| |

| |

| Markets Snapshot | | | | Market data as of 05:37 am EST. | View or Create your Watchlist | | | Market data may be delayed depending on provider agreements. | | |

Five things you need to know | |

- Donald Trump's April 2 tariff announcement is poised to be more targeted than the wide barrage he has occasionally threatened. The reciprocal tariffs will exclude some nations and blocs and as of now Trump isn't planning separate, sector-specific tariffs to be unveiled the same day, aides and allies say.

- Stocks rose on speculation that the levies could be more measured than feared. US futures pointed to a gain of about 1% for the S&P 500 at the open, while reduced appetite for safer assets sent Treasuries lower.

- Ukrainian and US officials held talks in Riyadh, resuming efforts to end Russia's full-scale invasion as Donald Trump pushes for a ceasefire. US and Russian delegates are expected to hold separate talks today.

- Mark Carney began his bid for election in Canada with a stark warning that Donald Trump is serious about wanting to annex the country.

- Shares of Bayer are slumping 7.5% after a jury in Georgia ordered the company to pay about $2.1 billion to a plaintiff who claimed its Roundup weedkiller caused cancer. US litigation has already cost the German company about $10 billion.

US President Donald Trump has launched an era of tariff wars, infusing the business world with a new level of chaos and uncertainty. How are business leaders adjusting? Join us for a Live Q&A today at 10:30 a.m. EDT. | |

