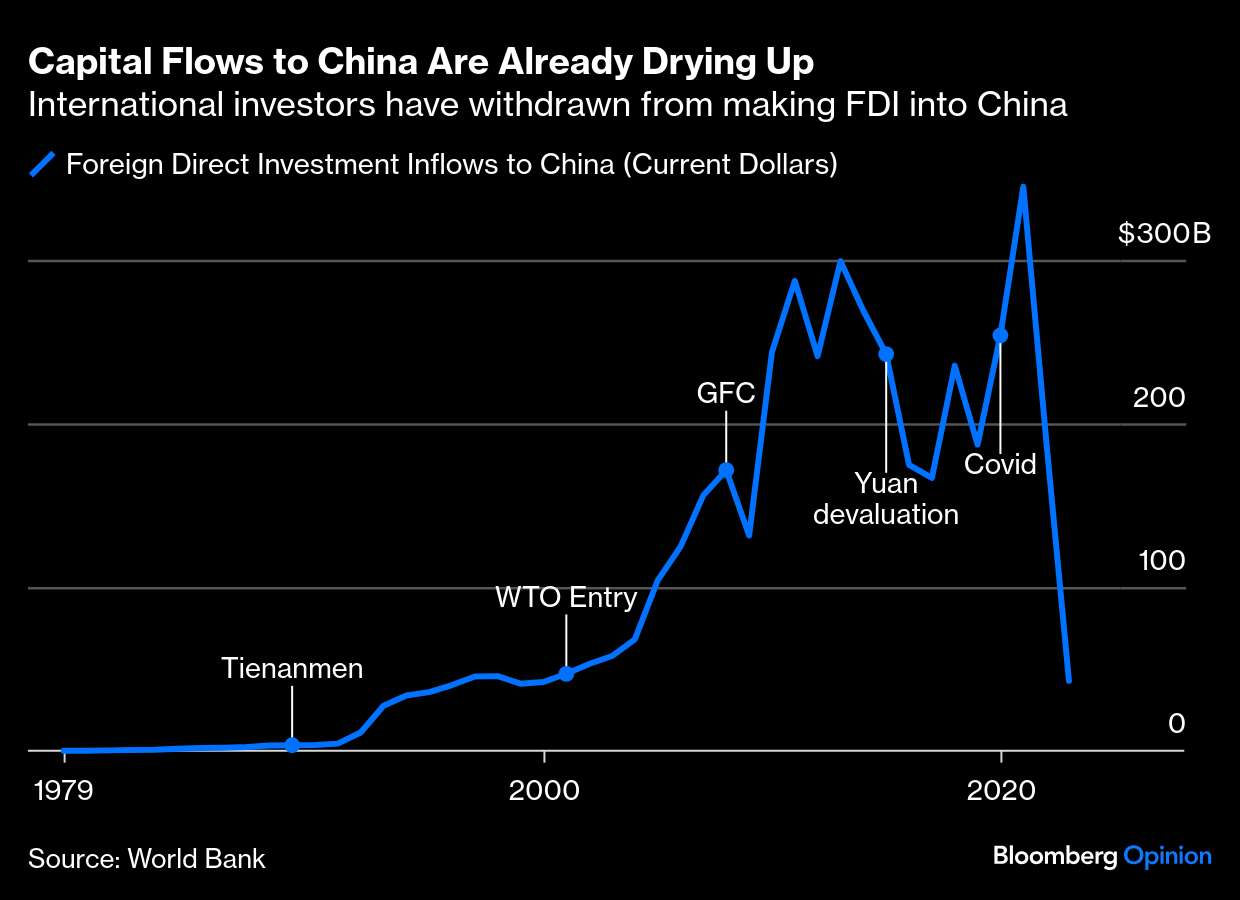

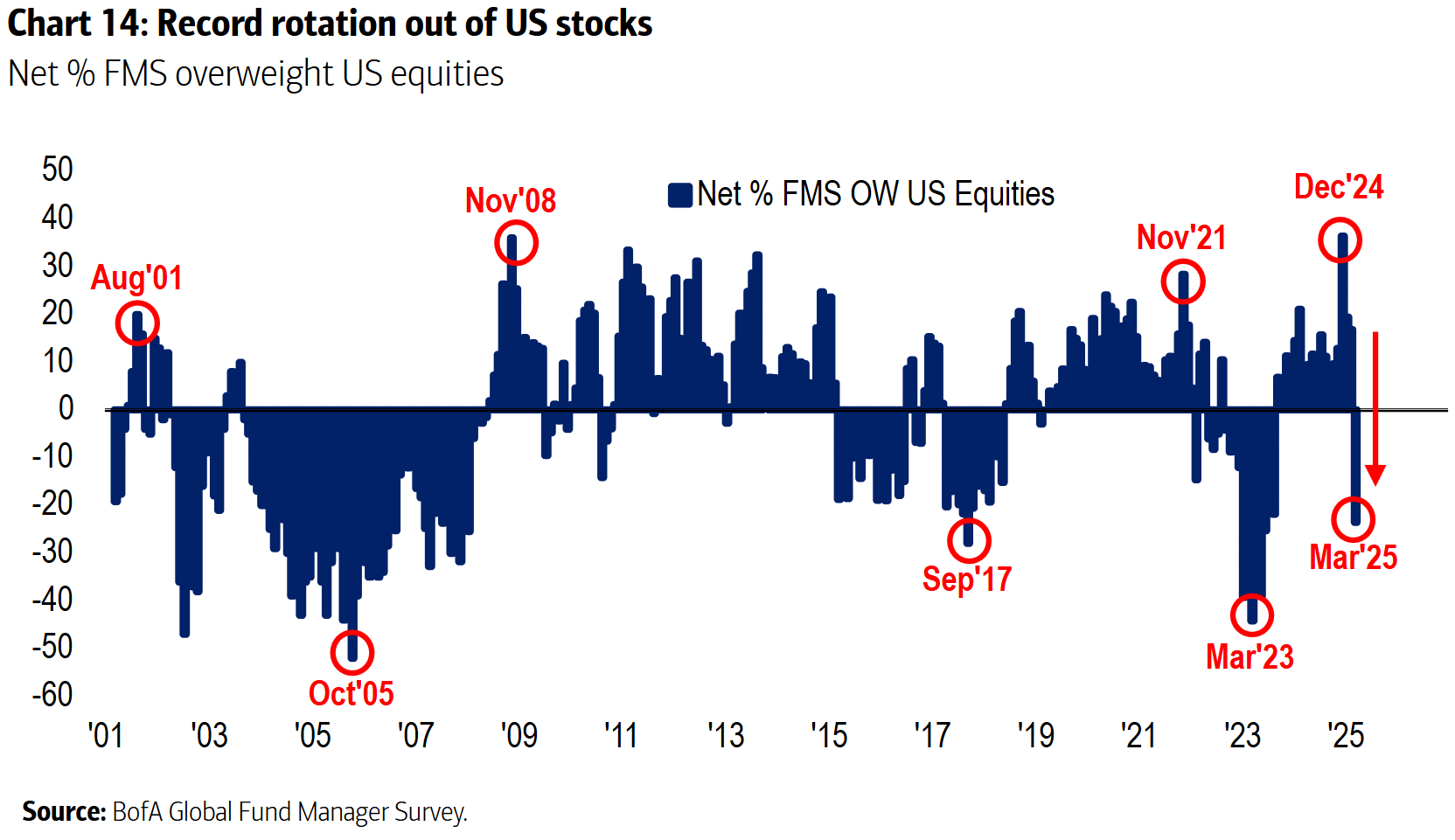

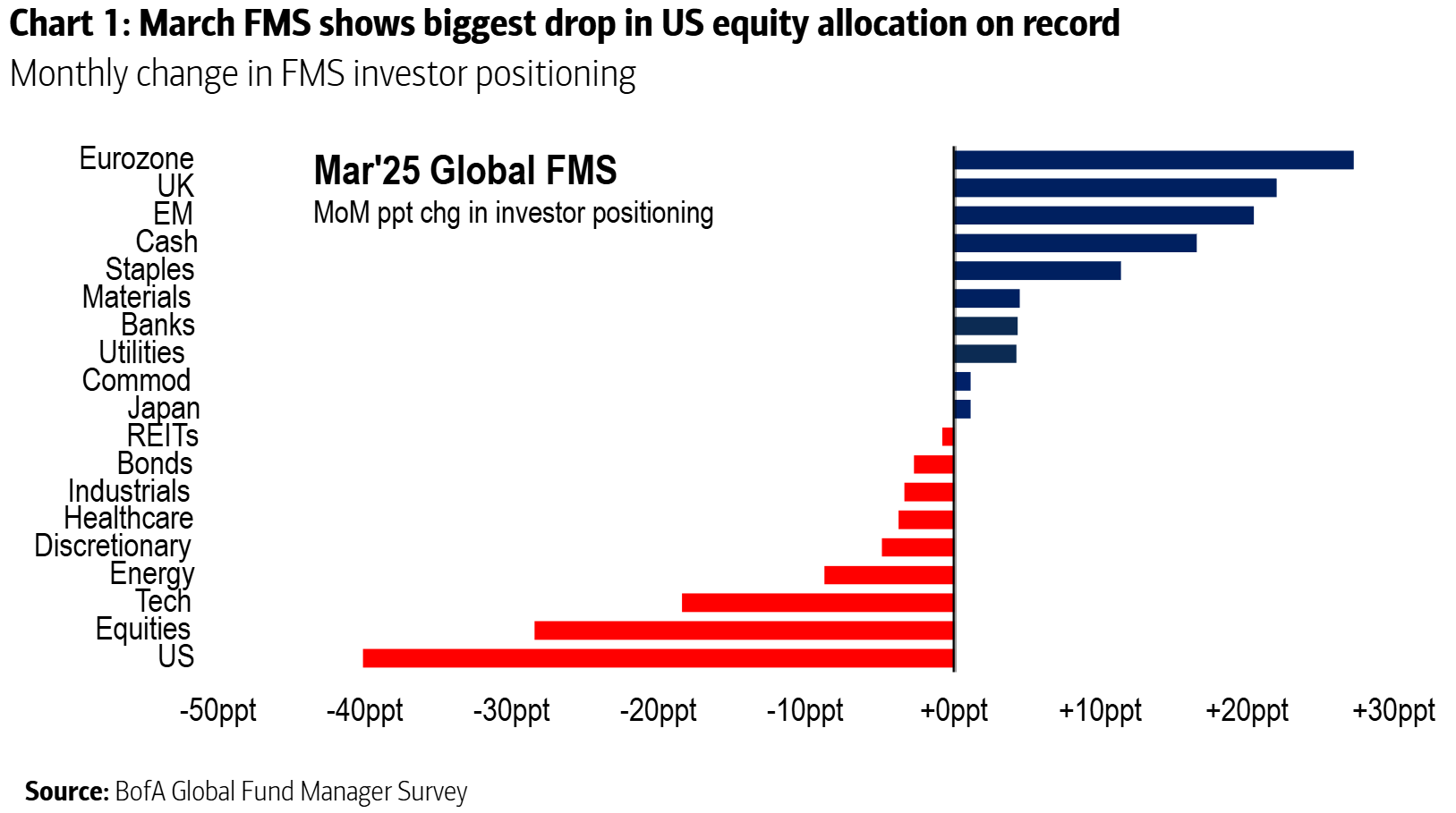

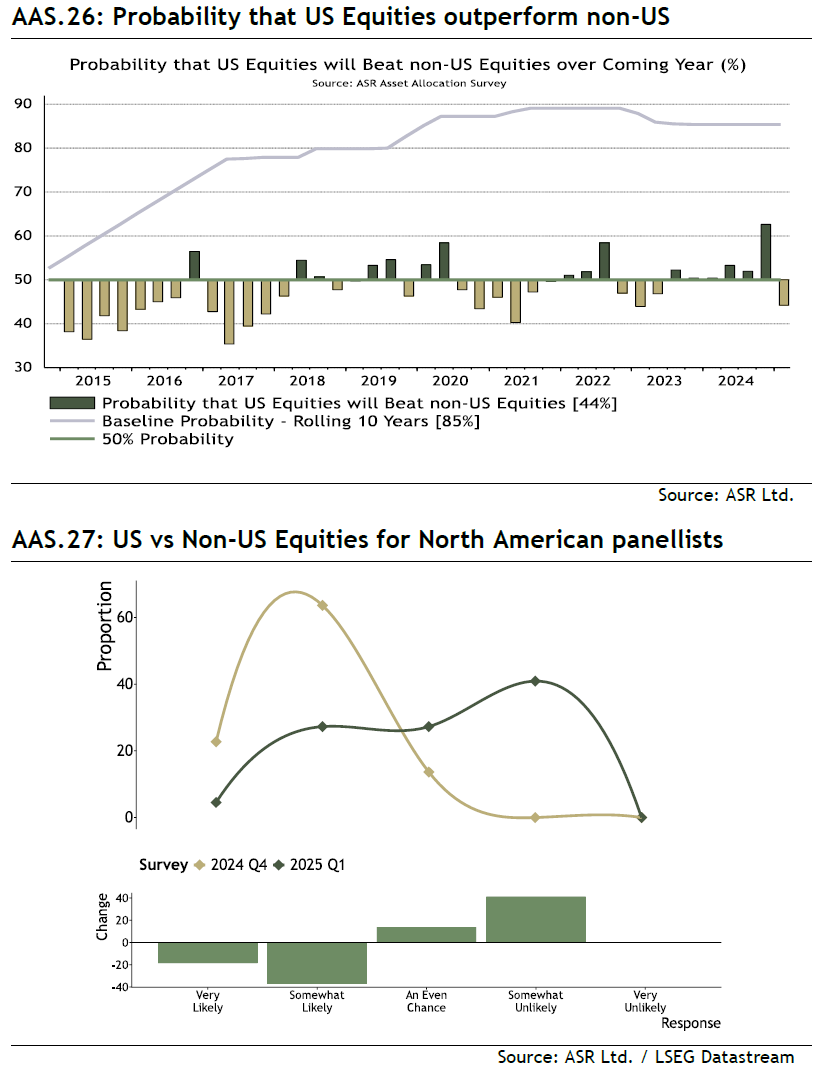

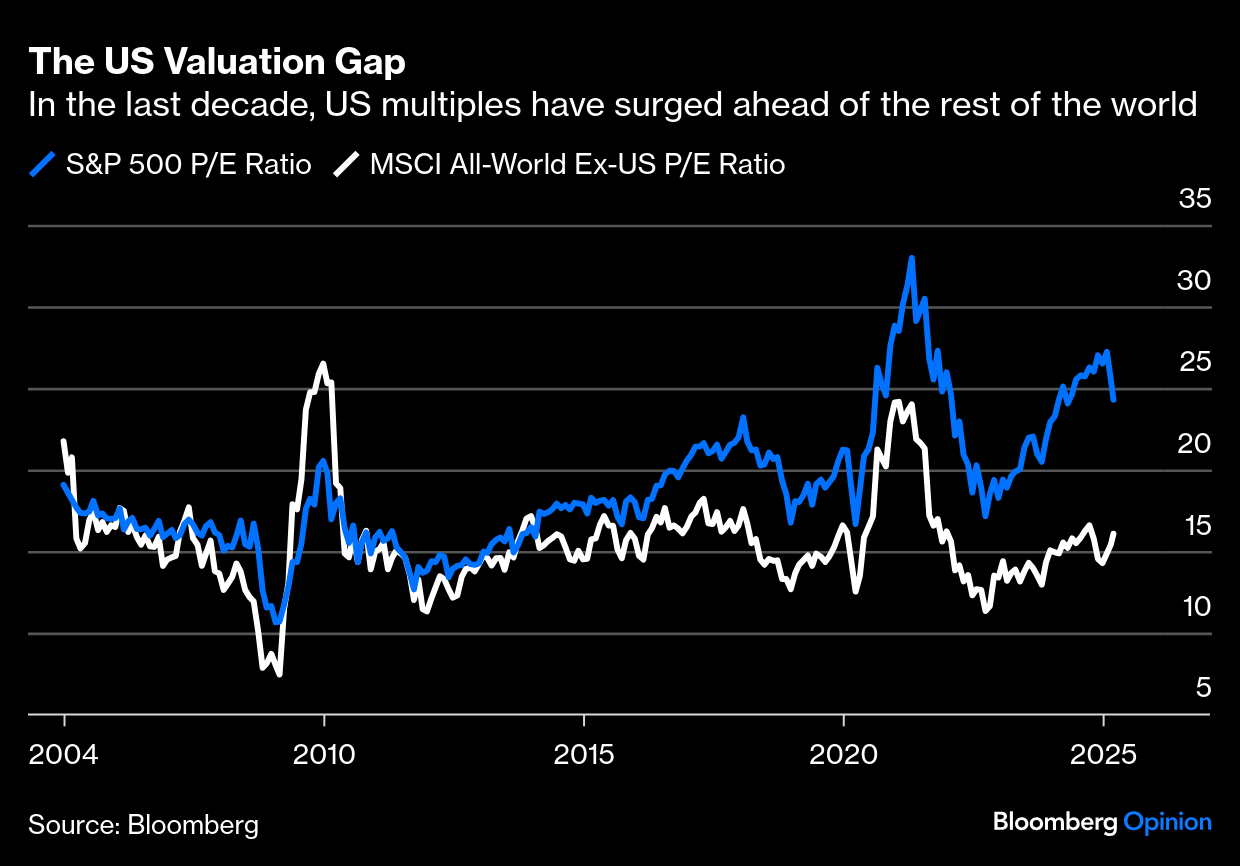

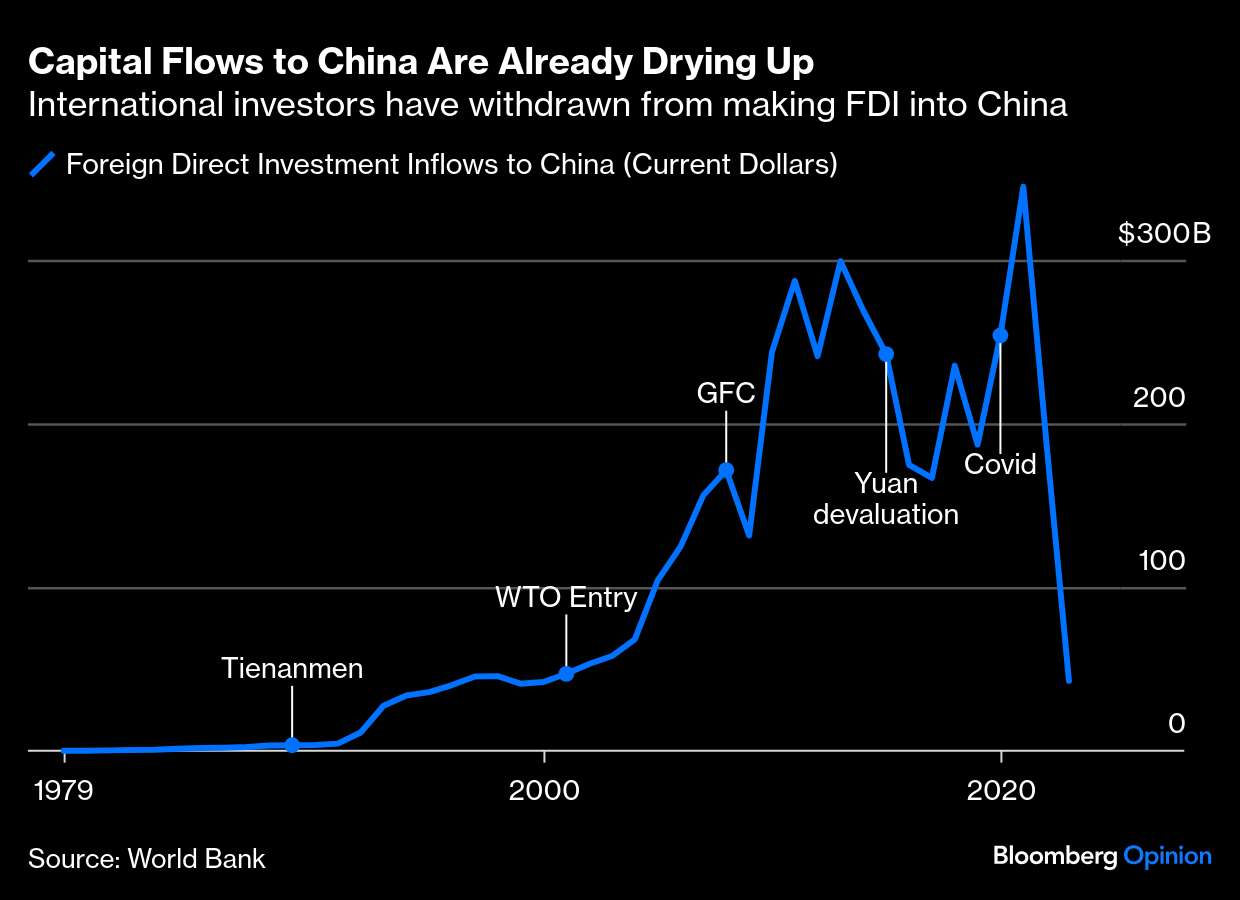

| This is a disconnecting world. Events of the last 24 hours have made ever clearer a trend that has been taking shape for years: Germany has decided to go ahead with massive borrowing to fund rearmament, and the DAX surged while US stocks fell; China's BYD Co. announced a new battery for its electric vehicles that prompted a big US selloff for Tesla Inc.; and Bank of America's latest survey of fund managers found the biggest switch away from US stocks on record. All of these are consistent with a move away from US exceptionalism, the popular name for the dominance of the dollar and the Magnificent Seven group of tech platforms that has been a feature of the last decade. But it goes further. Rather than the globalized free markets that have held sway since the end of the Cold War, the world is reallocating itself into independent groups or spheres of interest. This is a new form of mercantilism, or autarky — the economic term for national self-sufficiency. If the US has turned away from globalization, some autarkic direction is inevitable. But there's still huge uncertainty over how the new economic power blocs will be configured. The turn in markets has been startlingly sudden. This chart shows the Magnificent Seven's performance compared to the DAX since the start of last year. Anyone who shorted the Mag 7 and put the proceeds into the German benchmark before the Christmas break is now sitting on a 56% profit: The BofA survey shows the biggest switch on record by fund managers out of the US over the last four weeks. As with market prices themselves, the turn, when it came, was sudden and dramatic: Viewing the same information in a different way, this is how fund managers shifted their allocations just in the past month. The exodus into Europe and emerging markets (but not to Japan to the same extent) is extraordinary: Earlier this month, the quarterly survey of asset allocators conducted by Absolute Strategy Research, which asks them to put a probability on market moves, foreshadowed this with a dramatic drop in those expecting the US to outperform everyone else: Some of this is merely the unwinding of a market trend that was already overdone before its final dose of euphoria by Donald Trump's election victory. The US was priced for something close to perfection, which set it up to start lagging other markets at some point. The price/earnings ratio of the S&P 500 had parted company with the rest of the world, and some narrowing of the gap was inevitable: Other metrics suggest that the S&P is wildly overvalued. It trades at a higher multiple of sales than at the top of the dot-com bubble in 2000. As Points of Return noted, there is no telling whether that multiple is justified, but it's hard to say that the overvaluation has been corrected: But there's more to it than correcting a mispricing. Even before Trump 2.0 turbocharged the process, the world was beginning to turn in on itself. Here is the World Bank's estimate of foreign direct investment into China each year, in current US dollars. The halt to capital flows is dramatic:  Europe was already waking up — belatedly — to the need to reduce reliance on the US before Trump's return. Last year, French President Emmanuel Macron offered a new paradigm in a speech with the emotive title, Europe — It Can Die. Mario Draghi, former head of the European Central Bank and prime minister of Italy, published his own report calling on Europe to pool resources to become more competitive. And in the UK, approaching nine years from the vote to leave the EU, attention has turned to ways to get the domestic financial system to benefit the country again, rather than send money across the Atlantic. As laid out by Michael Tory for Bloomberg Opinion earlier this year, the idea now is to set up UK-only pension funds to bring capital home. Capital flows much more easily across borders than goods. It can also be cut off much more easily. With Japan now looking likely to raise interest rates further, there's a chance that savings will be repatriated. China has no choice but to reduce reliance on international capital. Europe's political imperative to build its own weapons rather than buy American could mean less money flowing to the US.  Japan may bring savings home. Photographer: Kentaro Takahashi/Bloomberg The financial historian Russell Napier suggests that the world is adopting "national capitalism" — a term he borrows from Lenin. By this, he means a form of financial repression in which governments direct national savings toward domestic purposes. This suggests that the shift away from US stocks should be seen as the beginning of a secular or tectonic shift, rather than a correction to a period of overvaluation. Napier suggests that the process could have much further to run, because so much money is currently tied up in the S&P 500: If we move into a world where every developed-world savings institution has to repatriate assets to buy bonds of their own government, they will need to liquidate the one asset they have all crammed into in the past years: the S&P 500... If they are mandated to own domestic assets, they would be forced to sell US assets.

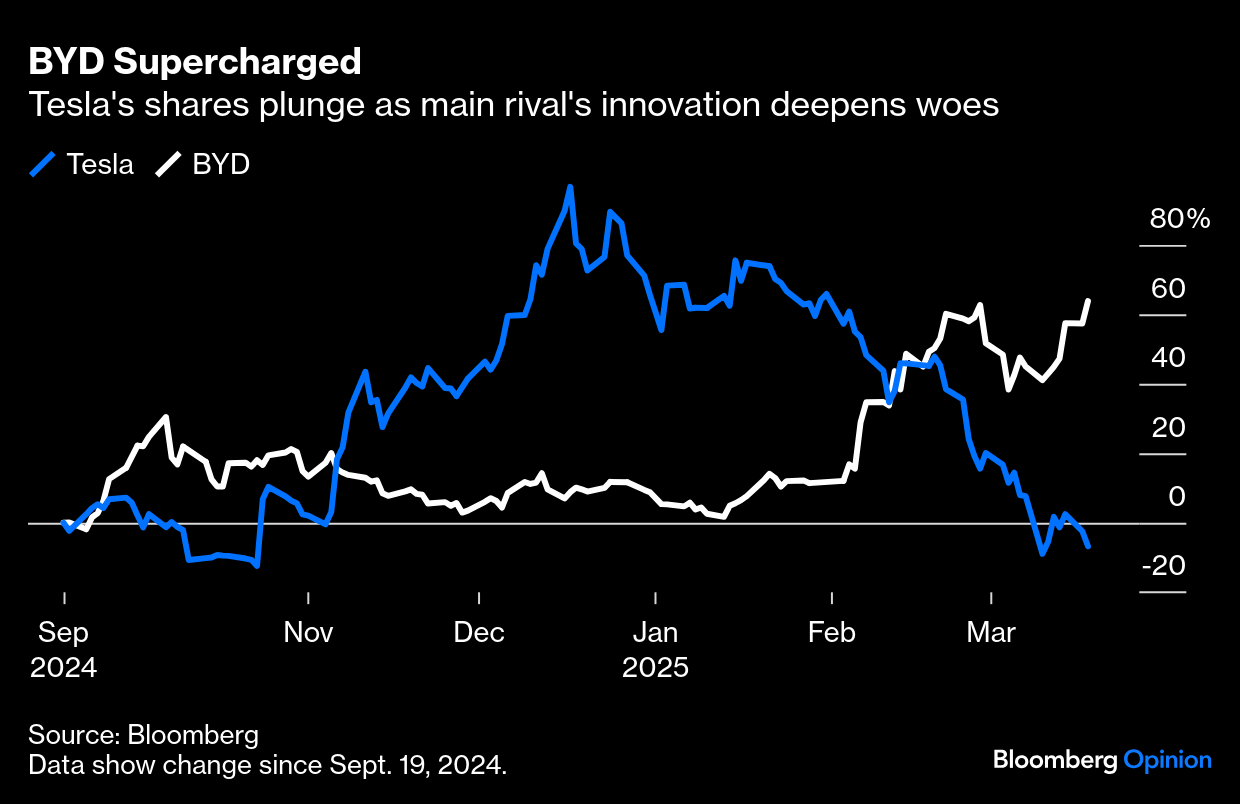

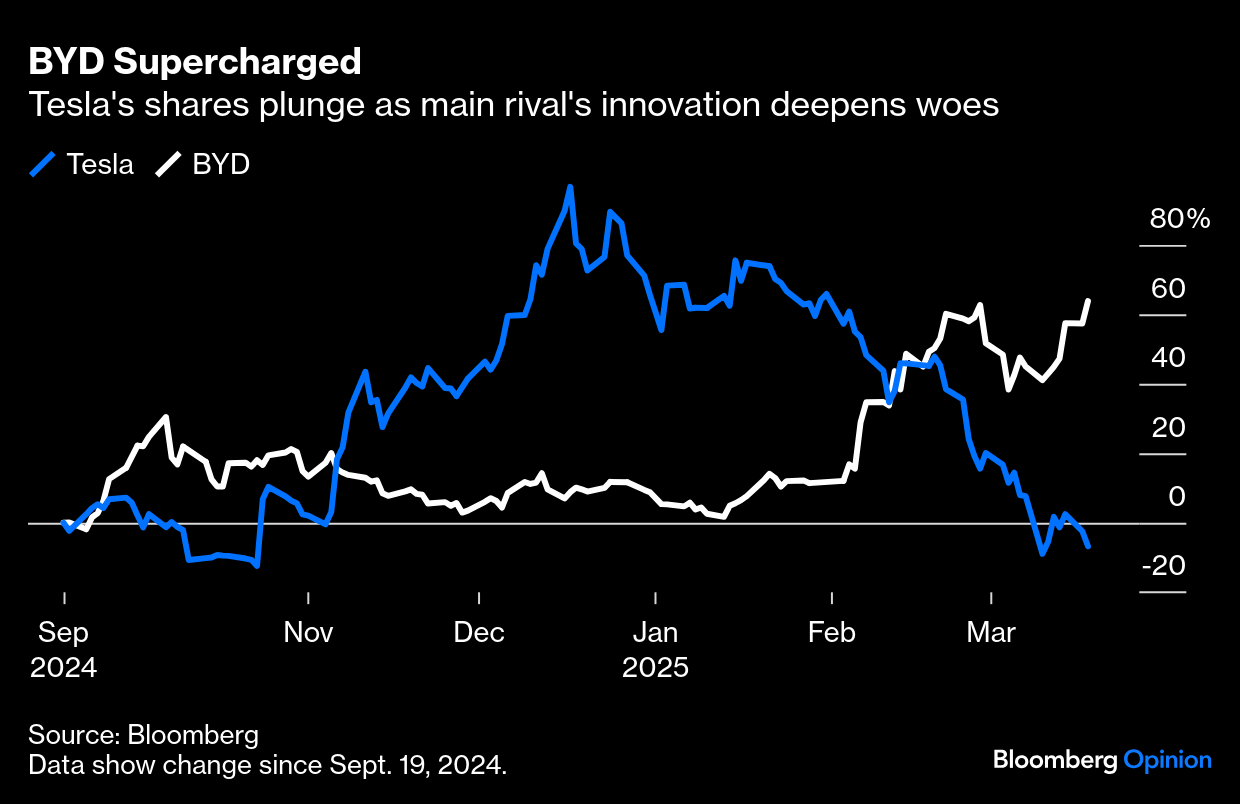

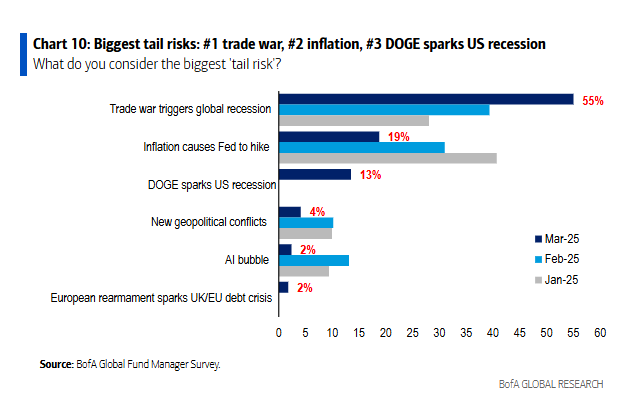

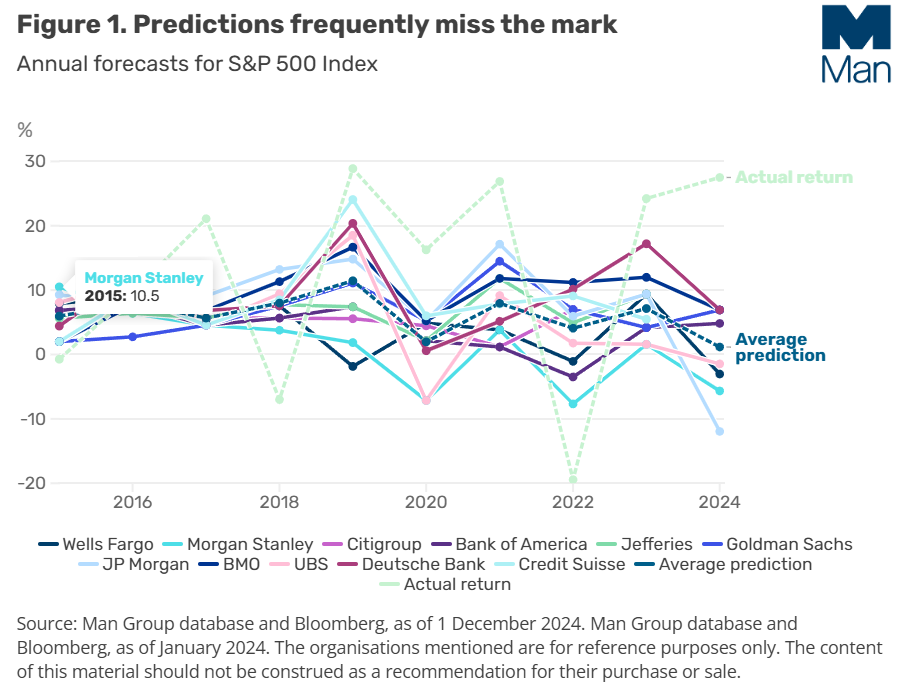

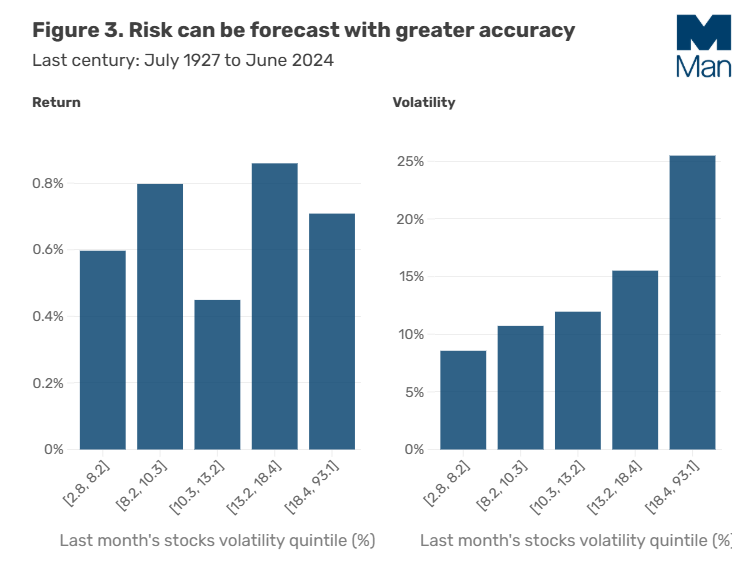

Viktor Shvets, macro strategist at Macquarie, takes a similar view. Born in Ukraine, Shvets comments that Americans tend to think things can't get worse — "whereas where I come from, you always know that things can get a lot worse." That means that there is plenty of support in the Trump base for the notion that it's best to burn the house down — while non-Americans might believe it safer just to try a renovation. How far the move away from the US stock market will go ultimately depends on just how far the Trump administration takes its trade policy, which depends on domestic political opinion. "The only guardrail left is the degree of pain in the market and the economy," Shvets says. "Maybe the pain threshold is high because a large part of the electorate agrees there has to be some pain to rebuild the house." After years of confidence, a by-product of the current policy uncertainty has been that negative outcomes grow easier to imagine. Investors are more prepared to believe the worst now, and nearly 70% of the BofA survey respondents said that US exceptionalism has peaked. Meanwhile, optimism about China — which has been using a version of mercantilism for years — has surged despite an increase of 20 percentage points in tariffs on exports to the US. In September, Beijing embarked on an incremental stimulus, which ignited a rally. Since then, big announcements on AI from DeepSeek and Alibaba Group Holding has helped mainland equities to rally further:  With the Magnificents priced for perfection, investors are taking any suggestion of competition from China as reason to sell. DeepSeek's R1 large-language model was hailed as a Sputnik Moment and fueled a US market rout in January, from which Nvidia Corp.'s share price has not recovered. Then, BYD, the popular Chinese electric vehicle maker, unveiled a new charging system that allows motorists to recharge their battery in only five minutes. That's provoked a mini-DeepSeek Moment for Tesla, which fell 5.3% in Tuesday trading. Tesla's previous missed deadlines on key projects, including robotaxis, are suddenly proving costly as its Chinese rival consolidates dominance through technological breakthroughs. The turnaround in their shares in the last three months has been breathtaking:  The way to restore confidence in US equities, and render investors less jumpy, lies in Washington. Rightly or wrongly, most investors are now convinced that trade is by far the greatest risk out there; indeed, more than 50% of respondents to BofA's survey named a recessionary trade war as the biggest "tail risk." That's the highest conviction in a single tail risk since investors were worrying about "Covid resurgence" in April 2020: BofA also found that "Long Magnificent Seven" is still regarded as the most crowded trade, though for the first time some named European stocks instead. That adds up to further reason to expect further flight from America, unless the trade policy uncertainty can somehow be resolved. The Antidote to Geopolitics: Diversification | Both nosebleed valuations and, as we've seen, geopolitical secular trends make a compelling case to rotate out of the US. But gauging the time to exit isn't simple. It can be avoided by taking a rigorous approach to diversification. Tarek Abou Zeid, a portfolio manager at Man AHL, argues that over the past 10 to 20 years, a simple volatility-diversified portfolio across multiple markets has delivered similar returns to the S&P 500. Sticking to that strategy while withdrawing from overweight US equities shouldn't hurt in the long run, just as it wouldn't have hurt as much as might've been thought over the last few years. This hinges on two central insights. First, the S&P 500 is hard to predict. This chart from Man compares year-end predictions by big Wall Street players against actual outcomes. In every year since 2016, the S&P has finished either above the highest forecast, or below the lowest. Second, while a stock's variability in any given month isn't particularly helpful for predicting its return in the best month, it's very useful for gauging the next month's volatility. That's because volatility tends to be persistent and to cluster; that is, high volatility over the recent past tends to continue in the near future. As this study notes, that observation helped win Robert Engle the 2003 Nobel Prize in Economics for his so-called ARCH models. Risky and turbulent stocks tend to stay that way, as do blander more stable ones. This is Man's own illustration of the phenomenon, using monthly returns from 1927 to 2024: Tarek argues that 25 years ago, few could have foreseen the S&P 500's long period of dominance. It follows that there's little point in trying to work out how the geopolitics will resolve over the next generation, while risk-balancing methodologies can work: Rather than trying to predict which region will lead in the next 25 years, we advocate for maximum diversification across indices. Historically, this approach has yielded comparable returns to the S&P 500 while offering improved risk-adjusted performance — without requiring forecasts or speculation. We are not arguing against US equities or taking a contrarian stance. We simply emphasize that market forecasting is highly uncertain, and historical analysis supports the benefits of a risk-balanced portfolio over time.

There's a lot to be said for that. Every so often, geopolitical events have big and immediate effects on markets. The change in US rhetoric on Europe is a spectacular example. Someone who can keep predicting the way geopolitics will reorganize in an autarkic world will make a lot of money. But sticking with simple risk management and not attempting to call the rise and fall of the Great Powers might be no less effective. —John Authers and Richard Abbey Some more material to help you think Big Thoughts. The great Martin Wolf has sallied forth on a possible Mar-a-Lago Accord for the Financial Times; the ever-fascinating Adam Tooze, a Columbia professor, explains the implications of the federal crackdown on his university; and for one prophetic vision of this emerging new system, try this video on Oceania, Eastasia and Eurasia, the blocs in Orwell's 1984.

Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: Want more Bloomberg Opinion? OPIN . Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment