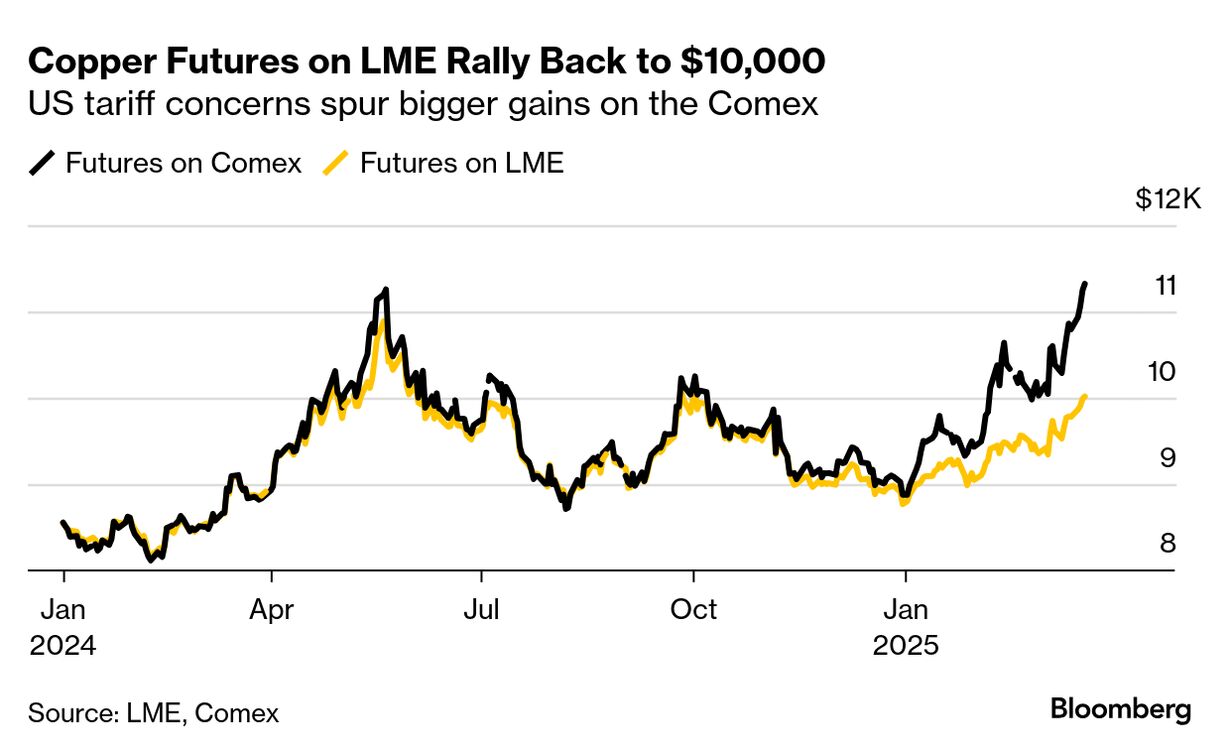

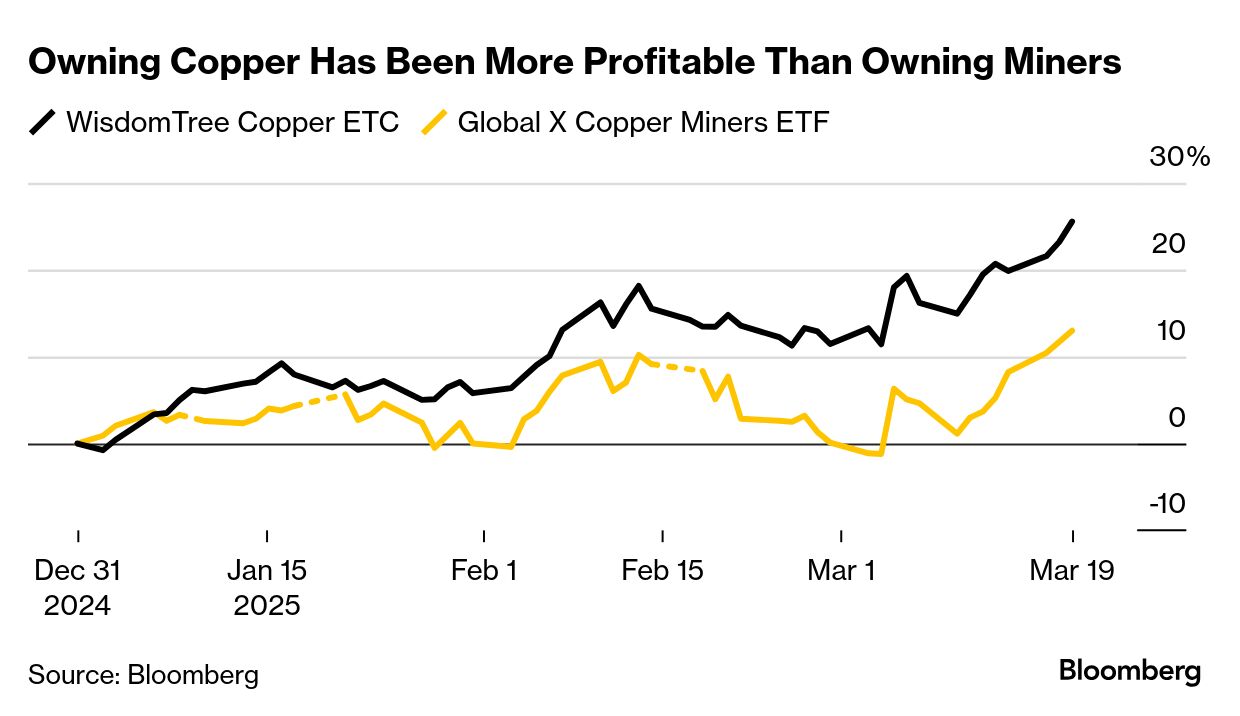

| There's one Trump trade that hasn't gotten much attention this year: Copper. The metal in London trading has surpassed the $10,000 a ton mark again after weeks of global dislocation triggered by the US president's push for tariffs on the crucial industrial commodity. Trump last month ordered the Commerce Department to investigate copper imports — a likely precursor to imposing duties. Since then, US prices have spiked and traders have scrambled to send metal to America ahead of any tariffs, in turn reducing availability in the rest of the world. "This is a round of cross-regional repricing triggered by potential US tariffs," said Wei Lai, deputy trading head at Zijin Mining. "Cargoes are lured to the US, leaving other places in shortfall.'' Also, copper typically benefits from a weaker dollar, and the greenback has softened since Trump returned to the White House. Finally, the metal has support from tight spots in its supply chain: Smelters are suffering as a frenzy of expansions has left them fighting to secure raw materials. Copper is mostly traded as a hedge by industrial companies, and by fast-money commodity speculators. But Wall Street of course has churned out plenty of products aimed at retail investors. A quick search on the Bloomberg shows 59 exchange-traded products around the world that have copper in their name. Here's how the two biggest have done this year: The quick takeaway is that the London-traded WisdomTree fund (ticker COPA LN), which tracks copper futures, is doing better than the Global X product (COPX), which owns shares of almost 50 miners. The real money, of course, has been made and lost on leveraged funds. A WisdomTree fund (3HCL LN) that makes a triple leveraged bet on copper has returned 87% this year, while a triple leveraged short bet — also from WisdomTree (3HCS LN) — has lost 52%. —Paul-Alain Hunt, Winnie Zhu and Phil Serafino |

No comments:

Post a Comment