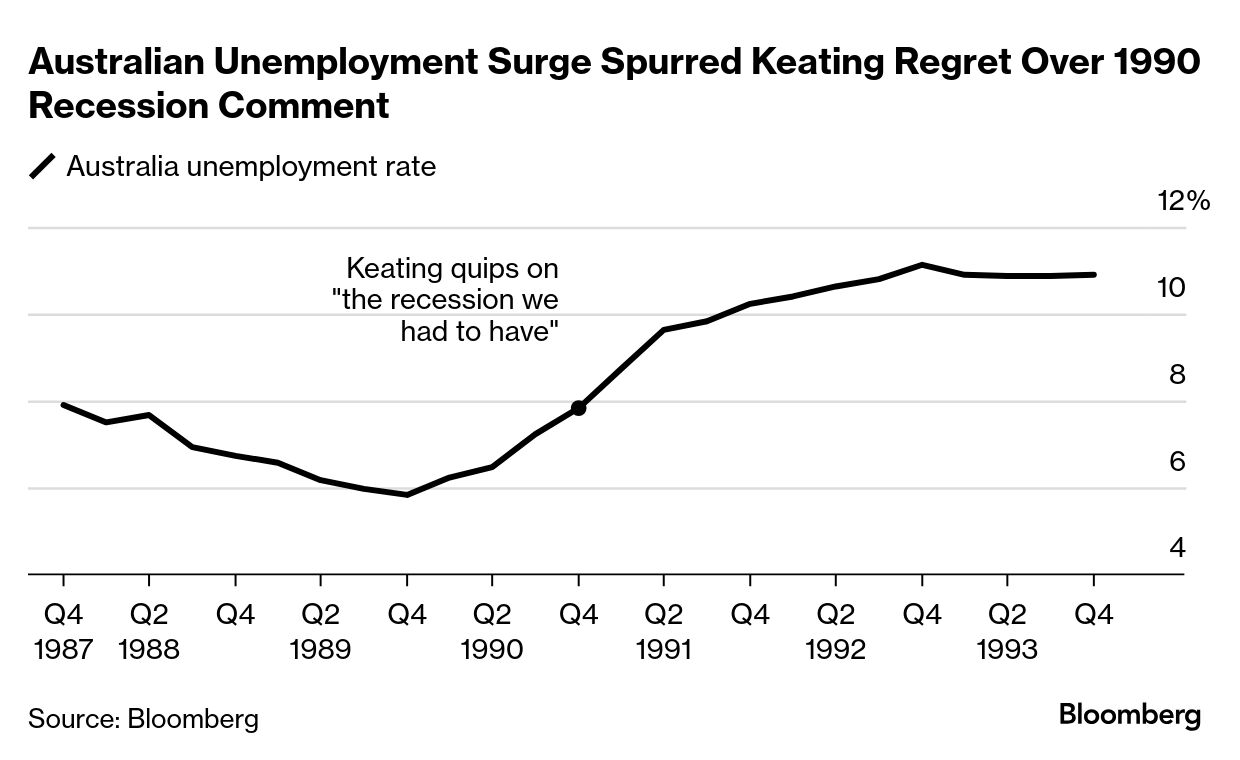

| I'm Chris Anstey, an economics editor in Boston. Today we're looking at the dangers of welcoming tough economic times for longer-term gains. Send us feedback and tips to ecodaily@bloomberg.net or get in touch on X via @economics. And if you aren't yet signed up to receive this newsletter, you can do so here. Against a backdrop of giant current-account deficits, Australia's economic policy chief deliberately moved to slow growth and take steps to boost domestic manufacturing. And when the economy contracted, he quipped, "This is the recession we had to have." Paul Keating's November 1990 remark as treasurer became infamous in politics Down Under. There's arguably a faint echo of his quip in Washington today, where President Donald Trump lately has been warning that the economy risks a bumpy transition towards his higher-tariff, smaller-federal-government policy model. "There'll always be a little short-term interruption — I don't think it's going to be big," Trump said Thursday. "There will be a little disturbance, but we're okay with that — it won't be much," he said in his March 6 joint address to Congress. And on Sunday, he pointedly declined to rule out a recession, saying "I hate to predict things like that. There is a period of transition, because what we're doing is very big."  Former Australian Prime Minister Paul Keating in March 200 Photographer: Dimas Ardian/Bloomberg One risk is that such language fuels angst about the outlook, along with Trump's apparent disregard — for now — about a stock market selloff. Another one, according to Dario Perkins at TS Lombard: "Perhaps the new US administration has forgotten what a 'real' recession is like." "There hasn't been a real US recession in 17 years," Perkins says — arguing that the Covid slump was triggered by shutdowns that were quickly reversed and countered by massive fiscal stimulus, so should be set aside. "Recessions are not always 'healthy' or 'cleansing,'" he wrote in a recent note. "Quite the opposite – they can cause damage. And that damage sticks around." Keating acknowledged that lesson a year after his recession comment, by when Australia's jobless rate had climbed into double digits. "It's one of the statements I made as Treasurer I regret," he said as prime minister in 1991. "You can never consign Australians to the misery of unemployment, believing there's a higher purpose to it." Keating was also famous for warning Australia was in danger of becoming a "banana republic" by having let its industrial base wither. Trump similarly uses aggressive language in touting policies aimed at ushering in a "golden age" of American industry. Despite high unemployment, Keating went on to win the next Aussie election. Though that's hardly something that ought to encourage any US Republican advocating for a "detox" economic program. Keating was rescued by an unpopular tax proposal from the opposition — perhaps a lesson for the Democrats. The Best of Bloomberg Economics | - Billionaire presidential adviser Elon Musk called entitlement spending — benefits including Social Security and Medicare — key targets for cuts, an assertion that directly contradicts Trump's pledge to not touch those programs.

- Japan's economy expanded in the last quarter of 2024 at a slower pace than earlier reported, a result that may give the Bank of Japan reason to hold steady next week. Meanwhile, the country's finance chief said higher yields aren't all bad.

- Italy's bond angst is shaping Prime Minister Giorgia Meloni's strategy from defense to banks.

- Poland will face consequences if it introduces a levy on large technology companies, the incoming US envoy to Warsaw warned.

- Australia's consumer confidence picked up in March as inflation pressures eased and the Reserve Bank reduced interest rates.

- Indonesia faces a shortage of qualified workers, with over a third of its population having only a primary school education or less.

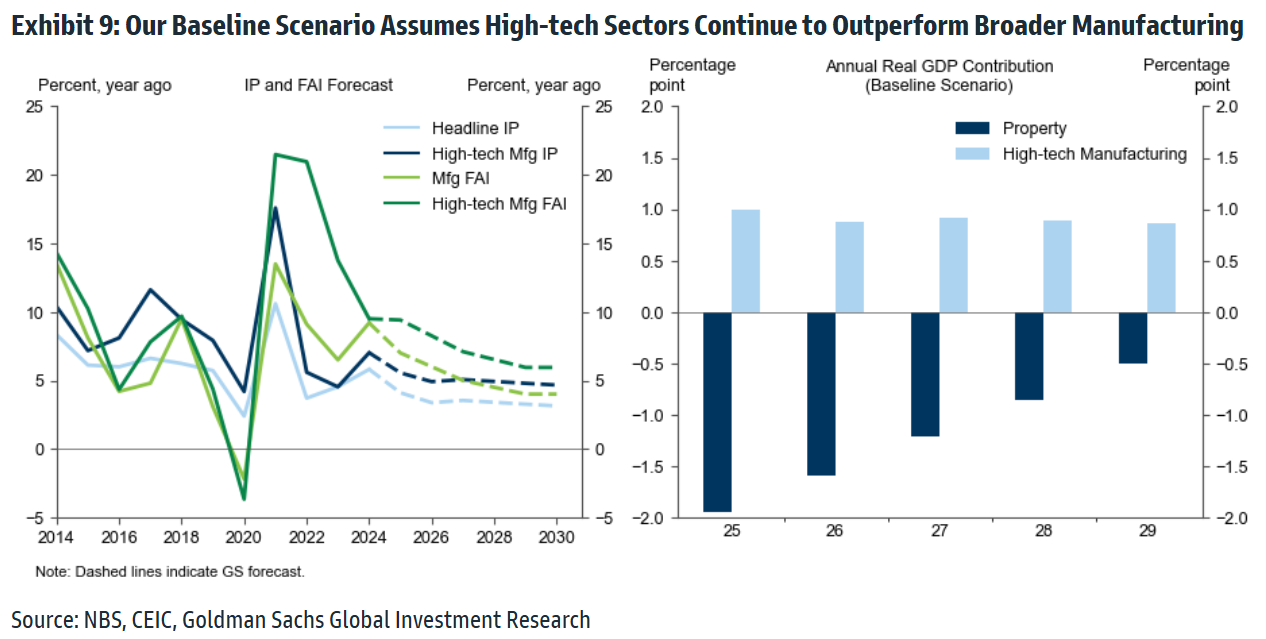

China's high-tech sector has become an increasingly important driver of the nation's economy in recent years, and is likely to account for a notable share of growth in the coming years, according to Goldman Sachs economists. High tech — using an OECD definition that includes items beyond the information and communications technology world, like pharmaceuticals and rail/ship/aircraft manufacturing — makes up 8% of China's GDP now, up about 2 percentage points compared with a decade ago, according to Goldman economists Chelsea Song and Xianquan Chen, writing in a note Monday. It is also "the only sector within the broader manufacturing sector to maintain strong profitability," they wrote. The duo sees high-tech manufacturing contributing an average of 1 percentage point to GDP growth over the 2025-29 period, with alternative scenarios ranging from 0.6 to 1.4 percentage points. That compares with Goldman's projection for overall GDP gains of an average 3.96% over those five years. |

No comments:

Post a Comment