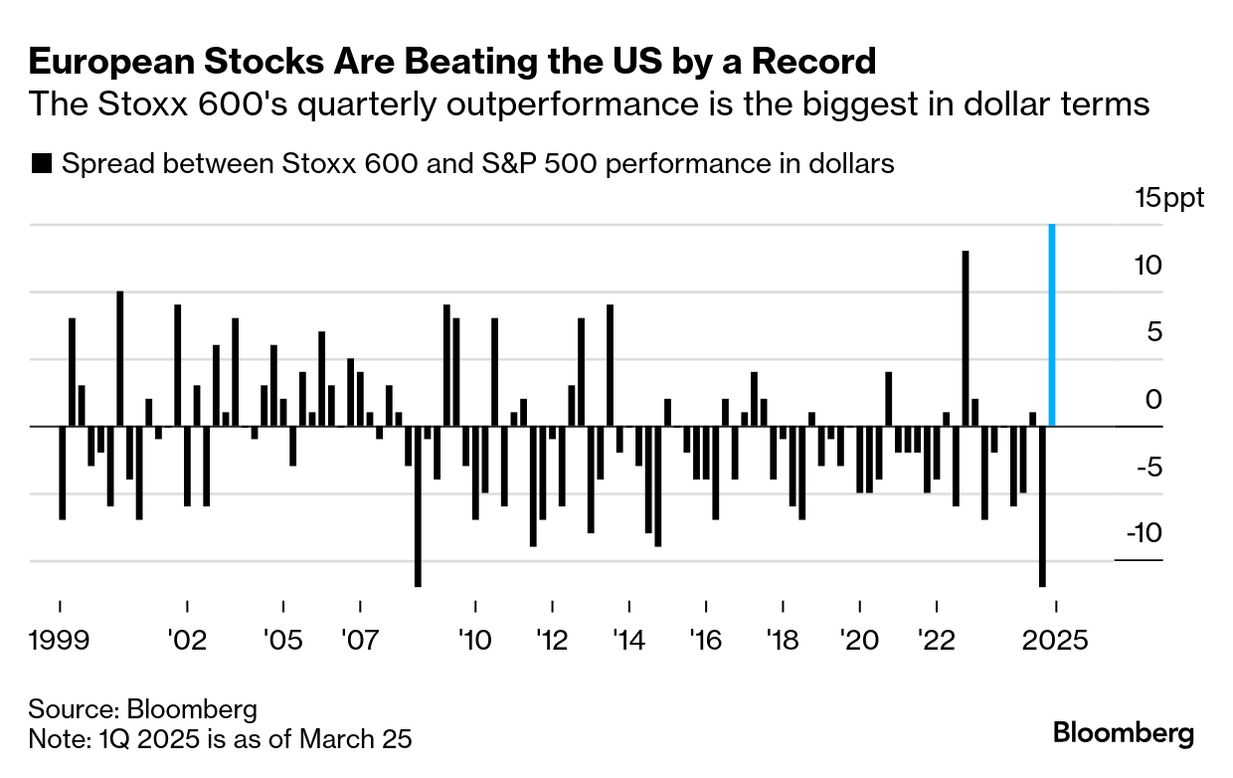

| A recurring question in markets this year has been whether US exceptionalism is well and truly over. It's sure seemed that way at times— stock indexes in Europe have been outperforming US benchmarks, while Chinese tech shares have soared even as the once-hot Magnificent Seven stumbled. But the world's largest asset manager sees a comeback in store for the US. Stocks in America will soon regain their long-held edge over European peers, says Jean Boivin, head of the BlackRock's in-house strategy shop, the BlackRock Investment Institute. The brighter outlook for the old continent's stocks is limited to sectors such as defense and banks, he says. "This is a pretty narrow European story," Boivin said in an interview in London. "There's no strong conviction yet to play Europe over the US over a six-to-12 month horizon. We need to see more fiscal impetus beyond defense and implementation will be key." In a reversal of trends from past years, Europe's benchmark Stoxx 600 Index is enjoying a record outperformance of the S&P 500 in dollar terms this quarter. The move is based on optimism around a ceasefire in Ukraine and Germany's historic fiscal reform, which has sent defense stocks to all-time highs. The Stoxx 600 Banks Index has also surged 28% this year, driven by resilient earnings. In the US, on the other hand, signs of a slowing economy and concern about high valuations for Big Tech have roiled markets. Volatility has picked up globally ahead of April 2, when US President Donald Trump has promised to enact levies on key trading partners. But Boivin said he's confident the US stock market "can live in a world with some tariffs." He expects US earnings downgrades to be short-lived as tariff-related uncertainty dissipates. "The US is the place where we expect to see the strongest earnings growth on a six-to-12 month horizon," the strategist said. "We think a 10%-tariff world is a likely landing zone, and the US can adjust to that. But if it's much more than that, then it's a different story." Hedge funds, meanwhile, have started to snap up the shares of economically sensitive companies in the US that cratered over the past month as recession worries rocked the market. Last week, they bought shares of banks, energy producers and other companies whose fortunes are closely tied to the economic cycle at the fastest pace since December, data from Goldman Sachs's prime brokerage shows. Those stocks had been among the hardest hit, with one key index plunging nearly 10% from its recent highs, as Trump's start-stop tariff threats sparked concern US growth would fizzle out. —Sagarika Jaisinghani and Natalia Kniazhevich |

No comments:

Post a Comment