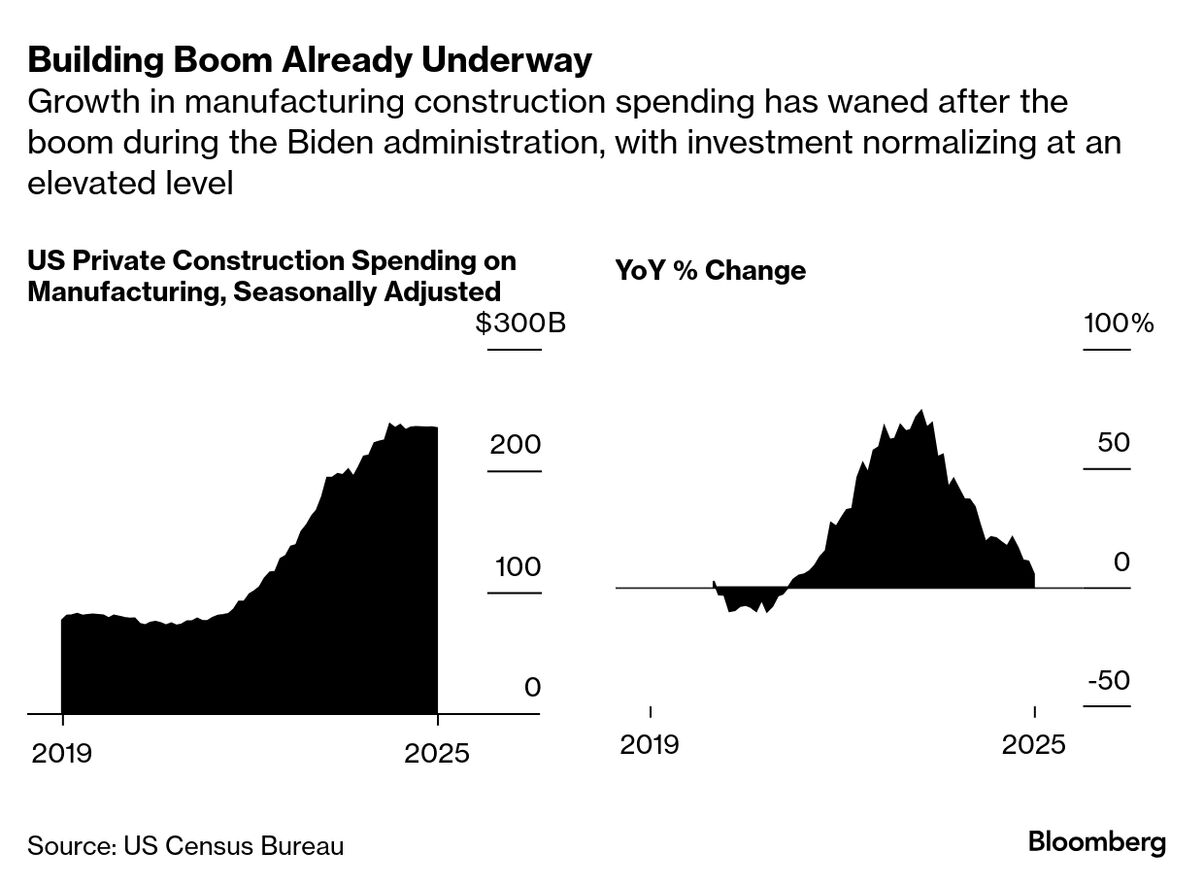

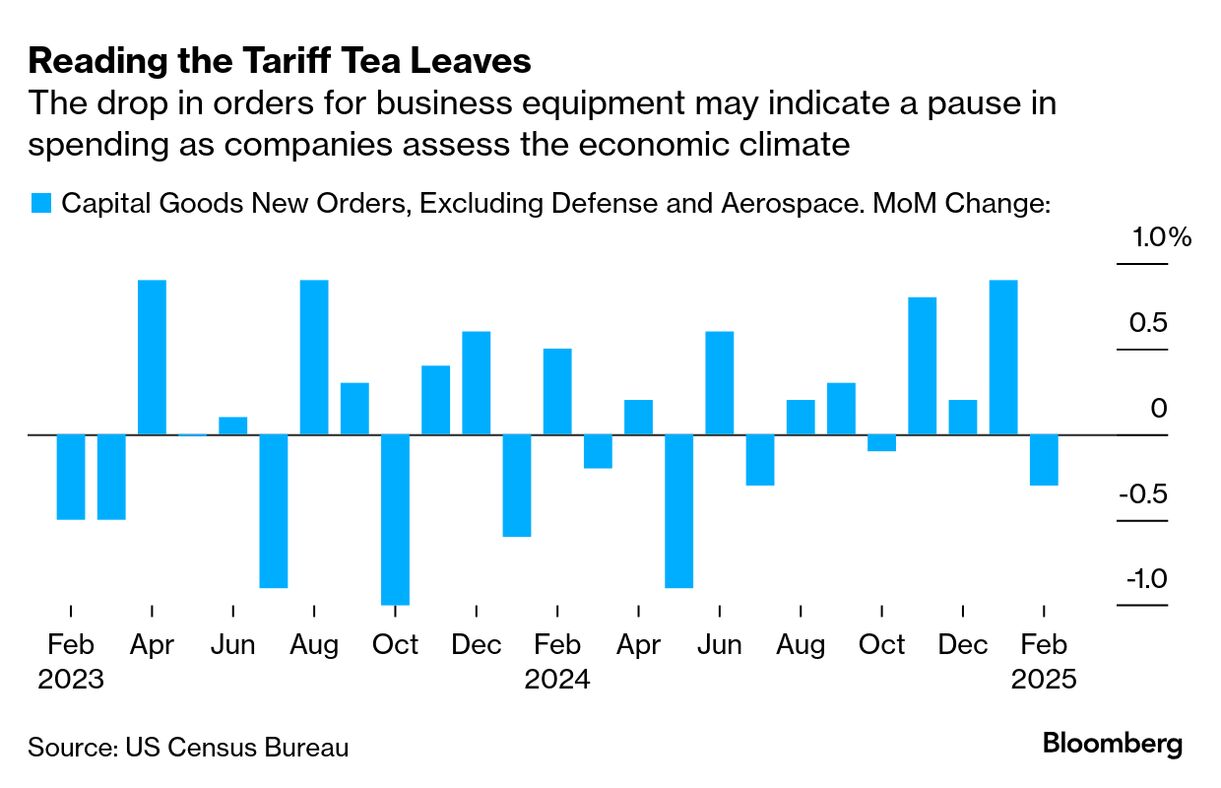

| Have thoughts or feedback? Anything I missed this week? Email me at bsutherland7@bloomberg.net. To get Industrial Strength delivered directly to your inbox, sign up here. Industrial companies are still spending, but they're primarily doing so in spite of tariffs — not because of them. Schneider Electric SE this week announced more than $700 million of planned new investments in the US, including expanding existing electrical equipment manufacturing sites in Tennessee, Texas and Missouri and opening new research centers for AI power systems and robotics in Massachusetts and North Carolina, respectfully. This follows investment announcements from GE Aerospace, GE Vernova Inc., Eaton Corp. and ABB Ltd. this year that range from about $100 million to $1 billion and involve expanding and retrofitting existing sites and building some new ones in Tennessee and South Carolina. What these investments have in common is that they are happening in response to growth opportunities in the US market — particularly the boom in data-center construction and surging demand for electrical equipment that still far outpaces available supplies. In other words, this spending is still not about uprooting factories from elsewhere in the world and plopping them down in America's heartland, and it's not about making more products in the US at the expense of other jurisdictions. Read more: Why Build a New Factory in US? Not Politics "There's clearly a fair degree of policy uncertainty but if you try and look through that and say, 'Do we still think that the data-center investments are going to continue? We do,'" Aamir Paul, president of Schneider Electric's North American operations, said in an interview. "We had flat load growth of electricity demand for decades and now we're growing pretty substantially" and the company is making investments to keep up, he said. Many of these trends and the broad strokes of Schneider's investment priorities were featured at its investor presentation in November 2023, "so we're really just executing that strategy," Paul said. Like most electrical equipment companies, Schneider relies on a network of facilities in Mexico to help supply the US market and it's not yet making any changes to that setup, he said. "Like everybody, we're looking for clarity," Paul said. There is some rewiring of supply chains happening: Hyundai Motor Co. pledged to spend $6 billion on a new steel plant in Louisiana and other projects related to automotive parts and materials, while committing another $9 billion to expand its vehicle production capacity in the US. President Donald Trump hailed the investment as a sign that his tariffs are working and encouraging companies to center more of their manufacturing operations around America. But growth in overall US private construction spending on manufacturing has flatlined from the boom seen under the Biden administration, which preferred to motivate American investment through the carrot of various stimulus programs rather than the stick of tariffs.  It's still wildly unclear which of the many tariffs the Trump administration has promised will be implemented in a lasting fashion and which are simply negotiating tools. So far, all imports from China are subject to 20% tariffs, while steel and aluminum sourced from outside of the US are taxed at a 25% rate. Trump imposed 25% tariffs on Canadian and Mexican imports earlier this month and then delayed them for goods, including cars, that comply with the current trade deal with those countries. On Wednesday, he ordered broad 25% tariffs on fully assembled cars starting next week, with levies on major automobile parts such as engines, transmissions and electrical systems kicking in later. The tariffs will be on top of levies already in place. Read more: Factory Recovery Wobbles on Tariff Whiplash Trump is separately set to announce a sliding scale of so-called reciprocal tariffs — or levies on countries that tax US imports — on April 2, but he's also indicated they may be watered down for some trading partners. Copper tariffs could also be coming earlier than anticipated, Bloomberg News reported. Amid the uncertainty, orders placed with US factories for business equipment unexpectedly declined in February, according to Commerce Department data. The value of core capital goods orders, a benchmark that excludes the volatile aerospace and defense industries, fell 0.3% last month, the first decline since October, compared to expectations for 0.2% growth. The drop signals some companies may be holding off on investments as they wait for more clarity on tariffs and geopolitical policy.

Any revival of US manufacturing will naturally entail automation investments as companies attempt to navigate a persistent shortage of skilled workers and keep costs low. "We're going to have some permutation of a labor shortage depending on different policy conditions. And frankly, to be competitive, we're going to have to have more automation," Paul of Schneider Electric said. Hence the robotics research facility that the company is building in North Carolina. Still, "there's no doubt short term, there's a lot of noise in the system," he said.

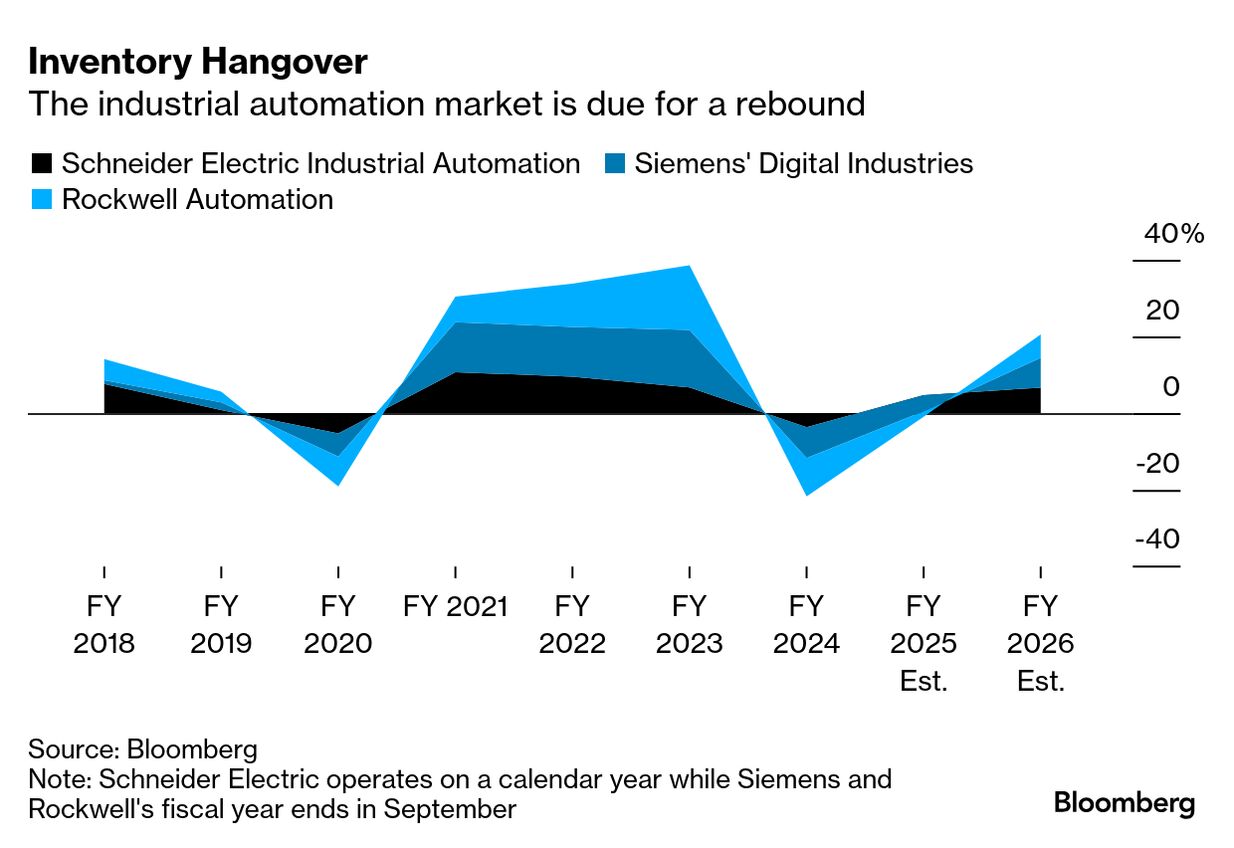

The automation market is still recovering from an inventory glut built up during the supply-chain snarls of the pandemic. There's no material upswing in demand in the US just yet that would indicate a particular reshoring boom linked to Trump's aggressive trade policy.

The tariff back-and-forth doesn't encourage companies "to pull the trigger for investments," Roland Busch, chief executive officer of Siemens AG, which sells both automation technologies and electrical equipment for data centers, said in an interview. Companies may hold back on spending "for another couple of weeks or months in order to see how that whole thing settles," even if longer-term it's clear that the new administration is seeking to bring certain manufacturing work back to the US, he said. While Siemens is seeing signs of a recovery in the digital industries arm that houses its automation business, it's not expecting the process to be linear, Busch said. The company announced earlier this month that it would cut about 5,600 jobs in its digital industries division amid muted demand in Germany and China. Siemens has made its own investments in the US: It has spent nearly $700 million over the past several years to bolster its US manufacturing capacity, including new or expanded facilities in Texas, California, North Carolina and upstate New York to support its electrical equipment and railcar businesses. The US is "an industrial market where we want to do more," Busch said. While more than 85% of its US supply chain has been localized, the company still imports about $2 billion of goods into America, including from Mexico and Europe. But the biggest risk for Siemens is that tariffs fuel inflation and trigger a broader economic slowdown. Already, consumer companies including the biggest US airlines, Best Buy Co. and Walmart Inc. have warned of a pullback in demand. It's too early to seriously worry about the economy, and there may be offsets including Germany's plans to ramp up spending on defense and infrastructure, Busch said. But if the demand slowdown gains momentum, then companies will really have a reason to reconsider their investments, he said.  | | | While takeover activity broadly is off to a slower-than-expected start this year, one corner of the market is proving relatively strong: industrial deals. Acquisition announcements involving industrial assets and at least one US company have totaled more than $80 billion so far this year, the strongest first-quarter showing since 2021, according to data compiled by Bloomberg. About a fifth of that total volume comes from just one deal: a BlackRock Inc.-led consortium's $19 billion agreement to buy the bulk of CK Hutchison Holdings Ltd.'s port operations, including key outposts near the Panama Canal that have attracted scrutiny from the Trump administration. But even absent that transaction, it's still the most robust first quarter for industrial dealmaking in four years. Read more: Trump Merger Mania Gets Off to a Slow Start Most of the other transactions haven't been that big but they add up, including Herc Holdings Inc.'s $5.6 billion takeover of machinery lessor H&E Equipment Services Inc., Honeywell International Inc.'s $2.2 billion acquisition of pump and compressor maker Sundyne and Eaton Corp.'s $1.4 billion acquisition of electrical enclosure company Fibrebond Corp.

Siemens this week closed its $10 billion acquisition of industrial software maker Altair Engineering Inc., several months ahead of schedule. Siemens continues to look for other acquisition opportunities, particularly in industrial software but also in connected hardware that creates data and would allow the company to further advance its strategy of linking the real and digital worlds, Busch said. Read more: Siemens Ties Factory Past to Digital Future Another $10 billion deal is unlikely in the short term but Siemens could look at acquisitions on the scale of "a couple of billions," he said. The company has plenty of financial firepower and the benefit of a majority stake in its Siemens Healthineers AG spinoff that it could further whittle down to help fund a transaction, he said. Deals, Activists and Corporate Governance | Azek Co., a maker of lower-maintenance outdoor deck products, agreed to sell itself to building materials company James Hardie Industries Plc. When it was announced, the cash-and-stock deal valued Azek at about $8.75 billion, including the assumption of debt. The implied value of the equity component has shrunk materially since then, however, as James Hardie investors question the logic of the takeover, with the acquirer's Australian-traded shares down more than 15% this week. Interestingly, analysts who cover James Hardie have said the deal's price tag — which implies a more than 35% premium — is too rich, while those who cover Azek have said the company could have asked for even more, based on its projected profit growth. The divergence reflects concerns about James Hardie's ability to integrate what will be by far its biggest acquisition and to realize the revenue and cost benefits it's targeting, especially as tariffs and high interest rates weigh on the US housing market.

Roper Technologies Inc. agreed to acquire CentralReach, which provides software for behavioral health therapists, for $1.65 billion, including a $200 million tax benefit. CentralReach's platform includes electronic medical records, client set-up and scheduling tools and claims management software. It's exactly the kind of niche application with little competition and high profit margins that Roper has preferred in its serial hunt for software acquisitions. The company, once primarily a pump-and-valve maker, has remade itself as a software specialist through a steady diet of deals and divestitures. Roper expects the CentralReach business to sustainably grow its revenue and profits at an annual rate of more than 20%. The purchase price works out to about 22 times CentralReach's expected earnings before interest, taxes, depreciation and amortization for the year ending June 30, 2026. Boeing Co. is set to stand trial on June 23 in a criminal case related to the two fatal crashes of its 737 Max jet after a surprise decision by a federal judge to accelerate the proceedings. Boeing reached a controversial agreement with the Justice Department in 2021 to defer prosecution on charges that it conspired to defraud the US by deceiving aviation regulators about certain characteristics of the Max jet. After a mid-air blowout of an auxiliary door on an Alaska Airlines flight last year, the Justice Department decided that Boeing had violated the agreement. Boeing then agreed to plead guilty to the charge, pay a fine, install a corporate monitor and invest in safety programs. That deal was thrown out by US District Judge Reed O'Connor over a provision that called for the monitor to be selected with an eye toward the government's diversity and inclusion commitments, which are now being eradicated by the Trump administration. Boeing was seeking to withdraw its guilty plea with the expectation that the current administration would take a more lenient approach, the Wall Street Journal had reported ahead of the trial date announcement, citing people familiar with the matter. |

No comments:

Post a Comment