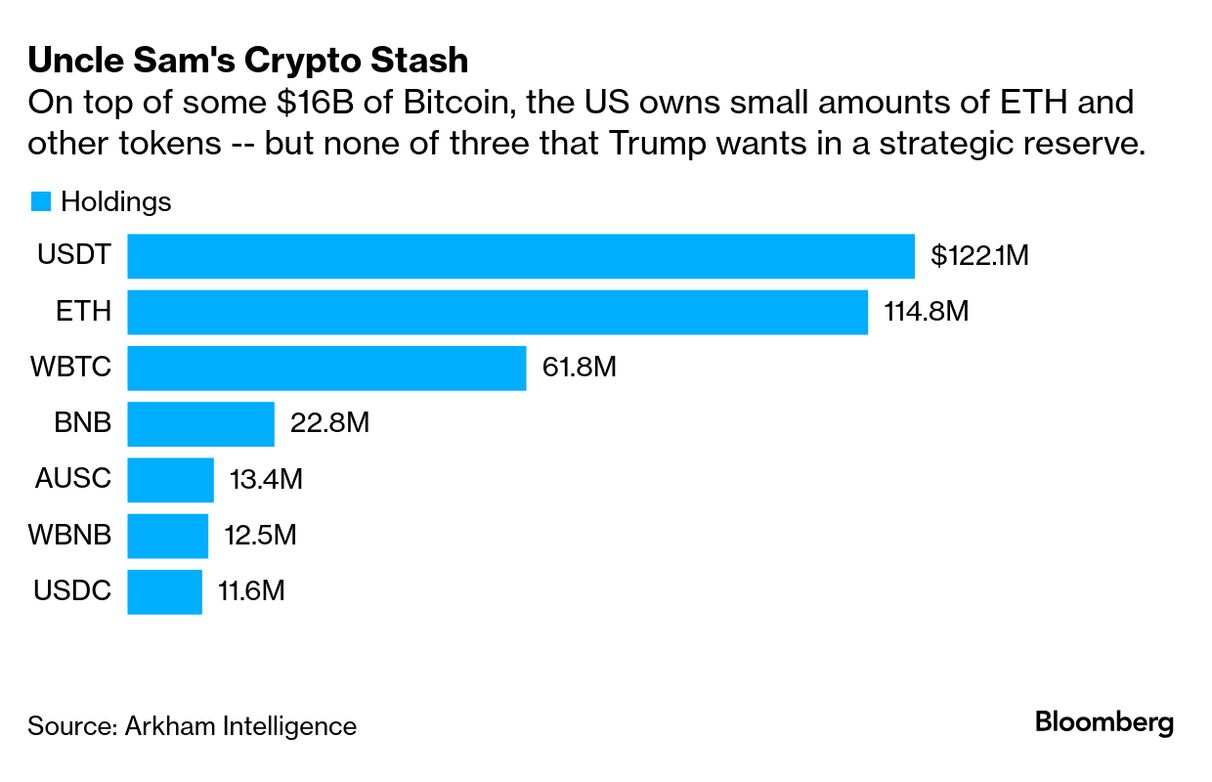

| President Trump surprised many crypto enthusiasts on Sunday by saying that the so-called altcoins Ether, XRP, Solana and Cardano would be a part of the nation's cryptocurrency reserve, along with Bitcoin. The move didn't sit well with many known as "Bitcoin maxis," or those who think that Bitcoin is the best cryptocurrency and the only one worth holding. It didn't even sit well with some crypto old-timers, who invest in the other coins Trump mentioned. Influencer and investor Anthony Pompliano, who said "Solana is our second largest crypto position," wrote in a newsletter on Monday that only Bitcoin deserves to be part of the strategic reserve, thanks to its decentralized nature and other characteristics that make it, in the words of proponents, "digital gold." "Instead of the United States creating a reserve of hard money, which has strategic importance due to the finite supply, the relationship with low-cost energy, and the backing of the strongest computer network in the world, we seem to be getting a random smattering of speculative tools that will enrich the insiders and creators of these coins at the expense of the US taxpayer," Pompliano wrote. Billionaires Tyler and Cameron Winklevoss, who own the Gemini crypto exchange and hold vast numbers of Bitcoin, spoke out against the inclusion of other coins as well. "Many of these assets are listed for trading on Gemini and meet our rigorous listing policy criteria, but with respect to a Strategic Reserve it is another standard," Tyler Winklevoss wrote on X. "An asset needs to be hard money that is a proven store of value like gold." Coinbase Chief Executive Officer Brian Armstrong tweeted that he is still forming an opinion, but "just Bitcoin would probably be the best option." While they are all cryptocurrencies, the coins are very different. Alts, for example, tend to be even more volatile than Bitcoin. Cardano lost about 92% of its value between September of 2021 and September of 2023, per tracker CoinMarketCap. Solana crashed 96% between late 2021 and late 2022, while XRP fell 95% between 2018 and early 2020. Even Bitcoin declined about 74% between late 2021 and late 2022, while Ether fell about 78% over about the same period. The coins also have different ownership concentration, decentralization and usage characteristics. While Ethereum has $48 billion locked in decentralized-finance apps and Bitcoin has $5.5 billion locked, for example, Cardano has only $354 million, per tracker DeFi Llama. XRP Ledger is even smaller, with $80 million. "The inclusion of these altcoins could presumably open the door to other altcoins as well, including memes and other digital assets with questionable utility and provenance," said Edward Chin, co-founder of Parataxis Capital. Trump launched the Trump memecoin several days before becoming president, and it's now down 83% from its peak in January, per tracker CoinMarketCap. With the game of picking cryptocurrencies for the national reserve underway, lots of folks are hawking different coins around Washington. Some proponents of altcoins, like XRP, have met with Trump or donated to his inauguration committee. Others are meeting with crypto czar David Sacks or Bo Hines, director of the President's Council of Advisers on Digital Assets. "The second-order effects of battling which crypto is 'in' vs 'out' will be as ugly as the 1st Council of Nicea," wrote Jeff Garzik, a former Bitcoin core developer. For those not familiar with the reference: "The council attempted but failed to establish a uniform date for Easter." Backers of altcoins, of course, are cheering Trump's inclusion, with the CEO of XRP creator Ripple Brad Garlinghouse, tweeting that "Maximalism is the enemy of the industry's progress." US strategic stockpiles have included gold, oil and cheese. Soon there could be more of what the maxis consider to be the latter, only of the digital kind. |

No comments:

Post a Comment