| Market data as of 06:45 am EST. Market data may be delayed depending on provider agreements. German stocks are surging and bund yields are c |

| |

| Markets Snapshot | | | | Market data as of 06:45 am EST. | View or Create your Watchlist | | | Market data may be delayed depending on provider agreements. | | |

Five things you need to know | |

| |

| |

| When UK Prime Minister Keir Starmer declared on Sunday the need for a "coalition of the willing" to support Ukraine, he did so from London's Lancaster House, the same location where Mario Draghi once pledged that the European Central Bank would do "whatever it takes" to protect the euro.

Two days later, Germany's Merz used Draghi's catchphrase when talking about efforts to defend the country, as he announced plans to set up a €500 billion infrastructure fund. Meanwhile, the EU will propose extending €150 billion in loans to boost defense spending. And traders are rushing to respond this morning: - German bond yields are surging by the most since 2022.

- The euro is on course for its best three-day gain since late 2022. It's now at the highest level versus the dollar this year. Goldman Sachs is among banks that have dropped predictions in recent days that the euro would reach dollar parity in 2025.

- The Stoxx 600 is up 1.3%. It's on track for the biggest quarterly outperformance of the S&P 500 in a decade.

Such a backdrop is prompting strategists at Deutsche Bank to ask: "Is Make Europe Great Again (MEGA) the new MAGA?"

"Europe and Germany in particular are showing a historically unprecedented responsiveness to revising the fiscal stance," Deutsche Bank's George Saravelos said in a note to clients. "This flexibility will not only likely mute the potential impact of upcoming tariffs, but creates an upside growth bias once the impact of tariffs has been absorbed." Reports that Ukraine may be more willing to negotiate with Russia are also adding to the optimism. A further fillip is set to come on Thursday with the ECB set to cut interest rates again. Economists see the Federal Reserve keeping rates unchanged at its March 19 decision. "These impressive plans underline that the authorities are thinking big and funding capacities could be maxed to the limit in coming years," said Christoph Rieger, head of rates and credit research at Commerzbank. —Simon Kennedy | |

| | This is just a slice of our global markets coverage. To unlock every story and stay on top of the stocks you care about with unlimited watchlists, become a Bloomberg.com subscriber. | | | | | | |

| |

- Shares of defense and industrial companies are soaring in Germany on the spending pledge, including Rheinmetall 5.8%, Hensoldt 7.3%, Renk 8.9% Heidelberg Materials 11%, Bilfinger 18%, Hochtief 15% and Thyssenkrupp 15%.

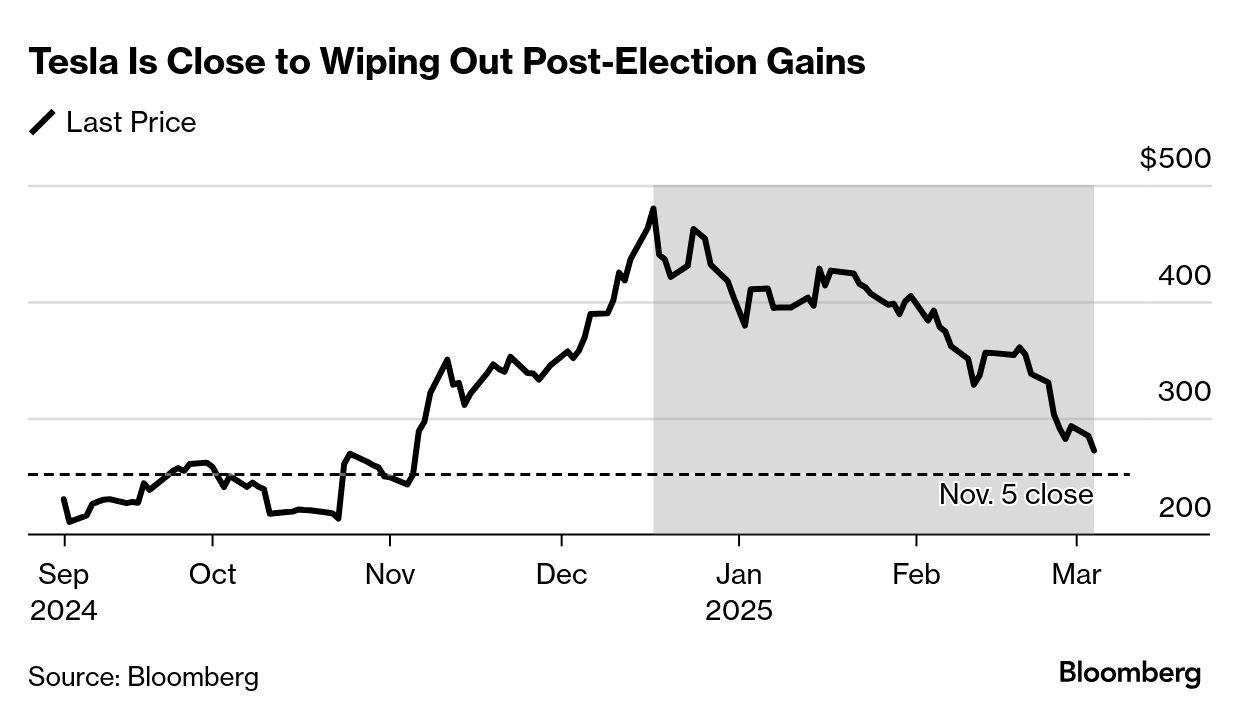

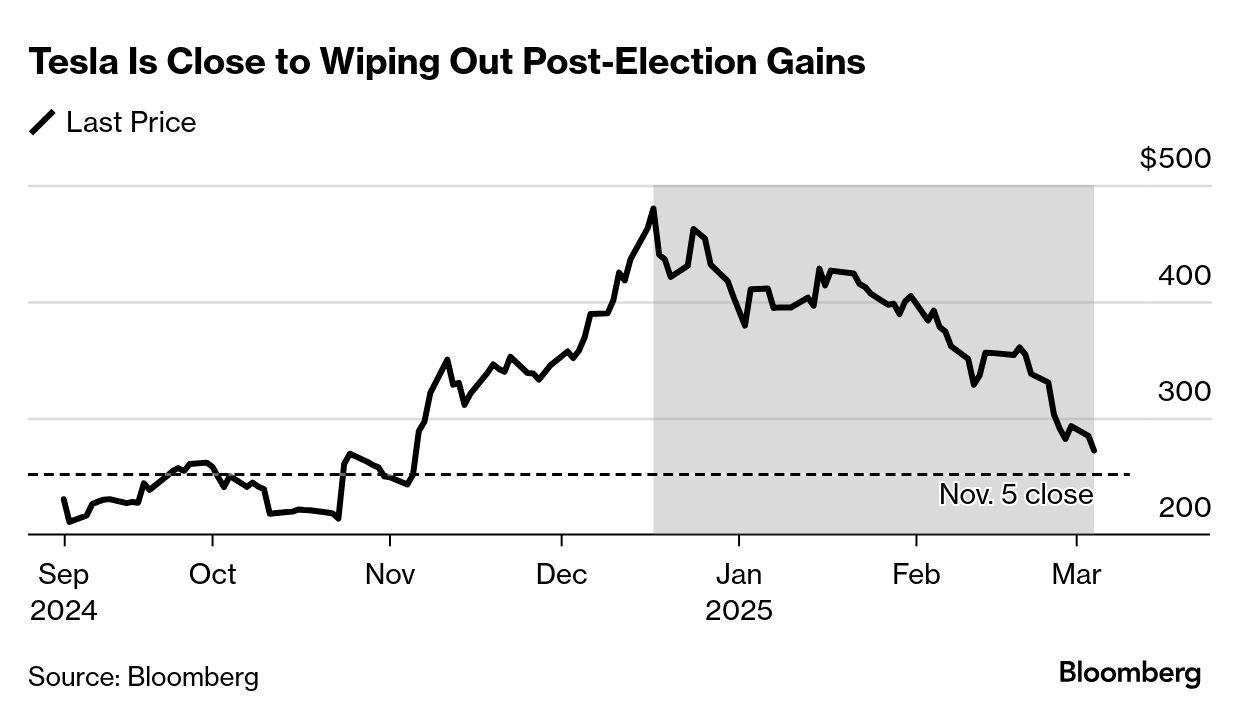

- Tesla rises 2.4% in premarket trading, paring some of its recent slump. The EV maker reported a 21% jump in UK car registrations last month. Registrations in Germany, though, fell 76%.

- Crowdstrike falls 9.4%. The cybersecurity company issued a worse-than-expected earnings outlook, signaling that it's still recovering from a flawed software update that crashed computers last year.

- Sports betting company Flutter Entertainment rises. The Fanduel owner reported a sharp increase in profit.

- Adidas falls 4.4% in Munich. The German sportswear brand said earnings will grow slower this year than investors expected, even as it builds momentum with its retro footwear.

- Bayer rises 5.5%. The German maker of drugs and farming pesticides reported sales and earnings that were ahead of expectations. —Subrat Patnaik

| |

| |

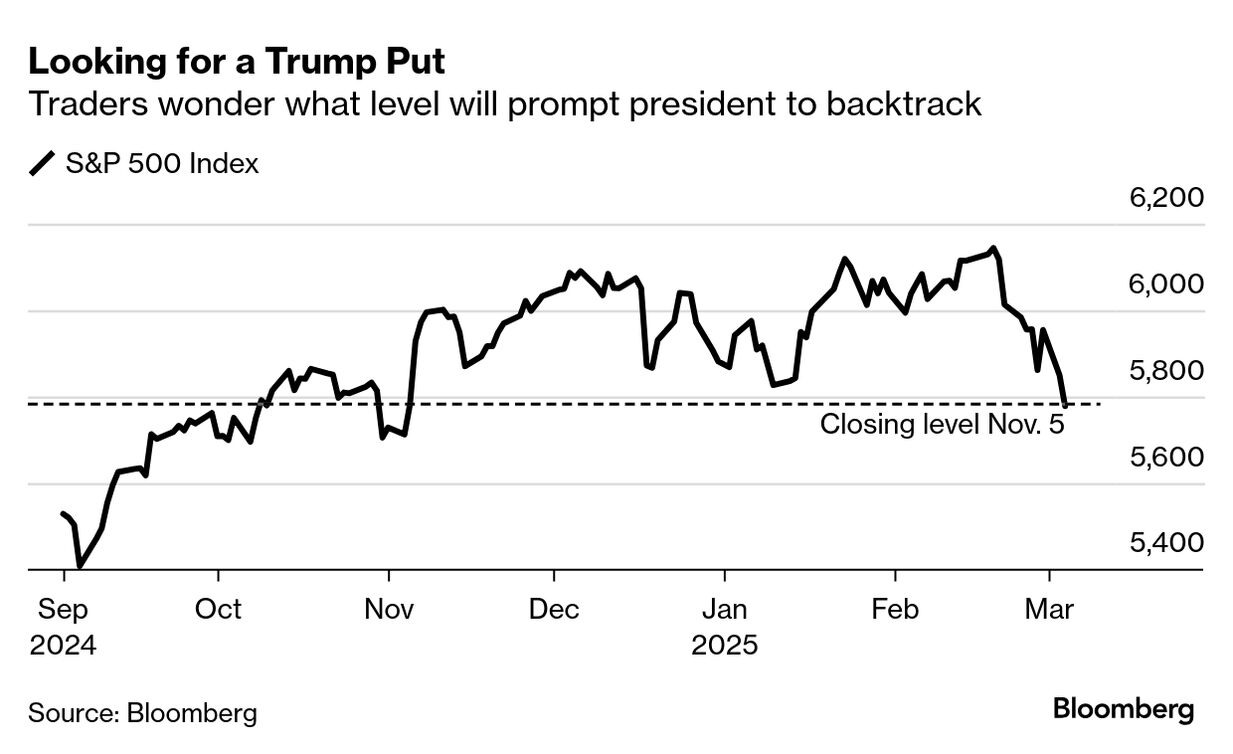

| Traders are now primed for the Trump put — a policy reversal that brings buyers in to the market when the slide in stocks gets too painful for the president. There were the makings of such a shift yesterday, when Commerce Secretary Howard Lutnick told Fox Business Network that Trump may offer a pathway for tariff relief for Mexico and Canada. Investors responded immediately, fueling an after-hours rally in stock-index futures and a 1% gain in the biggest ETF that tracks tech shares. Various Wall Street firms have guessed how much pain Trump could tolerate in the S&P 500 before retreating. That index level is being called the Trump put, in reference to a put option. Bank of America strategists had thought the first strike price of the Trump put was the S&P 500's closing level on Election Day, about 5,783. And that's almost precisely where the index closed on Tuesday. Some suspect it will take a more dramatic tumble to get Trump to flinch. JonesTrading's Dave Lutz says the Trump put may be below 5,500. "That's when the media will start rolling headlines about the stock market being in a correction — 10% off highs," he said. "Those headlines should get the President's attention." —Jessica Menton and Alexandra Semenova | |

Word from Wall Street | | "You have a white-hot marketplace that has been punched in the face the last five to six days about the reality of not one or two initiatives out of the White House, but a dozen initiatives." | | Jim Zelter President, Apollo Global Management | | Check out the interview on Bloomberg Television here. | | |

One number to start your day | | | |

| |

| |

| |

| |

Enjoying Markets Daily? You might also like: | - Breaking News Alerts for the biggest stories from around the world, delivered to your inbox as they happen

- Odd Lots for Joe Weisenthal and Tracy Alloway's daily newsletter on the newest market crazes

- The Everything Risk for Ed Harrison's weekly take on what could upend markets

- Money Stuff for Bloomberg Opinion's Matt Levine's newsletter on all things Wall Street and finance

- Points of Return for Bloomberg Opinion's John Authers' daily dive into markets

Bloomberg.com subscribers have exclusive access to all of our premium newsletters. | |

| |

Like getting this newsletter? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and subscriber-only insights. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Markets Daily newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment