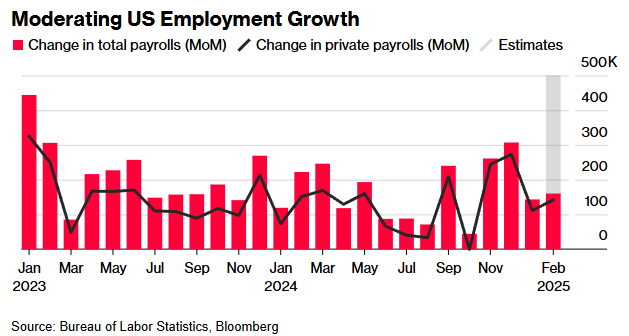

| I'm Cécile Daurat, an economics editor in the US. Today we're looking at the US jobs report. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. Two schools are emerging ahead of Friday's US jobs report, and both sides can base their cases on solid arguments: - The February data will show "relative calm before the federal policy chaos," as Pantheon Macroecomics said in a note.

- Payroll additions were weak — or even negative — and could fuel fears about economic growth, as Bloomberg Economics said in its preview.

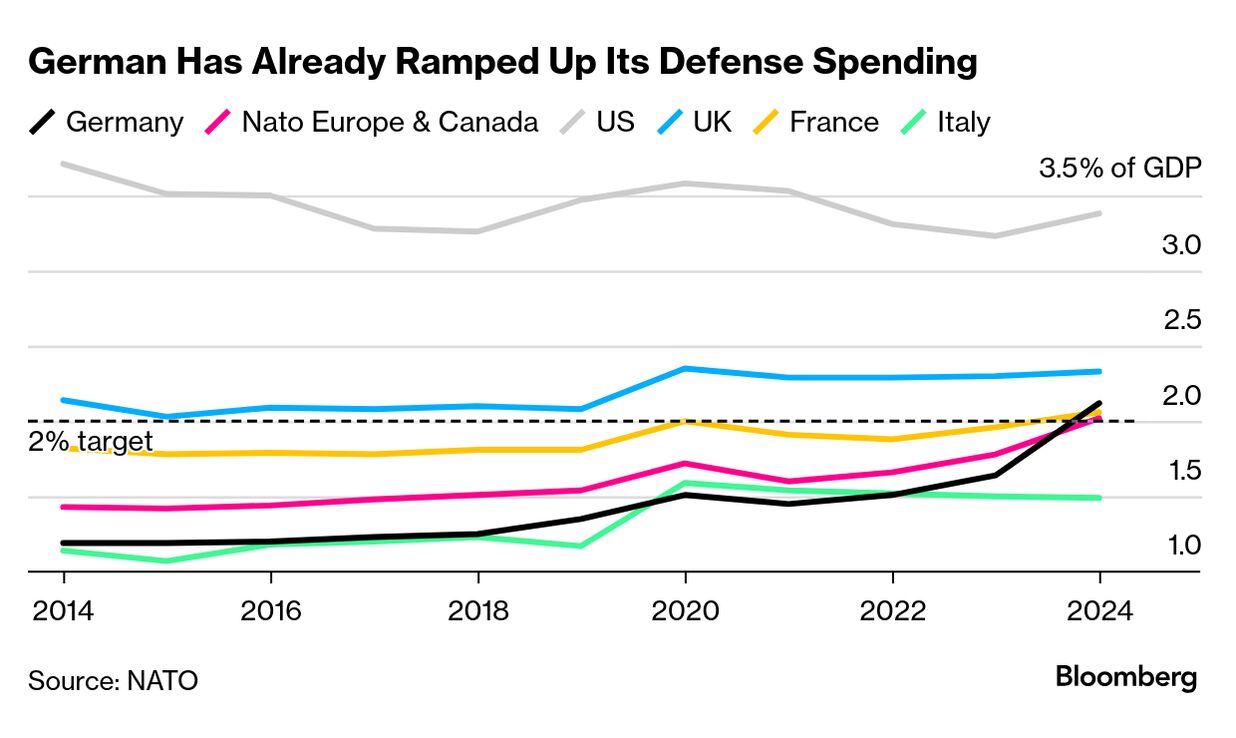

The optimistic camp point to the fact that the surveys used to compile the employment report were conducted the week before the Trump administration moved to fire federal employees across agencies. And jobless claims during that week remained relatively subdued — hovering near pre-Covid levels. Another case for healthy job growth in February, ironically, is that data from ADP Research showed the smallest gain in private payrolls since July 2020. Economists say there's a poor correlation between the ADP figures and the Bureau of Labor Statistics' private payrolls data. A weak ADP number could mean a solid BLS one. In addition, the employment measure in the ISM services report jumped to the highest since December 2021 — a sign of hiring strength in the largest sector of the economy. The pessimistic side can point to pretty much everything else that has happened in the US in the past six weeks. From the Beige Book to surveys of small businesses, there are signs everywhere that uncertainties around the Trump administration's policies are weighing on hiring decisions. Anna Wong at Bloomberg Economics also expects a retrenchment in hiring at local and state governments, which were a key driver of overall payroll growth in the past two years. The divergence of views is reflected in the wide range of estimates — from 30,000 to 300,000 additions. Looking beyond February, however, a consensus emerges. Most economists expect the ripple effects from federal spending cuts and tariffs to hit the labor market in the coming months. Don't Miss the Latest Trumponomics Podcast | Is a Trump recession on the way? Host Stephanie Flanders speaks with Evercore ISI's Kathryn Holston and Wong of Bloomberg Economics, about how Trump's policies may trip up the US economy. Listen here and subscribe on Apple, Spotify, or wherever you get your podcasts. The Best of Bloomberg Economics | After Germany's ground-breaking shift to set aside legal constraints on fiscal expansion this week, Morgan Stanley economists highlight that the outline included a specific amount for infrastructure, but an open-ended commitment on defense. "The total spending envelope could be more than €1 trillion ($1.1 trillion) over ten years, exceeding prior expectations," economists Jens Eisenschmidt and Claire Thürwächter wrote in a note this week. That includes the €500 billion infrastructure fund to invest in priorities such as transportation, energy grids and housing over 10 years that Chancellor-in-waiting Friedrich Merz flagged Tuesday. "Fiscal easing of this magnitude presents an upside risk to our baseline" growth forecasts, the duo wrote. That's not just from the direct spending, but also from a potential boost to sentiment — all the more so because the announcement in Berlin was fast and decisive, they said. The possible upside to 2026 growth is seen at 0.7 percentage point over their 0.9% baseline, and 0.2 percentage point for this year's 0.4%. |

No comments:

Post a Comment