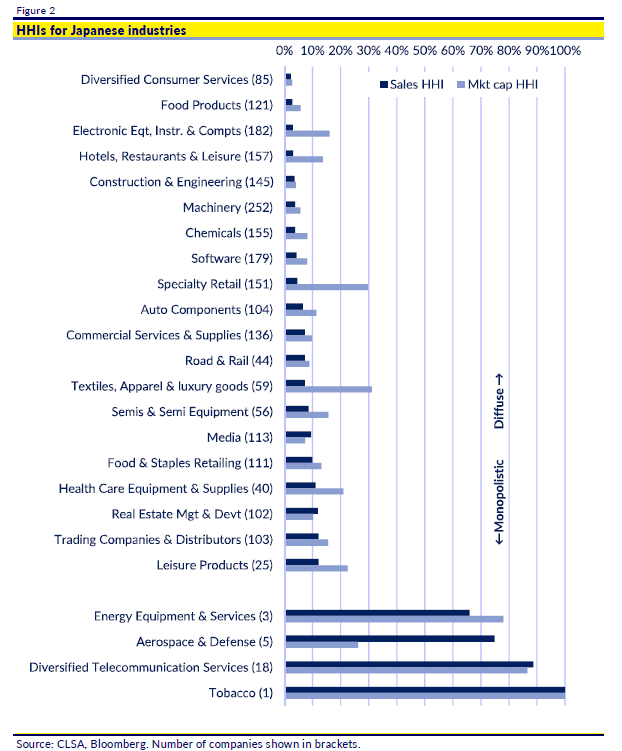

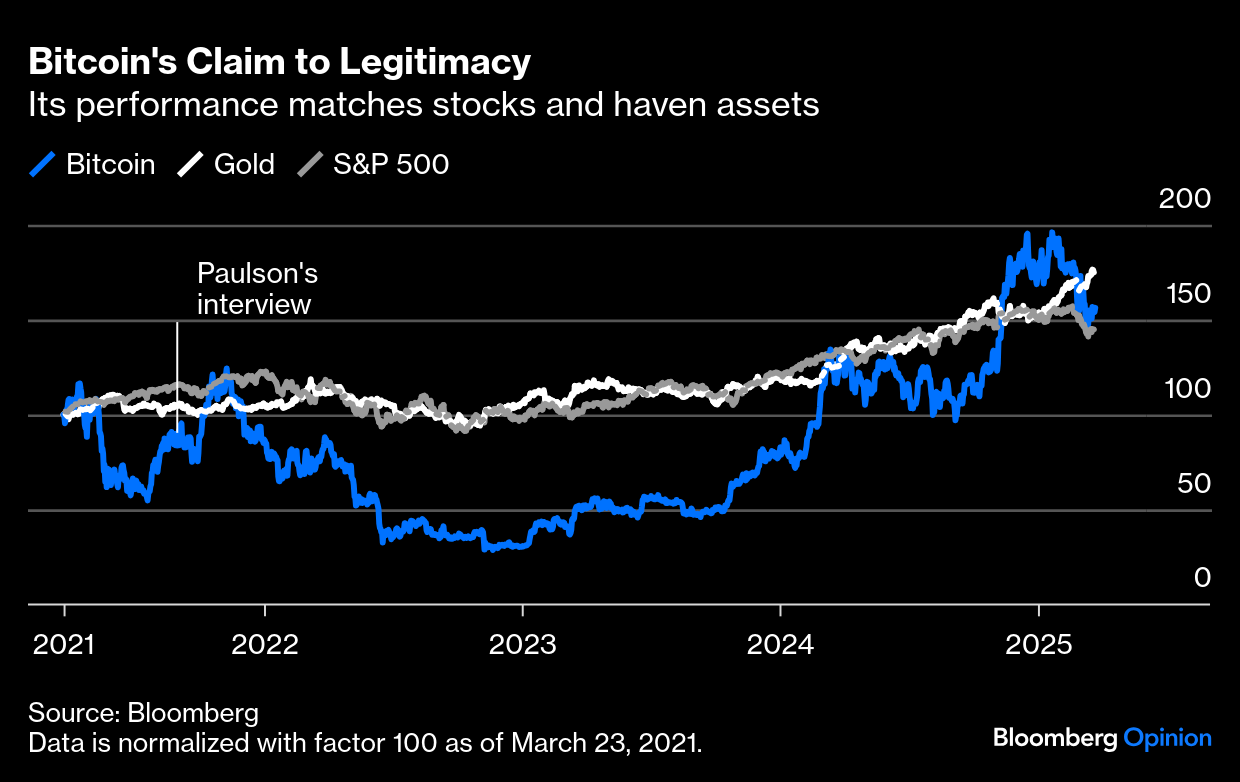

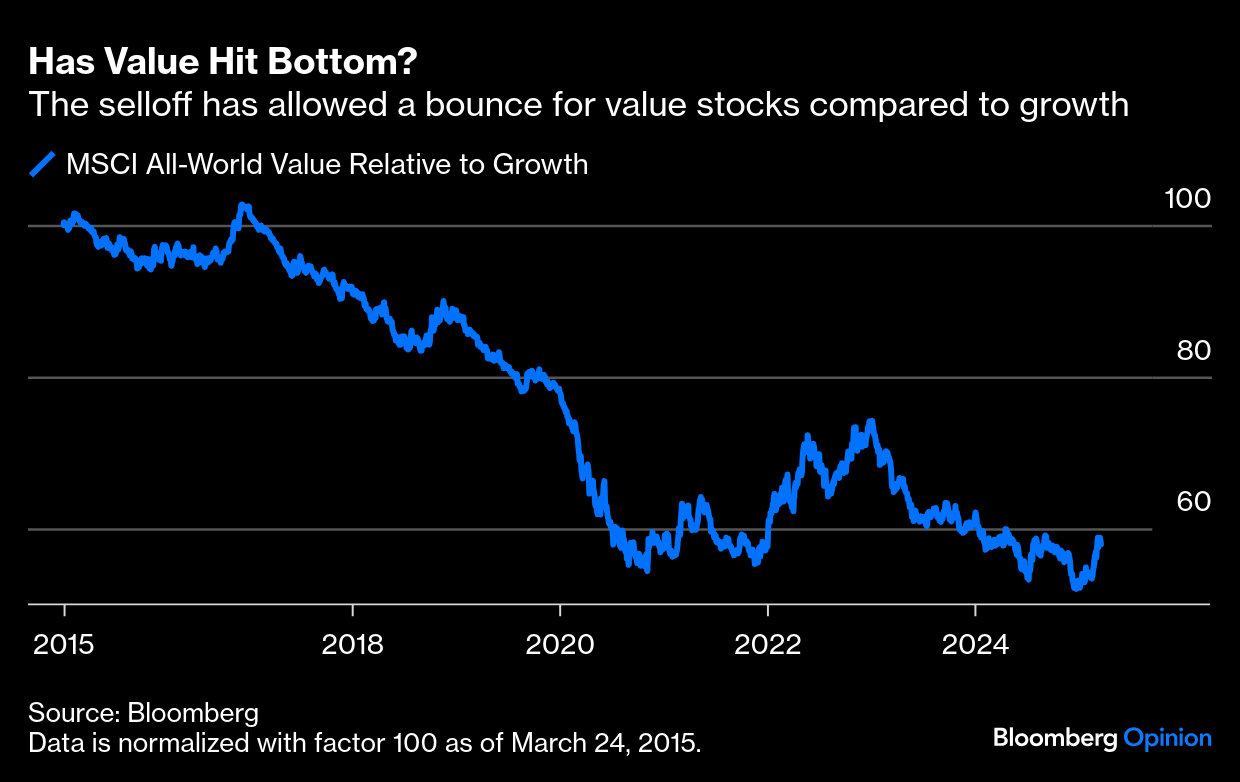

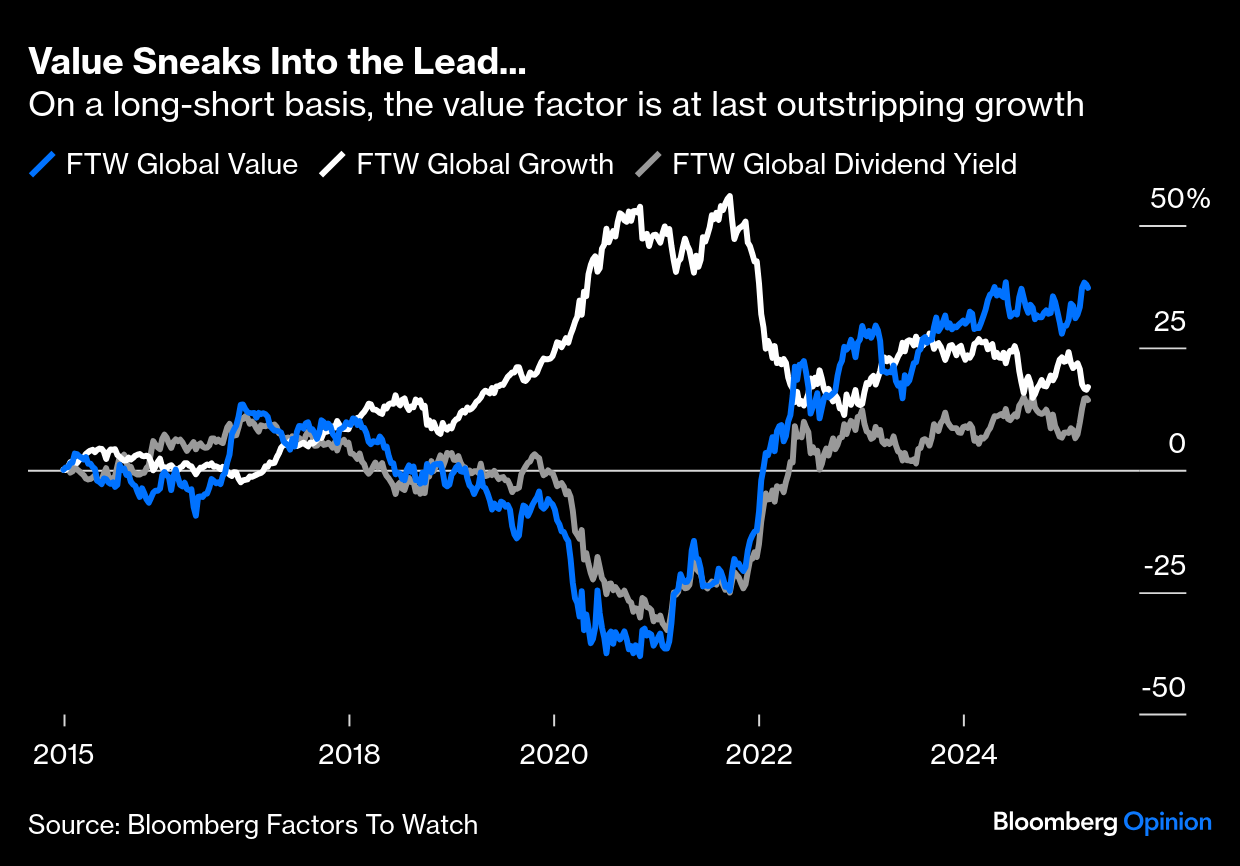

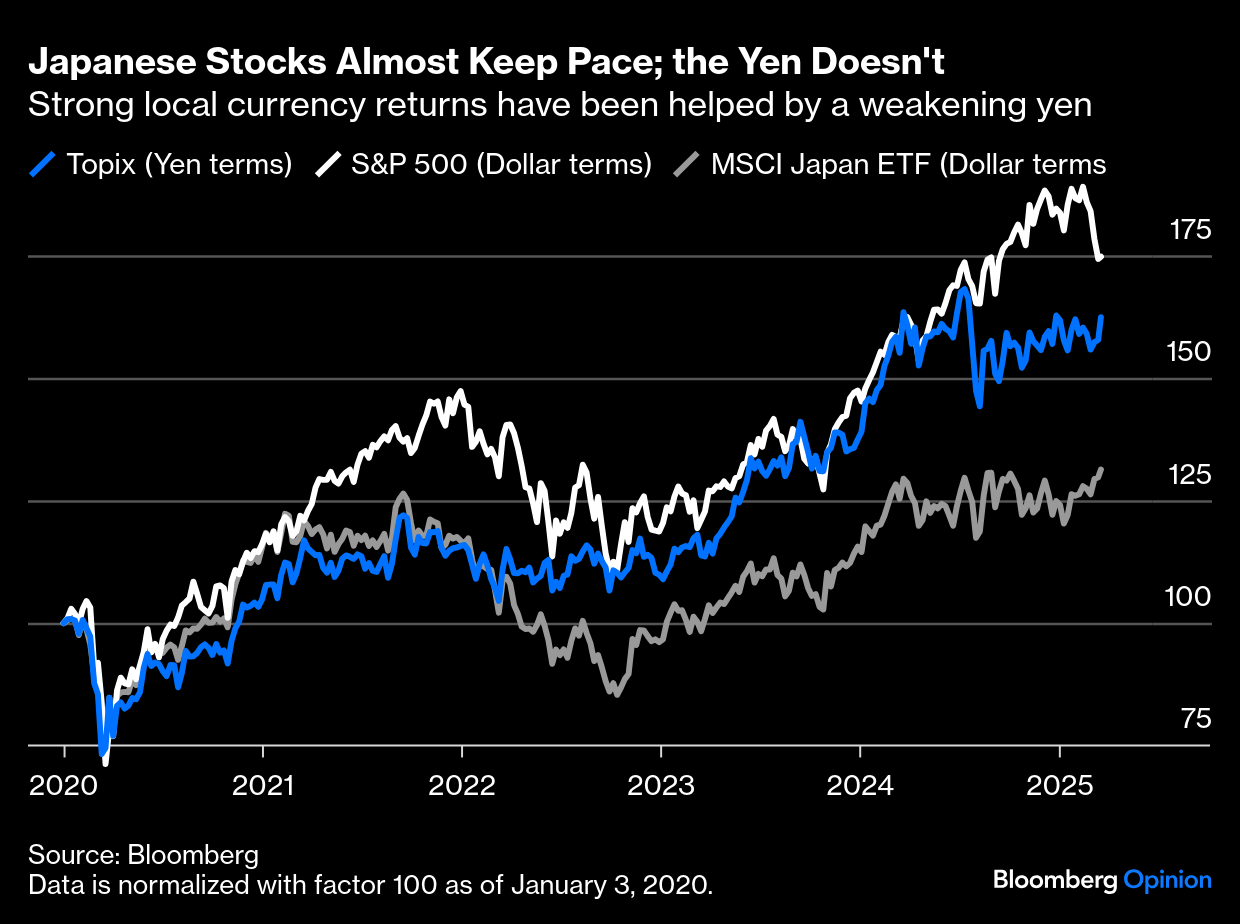

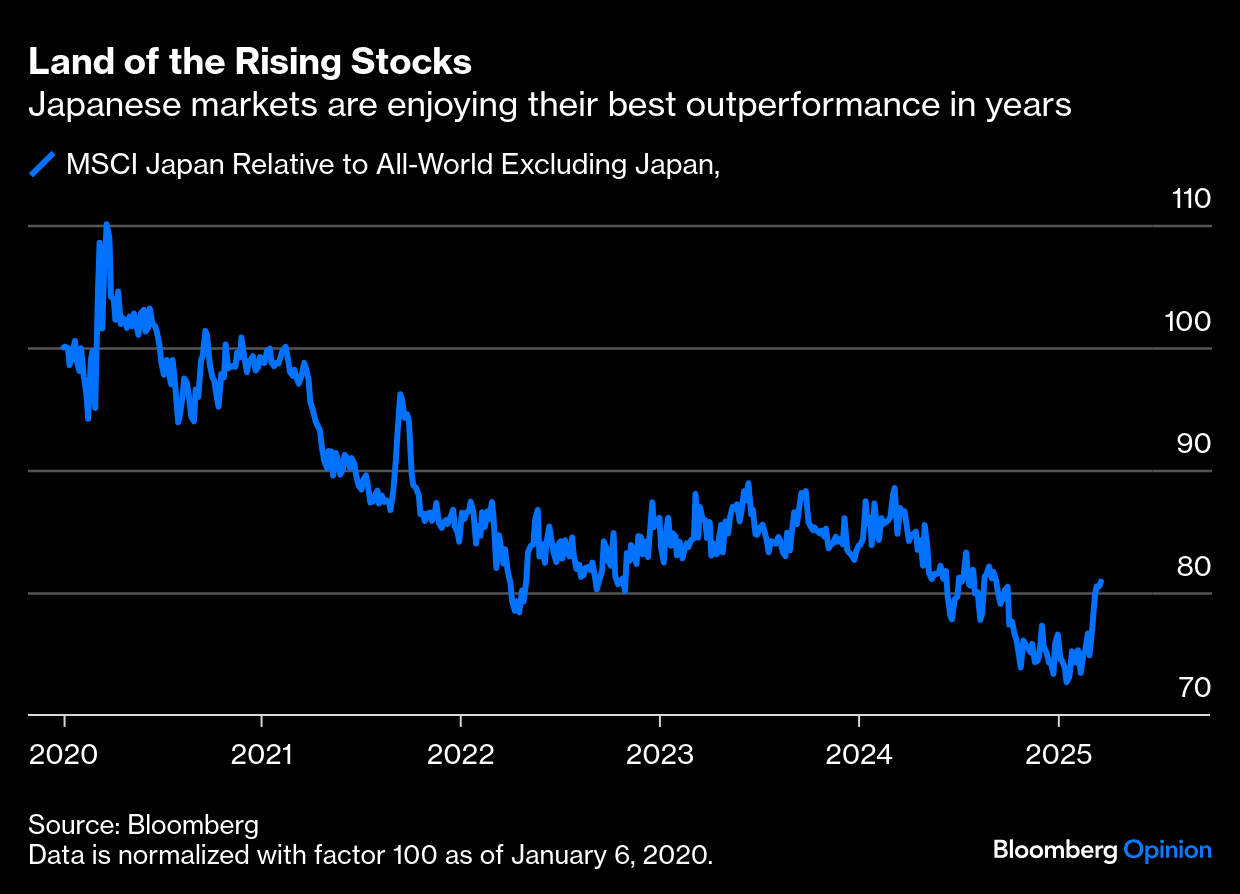

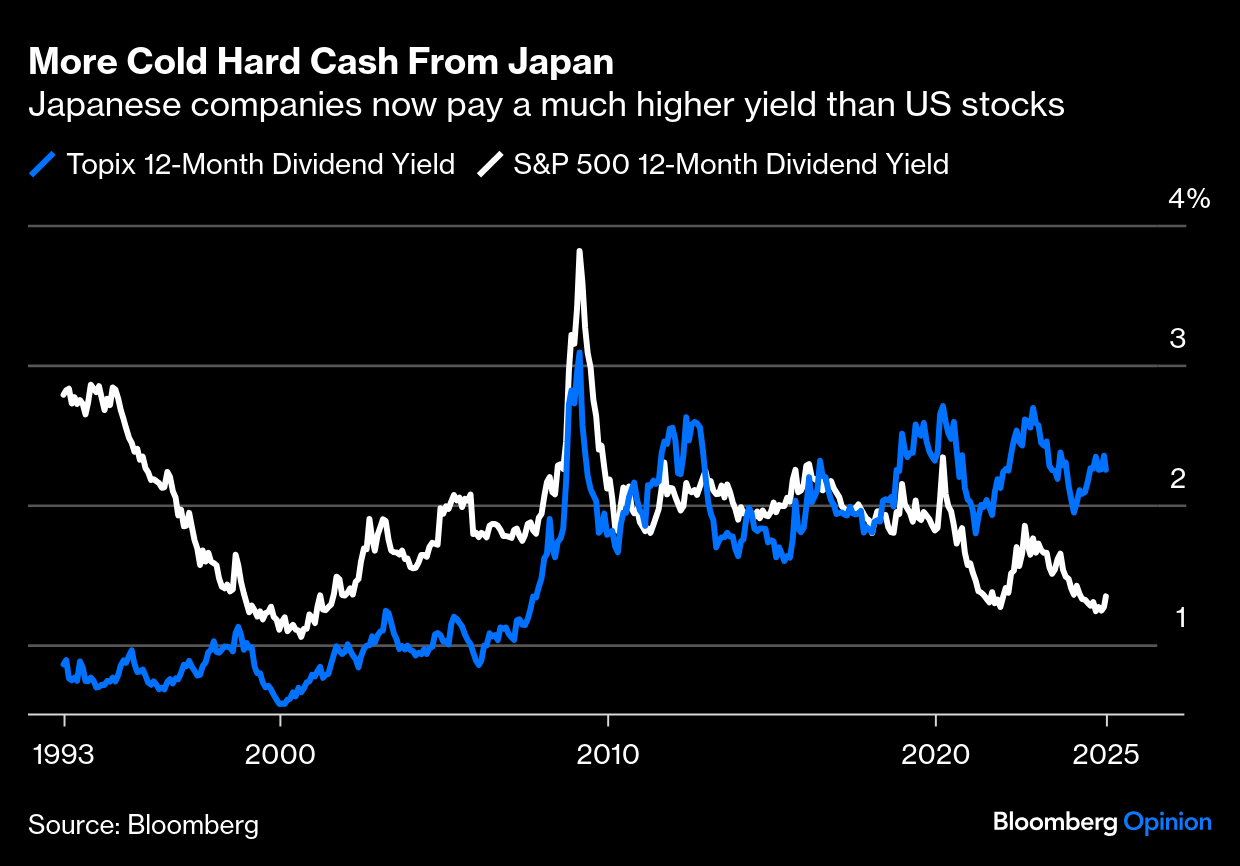

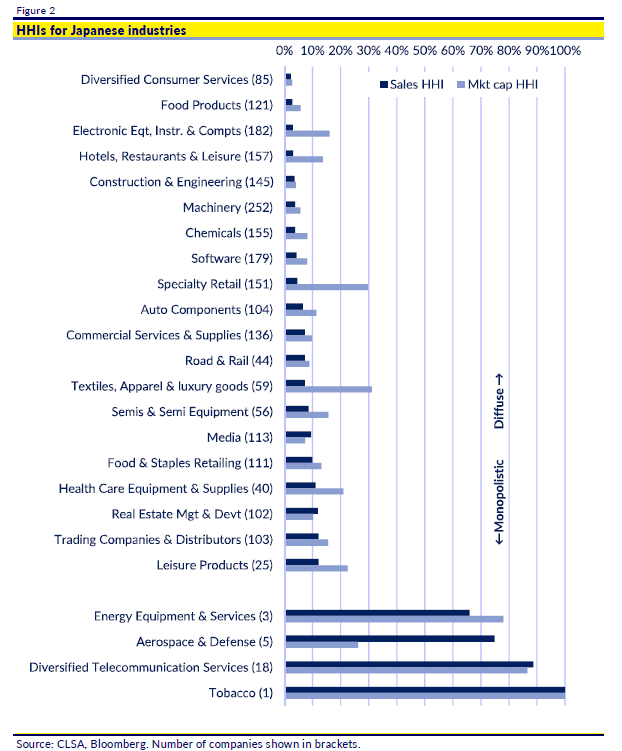

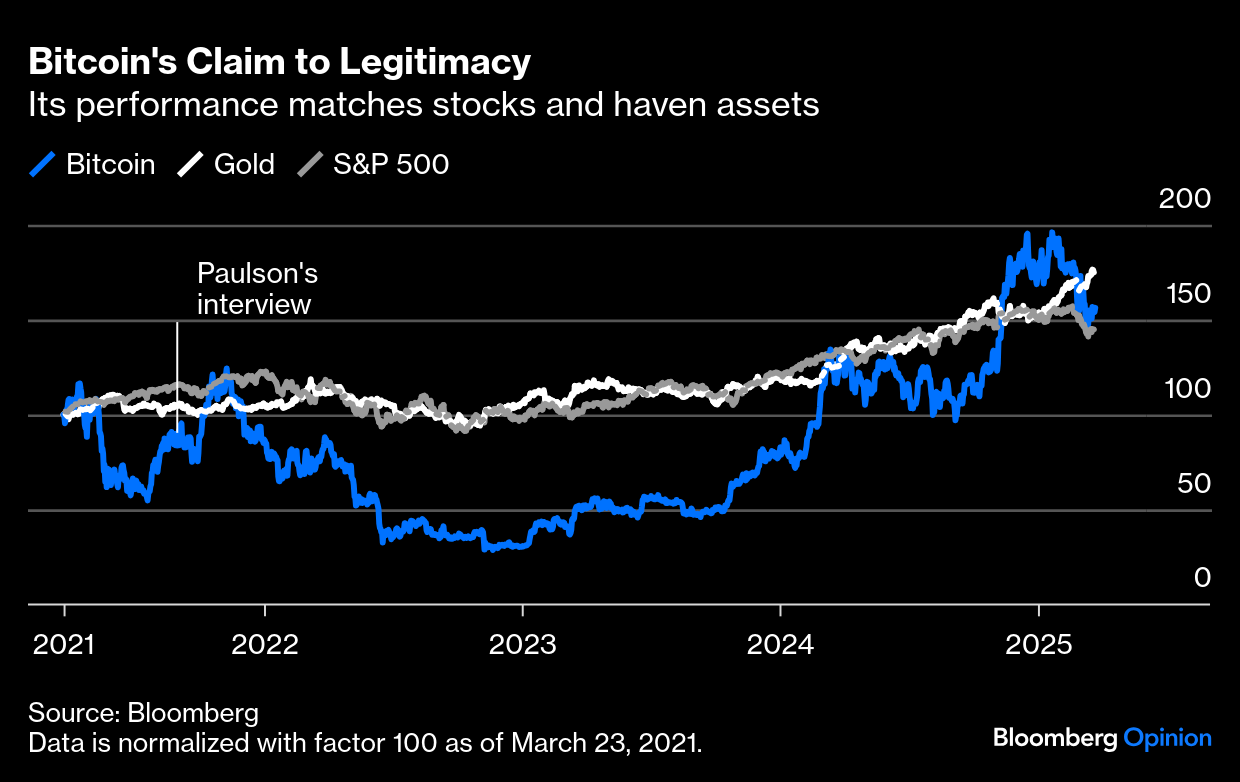

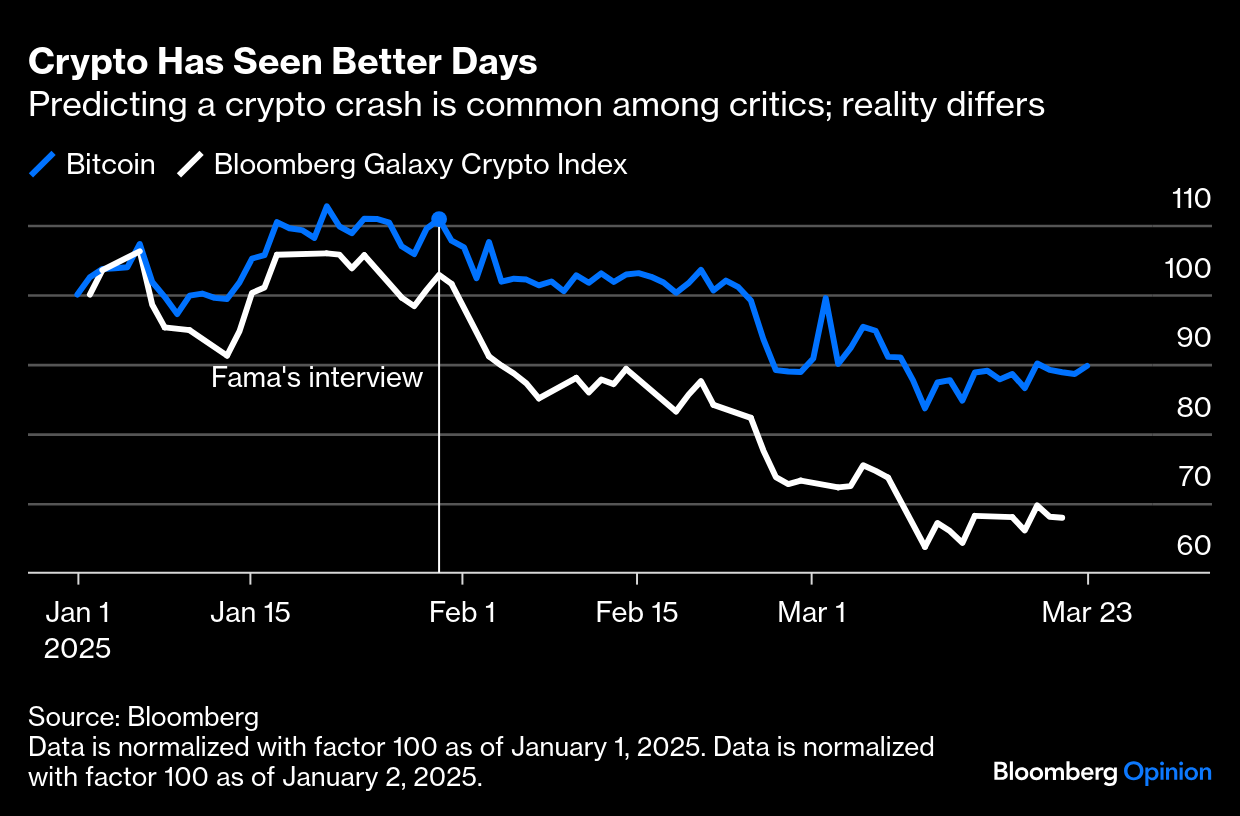

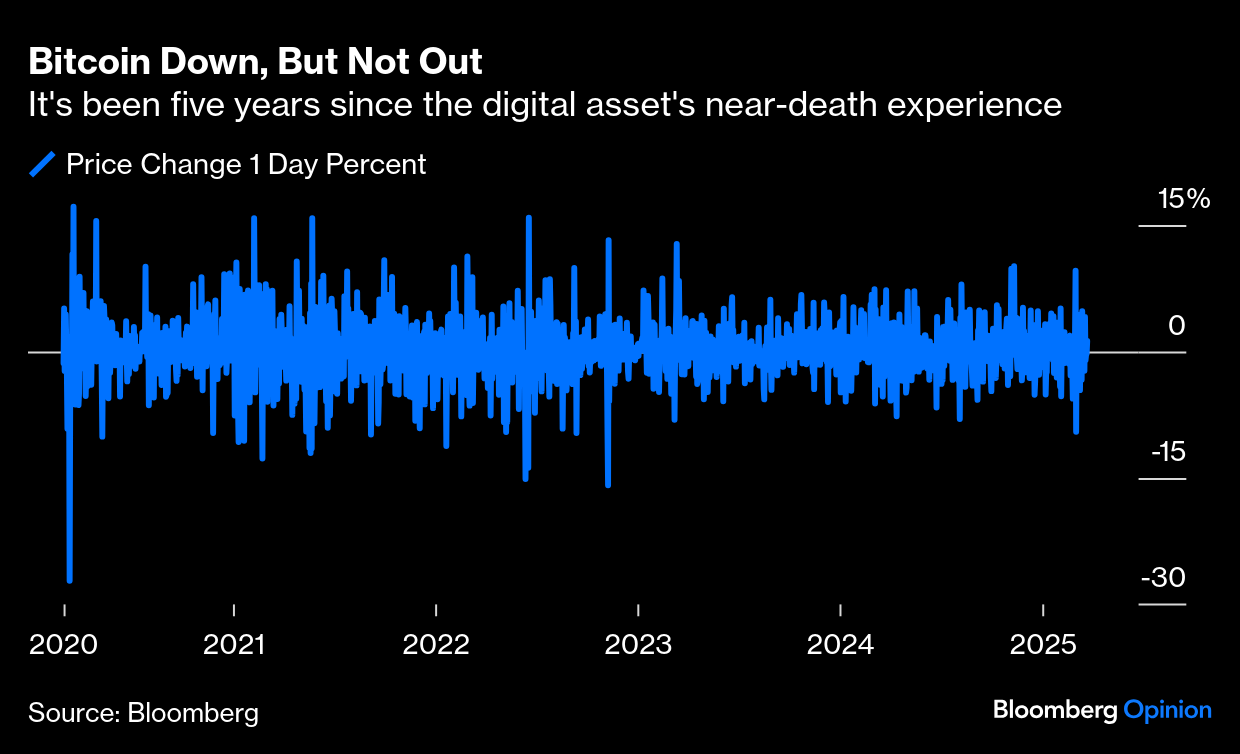

| We know people are selling stocks, particularly in the US and especially the Magnificent Seven tech platforms; what have they been buying? Value stocks — bought because they appear cheap compared to their fundamentals — have rebounded. That's not surprising during a correction. But the way they have done so is fascinating. This is how the MSCI All-World value index has performed compared to the equivalent growth index (of stocks whose earnings are growing fast) over the last 10 years. Value has bounced back but after a decade of brutal underperformance, it's hard to make much of it: Might this latest bottom prove durable? Using Bloomberg's Factors To Watch service (FTW <GO> on the terminal), the same calculation on a long-short basis looks different. The following indexes show the best stocks according to each factor, relative to the worst. It also includes dividend yield, a factor that tends to come into its own at times of uncertainty: The long-short exercise shows that the growth bubble after the pandemic was extreme, and also suggests that value now has rather more of a genuine head of steam — probably because the most expensive stocks are being punished in the correction. What's fascinating, as the world reconsiders American Exceptionalism, is the geographical breakdown. This dashboard shows the MSCI value relative to growth performance for Japan, Europe, the US, and emerging markets. In Japan, value has roared back; in the US, it's still on the floor: All are normalized for the end of 2020, which is when the value recovery started in Japan. What is going on here? First, Japan has been helped by the weak yen. It's an ingrained instinct with traders to treat the country as though all its companies are exporters. Thus stocks move inversely with the yen, gaining when the currency is weak. In local currency terms, Japan has kept pace with the US for much of the time since the beginning of this decade; in common currency terms, there's a gulf: Compare Japan to all of the rest of the world, to diminish the impact of US Big Tech, and something interesting is afoot. Its stocks have enjoyed their best rally in a decade, according to MSCI: The revival of value within Japan presaged a revival for the market as a whole. That's been helped by the classic value investing concept of the catalyst. Stocks can be cheap, but need a catalyst to revert to a more accurate value. In the case of Japan, corporate governance reforms enacted as part of the Abenomics economic package have steadily prompted companies to treat shareholders better, and to pay out some of the cash that they'd unproductively hoarded. Dividend yields now exceed US yields by the most in a decade — value is evident: Corporate governance reforms also open the way for more mergers and acquisitions. Japanese companies of any significant size tend to be public. They have also tended, in the zero-rate environment of the last generation, to stay in business in zombie form long after companies elsewhere would have gone bust or sold for what they could get. The result, as illustrated by Nicholas Smith, who writes the Benthos stock-picking newsletter for CLSA in Tokyo, is that Japan has a remarkably diverse and unconcentrated corporate sector. This chart show the least and most concentrated industrial sectors, along with the Herfindahl-Hirschman Index of concentration, a standard metric used in antitrust enforcement to gauge competitivity. A low HHI means the sector is diffuse. A score of 100% means there's only one company. The chart also lists the number of companies operating in each sector:  Source: CLSA There are a staggering number of small Japanese companies operating in highly competitive sectors where returns would benefit from consolidation. This is good for consumers, but miserable for shareholders. It also implies that lots of value could be released by investors prepared to put capital behind consolidation. That explains why value is big in Japan. There's a lot about, and investors are beginning to exploit it. Add signs of life for the economy, and rising rates that bring capital flows into the country, and there's an argument for much more to follow. By the same token, the US is unhealthily concentrated, and there are fewer opportunities for value investors. If value is due to perform, which it is, that outperformance is going to involve continuing flows out of the US, particularly toward Japan.  | | | Crypto pessimism is a favorite pastime of traditional finance enthusiasts, many of whom view digital assets as speculative bubbles. With crypto under pressure again, the argument that it has no underlying value is back on the agenda. There's a sense in which this is true. So what are the chances that Bitcoin could drop to zero? It's more than three years since billionaire hedge fund manager John Paulson, who made a killing from predicting the Global Financial Crisis, described cryptocurrencies as worthless in a famous Bloomberg interview with David Rubenstein. In that time, Bitcoin's value shot up by almost 90%, even after its retreat in the months since Donald Trump's election victory. That's a hefty return amid the pessimism:  Serial crypto enthusiasts would argue that the overall performance proves Paulson wrong, although extreme volatility suggests that even they are subject to big doses of nerves. There's a part of the "anti-crypto" universe where Bitcoin's value could crash to zero in the next decade — or maybe just to its level when a Florida man spent 10,000 Bitcoins, roughly $853 million today, on two pizzas. The economist Eugene Fama, a Nobel laureate and godfather of the efficient markets hypothesis, is a chief skeptic, and his assertions shouldn't be dismissed without parsing his logic. This is how Bitcoin and the Bloomberg Galaxy Crypto Index (which includes a range of cryptocurrencies) have fared since Fama's interview, when Bitcoin was near its record peak: Bitcoin was down more than 26% from its high at one point this month. A crude back-of-the-envelope calculation means that for Bitcoin to drop to zero in the next decade, at the current price, it would have to lose at least 79% of its value per annum. It would take something spectacular to produce consecutive falls like that: a government ban, a loss of public trust, or some black swan event. In this podcast, Fama states that crypto lacks intrinsic value and makes nonsense of the notion of money. "I'm hoping it will bust because if it doesn't, we have to start all over with monetary theory," Fama said. "It's gone. It might be gone already, but you have to start all over." His University of Chicago colleague Luigi Zingales adds in an interview that there's a growing belief that Bitcoin isn't being used as a currency, and indeed that the continuing extreme volatility means that it cannot be. Zingales describes this as "a common belief now." Crypto enthusiasts take Fama's view with a grain of salt. They have already won over many critics, including Bridgewater's Ray Dalio, who once made a similar doomsday prediction. Time alone will prove whether Fama has it right, but for now the Trump 2.0 boost has waned. The announced intent to set up a strategic crypto reserve, a sort of backstop, has done little to inspire confidence. The administration is also loosening tight regulatory scrutiny on the asset class to appease its crypto fanatics base — although weaker rules are unlikely to help ease the worries of skeptics considering whether to enter for the first time. Bitcoin's relatively muted recent performance is a source of pessimism, but the selloff is nowhere close to the one recorded March 13, 2020, Bitcoin's largest-ever one-day fall: That plunge was unimaginable even for an asset class noted for wild swings, and it's come back a long way since. Its market capitalization is pegged at about $2 trillion, and institutional adoption is now commonplace. Frnt Financial's Stephane Ouellette notes that the past five years have seen a proliferation of the HODL (Hold On for Dear Life) mantra: On March 13, 2020, the proportion of Bitcoin which had remained unmoved for over two years was 42%. This metric reached a record high of 57% in December 2023 and has since receded to 52%. This growth of unmoved Bitcoin has been interpreted as indicative of increased HODLing, an investment strategy that advocates for the long-term holding of the token. Advocates of HODLing have extreme conviction in the asset's long-term outlook and are agnostic to shorter-term price volatility. In addition to long-time ardent Bitcoin proponents, investors via ETFs have proven to be HODLers, too.

