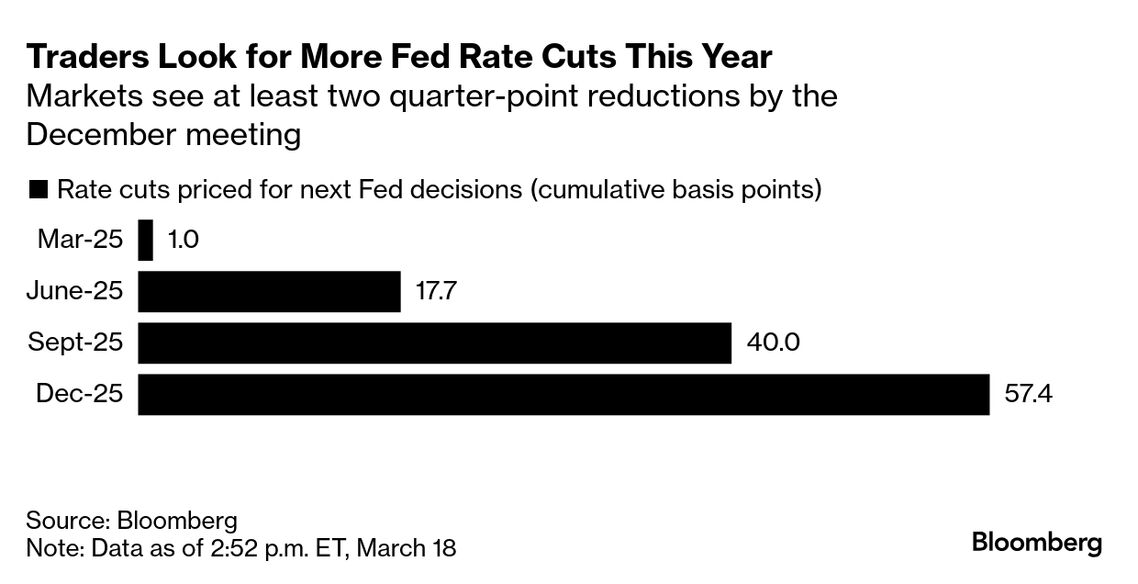

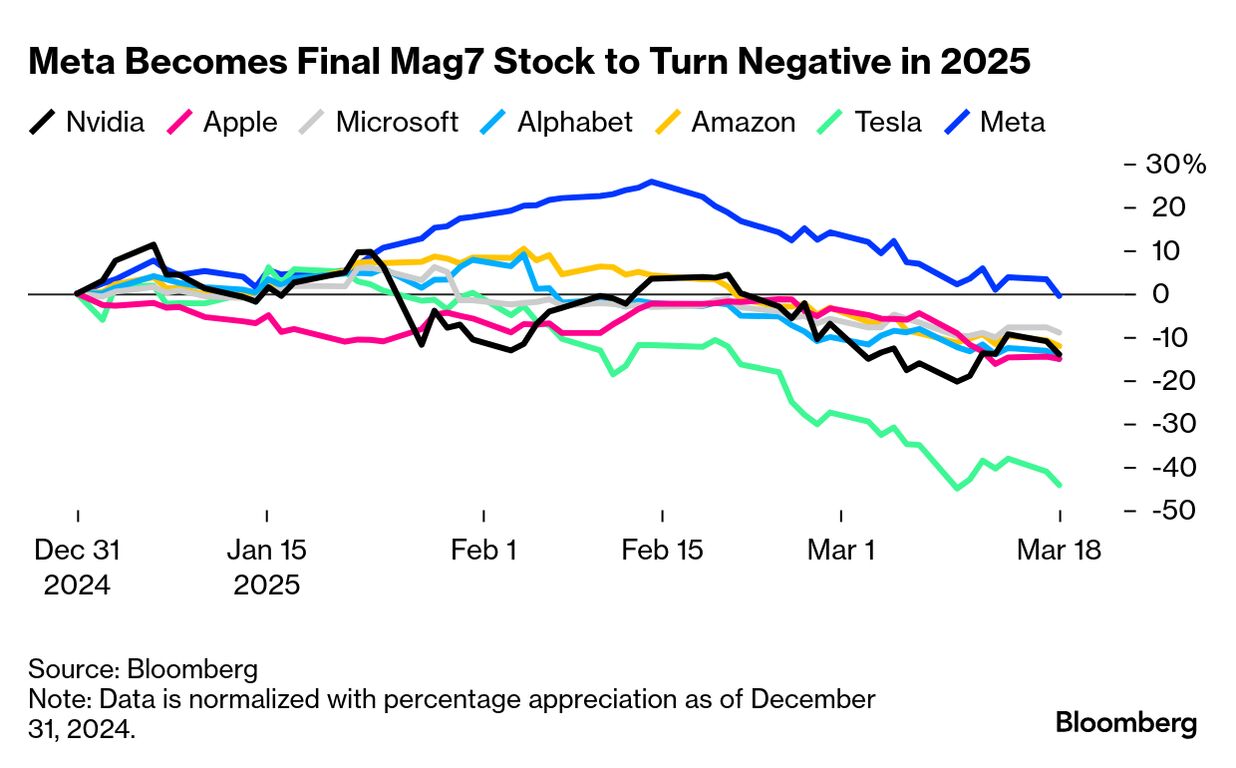

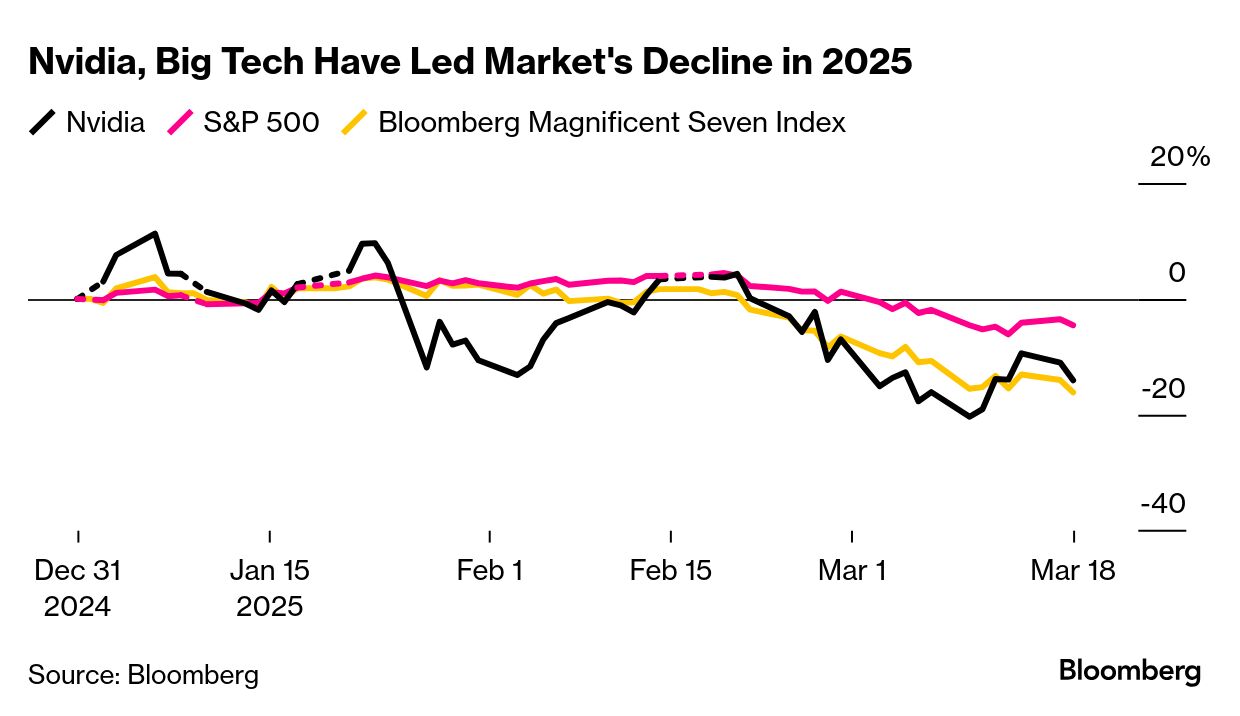

| As the Federal Reserve wraps up its two-day meeting today, bond investors will look for Chair Jerome Powell to hit just the right notes in his comments to keep up the momentum behind a rally in the $29 trillion Treasury market. US government debt has returned 2.4% this year, pushing yields to their 2025 lows as the equity market sold off and Donald Trump's tariff agenda led to forecasts for less economic growth and a resurgence of inflation. While Powell said "the economy's fine" two weeks ago, traders will scrutinize his comments and officials' revised forecasts, known as the dot-plot, for cracks in that view. "The rates market is willing and able to reassess the outlook very rapidly," said Ed Al-Hussainy, rates strategist at Columbia Threadneedle Investment. "Not a lot of data has changed between December and today, but what has changed is the range of outcomes." While markets imply essentially no chance the Fed lowers interest rates this month, uncertainty has been increasing about the rest of the year. As of yesterday's close, traders were pricing in about two quarter-point rate reductions by the end of 2025, down from about three a week ago. Taken together, moves in the short-term futures and options markets appear to show more hedging by traders who see the possibility that the Fed keeps rates on hold for at least the first half. The central bank's economic projections are viewed as likely to show a tempered growth outlook while anticipating sticky inflation. The two-year Treasury note yield reached its low for the year, 3.83%, on March 11. The last stage of its decline from 4.42% in mid-January was driven in part by White House comments that seemed to accept a growth slowdown as a short-term consequence of its deep spending cuts. The S&P 500 index went into a correction. For the stock market, the risk is that the Fed won't be dovish enough. Inflation has proved stubborn and tariffs could further reignite prices, forcing the central bank into caution. The typical pattern of Fed response is to actually see a solid change in the data, which will then lead to more forceful action. Yet that might only happen later this year. "Traders appear to have gotten too dovish on the Fed," say Macquarie strategists Thierry Wizman and Gareth Berry. —Liz Capo McCormick, Michael Mackenzie and Michael Msika |

No comments:

Post a Comment