| |

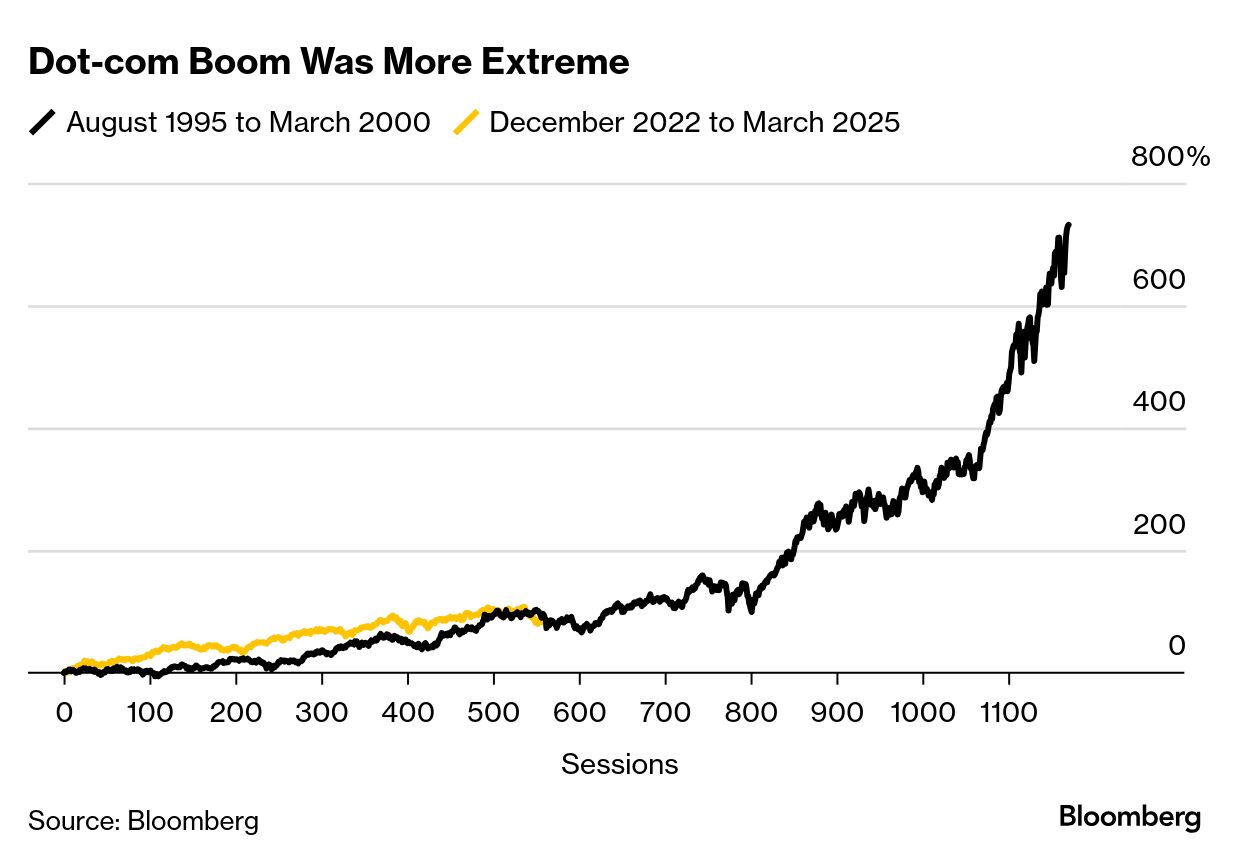

| A revolutionary new technology comes along and infatuates investors with its seemingly limitless possibilities. Euphoria sparks a stock market rally. Eventually things get overheated and share prices become ridiculous. Then it all collapses. Sound familiar? It happened exactly 25 years ago when the roughly five-year dot-com bubble popped, leaving trillions of dollars of investment losses in its wake. On March 24, 2000, the S&P 500 Index posted a record level it wouldn't see again until 2007. Three days later, the tech-heavy Nasdaq 100 also closed at an all-time high, the last time it would do that for more than 15 years. Those peaks marked the end of an electric run from August 1995 to March 2000. The S&P 500 would almost triple, while the Nasdaq 100 soared 718%. And then it ended. By October 2002, more than 80% of the Nasdaq's value was gone, and the S&P 500 was essentially cut in half. Echoes of that era are reverberating now. The technology this time is artificial intelligence. After a rally that sent the S&P 500 soaring 72% from its trough in October 2022 to its peak last month, adding more than $22 trillion of market value in the process, signs of trouble are emerging. Stocks are starting to sink, with the Nasdaq 100 losing more than 10% to fall into a correction and S&P 500 briefly dropping to that level. And the symmetry is raising frightening memories from a quarter century ago. "Investors have two emotions: fear and greed," said Vinod Khosla, a billionaire venture capitalist who was a key rainmaker during the internet boom and remains one today. "I think we've moved from fear to greed. When you get greed, you get I would say indiscriminate valuations." —Jeran Wittenstein,Ryan Vlastelica and Carmen Reinicke | |

| | This is just a slice of our global markets coverage. To unlock every story and stay on top of the stocks you care about with unlimited watchlists, become a Bloomberg.com subscriber. | | | | | | |

| |

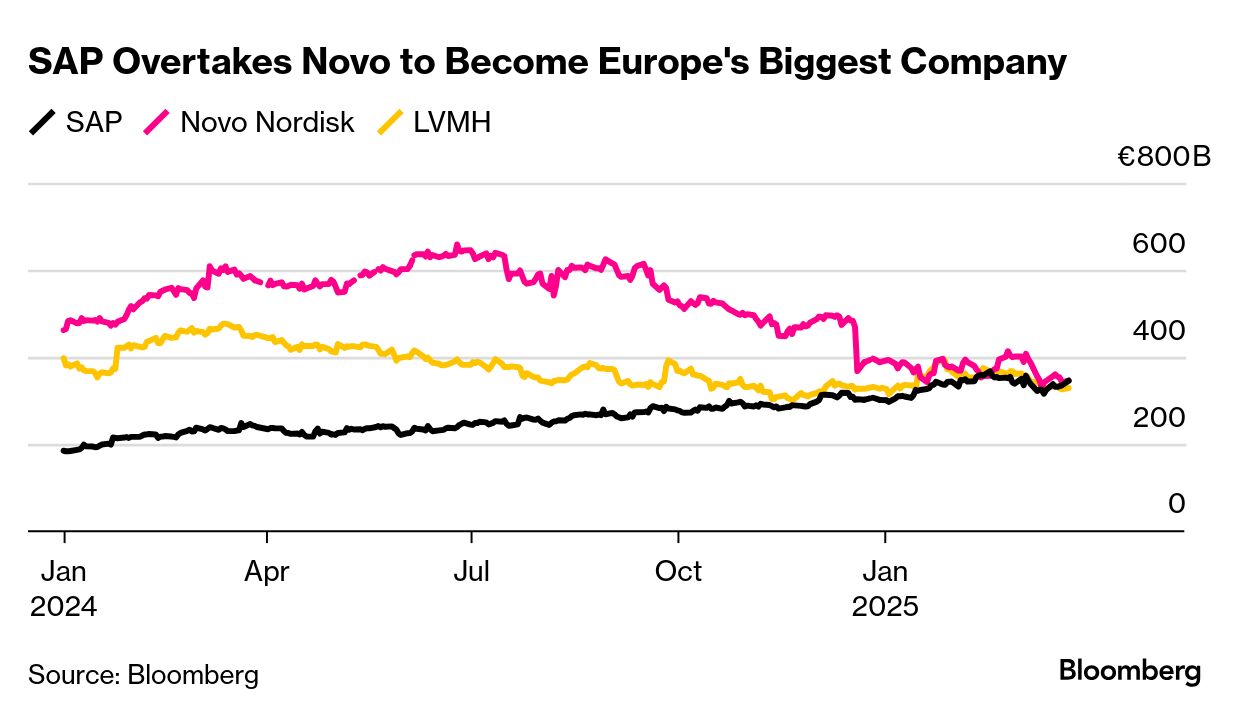

- German software giant SAP claimed the title of Europe's most valuable public company, surpassing Danish weight-loss drug maker Novo Nordisk. SAP shares have risen 42% in the past year as customers shift from traditional on-site servers to IT infrastructure on the cloud.

- Kenvue rises 1.1% as TOMS Capital Investment Management was said to have amassed a stake in the consumer-health company. The hedge fund is urging Kenvue to consider a full sale or separation of some assets, according to people with knowledge of the matter.

- Tesla is up 4%, leading premarket gains among the Magnificent Seven stocks on Monday as retail investors pile in.

- BYD's earnings, due today, could cement the electric-vehicle maker's place as the most valuable non-state company listed in China. BYD now rivals Tesla as the world's top EV seller.

- AZEK jumps 20% as the Australian building materials company James Hardie Industries agreed to buy home-decking provider in a $8.75 billion cash and stock deal. James Hardie closed down 15% in Sydney trading. — Subrat Patnaik

| |

| |

| Investors will be on watch for any more details of President Donald Trump's plan to impose reciprocal tariffs on April 2. Meantime, the US personal consumption expenditures price data is released. More on the economic outlook here. Monday – Purchasing manager indices. Atlanta Fed President Raphael Bostic will appear on Bloomberg TV. Tuesday – Germany's Ifo report and US consumer confidence. The Boao Forum for Asia begins. New York Fed President John Williams speaks. Wednesday – UK government's Spring economic statement, Congressional Budget Office releases estimate of when the US Treasury will reach debt ceiling. Paychex, Dollar Tree, Jefferies earnings. Thursday – Norwegian central bank decision (expected to leave rates on hold), Mexico's central bank sets rates (cut predicted). Congressional Budget Office releases 30-year US federal budget outlook. Lululemon earnings. Friday – US PCE price index (excluding food and energy, it's predicted to have accelerated to a 2.7% annual pace), Tokyo consumer prices, UK quarterly GDP and retail sales, Canadian GDP. | |

| |

| Treasury Secretary Scott Bessent can't stop talking about 10-year bond yields. In speeches, in interviews, week after week, he states and restates the administration's plan to push them down and keep them down. Some of this is normal — keeping government borrowing costs in check has long been part of the job — but Bessent's fixation on the benchmark US note is so intense that he's forced some on Wall Street to tear up their predictions for 2025. In the past couple weeks, chief rates strategists at Barclays, Royal Bank of Canada and Societe Generale have cut their year-end forecasts for 10-year yields. In part, they said, it's because of Bessent's campaign to drive them lower. It's not just the jawboning, they added, but the fact that Bessent can follow it up with concrete action like limiting the size of 10-year debt auctions. "What used to be often mentioned in the bond market is the idea of don't fight the Fed," said Guneet Dhingra, head of US interest rates strategy at BNP Paribas. "It's somewhat evolving into don't fight the Treasury." Yields have come down already over the past two months though that's less about Bessent and more about his boss, Donald Trump, whose tariff and trade-war threats have sparked fears of a recession and pushed investors out of stocks and into the safety of bonds. That's not exactly the kind of bond rally Bessent had in mind — he wants it to be the product of fiscal discipline and sustainable economic growth — but it has only added to the sense among some in the market that this administration is going to bring down yields one way or another.—Ye Xie and Liz Capo McCormick | |

Speaking of anniversaries... | |

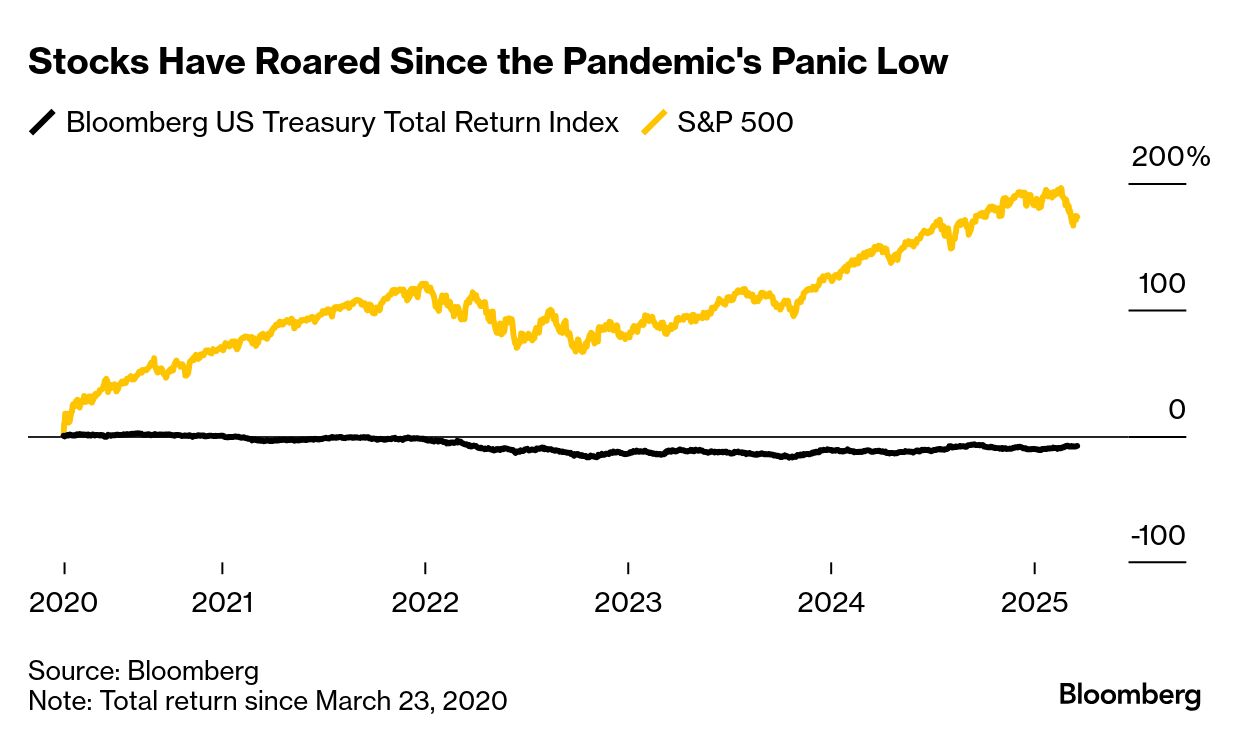

| Five years ago yesterday, the S&p 500 plunged to its lowest point during the pandemic, closing at 2,237.40, down by a third from its record of a month earlier. Covid had only been in the public consciousness for several weeks, and the magnitude was just sinking in – Attorney General Bill Barr warned against hoarding at a news conference that day, and in the UK, Boris Johnson ordered a nationwide lockdown. No one knew how deadly or long-running the pandemic would be. And certainly no one knew that we would have an effective vaccine by year's end. Yet stocks started to run up the next day, and by Aug. 18 the market was back at a record high. The S&P 500 has returned 173% since the March 2020 low, equal to 22% annually. Think about all that's happened since then: A mob attacked the US Capitol to try to overturn an election, Russia invaded Ukraine, the Fed jacked up interest rates, Donald Trump launched a trade war – and until a month ago, the market was at records (Yes, there was a bear market in 2022). That little history lesson just serves as a reminder for individual investors that it's almost impossible to try to trade around the news. The standard personal finance advice – use low-cost index funds to set an asset allocation that allows you to sleep well at night, rebalance when it gets out of whack, and otherwise leave well enough alone — would have paid off. —Phil Serafino | |

| |

One number to start your day | | | |

| |

| |

| |

Enjoying Markets Daily? You might also like: | - Breaking News Alerts for the biggest stories from around the world, delivered to your inbox as they happen

- Odd Lots for Joe Weisenthal and Tracy Alloway's daily newsletter on the newest market crazes

- The Everything Risk for Ed Harrison's weekly take on what could upend markets

- Money Stuff for Bloomberg Opinion's Matt Levine's newsletter on all things Wall Street and finance

- Points of Return for Bloomberg Opinion's John Authers' daily dive into markets

Bloomberg.com subscribers have exclusive access to all of our premium newsletters. | |

| |

Like getting this newsletter? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and subscriber-only insights. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Markets Daily newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment