|

Brought to you by: |

|

|

"Memecoins are dead," says everyone after LIBRA's spectacular failure last month. But are they really though? "Fundamentals are back." But how should crypto businesses manage their tokens? |

|

|

Bitcoin: SOPR-adjusted short-term holder CCD (hourly) |

|

Bitcoin's short-term holder (STH) coin days destroyed (CDD) serves as a key indicator of fear-driven selloffs by measuring the economic weight of spent coins. By adjusting this metric with the spent output profit ratio (SOPR), Glassnode differentiates between profit taking and panic selling. |

The latest market dip has pushed STH-SOPR-adjusted CDD to -12.8k coin days per hour — a level not seen since August 2024. This suggests that a significant portion of recently acquired BTC is being dumped at a loss, a sign of capitulation among short-term holders. |

Historically, such deep negative spikes tend to occur during market corrections, but often mark local bottoms. While long-term holders remain largely unfazed, short-term traders appear to be exiting in haste, a pattern that has played out many times before. |

— Macauley Peterson |

|

Brought to you by: |

|

Accurate crypto taxes. No guesswork. Tax season doesn't have to be a headache. With Crypto Tax Calculator, you can generate accurate, CPA-endorsed tax reports fully compliant with IRS rules — quickly and effortlessly. |

3,000+ integrations to support your wallets, exchanges, and on-chain activity Reports you can import directly to TurboTax or H&R Block Easily share with your accountant

|

Exclusive offer: Use the code BW2025 to get 30% off all paid plans. But hurry — this offer expires on 15 April, 2025! |

|

|

Speculative assets out, fundamentals in |

The current mood on Crypto Twitter: Speculation is dead and fundamental revenue drivers are back in. |

"Speculation is dead" points to the increasing consensus that memecoins are a dying meta. |

The straw that broke the camel's back was of course the controversial LIBRA memecoin launch last month. |

LIBRA peeled back the curtain on the explicitly extractive practices that memecoin projects exercise, such as sniping one's own token quickly on launch. |

Are memecoins dying though? Activity certainly isn't at its all-time highs but the data suggests they're far from death. Pump.fun launched 187k new tokens over the last week, while making $8.1 million in revenue. |

|

Base memecoin launchpad Clanker even saw an all-time high in memecoin launches (10.8k) yesterday. It's perhaps an anomaly, but it does cast some doubt on the idea that memecoins are a dying meta. |

|

Besides, why would memecoins die? |

Recall that memecoins were thought of as a casino game, what Dragonfly's Haseeb Qureshi likened to a video game "simulacrum of crypto trading." |

It was a high-risk bet with very low guarantees of a return, but so long as blockchains are still permissionlessly accessible and human greed is a variable, the appetite for gambling will persist. |

The case for fundamentals being back in play is perhaps more persuasive. |

A great piece from Decentralised.co argues that revenue-generating apps/protocols will swing back in favor as capital allocators tighten their pursestrings and token attention is continually diluted. |

With a glut of tokens on the market and no guarantee of the "rising tide lifts all boats" dynamic of past crypto cycles, investors need to be more selective about what tokens they purchase. So, they look to fundamental drivers. |

Many prominent crypto companies are signaling the pivot back to "fundamentals" — to name a few, Jupiter, Hyperliquid, Raydium, Sky, Jito — by announcing token buybacks over the last few months. |

Token buybacks are the TradFi-equivalent of "stock buybacks," what is typically considered a more tax-efficient way than dividends to return value to shareholders. Some of the most successful companies in the 1970s and 1980s engaged in massive stock buyback campaigns, in a time where buybacks were considered extremely unpopular. |

The canonical example is Teledyne. From 1972 to 1984, Teledyne's CEO Henry Singleton bought back approximately 90% of the company's outstanding shares. |

The result: Teledyne's stock massively outperformed the S&P 500 twelvefold by 1990. |

But what worked for TradFi may not for DeFi. |

Unlike most traditional businesses, some crypto products enjoy a relatively high ceiling for growth and expansion. Products like Aave or Uniswap, for instance, have had fairly sustainable revenue streams. Reinvesting capital into product expansion and user acquisition may yield greater returns than buybacks. |

|

In that event, token buybacks don't justify their costs, given easier routes to grow the business and create tokenholder value. |

Not only is it a poor spend of capital, it signals that the business has no other avenues for growth. |

Fundamentals may be back in, but don't assume token buybacks are a one-size-fits-all solution. |

— Donovan Choy |

|

|

Compound and Morpho are teaming up to launch lending vaults managed by Gauntlet on Polygon PoS. These aren't your typical Compound markets. The vaults are immutable, the process of adding assets is much quicker, and liquidation mechanics are tuned for capital efficiency. |

To juice adoption, $3m in incentives will start today, comprising $1.5m in POL from Polygon Labs and $1.5m in COMP from Compound DAO, spread over four months. The vaults are owned by Compound DAO, Morpho powers the lending infra, and Gauntlet optimizes risk. The combination, according to Polygon Labs CEO Marc Boiron, leads to a DeFi lending product that is "faster, more efficient and fundamentally safer." |

Morpho co-founder Paul Frambot called it a full-circle moment, arguing that the modular approach is fundamentally better than governance-heavy lending designs such as Aave. "What started as an optimization layer now powers one of DeFi's most trusted protocols," Frambot said. |

The move follows a decision by Aave governance, led by the Aave Chan Initiative (ACI), to offboard the protocol from Polygon. ACI, which contributed 385k of the 405k votes needed to pass the measure, has been openly critical of both Morpho and Gauntlet. Its departure from Polygon went ahead even after the underlying justification — a Polygon proposal — was removed, suggesting Aave's move was driven by protocol politics. |

— Macauley Peterson |

|

|

Blockworks is hiring a VP of sales! As our VP of sales, you'll be directly responsible for the day-to-day operations and leadership of our media and subscription sales teams. |

Remote US | $200k Base & OTE $300k |

Apply for the position if you are: |

|

|

|

|

| Yano 🟪 @JasonYanowitz |  |

| |

TVL will become the Assets Under Custody metric of crypto. A fluffy headline metric that actually means very little for a business. State Street custodies $50 trillion yet is only valued at $25 billion. Compare that to JPM, who custodies $30 trillion yet is valued at a… x.com/i/web/status/1… | | | 12:21 AM • Mar 12, 2025 | | | | | | 328 Likes 33 Retweets | 38 Replies |

|

|  | Marc "Billy" Zeller 👻 🦇🔊 @lemiscate |  |

| |

ETH has passed every major update flawlessly. Gas is now below 1 gwei, thanks to a recent 30% block size increase with zero issues. Pectra is on the horizon to massively improve UX, and Rabby keeps the EVM safe and fun. Liquidity is robust, protocols are mature and profitable,… x.com/i/web/status/1… | |  | | | 12:29 PM • Mar 12, 2025 | | | | | | 1.52K Likes 205 Retweets | 104 Replies |

|

| |

|  | Route 2 FI @Route2FI |  |

| |

Good article. Some of the problems I see: -There's an overwhelming number of chains, tokens, and dApps competing for attention

-This leads to a constant rotation and a fight for yield, as fast as the yield incentives are gone --> users run too

-Scams and memecoin pump & dumps… x.com/i/web/status/1… |  Emily Lai @emilyxlai Emily Lai @emilyxlai

x.com/i/article/1899… |

| | | 12:28 PM • Mar 13, 2025 | | | | | | 257 Likes 7 Retweets | 19 Replies |

|

|  | Tom Wan @tomwanhh |  |

| |

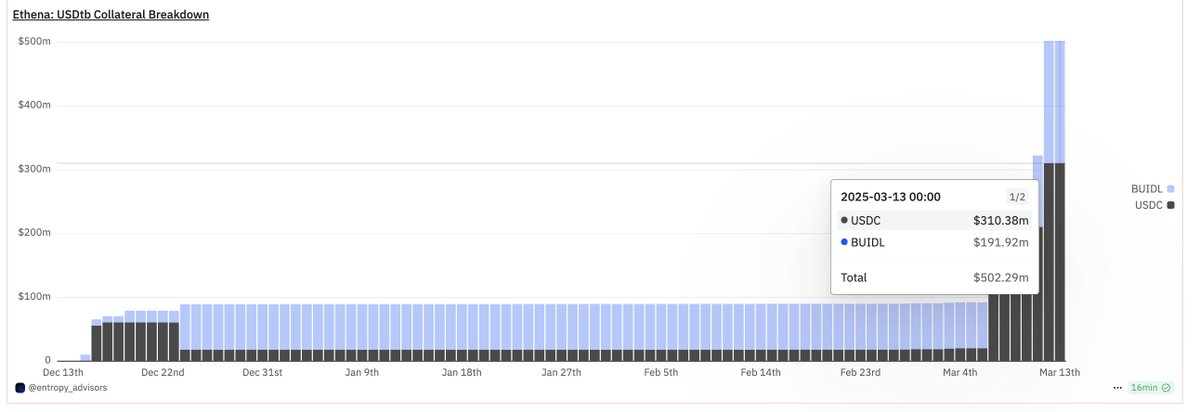

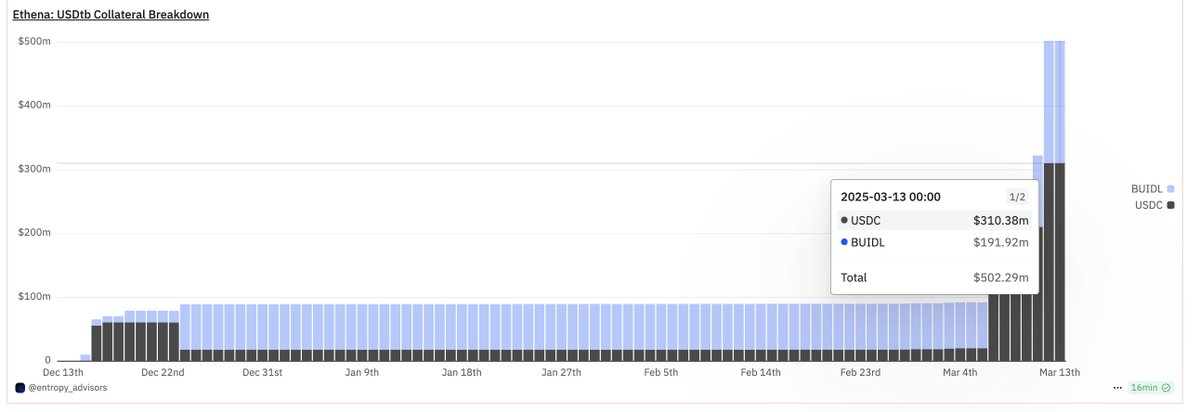

USDtb is @ethena_labs secret weapon. I shared this 1 month ago, and it is happening. 1. Additional Revenue

USDtb has hit $500M market cap, making Ethena the largest holder of BlackRock & @Securitize's BUIDL fund with $191M. At a 4% rate, that's $7.6M in annualized revenue. 2.… x.com/i/web/status/1… |  Tom Wan @tomwanhh Tom Wan @tomwanhh

People don't realize how impactful USDtb could be for @ethena_labs, potentially bringing in $70M annually. With $89M mcap, its collateral (BUIDL) earned $300K ($3.6M annualized) in interest last month. If USDe's $1.9B in stables converts to USDtb, Ethena's revenue could double. |

| |   | | | 9:41 AM • Mar 13, 2025 | | | | | | 119 Likes 42 Retweets | 3 Replies |

|

| |

|

|

No comments:

Post a Comment