| Bloomberg Evening Briefing Americas |

| |

| The selloff in US equities accelerated Monday with the S&P 500 dropping another 2.7% and the Nasdaq 100 losing 3.8%, it's worst day since 2022. In the megacap space, Tesla sank 15% while Nvidia drove a closely watched gauge of chipmakers toward the lowest since April. The Dow Jones Industrial Average lost 2.1%. The main culprit? Uncertainty. Continuing angst over Donald Trump's unpredictable tariff threats drove investors to havens. The US president's mass firings of federal employees—many of which are tied up in litigation—and his apparent ambivalence toward the possibility he may trigger a recession all appeared to drive equities down. But not everyone is filled with dread. "We've gone from animal spirits to what are the odds of a recession," said Gina Bolvin, president of Bolvin Wealth Management Group. "We finally have the correction we were waiting for, and long-term investors will be rewarded again." —David E. Rovella | |

What You Need to Know Today | |

| Investors looking for a safe place to hide are shoveling money into ultra-short bond exchange-traded funds. The cohort has taken in more than $16 billion so far this year. Yields on policy-sensitive two-year Treasuries have dropped sharply in recent days as bond traders increasingly signal that the US economy is about to sputter out. Investors are now betting that the Federal Reserve will resume cutting interest rates by June, if not sooner, to bolster the economy. During such times of turmoil, investors tend to turn to less volatile and lower-risk assets like fast-maturing bonds. | |

|

| A Canadian province that exports electricity to the US raised power prices for three states by 25% on Monday in retaliation for Trump's tariffs. Ontario directed its grid operator, the Independent Electricity System Operator, to add a C$10 ($7) per megawatt-hour surcharge to all power exported to Minnesota, Michigan and New York. "Believe me when I say I don't want to do this. I feel terrible for the American people," Premier Doug Ford said. "It's one person who is responsible." Though largely symbolic, the move is emblematic of the intensifying blowback the US is feeling over Trump's scattershot tariff strategy. | |

|

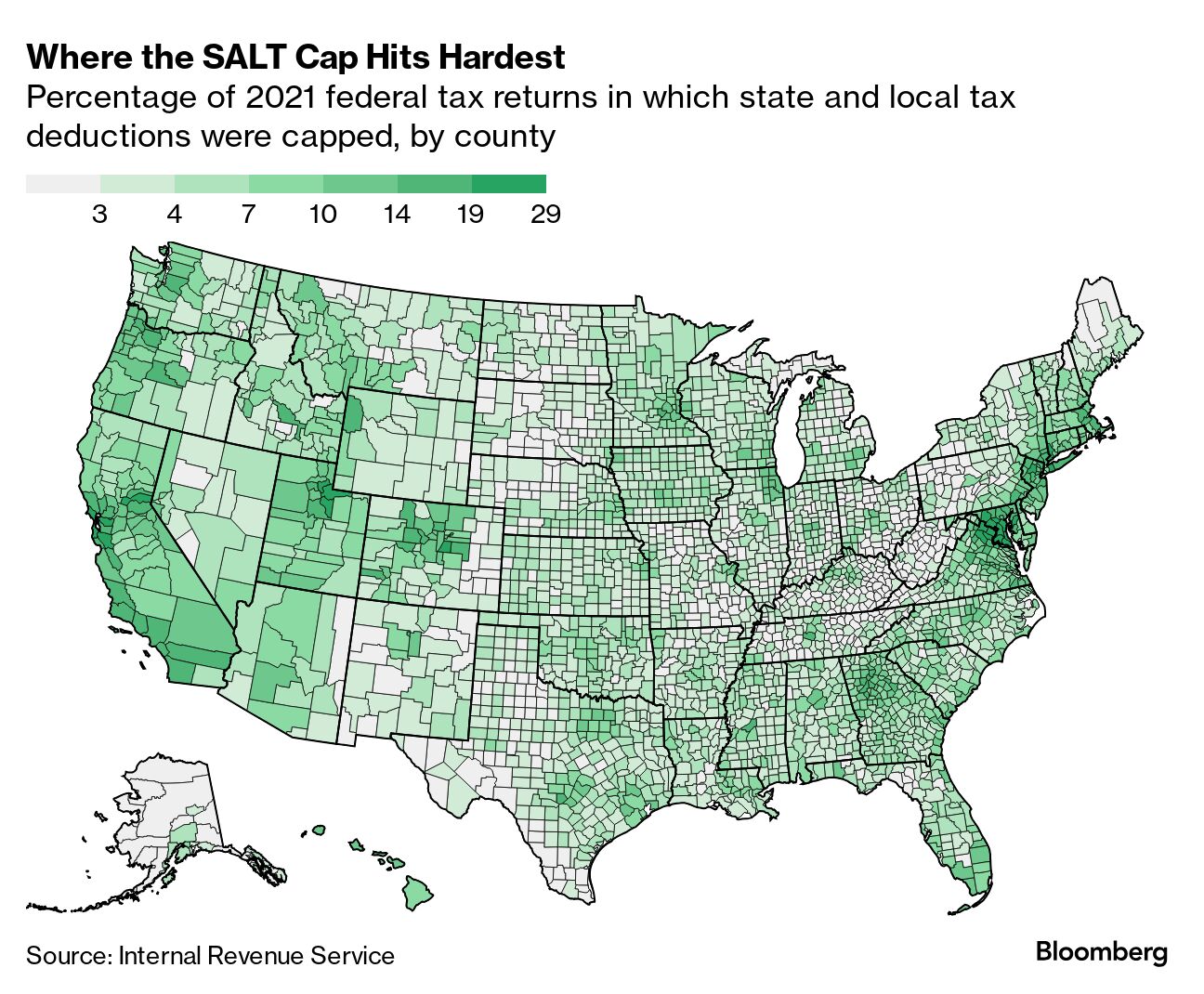

| The head of the House Freedom Caucus predicted Monday that Congress will raise the $10,000 cap on the state and local tax deduction (SALT), a sign deficit hawks won't stand in the way of SALT changes later this year as part of a massive tax and spending package promised by Republicans. Congress is set to double the deduction for joint filers to $20,000, eliminating the current so-called marriage penalty because the deduction was capped at $10,000 (under a 2017 Republican tax cut bill, many parts of which the GOP is seeking to renew). If passed, the provision would be good news for residents of higher-tax blue states, which may be part of the plan. | |

|

| Germany's effort to start rearming in the face of Russian aggression and America's historic shift toward the Kremlin hit an obstacle: The Green Party. It rejected a debt-financed package that would unleash hundreds of billions of euros in defense and infrastructure spending, potentially imperiling the flagship policy of chancellor-in-waiting Friedrich Merz. He needs Green support to secure a two-thirds majority required for a constitutional amendment to ease borrowing restrictions. The debt spending was embraced by NATO partners as a significant step forward in bolstering European defenses, but Green Party leaders apparently were miffed at having been left out of negotiations. | |

|

| |

|

| The virtue economy has now completely burst, Allison Schrager writes in Bloomberg Opinion. Many companies are cutting their DEI programs, flows into ESG funds in the US have fallen and companies are being more quiet about politics. The disappearance of the "virtue-industrial complex" does not come without a cost, on a human as well as financial level, she writes. At the same time, there is a clear winner— the concept of shareholder primacy. The idea, popularized by Nobel laureate Milton Friedman in 1970, is that corporate executives and boards have a single goal: to maximize return to their shareholders. | |

|

| |

What You'll Need to Know Tomorrow | |

| |

| |

| |

| Enjoying Evening Briefing Americas? Get more news and analysis with our regional editions for Asia and Europe. Check out these newsletters, too: Explore all newsletters at Bloomberg.com. | |

| |

Like getting this newsletter? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and subscriber-only insights. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Evening Briefing: Americas newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment