Market-Beating Stock Picks: Uncovering Trades Primed for Profits

In the high-stakes world of investing, finding truly exceptional stocks is like searching for a needle in a haystack. And even then, those elusive winners can quickly transform into portfolio-killers. Indeed, as the old saying goes, stocks take the stairs up and the elevator down. Often, a trade looks poised to start a long and steady ascent – only to suddenly plummet to the ground floor, wiping out investors’ hard-fought gains. When trading the markets, you can do everything right… and still lose money. That’s because exogenous events often play a massive role when it comes to trading results. If a company in the same sector as one of your current investments reports poor earnings, your trade may sell off in sympathy. Many times, the entire market will nosedive in response to some geopolitical event. Or a short seller could make a damning claim against the company you’re trading, and the stock tanks in response (even though that assertion is eventually proven baseless). All these variables could result in a losing trade, and it would have nothing to do with you or your system. But what if you had a powerful tool that could cut through such rampant market noise, analyzing thousands of stocks to uncover only the most promising opportunities? Auspex, an Innovative Investment Resource For several months, my team and I worked to create what we hope is the ultimate stock-picking tool – one that can help us spot the best stocks to buy at the most opportune time. I’m talking about stocks with strong fundamental, technical, and sentimental support; nearly airtight trades that are strong in every way. That is exactly what we designed our tool – dubbed Auspex – to do. Specifically, Auspex analyzes market data to find stocks that are: - Growing – displaying positive and accelerating earnings and revenue growth, as well as positive profit margin expansion.

- Rising sustainably – featuring an upward-sloping 200-day moving average (MA), short-term MAs above long-term ones, upward-trending action in the moving average convergence/divergence (MACD) line, and more.

- Garnering positive attention – increasing trading volume, analysts revising their earnings estimates higher, etc.

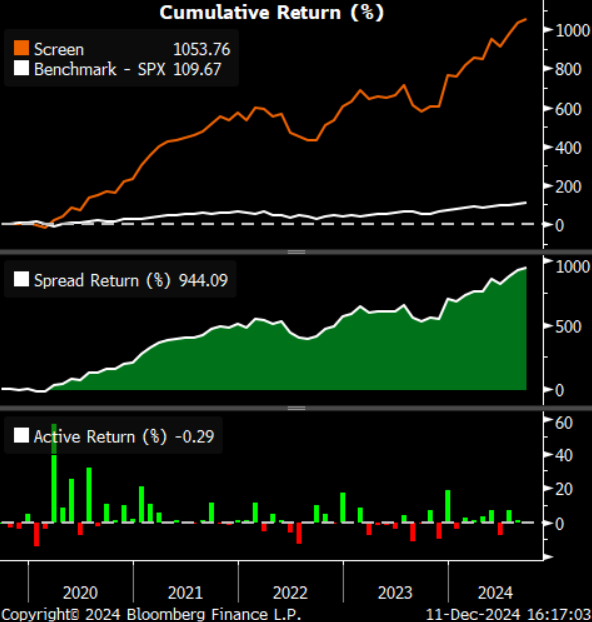

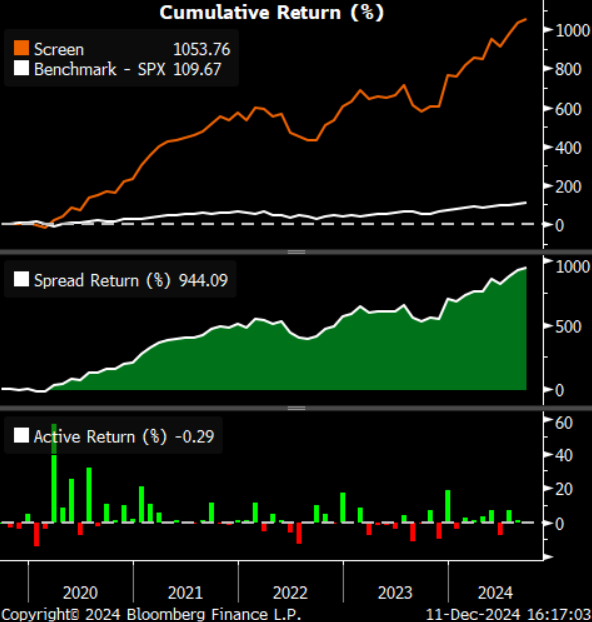

When a stock meets all these strict fundamental, technical, and sentimental criteria, then – and only then – does our model flag it. And, trust me; there’s not a lot of stocks that meet these standards. The Final Word In late January, for example, we ran an Auspex scan for the month of February. The model analyzed a universe of about 14,000 different stocks, looking for those that met all our strict fundamental, technical, and sentimental criteria. You know how many stocks made the cut? Out of roughly 14,000? Less than 20. Since its purpose is to find the best stocks to buy at the best time, the model is highly selective. But in being selective, we hope it delivers excellent results, too. And so far, it has. We’ve been internally testing Auspex since July. That month, Auspex helped us score a nearly 40% gain in AnaptysBio (ANAB) and ~30% gains in Zeta Global (ZETA) in just about 30 days. And various back tests show that one strategy of using the Auspex model could’ve led to a ~10X outperformance of the S&P 500 over the last five and 10 years.  That’s why I’m writing to you today. The stock market has been highly volatile recently. There’s a lot of uncertainty on the global geopolitical stage right now. And various surveys show that business and consumer sentiment is plunging. Across the board, conditions are a bit chaotic. But even with this turbulence, we hope to find peace of mind with some strong stocks for the month ahead. And in just a few short days, we’ll be releasing the results of Auspex’s latest scan, including what we think are some of the best stocks to buy for March. Game a struggling market with stocks primed for profits. Sincerely, |

No comments:

Post a Comment