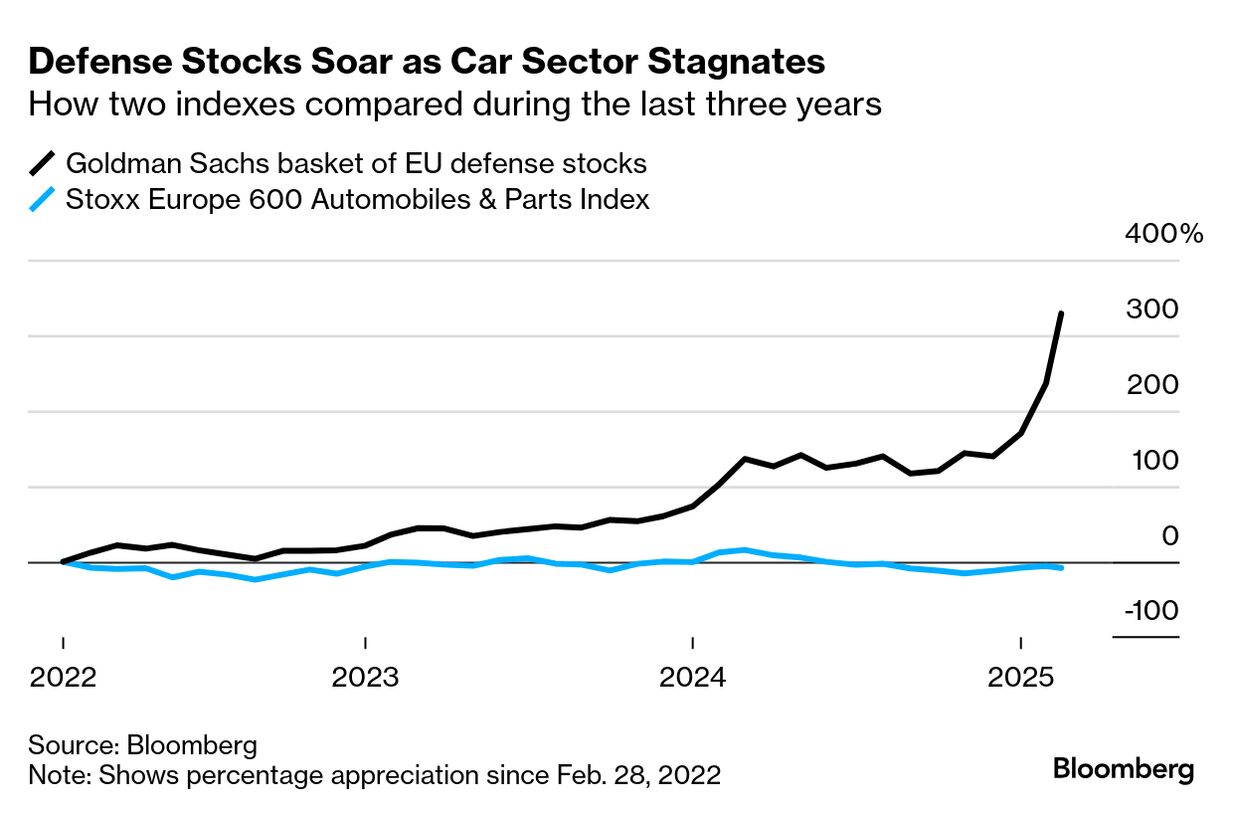

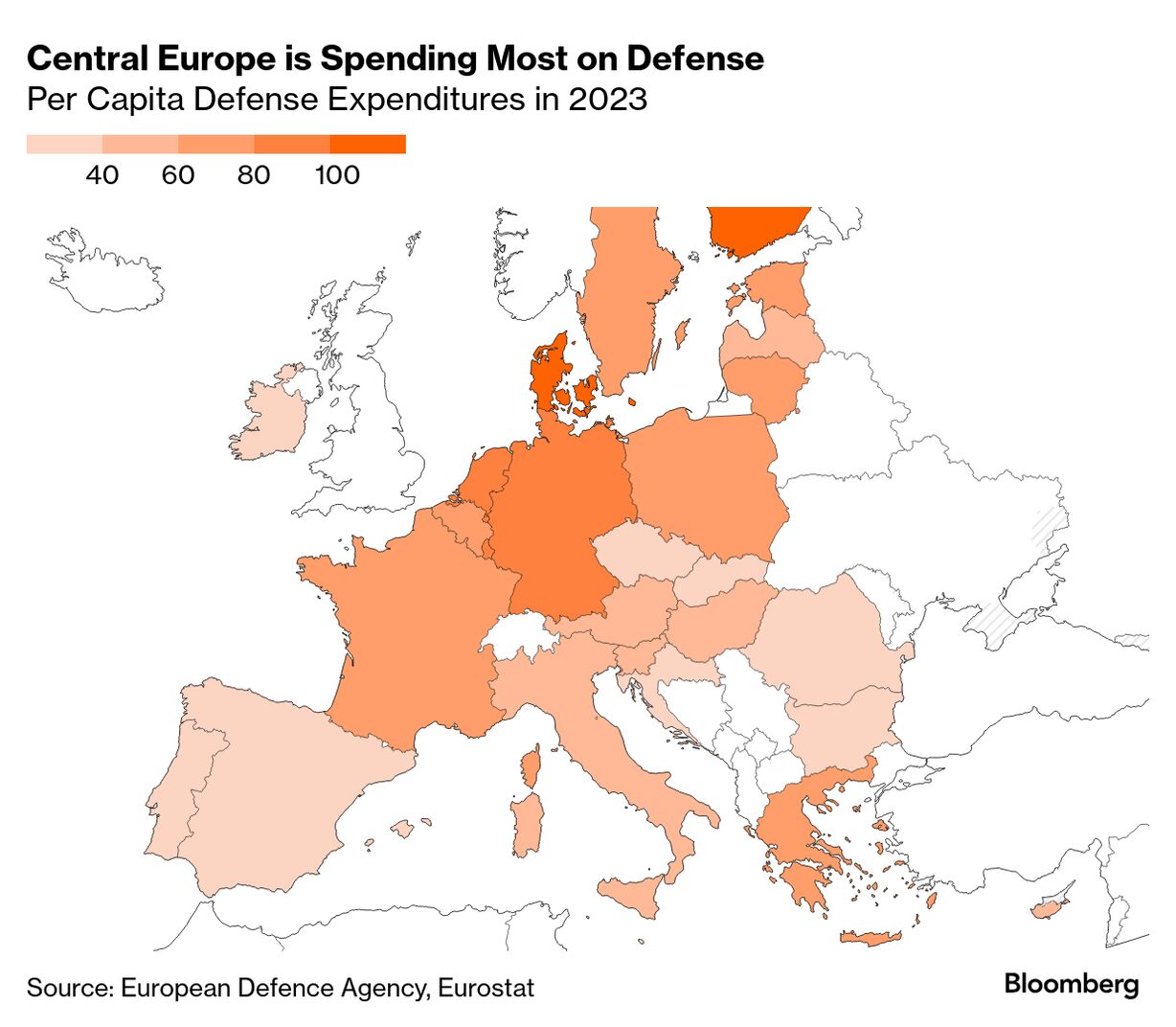

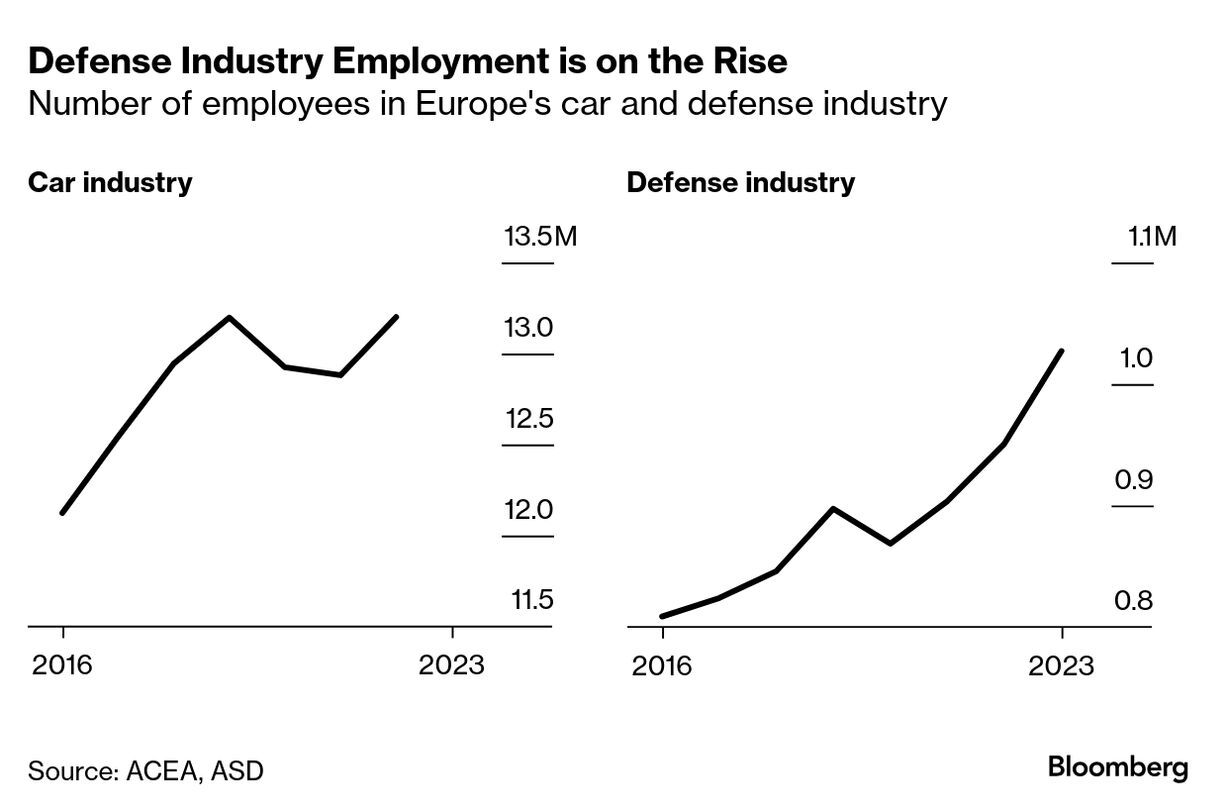

| Thanks for reading Hyperdrive, Bloomberg's newsletter on the future of the auto world. Read today's featured story in full online here. Martin Büchs' family business in small-town Bavaria has been supplying gearshift and engine-cooling systems to carmakers for more than a century. With Europe's auto sector in turmoil, Büchs is trying to reinvent his company, Jopp, as a supplier to one of the country's fastest-growing industrial sectors: the military. "We see a lot of opportunities in the defense industry," said Büchs, who's had to cut 20% of Jopp's workforce over the past five years due to the automotive downturn. "Our employees are generally open to new ideas because their priority is to have sustainable jobs in the long term." Büchs' decision reflects a growing trend in Europe as vast networks of small and mid-sized manufacturers struggle with the auto industry's shift to electric vehicles that require different and far fewer parts. Many are turning to the defense industry in hopes of cashing in on the hundreds of billions of euros European governments are allocating to ramping up their militaries as the US walks back its commitment to the decades-old transatlantic security alliance.  The production line at a Rheinmetall factory in Germany. Photographer: Pool/Getty Images Europe Germany this week paved the way for more defense expenditures by loosening national debt rules, while Sweden, the Czech Republic and the Baltic nations are increasing their military budgets. The European Union plans to mobilize €800 billion ($874 billion) to bolster the continent's security, and NATO Secretary General Mark Rutte has called on European countries to boost defense spending to 3.5% of their economies. Transforming factories to supply the military isn't easy, requiring equipment to be refitted and workers to be retrained. But the extra money is already mobilizing manufacturers across the continent. In Germany, auto-parts maker Schaeffler is looking for defense industry partners to expand sales, while Trumpf, an industrial manufacturer known for its specialty lasers, is considering building devices that can shoot down drones. Hungary's Büttner, which previously supplied German automotive tool makers, expects to shift more of its capacity to the defense sector. In France, Europlasma, a company that develops solutions to destroy hazardous waste, made a takeover offer for the Fonderie de Bretagne factory that supplies cast-metal parts to Renault. Europlasma said the bid is part of a strategy to diversify into the defense sector in order "to respond to the challenge of national sovereignty and to growing demand on a European scale." Although the defense industry is booming, it's still much smaller than the auto sector and can only make up for part of the job losses and production cuts of late. Roughly 13 million people work in Europe's auto industry — about 7% of EU employment — while the defense sector employs just over 1 million. "I think the discussion that defense will stop the decline in the automotive industry and its suppliers is an illusion," said Jürgen Kerner, deputy chief of IG Metall, Germany's largest union. "None of this can be done overnight." Volkswagen, which is cutting production and more than 40,000 staff, is open to the defense industry tapping into its excess capacity. Rheinmetall has looked into using VW's factory in Osnabrück, Germany, to make armored vehicles, and the company's Audi production site in Brussels could be similarly transformed, according to plans by Belgium's John Cockerill Defense. Italy's Industry Minister Adolfo Urso has proposed converting car factories to defense production. The plan — driven by a 63% drop in vehicle output in January and Stellantis's shrinking presence domestically — aims to protect jobs by leveraging the sector's overlap with military technology. In addition to retooling factories to make weapons, manufacturers will have to contend with a cumbersome certification and security clearance process. To directly supply the military or produce specialized military products requires NATO certification, which typically takes one to two years and costs a minimum of €200,000, according to Christian Bartsch, chief executive officer of ACATO, a firm specialized on certifications and cyber security. And the process can't start until the company has already received an order from the military. "In Germany, the procurement process is tenacious and life-threatening. The company is starved until it gets its turn," Bartsch said. "It takes time for the German authorities to actually order, during which companies have costs, costs, costs, and don't earn a single euro." Yet, if Europe wants to achieve military independence from the US, it will need to support its own companies, like Büchs' Jopp, which employs about 1,600 people worldwide. "We will probably be able to become a supplier for companies in the defense industry," Büchs said. "We'll talk to potential customers to see if there is demand." Thomas Hirsch, who founded Germany's Hirsch Engineering Solutions, has already made the jump. The auto sector accounted for 95% of his company's revenue four years ago. Now, the mechanical parts Hirsch produces go into anything from military vehicles to satellites and rocket engines. "Getting into this sensitive sector takes time and energy," Hirsch told an audience of more than 100 entrepreneurs at a recent event organized by the chamber of industry and commerce in Schweinfurt. "But once you're in the system, you remain in the system." — By Marilen Martin and William Wilkes  Investigators at a Tesla collision center in Las Vegas on Tuesday. Photographer: Ethan Miller/Getty Images North America The Federal Bureau of Investigation is investigating "a number" of incidents where Tesla charging stations and stores have been damaged. Incidents have occurred in several states and the FBI is coordinating with federal, state and local law enforcement partners to gather information, the agency said Tuesday. Just a week ago, President Donald Trump suggested he would deem acts of violence against the EV maker as domestic terrorism. Republican lawmakers have also called for Congress to investigate the incidents and assist the FBI and Justice Department to ensure that the perpetrators are prosecuted. Read More: |

No comments:

Post a Comment