| Bloomberg Evening Briefing Americas |

| |

| A fresh bout of instability gripped the stock market as uncertainties around collateral damage flowing from President Donald Trump's trade war outweighed the lack of bad news in new housing and jobs data. Following the S&P 500's biggest advance for a Federal Reserve day since July, the US equity benchmark headed back down on Thursday. With sentiment still fragile just a week after the gauge slipped into a correction, the market is heading for a big test on Friday: The ominously named "triple witching." During the quarterly event that often stokes volatility, an estimated $4.5 trillion of options contracts expire. After the central bank kept rates steady this week, Fed Chair Jerome Powell sought to calm investors about mounting growth and inflation concerns, though he also used the word "transitory," which didn't work out so well last time. Trump meanwhile, after a few days of railing against federal judges and stoking a constitutional crisis, returned to making tariff threats, promising "reciprocal" levies on at least some, unidentified nations. "We will go up and down as policy uncertainty continues," Michael Rosen, chief investment officer at Angeles Investments, said. "Investor sentiment is going to be very volatile, and that will be reflected in the market." —Jordan Parker Erb | |

What You Need to Know Today | |

| Two apparently can play the on-again, off-again tariff game. The European Union is delaying its proposed 50% tariff on American whiskey until mid-April, aligning with broader countermeasures against US steel and aluminum duties. The shift in the timing of the levy, originally set to take effect April 1, allows for more talks with US officials, a spokesperson for the European Commission said Thursday. The delay also gives US distillers "a glimmer of hope" after last week scrambling to prepare for the EU's tariffs. | |

|

| UBS is considering relocating its headquarters if Switzerland sticks to its demand that the bank hold an extra $25 billion in capital. Based on internal calculations showing that the bank's key capital ratio would rise to around 20% in the harshest scenario from around 14% now, executives believe that remaining in Switzerland would make the group uncompetitive relative to global rivals. The Swiss government and regulators are pushing for UBS to fully deduct the value of its foreign subsidiaries from the capital of the parent bank, a step officials see as necessary to prevent a repeat of the 2023 collapse of Credit Suisse. While Switzerland wants to avoid the financial devastation that would ensue from UBS ever failing, the bank sees the plan as an unfair overreaction, and views the proposal as so detrimental that it would have no choice but to relocate its headquarters. | |

|

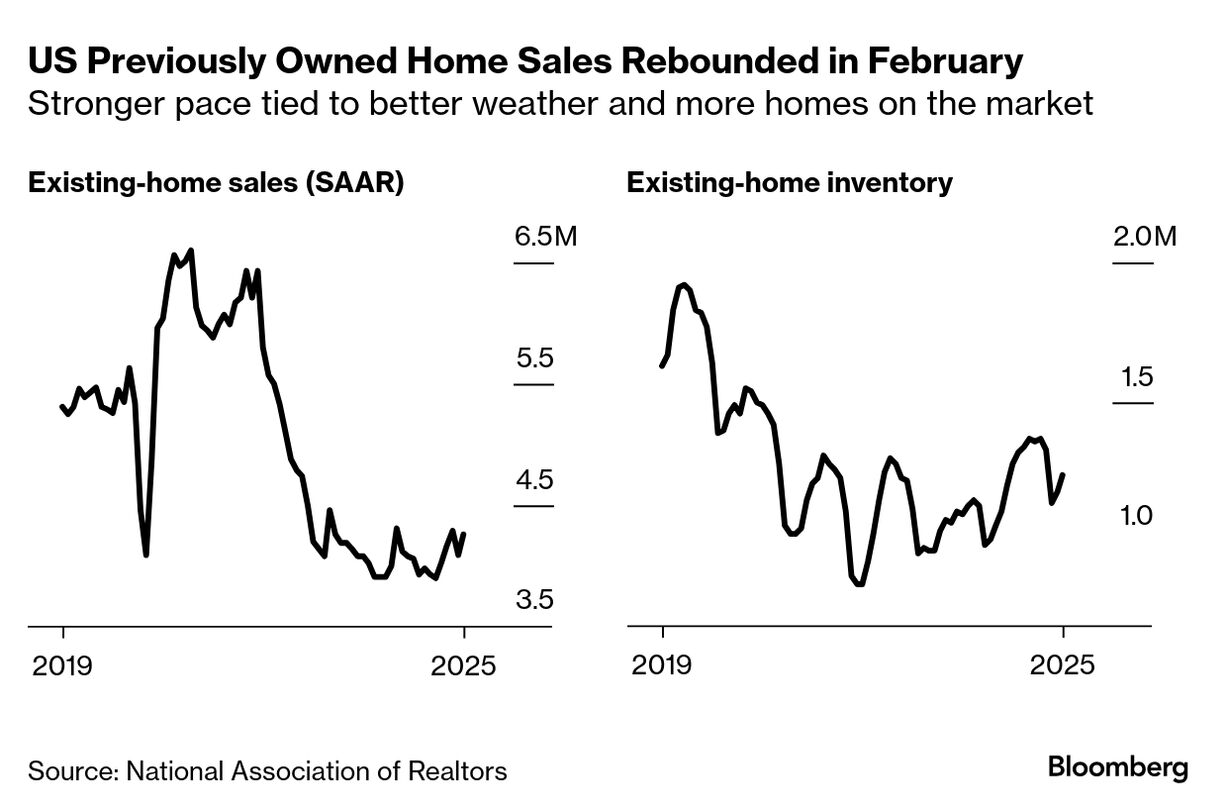

| US mortgage rates rose for a second week, climbing to 6.67%. Buyers have been contending with high borrowing costs and prices, but have also seen more properties become available, easing a supply crunch that's gripped the market in recent years. As supply increases, so too have sales of previously owned homes in the US, which unexpectedly bounced back in February. Contract closings increased 4.2% to an annualized rate of 4.26 million in February, according to National Association of Realtors figures released Thursday. | |

| |

|

| Citi's private equity "club" underwhelmed its billionaire members. The bank's experiment to offer exclusive investment opportunities to wealthy clients through a partnership with Silverfern Group ended with disappointed members of the uber rich, a bitter legal battle and a lesson on the pitfalls of marketing private assets. The Silverfern Equity Club was designed to offer exclusive investment opportunities to a few dozen elite clients. By 2016, Citi bankers started to sour on Silverfern as customers complained about poor performance. More than a decade after its creation, a New York judge ruled that Silverfern owed Citi millions in fees that it had failed to pay. | |

|

| The Boston Celtics just became the NBA's most valuable team. Led by private equity boss Bill Chisholm, a consortium of tech and real estate investors has reached a deal to buy the team for $6.1 billion. The takeover is not only the biggest NBA deal ever, surpassing the $4 billion valuation hit when Mat Ishbia struck an agreement for the Phoenix Suns in late 2022, but also the largest ever sports takeover (the Washington Commanders were sold in 2023 for $6.05 billion). Sixth Street also committed more than $1 billion to the Celtics deal. The deal is the second major sports investment the private equity firm has made this week, after buying a 10% stake in the San Francisco Giants. | |

|

| Apple is undergoing a rare shake-up of its executive ranks, aiming to get its artificial intelligence efforts back on track after months of delays and stumbles. Chief Executive Officer Tim Cook is said to have lost confidence in the ability of AI head John Giannandrea to execute on product development, so he's moving over another top executive to help: Vision Pro creator Mike Rockwell. Rockwell will be in charge of the Siri virtual assistant, removing Siri completely from Giannandrea's command. Apple is poised to announce the changes to employees this week. The moves underscore the plight facing Apple: Its AI technology is severely lagging rivals, and the company has shown little sign of catching up. The Apple Intelligence platform was late to arrive and largely a flop, despite being the main selling point for the iPhone 16. | |

|

| |

What You'll Need to Know Tomorrow | |

| |

| |

| |

| Fake images. Real horror. The rise of deepfakes. Young women in a model suburb are drawn into a global battle over AI-fueled porn. Listen to Levittown, a new series from Bloomberg's Big Take podcast. | |

| |

Like getting this newsletter? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and subscriber-only insights. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Evening Briefing: Americas newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment