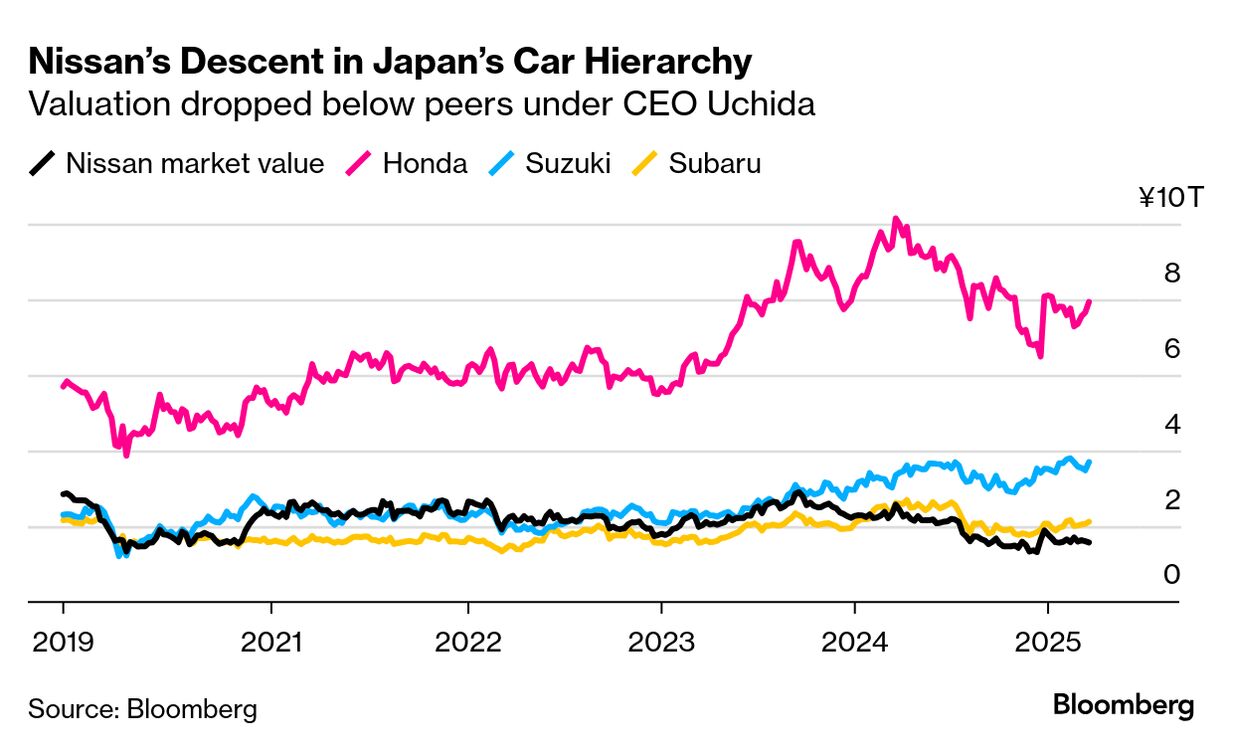

| Thanks for reading Hyperdrive, Bloomberg's newsletter on the future of the auto world. Read today's featured story online here. Taking Over a Carmaker in Crisis | Nissan's incoming CEO said he's open to pursing a partnership with Honda, the Japanese peer his carmaker tried to combine with before talks broke down last month. The auto industry's push into intelligent cars "is going to require a lot of work and a lot of investment that probably will need some partner," Ivan Espinosa, who assumes his new role on April 1, said Wednesday. "I'm open to Honda or other partners, as long as these partners are helping us drive the vision of the business." Nissan tapped Espinosa, 46, to take over its top job at a critical juncture. The Japanese carmaker has braced investors for a third annual net loss in the last six years, sales are slumping and negotiations with Honda fell apart last month under outgoing CEO Makoto Uchida.  Nissan and Honda dealerships in Tokyo. Photographer: Kiyoshi Ota/Bloomberg The top items on Espinosa's to-do list will be to seek collaborations with companies that would help Nissan develop electric vehicles and refresh the aging car lineup costing the company share in major markets including the US and China. A tie-up with a traditional automaker could offer "some synergy" in terms of size, powertrain technology and battery investment, Espinosa told reporters in Atsugi, near Nissan's headquarters in Yokohama. "There's another avenue, which is who should you partner with in order to develop this intelligent part of the future. There are some traits and some competencies that traditional OEMs don't have," he said.  Ivan Espinosa. Source: Nissan Taiwanese iPhone maker Hon Hai Precision Industry has expressed interest in buying French automaker Renault's stake in Nissan. Although Nissan is receptive to cooperating with the company also known as Foxconn, it sees more merit in partnering with a big tech firm, Bloomberg News reported earlier this month. Espinosa, who's been chief planning officer since April of last year, said he regrets not accelerating product development previously. "Changing a big company like Nissan is not an easy thing," he said. He reiterated the Japanese automaker's plan to shorten the time it takes for a car to go from development to production to as few as 30 months, from as many as 52 months. Nissan will roll out a number of new and refreshed models in its next two fiscal years to arrest its financial free fall. In North America, a new version of the Sentra compact sedan will be introduced later this year, and the US and Canada will be the first markets to launch the new Leaf, which will be equipped with a port that enables plugging in at Tesla's Superchargers. Nissan also plans to start producing an unspecified new EV at its plant in Canton, Mississippi, starting late in fiscal year 2027. In Europe, Nissan is bringing back the Micra — a small car the company stopped making in the UK in 2010 — later this year, reintroducing the model as a compact EV. An electric variant of the Juke compact SUV will be launched in fiscal 2026. A mechanical engineer by training, Espinosa has overseen the future product and service portfolios for the Nissan and Infiniti brands worldwide. He lists the auto industry's top challenges as electrification, connectivity and autonomous-driving technologies — three areas where Nissan has historically lagged. "A CEO is normally dealing with one or two major crises in his or her career," Espinosa said. "I'm gonna have to deal with four or five at the same time. I have a turnaround to work on. I have a deep morale crisis in the company. I have deep transformational work to do." — By Tsuyoshi Inajima  Xiaomi XU7 electric vehicle on display at one of the company's stores in Shanghai. Photographer: Qilai Shen/Bloomberg Xiaomi's $5.5 billion share sale Tuesday — coming only weeks after BYD raised $5.6 billion of its own in Hong Kong — is another warning tremor ahead of the tidal wave heading for the world's carmakers, Bloomberg Opinion columnist David Fickling writes. Those who've dragged their feet on the switch to electric vehicles better act quickly, or they're going to get swamped. Read More:  Politicians in Europe have argued the region should become less dependent on China and the US for high-tech parts. Photographer: Chris Ratcliffe/Bloomberg Europe's dependency on the US and China for computer hardware and cloud services puts its car industry at risk as vehicles become reliant on artificial intelligence, a Mercedes-Benz executive said. "The more we move into AI, the more we're moving into a phase where we need a more efficient computer," Georges Massing, a Mercedes executive working on the company's automated-driving push, said at an industry conference in Berlin. |

No comments:

Post a Comment