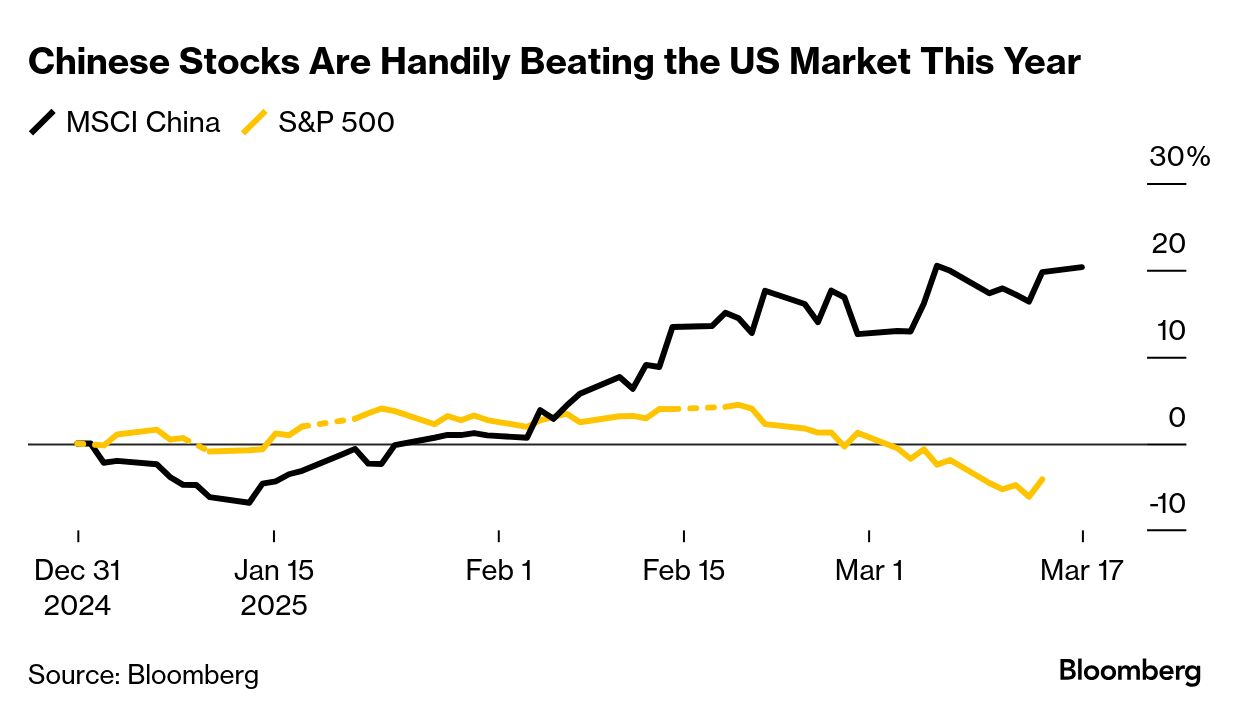

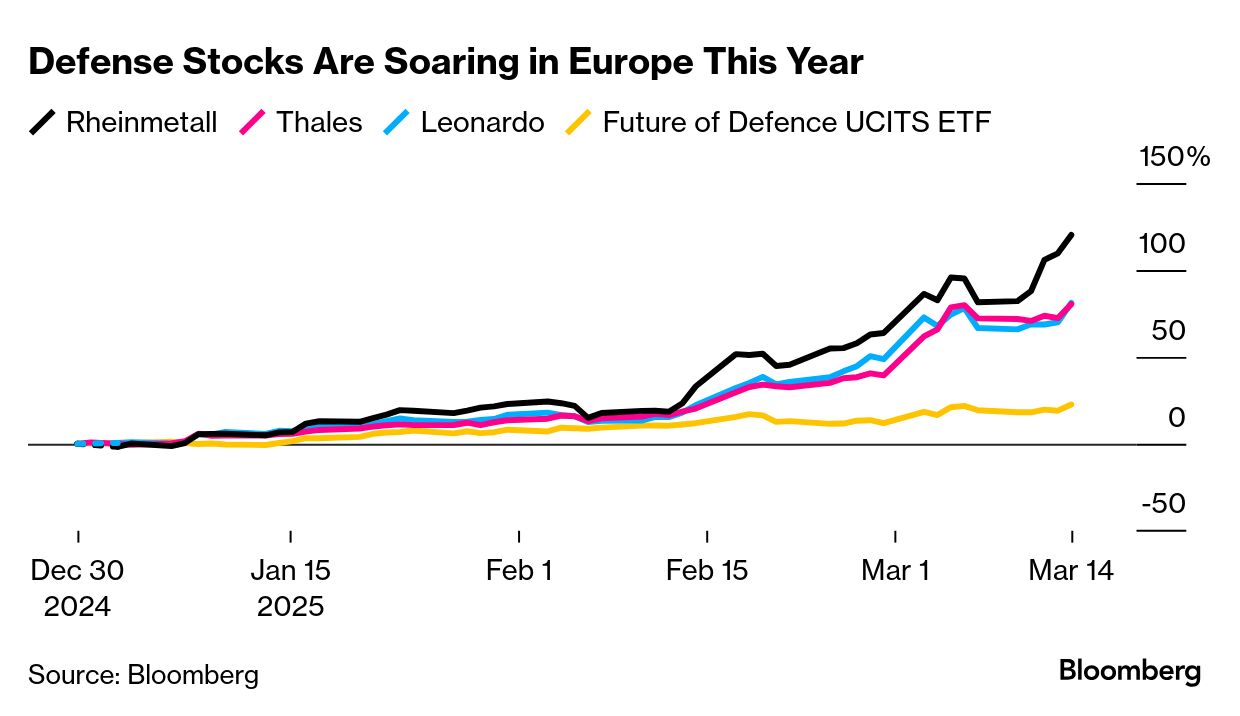

| There's much debate around the existence of the "Fed put" or "Trump put" — whereby US authorities step in with market-friendly policies when stocks slump. Now speculation is swirling around a "Xi put" as Chinese investors turn optimistic President Xi Jinping's push for economic expansion and tech innovation will help extend this year's advance in equities. The idea marks a notable shift in investor perception about the Chinese leader, whose grip on power has deterred foreign flows over the past few years. The MSCI China Index has soared 20% in 2025. By contrast, the S&P 500 has dropped 4%. Figures today showed that Chinese consumption, investment and industrial production exceeded estimates to start the year, pointing to signs of resilience for the economy. Still, more stimulus is needed as Trump's tariffs threaten growth. China's central bank said today it's studying the possibility of new monetary policy tools to spur consumption, though the briefing failed to enthuse investors. With fresh measures anticipated to revive the economy and signs of an earnings recovery emerging, JPMorgan Chase and Templeton are among those forecasting the rally will widen beyond the tech sector in the coming months. — Sangmi Cha and Abhishek Vishnoi Investors are chasing this year's hottest trade in European stocks: defense contractors. Exchange-traded funds focused on defense and arms companies have attracted more than $1.4 billion in inflows as US President Donald Trump pushes for European countries to increase military spending. The Select Stoxx Europe Aerospace & Defense ETF in the US has taken in $280 million this year after barely any cash inflow between its October launch and the end of 2024, data compiled by Bloomberg show. Global X's Defense Tech ETF has drawn $230 million. In Europe, the Future of Defence UCITS ETF, which trades under the NATO ticker, has added roughly $910 million. A new competitor entered the European market last week too: WisdomTree launched the WisdomTree Europe Defence UCITS ETF. "Most investors in defense are long term," said Hector McNeil, co-founder and co-CEO of HANetf, which helped launch the NATO fund. "They see that all countries, especially NATO countries, will have to up their spending for at least the next decade." —Vildana Hajric |

No comments:

Post a Comment