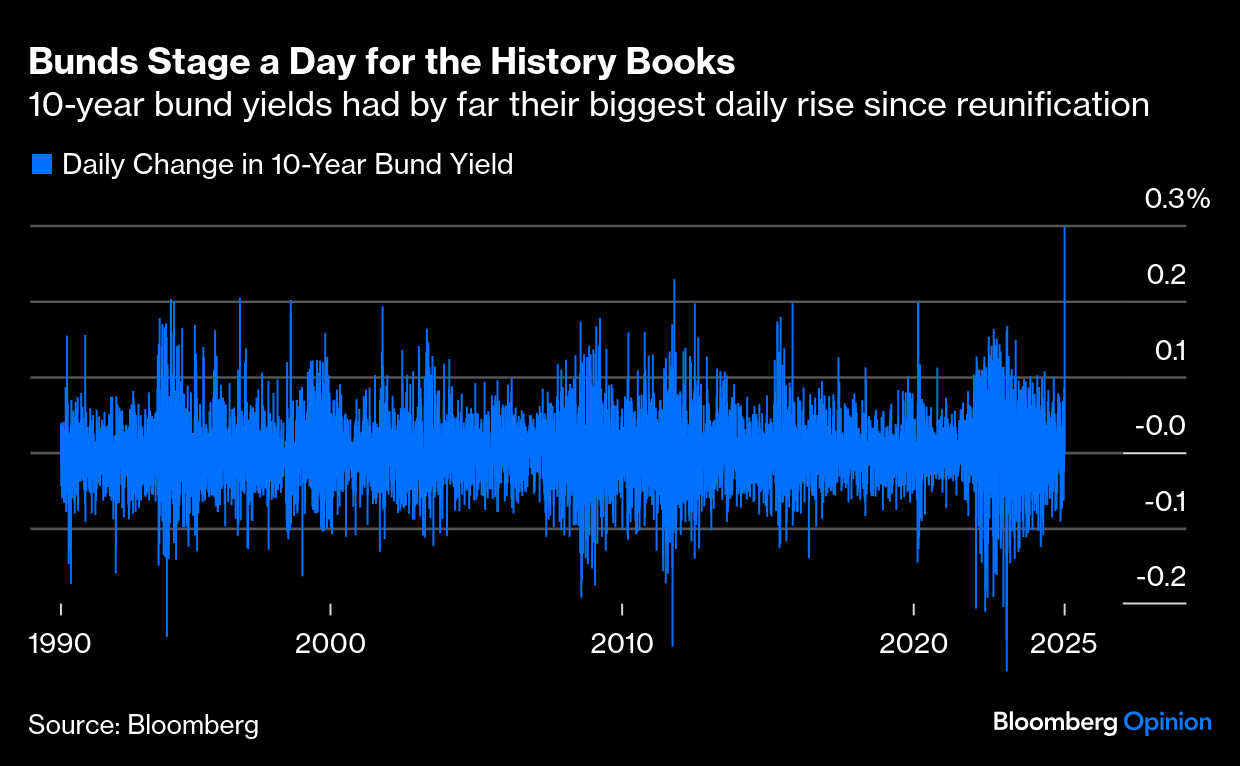

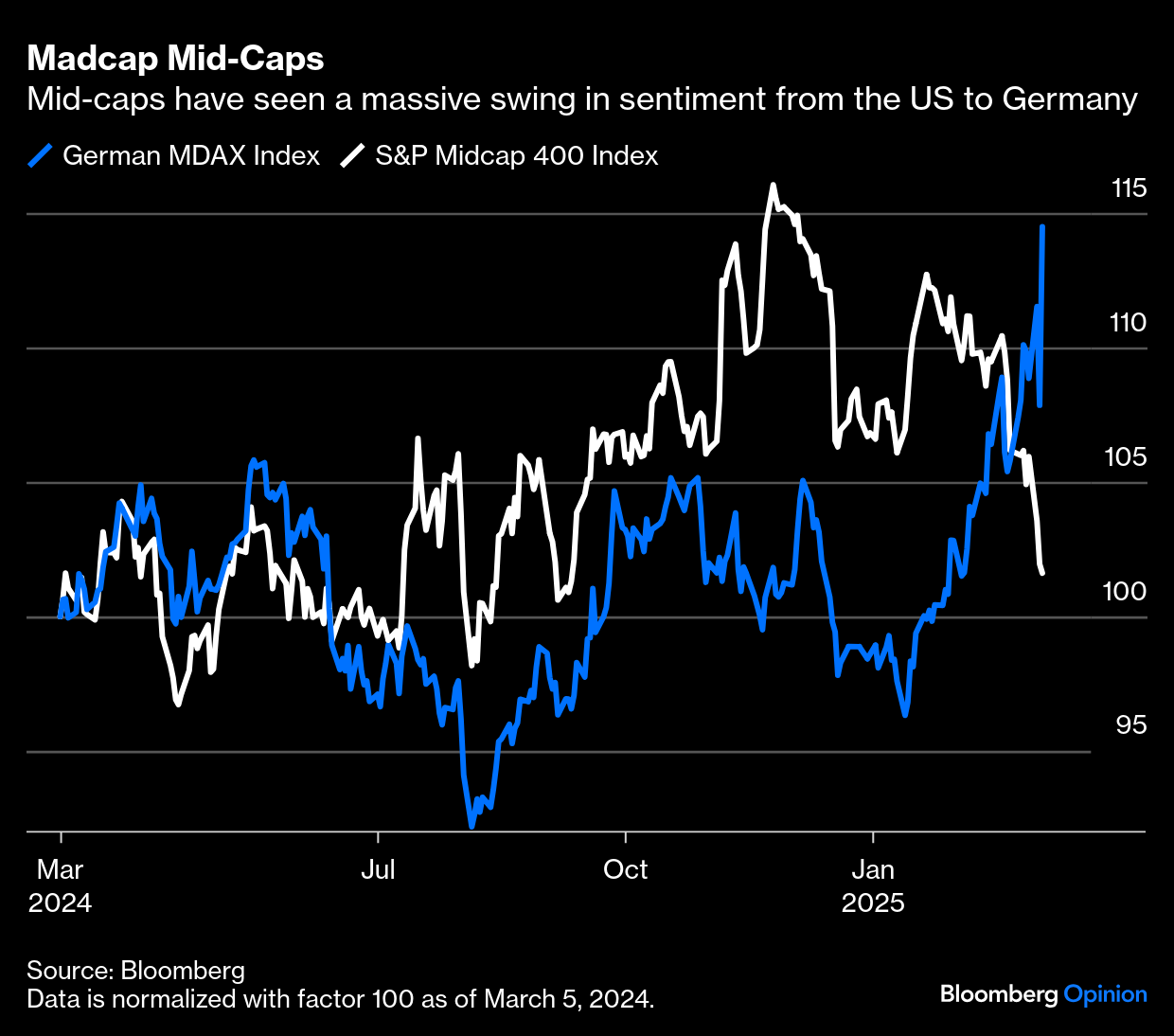

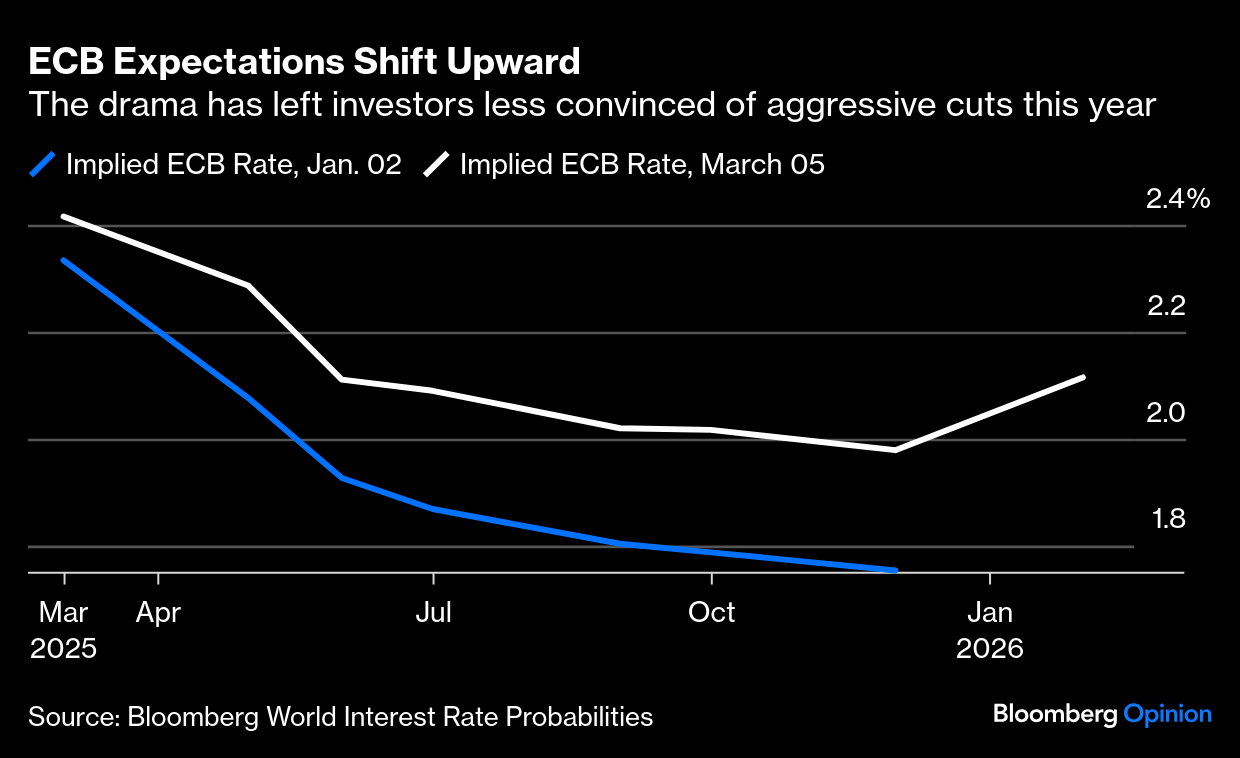

| Sometimes you can feel the global economy's tectonic plates move under your feet. This is one of those times. Late Tuesday, the leaderships of Germany's traditional two dominant parties, the Social Democrats and Christian Democrats, announced their intention to borrow €900 billion, to be spent on two funds covering defense and infrastructure. To do this, they will amend the constitution in the two weeks before the next legislature is convened. After decades of defiantly running a tightly conservative fiscal ship, this is a sudden "whatever it takes" moment. For European economics, the change is almost as radical as the US shift to support Russia rather than Ukraine. It's also, of course, linked to that shift. Faced with a crisis imposed on them by the US, Germany's governing elite has made a move that it had been resisting for decades. Quantitatively, we can gauge what an asteroid collision this is from the market reaction. The most consequential was in the 10-year bund yield, which rose 30 basis points for its biggest one-day rise since Germany reunified in 1990: Yes, this is a really big deal. But context is important. Even after its seismic selloff, the 10-year bund yield remains lower than equivalents in the US, the UK, or any other country in the EU. The market had been telling German politicians that they had room to do this. Meanwhile, the euro has surged against the dollar, and appeared to break conclusively out of what many thought would be a protracted downward trend after Donald Trump won the US election: Stock markets, also trying to process developments on US tariffs, are staging a remarkable move out of the US and into Europe, particularly Germany. The market response to the twin crises of the US defense withdrawal and likely tariffs on the EU has so far been emphatic; traders think the US will come out of this worse than Germany: This is most dramatic in the mid-cap segment, where companies tend to be most directly exposed to their domestic economy rather than to global growth. The turnaround in favor of the German MDAX index, and against the S&P 400 mid-cap index in the US, has been breathtaking. It's taken only two months: With the European Central Bank scheduled to meet Thursday, and virtually certain to announce a rate cut, there's concern that it will feel the need to address the sudden spurt of generous fiscal policy with somewhat tighter monetary policy. Projections for rate cuts over the rest of this year have been trimmed back in the overnight index swaps market: Now for some qualitative reactions. By great luck, I had chosen today to visit Frankfurt, Germany's financial capital. I'll try to capture the most important points to emerge in bullet form: - Nobody doubts that this is the biggest turning point for German economic policy at least since reunification, and possibly much longer. The country's frugal monetary and fiscal policies are born of folk memories of the Weimar Republic's hyperinflation a century ago, and this is a decisive turn away from that.

- Plenty of people predicted that Germany would have to start spending more; nobody I spoke to pretended to have had any idea of the scale of what is underway. Only a week ago, the talk was of €200 billion, which seemed extraordinary. Now we're talking about €900 billion, closing in on the psychological threshold of $1 trillion.

- Everybody in the Frankfurt financial center seems elated. You would think that Germany had just won the World Cup.

Trading floor at the Frankfurt Stock Exchange. Photographer: Alex Kraus/Bloomberg - There is deep disquiet over the way this is being done. The lame duck parliament elected in 2021 is rushing this through in two weeks, led by a combination of parties that will no longer have the necessary two-thirds support to make this change once the newly elected legislature is seated in two weeks. It's being orchestrated by the Christian Democrat Friedrich Merz, who spent the recent campaign arguing against doing any such thing. This isn't a great advertisement for democracy, and there will be real trouble if it goes wrong.

- In the short run, there's a slight risk that the Greens decline their support; the leaders of the CDU and SDP appear to have taken them for granted. There is also a need to find an extra four votes in Germany's upper house, the Bundesrat. This is likely, but not a total certainty.

- Longer term, the biggest risk might lie in the reaction function of the ECB. Its predecessor, the Bundesbank, responded to the massive fiscal expansion of reunification by hiking its deposit rate from 5% when the Berlin Wall came down 1989 to 8.75% by the summer of 1992, a move that broke the EU's exchange rate mechanism and dampened the German economy. The ECB is a different institution, but gets a lot of its genes from the Bundesbank.

- Spending the money on something is not going to be difficult. Germany's armed forces are inadequate, it has a well-established procurement system, and any money the Defense Ministry is allocated, it will spend. Investment in infrastructure will be more contentious, but again, there's little doubt that the money can be spent.

JD Vance influencing people. Photographer: Sean Gallup/Getty Images - US Vice President JD Vance appears to be by a wide margin Frankfurt's most despised living human. His name keeps coming up. Germans see his attempt to interfere in their election, tell them how to deal with their Nazi legacy, and then humiliate Ukraine's President Volodymyr Zelenskiy, as despicable and unforgivable. It's the extent of the shock caused by Vance (and Trump) that has shaken the German establishment into action. Or, put differently, if this was all a Machiavellian strategy by Vance to get Germany to take up its share of the burden of Europe's defense, wow did it succeed.

- There's hope, expressed by several people, that Germany's ability to repurpose manufacturing facilities could help it swiftly turn around arms production as auto plants take up the burden. The US is so unpopular that it will be politically difficult to buy American arms.

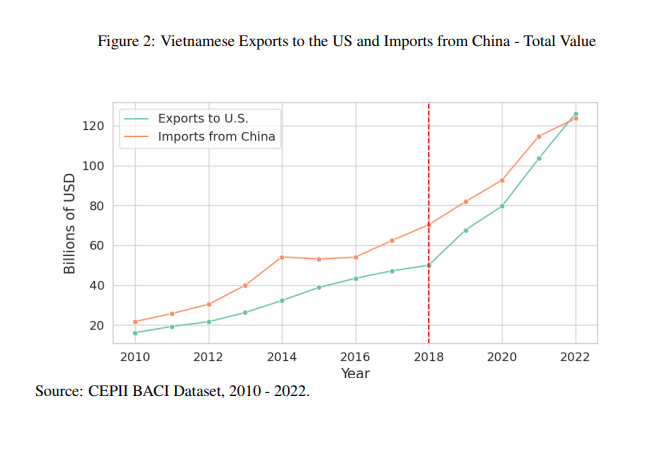

There will be far more to write about this. For now, the optimism for a sustained stock market rally and for the German economy to jolt back into life is overwhelming. German financiers aren't known for their over-excitability. They're really excited now. Wednesday brought a stay of a month for tariffs on auto imports from Canada and Mexico. The delay followed desperate requests from the big US automakers, exactly the people the measure is supposed to be protecting, because of the chaos it would inflict on their supply chains. The move suggested that the administration can listen to reason on tariffs, but also that it might not have given the policy enough thought beforehand. It helped buoy the US stock market for a strong day, but the S&P 500 remains 5% below its record set last month. Meanwhile, the incident sheds light on the complexity of the issue; it may well not be the only case of protectionism harming those it's supposed to protect. In the years since Trump's first election victory, manufacturers have adapted ways to circumvent tariffs by turning to friendshoring or nearshoring — setting up next door to gain easier access to markets that have instituted strict tariffs. Hence, the Chinese firms rerouting trade through the most cost-effective countries to access US markets. But with Trump focusing on Canada and Mexico, ideal candidates for friendshoring, there are limits to how far this can go — and there's still no sign of clemency being shown China's way. Research published in the Harvard Business Review reveals that rerouting levels have been lower than many market analysts and journalists had thought, but did increase significantly after the 2018 US-China trade war. Notably, nearly two-thirds of this increase involved rerouting through Chinese-owned companies in Vietnam — geographically close to China, with similar institutional frameworks and shared cultural norms. Since 2017, as China's exports to the US declined, Vietnam's rose by the most to all its trading partners: Harvard's Ebehi Iyoha notes that there's not as much rerouting going on as people think, considering the prevalence of China Plus One, a trade policy that encourages diversification into economies like Vietnam: China is getting more expensive for manufacturers. This is not a new pattern… Even Chinese-owned firms themselves have been looking for locations to manufacture that are cheaper… What the trade war did in 2018/2019 was accelerating something already happening.

Trump's unrelenting tariff rhetoric is likely to put a strain on supply as manufacturers seek a path of least resistance, if possible. Morgan Stanley's Seth Carpenter argues that in the next phase of reshoring, there will be pressure for a migration of productive capacity. No longer will it be enough for goods to trade through friendly partners. Where they are produced and sourced will matter as much: We expect the next phase of supply chain reorientation to involve more complex products and more concentrated factors of production... greater geopolitical distance between trading partners will likely trigger harder and potentially more rapid investment decisions about relocating production — hence supply chain strain.

So far, stock markets imply that US tariffs could boomerang. Maximilian Uleer, strategist at Deutsche Bank AG, suggests that should tariffs on the EU be adopted, they'd likely lead European stocks to outperform the US: Imagine you are an average DAX company, your US revenue exposure is 20%, and you produce 90% of those revenues in the US for the US. Within the US, you have exactly the same supply chains as your US competitors. Your real problem is sourcing at higher costs into the US, not the 25% tariff you pay on the 10% of your exports on 20% of your revenues. If you are a US company, your revenue exposure to the US is a lot higher, you produce a lot more in the US, and you source a lot more from Mexico, Canada, and Europe. Tariffs are a much bigger problem for you.

The more complicated goods are to produce, the greater these issues will be. With China dominating many complex and concentrated product supply chains, fresh tariffs risk disrupting them when the US lacks the manufacturing capacity to absorb production easily. Trump's decision to pause auto tariffs on Canada and Mexico was perhaps a first recognition of this. Markets continue to tell the administration that these policies are well-intended but risk blowing up in a manner that hurts all involved. — Richard Abbey More songs to help you hit the panic button (and quite a few people seem to be in need of it): The Way You Dream by 1 Giant Leap (featuring Asha Bhosle and Michael Stipe), FC Kahuna's Hayling, or Lament by Nusrat Fateh Ali Khan and Michael Brook. Any more? Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: - Marcus Ashworth: EU's €800 Billion for Defense Is Bond Tantrum in the Making

- James Stavridis: Europe Is Getting Ready for the End of NATO

- Daniel Moss: We'll Keep Having Fewer Babies. Time to Accept That

Want more Bloomberg Opinion? OPIN . Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment