| I'm Malcolm Scott, international economics enterprise editor in Sydney. Today we're looking at Laura Curtis's reporting on a proposed measure to impose levies on Chinese ships docking in the US. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. - Republicans are trying to deliver massive tax cuts, while Treasury Secretary Scott Bessent's focus on 10-year bonds is spurring lower yield targets.

- Purchasing manager indexes surged to a seven-month high in the euro zone, and a six-month high in the UK.

- The richest Americans kept the economy booming. What happens when they stop spending?

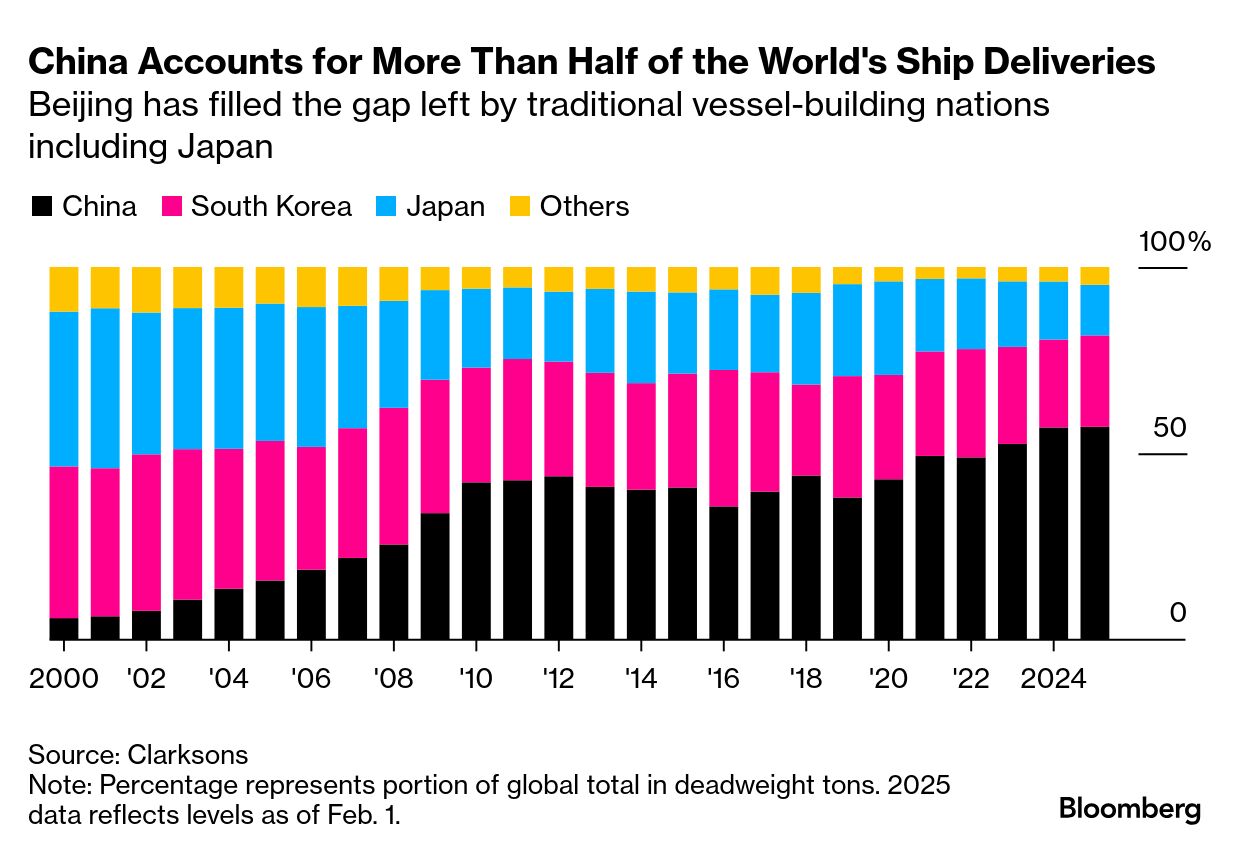

In a bid to revive America's long-dormant merchant shipping industry, Washington has proposed putting million-dollar levies on Chinese ships docking in the US — a threat that could disrupt global trade by more than President Donald Trump's tariffs — especially after new indications that such levies will be more targeted. The subject will be at the heart of a two-day hearing in Washington that begins on Monday where the entire supply chain will be represented, from soybean growers to shippers to Chinese shipbuilders. China now produces more than half of the world's cargo ships by tonnage, up from just 5% in 1999, according to the Office of the US Trade Representative, with Japan and South Korea the other shipbuilding powers. Last year US shipyards built just 0.01%, and the USTR has an eye on reviving the industry. China's dominance gives it "market power over global supply, pricing, and access," the USTR said on Feb. 21 when it unveiled the proposal. The China State Shipbuilding Corp., which has the largest order book of any shipbuilding group in the world, described the measures as a breach of World Trade Organization rules. Caught in the middle are business owners and industry officials who say the proposals could be devastating for the US economy by making American goods more costly, driving up freight rates and inflation, and diverting trade away from US hubs. John McCown, a veteran of the industry and author of a history of cargo shipping, put it starkly: "If you wanted to take a sledgehammer to trade this is what you would do. You take it all together — it's like an apocalypse for trade." The Best of Bloomberg Economics | - Canadian premier Mark Carney called an election for April 28, with fixing the economy to blunt Trump's trade threats a core issue.

- The UK will aim to slash the number of civil servants by 10,000 as part of a key loyalty test that Chancellor Rachel Reeves will present to Labour lawmakers.

- Australia's Treasurer Jim Chalmers warned that the new US administration's policies will have a "seismic" impact on the global economy.

- The European Central Bank's case to cut interest rates further has strengthened since March, policymaker Piero Cipollone said.

- Japan and China held their first economic dialogue in six years in Tokyo on Saturday, aiming to reduce tensions.

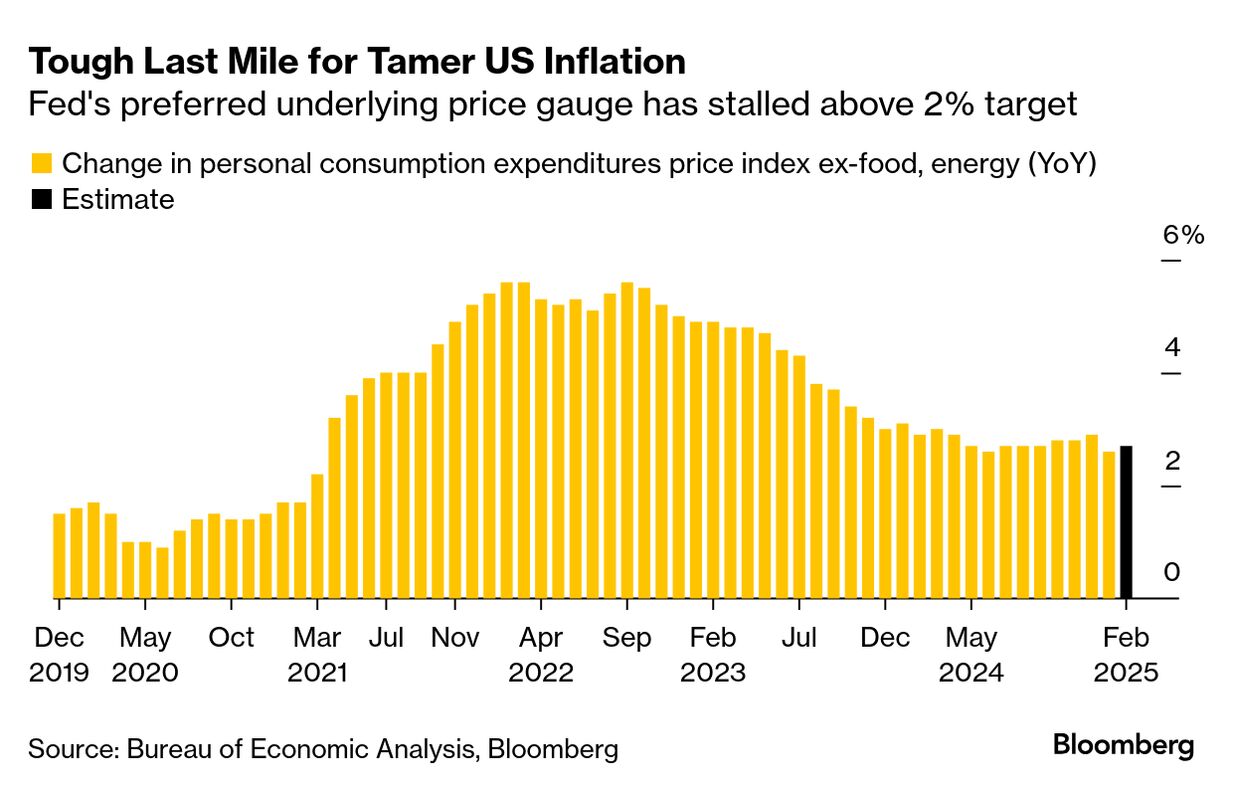

US inflation remains at a disquieting level for Federal Reserve officials, just as the Trump administration moves forward with tariffs that risk keeping price pressures elevated. The personal consumption expenditures price index excluding food and energy — the Fed's preferred measure of underlying inflation — probably rose 0.3% in February for a second month, based on a Bloomberg survey. The so-called core gauge is estimated to have accelerated to a 2.7% annual pace. The government's report on Friday is also expected to show consumer spending firmed after a tepid start to 2025, while income growth moderated after rising a month earlier by the most in a year. Consumer outlays, unadjusted for price changes, are forecast to have climbed 0.5% after the biggest weather-driven retreat in nearly four years. Personal income is seen rising 0.4%. Elsewhere, UK inflation data and Reeves's fiscal update, central bank minutes for Canada, Sweden and Brazil, and rate decisions from Norway to Ghana to Mexico will be in focus. See here for the rest of the week's economic events. The Bank of Japan in December released an autopsy on policymaking since the 1990s, but it still fell short of a thorough airing of the mistakes made in Tokyo as what was then the world's No. 2 economy sank into stagnation. That's according to Jun Saito at the Japan Center for Economic Research, who pored over the report in a note last week. First off, the BOJ failed to highlight the importance of how long it took for the government and the BOJ itself to recognize the deflation that set in in the latter half of the 1990s. In the government's case, that didn't happen until 2001, Saito says. Another of the many shortcomings was the omission of discussing "portfolio rebalancing," he wrote. One of the ways ultra-easy BOJ policy was thought to work was by encouraging investors to move out of low-yielding government bonds and into riskier assets like stocks. But the BOJ didn't look at that, Saito said. More broadly, the BOJ didn't engage in reviewing what should have been done, Saito said. That work remains. |

No comments:

Post a Comment