| Market data as of 06:29 am EST. Market data may be delayed depending on provider agreements. President Donald Trump delivered on his threat |

| |

| Markets Snapshot | | | | Market data as of 06:29 am EST. | View or Create your Watchlist | | | Market data may be delayed depending on provider agreements. | | |

Five things you need to know | |

- President Donald Trump delivered on his threat to hit Canada and Mexico with sweeping import levies and doubled an existing charge on China, spurring swift reprisals that plunge the world economy into a deepening trade war.

- European equities fell from a record on concern the continent could be the next to faces US tariffs. S&P 500 futures trade little changed after the index yesterday had its biggest loss of the year, weighed down by tepid economic news and the trade conflict.

- The currencies of Canada and Mexico took a hit on the tariffs too, the latest in a string of trade announcements from the administration that have buffeted investors in the $7.5 trillion-a-day foreign-exchange market.

- The European Union will propose extending €150 billion in loans to boost defense spending as the bloc tries to adjust to Trump's abrupt pullback of American security.

- Aramco cut the world's biggest dividend in a blow for Saudi Arabia's widening budget deficit, as the company seeks to relieve stress on its own finances. The oil producer plans to pay out about $85 billion in 2025, down from $124 billion.

| |

| |

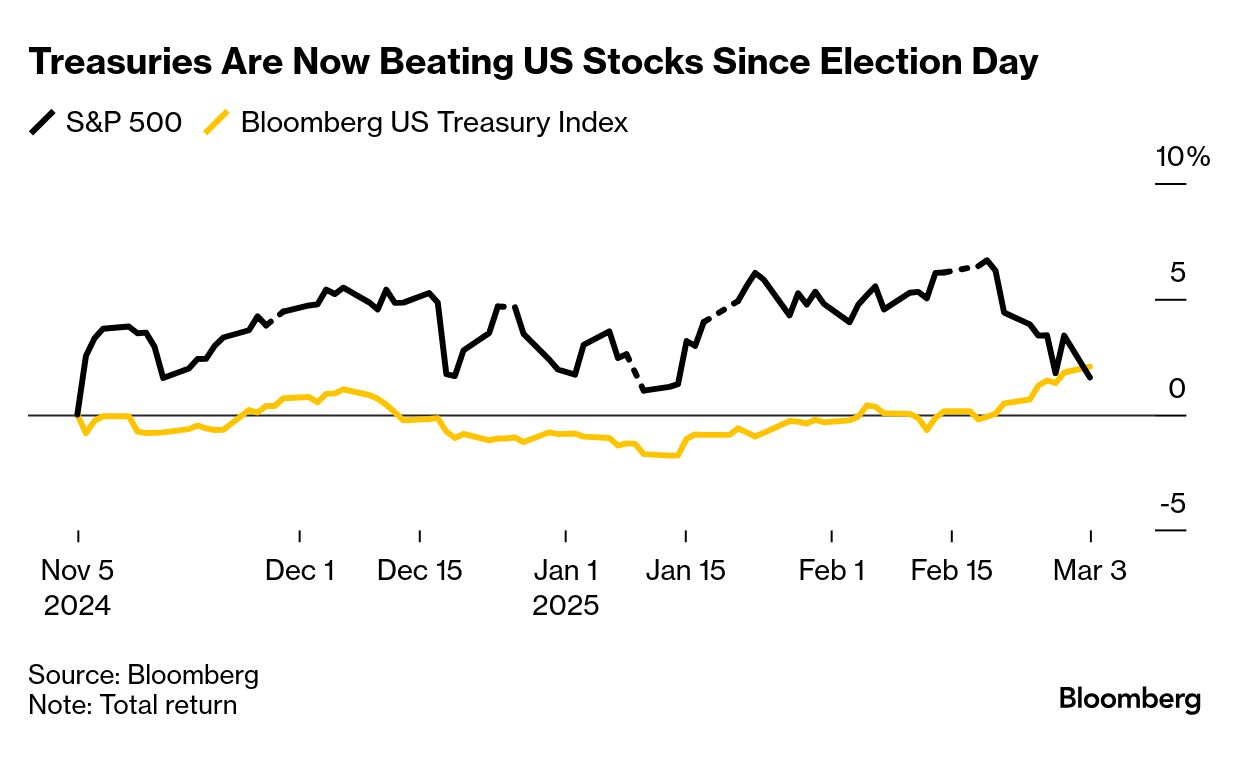

| Yesterday's big selloff in the US stock market and the plunge in Treasury yields has upended a once-powerful market trend — bonds are now outperforming equities since Trump was elected president. A Bloomberg gauge of US sovereign debt has returned 2.1% since the Nov. 5 vote, beating a gain of 1.6% from the S&P 500 Index including reinvested dividends. Treasury 10-year yields fell to a four-month low of 4.11% today as investors bet the intensifying trade war will bludgeon global growth. The US economy, long lauded for its outperformance, is showing cracks with factory activity edging closer to stagnation in February — bolstering the appeal of fixed-income assets. Taken together, it's the opposite of the so-called Trump trade, which triggered a surge in stocks and higher Treasury yields. "The 'US exceptionalism' narrative – a driver of macro markets for well over a year – faces an increasingly uphill battle," Morgan Stanley strategists including Matthew Hornbach wrote in a note. "Treasuries will benefit the most from a rethink of the narrative." It's worth noting that declines in Asian stock markets were limited today. As Garfield Reynolds from our Markets Live blog notes, that seems to indicate the tariffs were already priced in. It might mean Trump's tariffs will be short-lived because any more economic weakness may force him to take a less aggressive policy path, he says. —Ruth Carson | |

| | This is just a slice of our global markets coverage. To unlock every story and stay on top of the stocks you care about with unlimited watchlists, become a Bloomberg.com subscriber. | | | | | | |

| |

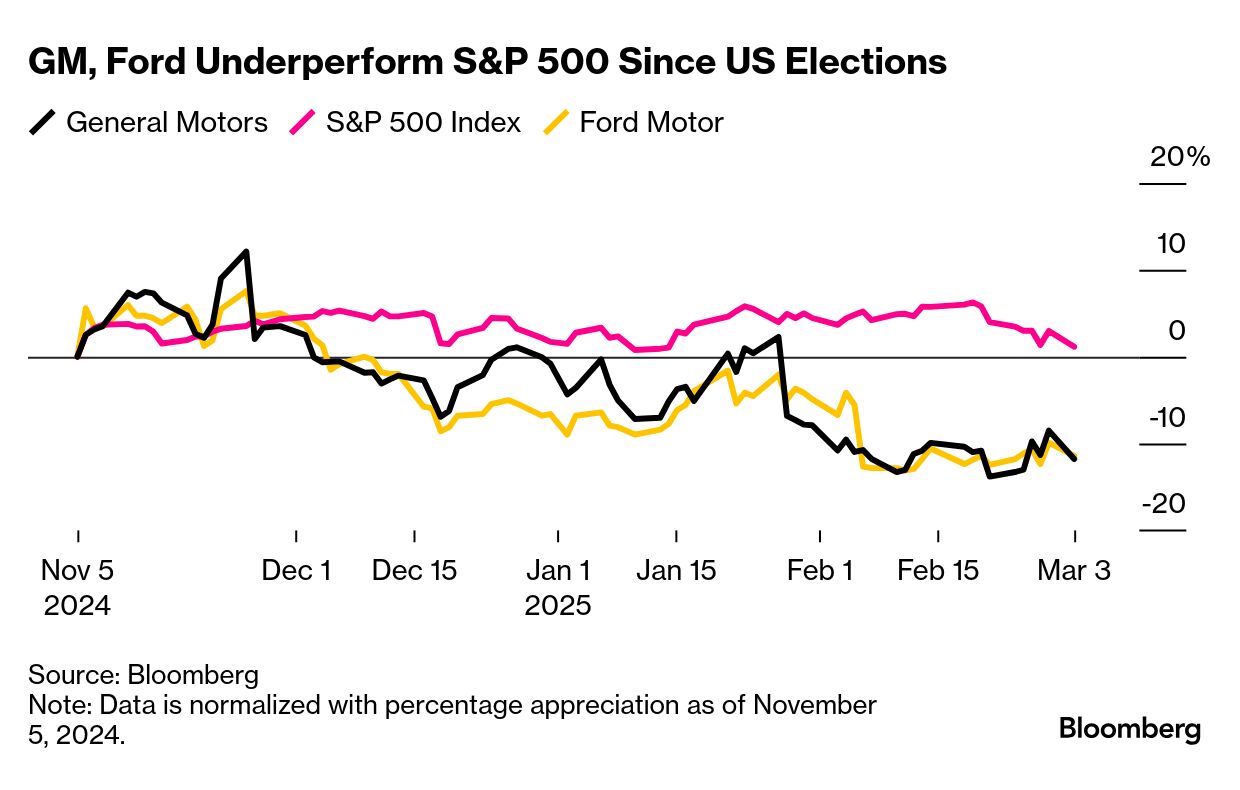

- The tariffs are hitting shares of European automakers Stellantis, Mercedes-Benz, BMW and Volkswagen — down 3% to 5% — along with parts makers Valeo and Continental, down 9% each. Keep an eye on GM and Ford when the US market opens, though shares of both took a hit yesterday, so the news may be priced in.

- Eutelsat, a French satellite operator, has more than tripled this week as Europe plans to ramp up defense spending. Rival SES is up 16% today.

- Walgreens Boots Alliance rises 7.2% in premarket trading. Sycamore Partners is nearing an acquisition of the drugstore operator that may be announced as soon as this week, people with knowledge of the matter said.

- Okta shares jump as much as 17%. The infrastructure software company reported better-than-expected results.

- Lindt, the owner of the Ghirardelli and Russell Stover chocolate brands, gains 5.6% in Zurich after the company posted strong results despite the surge in cocoa prices. —Subrat Patnaik

| |

| |

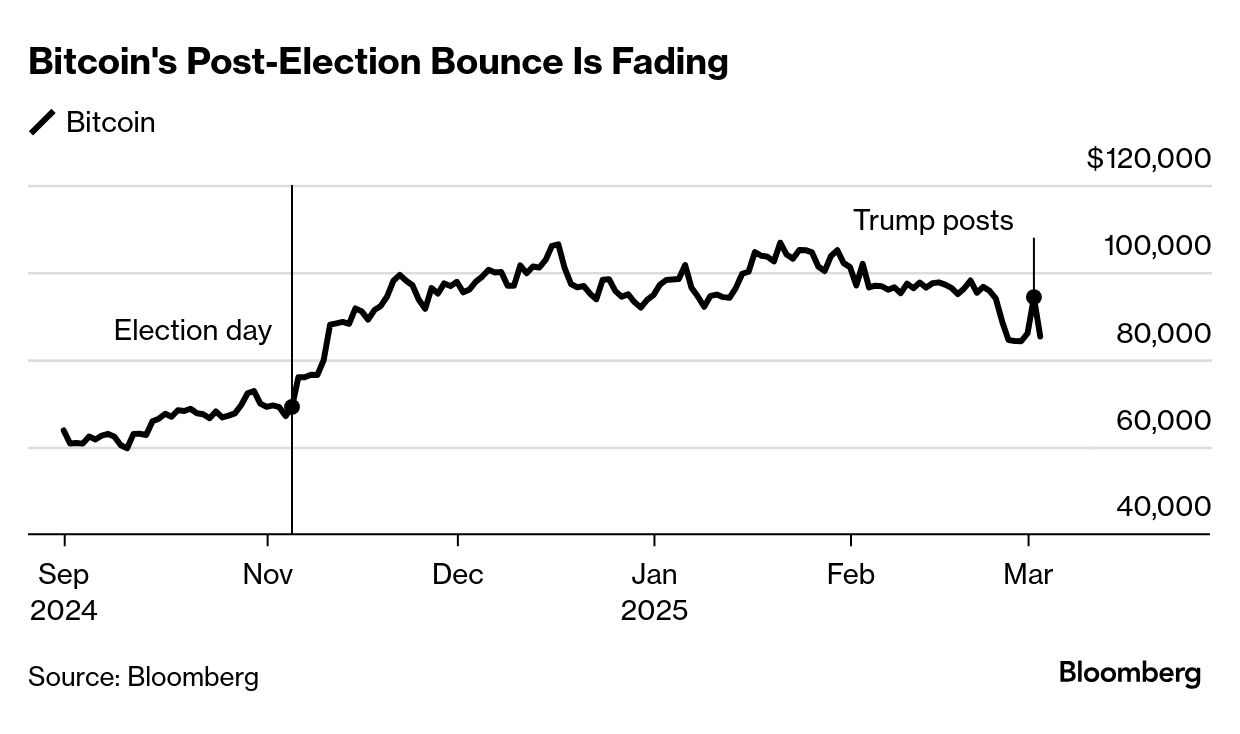

| The weekend crypto rally that followed Trump's social media posts about a digital asset reserve has evaporated.

After Sunday's initial euphoria, traders sobered up to the reality that neither the president nor David Sacks, the so-called crypto czar, had followed up with details on how such a reserve would work. And the tariffs that took effect yesterday sent risk assets falling across the board. Bitcoin hovered around $84,000 on Friday, after plunging 18% in the month of February. It spiked above $95,000 Sunday on the Trump posts and now is back below $84,000. And what of the tokens mentioned by Trump in his initial post? - XRP is the cryptocurrency associated with Ripple, a digital payments company run by Brad Garlinghouse. Ripple donated $5 million of XRP tokens to Trump's inauguration, which Garlinghouse attended.

- SOL and ADA are the native tokens of the Solana and Cardano blockchains. Solana is the blockchain of choice for issuers of so-called memecoins, including Trump's own self-titled coin.

- Cardano hasn't claimed significant market share or trading volumes. Charles Hoskinson, co-founder of the company behind the Cardano blockchain, said in a podcast after Trump's win that he had been helping US lawmakers to shape crypto policy.

- ADA, SOL and XRP have a cumulative market value of just $240 billion.

Beyond expressions of bafflement at the logic of the token selection — and of dismay from Bitcoin fans like the billionaire Winklevoss twins — there remain big questions about how any potential reserve would be funded, and whether taxpayer dollars are best spent on highly volatile assets. —Isabelle Lee and Philip Lagerkranser | |

| |

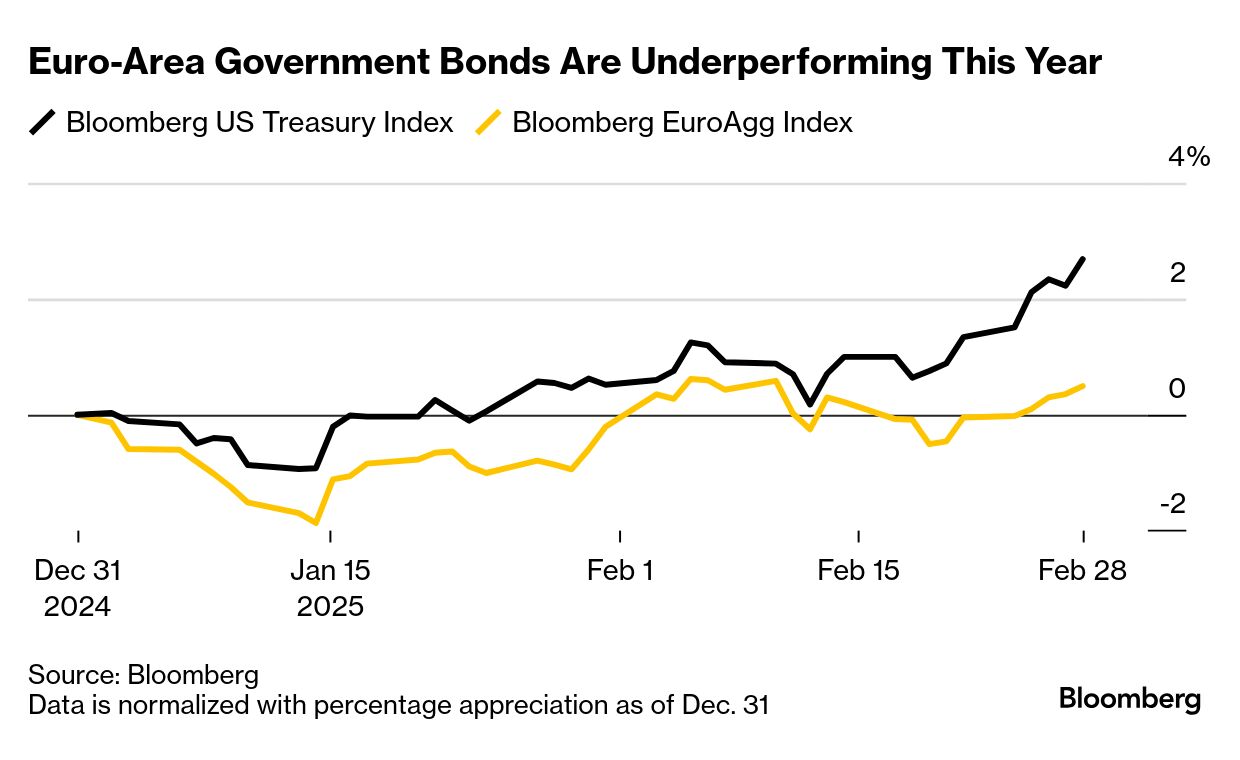

| European markets are coming to grips with a looming era of higher government spending as the transatlantic alliance that's endured for almost 70 years starts to buckle. Now Europe is embarking on the most aggressive increase in defense spending since the Cold War and investors are expecting a wave of debt sales. The result: - Bonds from euro-area governments are underperforming the US.

- Defense stocks have soared to record highs.

- The euro is strengthening against the dollar.

Union Bancaire Privée sees the yield on the German 10-year bund rising to 3%, potentially within three to six months, from 2.4% last week. Meanwhile, Deutsche Bank scrapped its long-standing euro short recommendation. —Alice Atkins and Alice Gledhill | |

| |

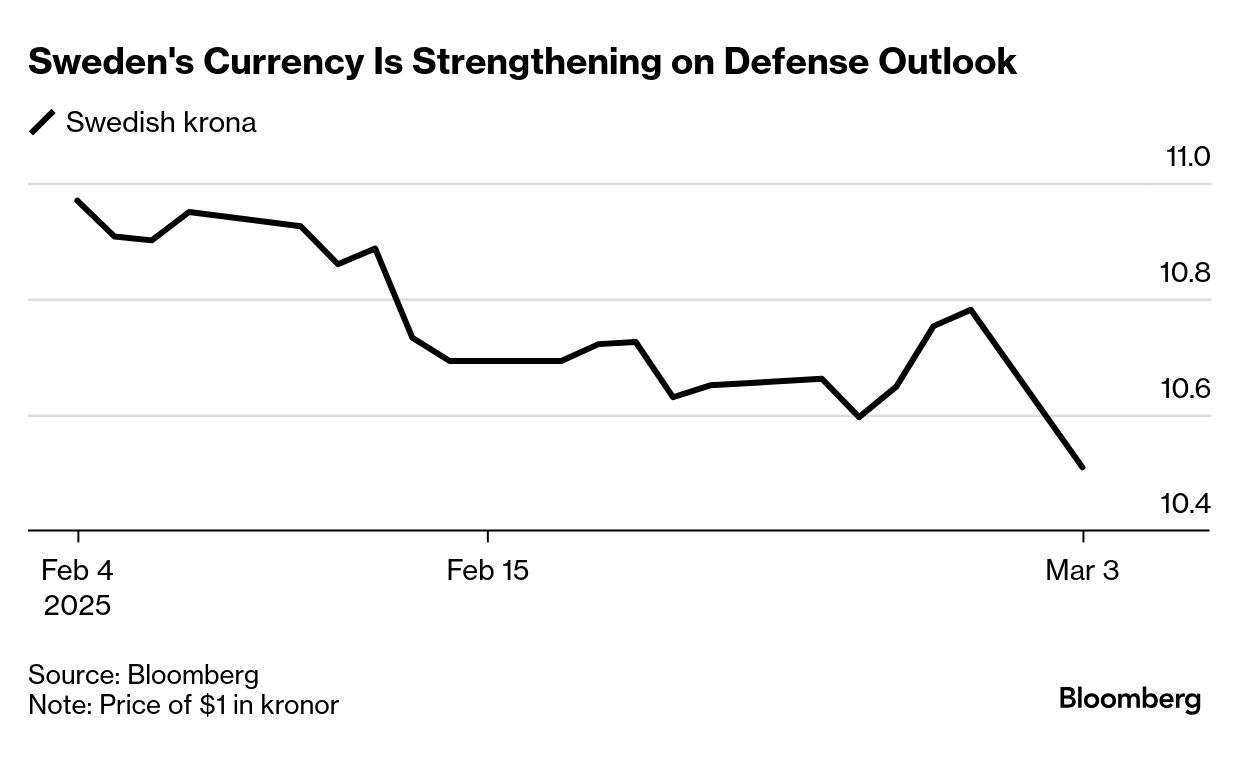

| The krona is emerging as a favored way to bet on Europe's race to rearm. The Swedish currency surged more than 2% against the dollar yesterday, outperforming its G-10 peers after European leaders pushed forward with plans to boost defense spending and support Ukraine. Swedish defense contractors are seen as major beneficiaries, in particular companies like Saab and BAE Systems Hagglunds that produce fighter jets, submarines and combat vehicles. —Naomi Tajitsu and Christopher Jungstedt | |

Word from Wall Street | | "The US equity market is priced for perfection and we would say the US equity market is actually overvalued by a pretty fair degree." | | Greg Davis Chief Investment Officer of Vanguard | | |

| |

| |

| |

| |

Enjoying Markets Daily? You might also like: | - Breaking News Alerts for the biggest stories from around the world, delivered to your inbox as they happen

- Odd Lots for Joe Weisenthal and Tracy Alloway's daily newsletter on the newest market crazes

- The Everything Risk for Ed Harrison's weekly take on what could upend markets

- Money Stuff for Bloomberg Opinion's Matt Levine's newsletter on all things Wall Street and finance

- Points of Return for Bloomberg Opinion's John Authers' daily dive into markets

Bloomberg.com subscribers have exclusive access to all of our premium newsletters. | |

| |

Like getting this newsletter? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and subscriber-only insights. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Markets Daily newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment