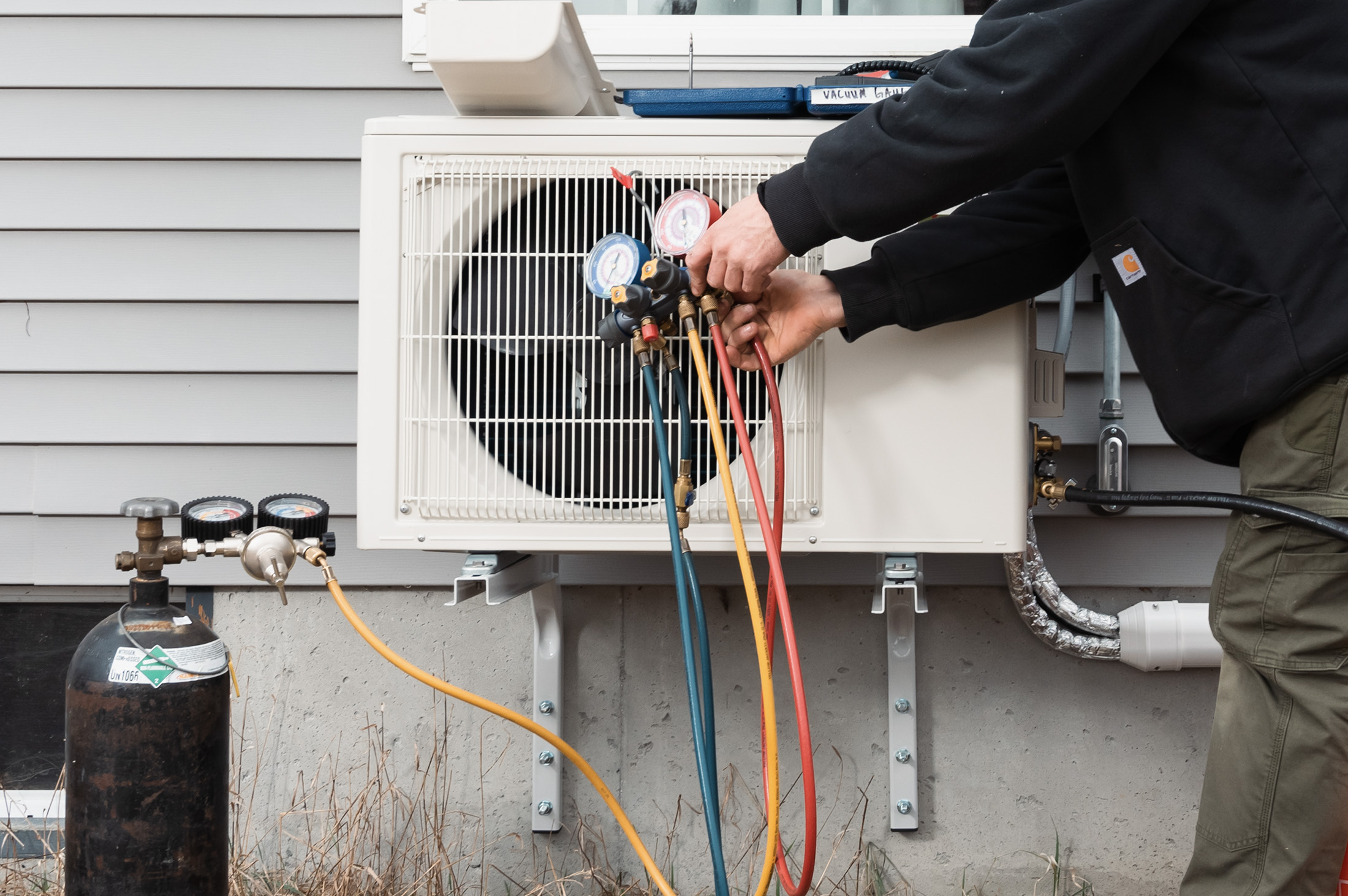

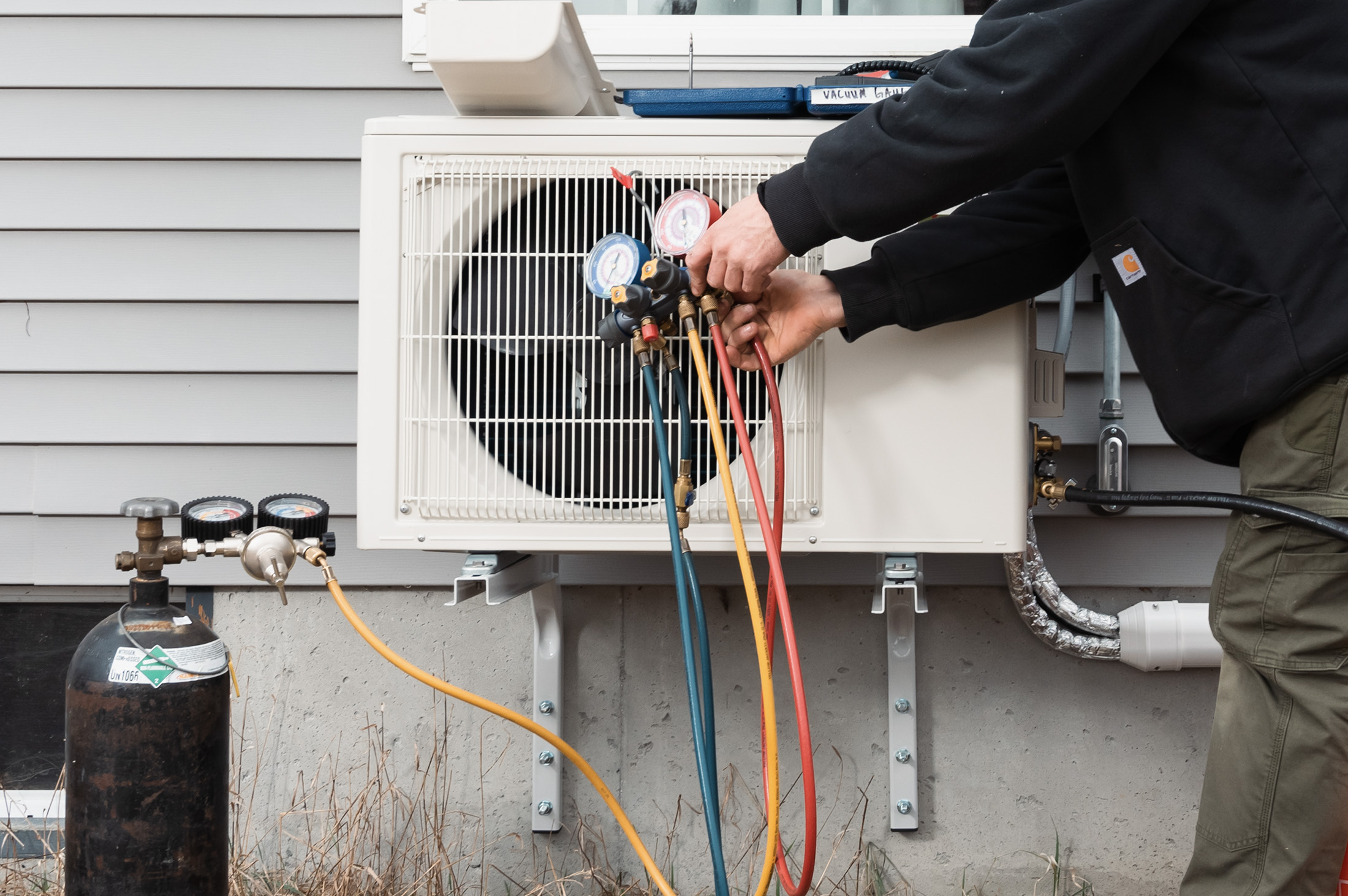

| Decarbonizing your life will get more expensive as President Donald Trump imposes tariffs on the US' top trading partners, spiking the cost of home heat pumps, battery storage systems and electric cars, according to economists. Trump on Tuesday levied 25% tariffs on goods imported from Canada and Mexico, a day after he signed an executive order doubling a tariff on Chinese products to 20%. The administration has said it intends to put a tax on imports from the European Union and collect a 25% tariff on aluminum and steel imports. "It's definitely going to slow down the shift to electric vehicles in particular," said Mary Lovely, a senior fellow at the Peterson Institute for International Economics. "Once you include taxes on Canada and Mexico, you are going to be hard-pressed to find anything that isn't in some way or another subject to these taxes." In addition to finished goods, the US imports components from those countries to assemble cars and other products domestically.  A technician installs an electric heat pump. Photographer: The Washington Post/The Washington Post/Getty Images United StatesThe trade war is adding strain to New York City's climate goals. The city's access to clean electricity took another blow as a key Canadian province moved to respond to US tariffs with a 25% surcharge on power exports across the border. A climate finance co-founder is arrested on fraud charges. Joseph Sanberg of the unicorn startup Aspiration Partners — once valued at $2 billion — was arrested on charges linked to loans he took out using shares of the company's stock as collateral. The EPA unfreezes funds for solar grants. A $7 billion US government grant program for solar energy has been unfrozen by the Environmental Protection Agency following a review of Biden-era climate spending mandated by the White House. EuropeBelgium's EV market gets a boost from company cars. EV sales surged 37% last year after the government introduced new tax policies that make it more favorable for companies' to buy all-electric corporate cars. The policy is now seen as a potential model for other European nations.  A surge in electric-powered company cars has triggered an expansion of charging points, like this one in Brussels. Photographer: Ksenia Kuleshova/Bloomberg Ireland rolls back on climate in favor of security. The nation approved a plan to develop an emergency gas facility amid energy security concerns. It's a departure from the country's previous stance on what energy facilities it approves as it tries to meet ambitious climate goals. A huge Nordic battery-storage facility gets the green light. The 70-megawatt project, led by SEB Nordic Energy's Locus Energy and Ingrid Capacity AB, is starting construction in Nivala, Finland. The unit will be able to store power for two hours when it's expected to be operational in the second half of the year. Asia China plans to cut energy use per unit of GDP. China plans to reduce energy used to grow its GDP by around 3% in 2025, slightly higher than its 2024 goal but below last year's result. As part of this push, the country's top leaders also pledged to expand the nation's emissions trading system to cover more industries. Japan's second-largest bank exits industry's net zero pact. Sumitomo Mitsui Financial Group is the first major Japanese lender to withdraw from the Net-Zero Banking Alliance, joining an exodus led by institutions from Wall Street and Canada. Goldman Sachs, Morgan Stanley and Bank of America have also departed. US halts global air pollution monitoring program. The State Department first began collecting and publishing air quality data from its embassy in Beijing in 2008 and expanded the program to cover dozens of locations. The program has now been halted on budget grounds. By Ben Westcott A tropical cyclone off Australia's northeast coast that's menacing the city of Brisbane could derail the government's plans to call an election this weekend — after speculation mounted that Prime Minister Anthony Albanese was on the verge of setting an April 12 ballot. While Australia must hold a vote by mid-May, there has been a growing view in and around Parliament House in Canberra that the prime minister will call an election slightly earlier to capitalize on improved economic data and the first interest-rate cut in more than four years. That plan risks unraveling asCyclone Alfred heads toward Brisbane, Australia's third-largest city with 2.5 million people, and is due to cross the coast early Friday. The likelihood of torrential rains and widespread flooding suggests it would be wrong to announce an election in the wake of a natural disaster.  Cyclone Alfred on March 5. Source: RAMMB/CIRA The world of ESG regulation and investing was already suffering a period of shaky confidence even before President Donald Trump returned to the White House. Now, companies are facing a new period of uncertainty when it comes to Environmental, Social, and Governance policies. Reporter Frances Schwartzkopff tells Akshat Rathi why the EU is rolling back some ESG legislation. And reporter Saijel Kishan explains that many companies today are still keeping their ESG plans in place — but just not talking about it. Listen now, and subscribe on Apple, Spotify, or YouTube to get new episodes of Zero every Thursday. |

No comments:

Post a Comment