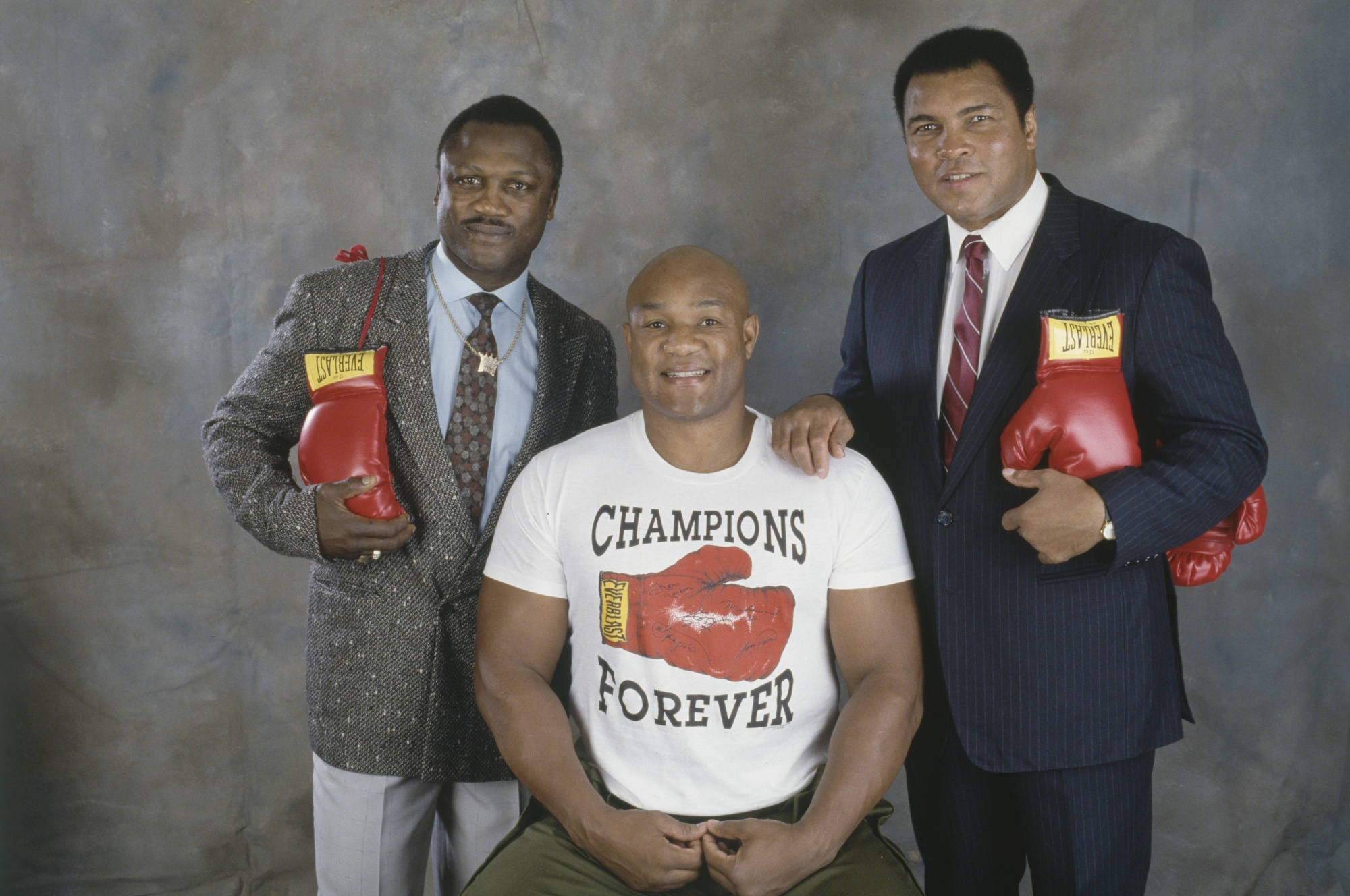

Bitcoin isn't the only asset with disappointing returns this year. Tariff threats have left other markets in limbo. But the paralysis strongly suggests that the notion of Bitcoin as a store of value similar to gold begins to look very wishful, given their different responses to the economic uncertainties. And if more Bitcoin remains unmoved, it's not being used as a currency either, and certainly not for buying pizza. If it's not a store of value or a currency, the questions will persist. — Richard Abbey  And then there were none. Photographer: Micheline Pelletier/Sygma/Getty Rest in Peace George Foreman. The last of the great heavyweight boxers of the 1970s has passed away. Foreman was an extraordinary human being who won the heavyweight championship, lost it in humiliating fashion, and reinvented himself to regain it 20 years later. He was also a charismatic preacher and advertising pitchman. What a life. But he's famous for his part in a series of great fights in the 1970s, when boxing was still the world's biggest sport. It's worth watching how Foreman won his world title, by knocking down Joe Frazier six times in less than five minutes, as well as the more famous fight in which Muhammad Ali took the championship back and the Thrilla in Manila, in which Frazier's corner threw in the towel after 14 rounds of his bout with Ali. These fights, which I remember watching on TV as a child, are utterly compelling. The reason, rewatching them, is that they were real, not reality TV. These three men in particular were great athletes with immense courage who inflicted terrible pain, and indeed lasting damage, on each other. Knowing what it did to them in old age, it's hard to justify as sport. But it was so exciting, and their courage and strength can only inspire awe. RIP again, George. Have a great week everyone.

Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: Want more Bloomberg Opinion? OPIN <GO>. Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment