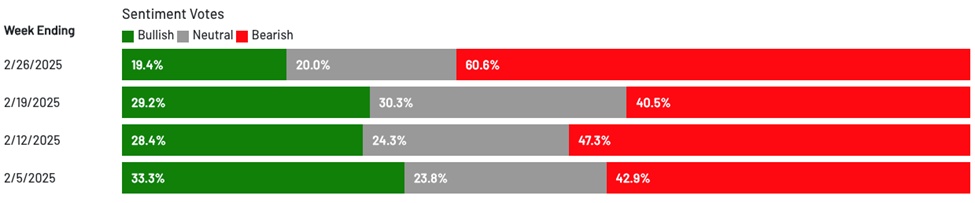

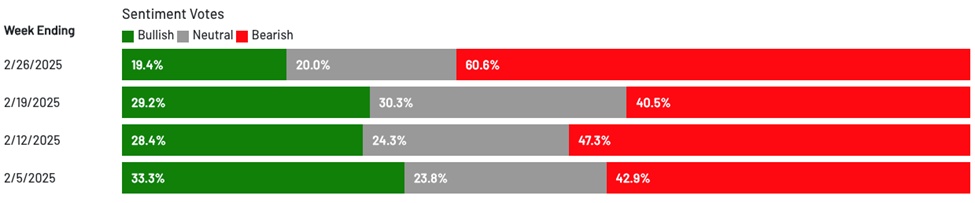

Don't Let Emotions Wreck Your Portfolio. We’re on the verge of a market meltdown. Or so you might believe based on the sentiment indicators. The latest AAII Sentiment Survey showed only 19.4% of respondents are bullish. This was the sixth time in eight weeks the reading came in below the historical average of 37.5%. Here are the results from the last four weeks:

Meanwhile, the Conference Board Consumer Confidence Index showed a rise in consumer pessimism. The Expectations Index (based on consumers’ short-term outlook for income, business, and labor market conditions) dropped 9.3 points to 72.9. From their press release: For the first time since June 2024, the Expectations Index was below the threshold of 80 that usually signals a recession ahead. The survey also showed that 27% of consumers expect business conditions to worsen over the next six to 12 months, the highest since June 2022. Looking at this data could spook any investor, leading to a classic investing mistake. However, investors who can keep their heads can profit no matter what the crowd is doing, and I’m going to share an opportunity today. Profiting by Separating Feelings from Data Last week I wrote about the Iron Law of the Stock Market: If a company massively grows its sales and earnings, its stock price will grow, too. Today, investor sentiment is low, but the earnings data tells a different story. According to FactSet: - 77% of S&P 500 companies exceeded earnings per share (EPS) estimates – equal to the five-year average of 77%.

- The S&P 500 reported growth in earnings of 17.8% – the highest growth since Q4 of 2021.

No wonder the market hit an all-time high just a week ago. And amid all the concern about inflation reigniting, yesterday, we learned the Personal Consumer Expenditures Index is 2.5%, down from 2.6% in December. Regardless of the numbers, herd mentality takes over when sentiment turns negative, causing investors to react without thinking. Here is what legendary investor Louis Navellier, editor of Growth Investor, has written about this classic investing mistake. A lot of you are probably fans of momentum investing. The truth is, I am, too. You always want to capitalize on a trend, and trends are made up of people. But while following the crowd CAN result in great momentum plays... you don’t want to do so blindly. The crowd-seeking I’m talking about – follow the herd, think later – is responsible for a lot of failed investments. It means you won’t pick up on a shift in the trend. Thus, you’ll get your timing all wrong. You’ll often end up buying near the highs and selling near the lows. Taking our natural biases out of the equation is at the heart of Louis’ quantitative stock picking system. A Quality Stock on Sale When market fear is high, savvy investors start to look for superior stocks that are on sale. That doesn’t necessarily mean cheap stocks. It means great companies selling at reasonable prices, resulting in good value. Warren Buffett once encapsulated this idea in his usual folksy way, saying: It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price. In Louis’ system, that means stocks growing sales, operating margins, and especially earnings. When a stock like that experiences a sell-off... then that’s a great opportunity. This week, one of Louis’ Growth Investor stocks, Vistra Corp. (VST), reported outstanding earnings...and still took a hit from the market. Here is Louis’ summary of its earnings report. Vistra Corp. (VST) noted that 2024 was not only a “record year but a transformational one” for the company. Full-year earnings soared 88.5% year-over-year to $2.81 billion, compared to $1.5 billion in fiscal year 2023. Revenue rose 16.5% year-over-year to $17.22 billion, topping estimates for $17.15 billion. For the fourth quarter, Vistra reported earnings of $490.0 million, up from a loss of $184.0 million in the same quarter a year ago. Below is a screenshot of how the stock rates in Louis’ system. Despite outstanding earnings, the stock took a hit at the end of the week. But you can also see that the stock is still an “A” in Louis’ Stock Grader system.

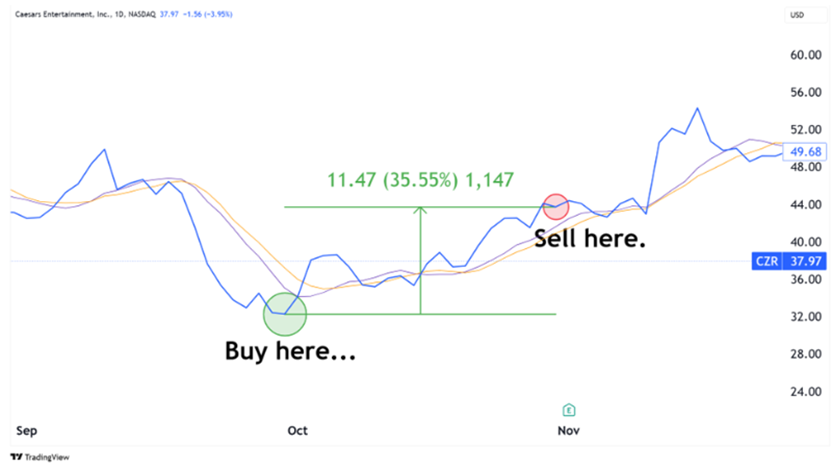

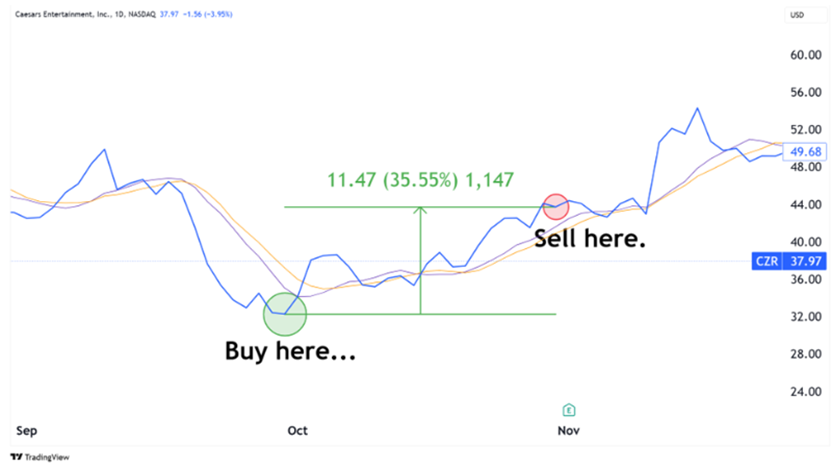

As I write Friday morning, Vistra is up more than 140% since Louis recommended exactly one year ago. And it’s still below his “buy below” price, and that means Louis believes there is a lot more room left for growth! Click here to learn more about Louis system and how you can find other superior stocks that could be on sale this week! | Recommended Link | | | | Leverage scares some investors, but it’s a tool the rich have been using for centuries. Controlling a large asset with just a small investment was key to the rise of the fortunes of billionaires like Musk and Bezos. Wall Street legend Eric Fry uses leverage to turn modest stock moves into huge gains, like his recommendation on the Silver ETF that transformed a 22% gain into a monster 252% return. His new video explains not only why this strategy has delivered 29% average gains on every trade recommendation over the last five years, but how you can get his next three trades that put the power of leverage to work for you. Click here to get the critical details. |  | | More Ways to Use Data to Profit Keith Kaplan, the CEO of our corporate partner TradeSmith also is a big fan of using data to invest wisely. His own experience of allowing emotions to drive his investment decisions led him to develop computer systems that can pinpoint the right time to buy and sell any stock, and a set of indicators that can tell him when the market is headed for a rally or a plunge. Despite widespread investor pessimism, Keith’s data suggests it could be a great time to grab stocks poised for profits. Here he is describing what he sees. They say you should never try to catch a falling knife. That’s certainly true… if you’re doing it without a plan. But if you do it with the right stocks, buying into a downtrend and banking on a reversal can be quite lucrative. A couple months back, we got the idea of designing a system that’s like catching a falling knife with Kevlar gloves on… where we minimize the risk and trade only the rarest setups with a strong track record of working. We tested tons of different variables, and eventually we found one combination that produces a rare but quite reliable trading signal. Keith and his team designed a system that helps investors take advantage of rare but reliable setups with a strong track record of success. Here is one example from Keith’s back-testing. One of the cleanest examples I’ve found – a case from 2022, in Caesars Entertainment (CZR). The signal triggered at $32.36 on Sept. 30… and would’ve led to a 35.5% gain if you’d sold it 21 trading days later (on Oct. 31) for $43.73:  To be clear, there are losers too. No system is 100%. But in Keith’s study, only one-fifth of the signals lost money, which makes for pretty good odds. Recently, his system detected an ultra-rare bullish signal that only occurs every few decades! Our data shows that we’re in a rare kind of market that we previously only saw in 1996… and then 70 years earlier, in 1926. If your market history is sharp, you know those were the early stages of massive investment manias that went far further and lasted much longer than anyone expected. Both were powered by technological breakthroughs… financial institutions lowering the barrier for smaller investors to participate… and a consumer credit revolution that spurred the economy higher. These are all things we’re seeing the beginnings of today. And what we’ve found is that these specific conditions signal the start of a “mega melt-up.” Keith prepared a free demo where he shows how to find 10 “melt-up stocks” for the historic market conditions TradeSmith is picking up now. Click here to access that presentation and put market data on your side. We all work hard for the money we invest, so it’s difficult to watch the market plunge. But staying with the data and not acting emotionally is going to lead to greater profits over time. Enjoy your weekend, Luis Hernandez Editor in Chief, InvestorPlace |

No comments:

Post a Comment