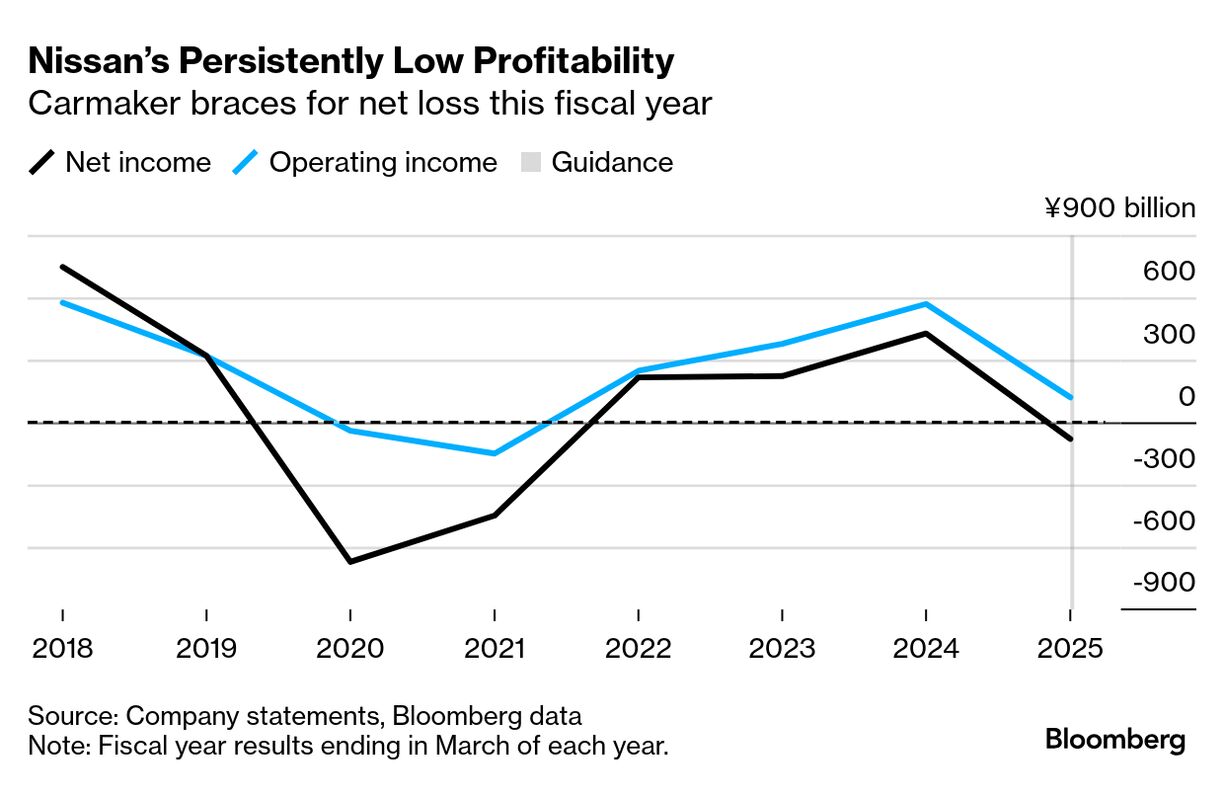

| Thanks for reading Hyperdrive, Bloomberg's newsletter on the future of the auto world. Read today's featured story online here. Espinosa's Many Challenges | Hours before Ivan Espinosa was revealed as Nissan's next chief executive officer, he was spotted rolling up to work in the driver's seat of a sleek sports car — a rare sight in Japan, where corporate executives are typically ferried around in the back of a luxury saloon. While Espinosa impressed car lovers with his ride — a metallic grey, left-hand drive Fairlady Z — confidence around the little-known executive's ability to address Nissan's pile pf problems remains less favorable. The 46-year-old "was praised for being a car guy, but that doesn't help him overcome the huge issues that Nissan is facing at the moment," said Julie Boote, an automotive analyst at London-based research firm Pelham Smithers Associates.  Ivan Espinosa. Photographer: Tsuyoshi Inajima/Bloomberg His tenure begins Tuesday when he'll officially replace Makoto Uchida, whose 5 1/2-year reign was brought to a swift end earlier this month after a potential tie-up with rival Honda collapsed. Espinosa faces the unenviable task of reversing Nissan's fading fortunes, refreshing an aging, outdated lineup and finding a new business partner. He'll also have to navigate the upheaval caused by Donald Trump's sweeping 25% tariff on US car imports. Nissan has stumbled from one crisis to another since the 2018 ouster of Carlos Ghosn, who pulled the carmaker out of its last brush with disaster in 1999. Espinosa, who joined Nissan in 2003 in his native Mexico, has spent most of his time in strategy and planning. He most recently served as chief planning officer in the automaker's Yokohama headquarters, following stints in Switzerland and Bangkok. The new CEO pick came as a surprise for many industry watchers, and even to Espinosa himself, it seems. "I've just been informed of this appointment so I need some time to reflect," he said during a press conference on March 11 after his appointment was announced. "I would refrain from commenting on speculation." His role overseeing the company's product portfolio raised concerns, particularly since its unpopular vehicle lineup is a big reason Nissan is in desperate need of a lifeline. The management shakeup was also criticized for keeping the entire suite of external independent directors intact. Espinosa will be younger than most of the executives who will report to him, including Chief Performance Officer Guillaume Cartier and Chief Financial Officer Jeremie Papin. Speaking with reporters last week, Espinosa said he regrets not accelerating production development in the past, and reiterated Nissan's plans to shorten the time it takes for a car to reach production from 52 months to as little as 30 months. Espinosa's top priority is to get a deal of some sort done, Boote said. Espinosa said he's still open to pursuing a partnership of with Honda. "I'm open to Honda or other partners, as long as these partners are helping us drive the vision of the business," he said in Atsugi, near Nissan's headquarters in Yokohama. The industry's push into intelligent cars "is going to require a lot of work and a lot of investment that probably will need some partner," Espinosa said. "There's another avenue, which is who should you partner with in order to develop this intelligent part of the future." Nissan was interested in a tie up with a company in the technology sector, preferably one based in the US, Bloomberg reported earlier this month. Hon Hai, the Taiwanese iPhone-maker also known as Foxconn, has also previously expressed interest in buying Renault's stake in Nissan.

At last week's event, Espinosa didn't shy away from the task in front of him. He noted that, while most CEOs normally deal with one or two major crises during their career, he is facing "four or five at the same time." "I have a turnaround to work on," he said. "I have a deep morale crisis in the company. I have deep transformational work to do. And I have, on top of that, the perception of the company because, up until recently, everything what you read about Nissan was negative." He also said Nissan needs to be better with forecasting demand and delivering on its delivery targets. That gap was on full display in November, when the company unveiled plans to dismiss 9,000 workers and slash manufacturing capacity by 20%. It also lowered its retail sales outlook for this fiscal year to 3.4 million vehicles, paring forecasts for each of its major markets: North America, China, Japan and Europe. It was arguably the beginning of the end for Uchida.  Nissan Leaf S Plus Photographer: Michael Nagle/Bloomberg A mechanical engineer by training, Espinosa's mission statement on the company's website states electrification, connectivity and autonomous driving are the industry's three biggest challenges — all areas where Nissan has historically lagged behind its competitors. Its early lead in cheap EVs has been overtaken by Chinese automakers like BYD, and it lacks the latest-generation hybrids to compete effectively in the US. Nissan has finally started to refresh its lineup, last week unveiling a range of models including a new electric Micra and a refreshed Leaf EV, that will be compatible with Tesla's Supercharger network in North America. It also announced next-generation Qashqai and Rogue hybrids, and will start manufacturing a yet-to-be named all-new EV at its Canton, Mississippi plant in fiscal 2027. "This is just the beginning of an exciting journey ahead," Espinosa said at the launch. - Trump hopes auto tariffs will send buyers to US cars.

- Car buyers fearing tariff price hikes rush to dealers.

- Wedbush sees no winners from Trump's ` armageddon' car tariffs.

Hakan Samuelsson Photographer: Mikael Sjoberg/Bloomberg Volvo tapped its former longtime Chief Executive Officer Hakan Samuelsson to retake the helm as the Swedish automaker tries to navigate its way out of a malaise worsened by looming US tariffs. Samuelsson, 74, will replace Jim Rowan on April 1, and serve for two years as the board looks for a long-term successor. Samuelsson was Volvo's CEO for a decade until 2022. Volvo is among European manufacturers hit by President Donald Trump's 25% auto tariffs. While it has a factory in South Carolina, Volvo still exports a significant share of vehicles from Europe to the US. The trade tensions and waning demand for EVs have weighed on the company's shares, which have slumped 48% in the past year. |

No comments:

Post a Comment