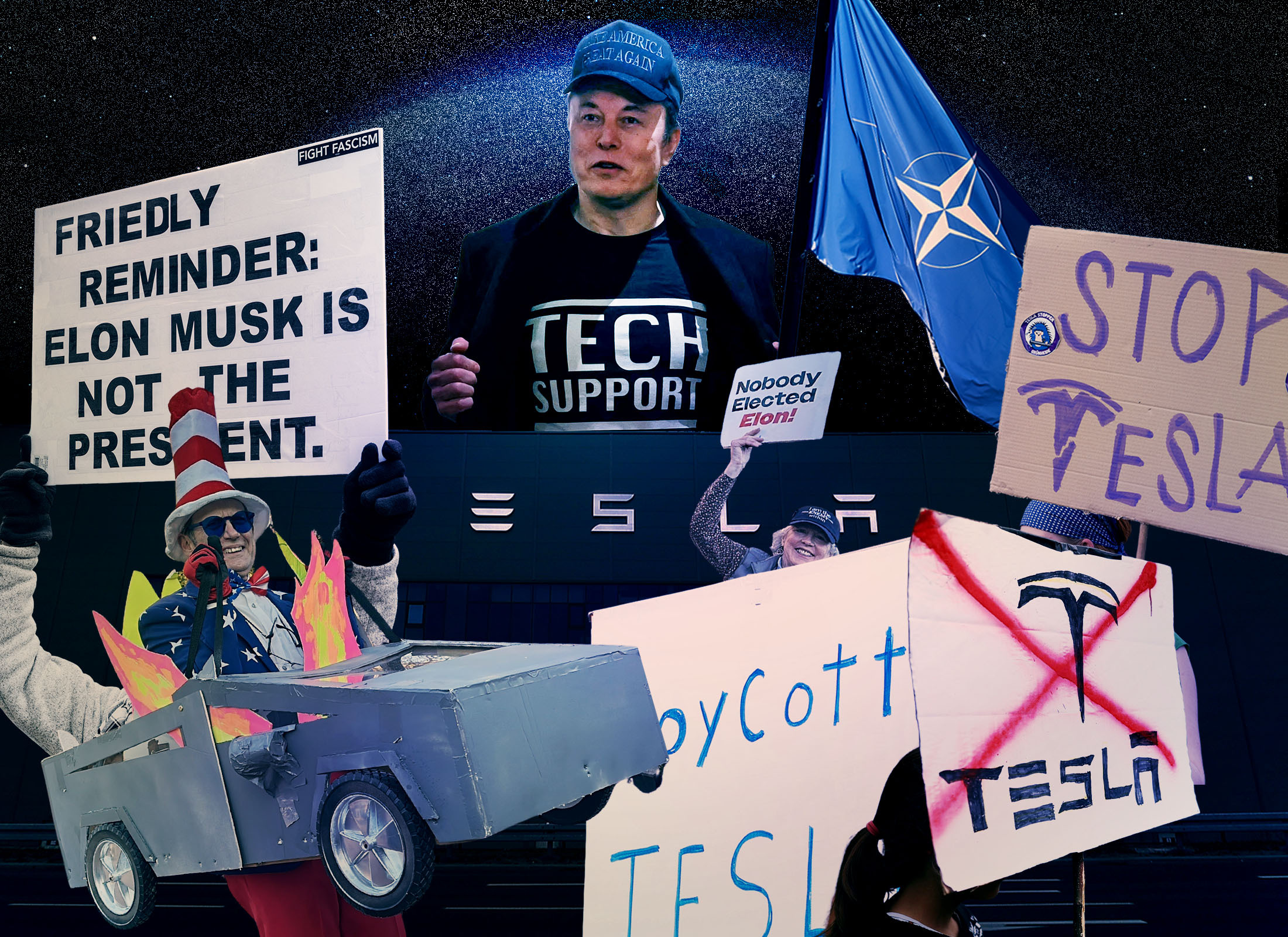

| The annual Bloomberg Invest conference wraps up today, and Sonali Basak is here with some highlights. Plus: How Elon Musk's government work is affecting Tesla, and Greenlanders prepare to vote with Donald Trump's threats in mind. If this email was forwarded to you, click here to sign up. You may remember after President Donald Trump's victory in November the way the markets rallied. Since then, it's been a walk down a stairway into another reality—the S&P 500 has lost its gains, and investors are recalibrating in reaction to the moves made in Washington in Trump's first 44 days. For former Treasury Secretary Robert Rubin, the cuts by the so-called Department of Government Efficiency are excoriating confidence. "DOGE is doing tremendous damage to government and to the recipients of government services and government activities," Rubin said in an interview on Tuesday with my colleague Lisa Abramowicz during the Bloomberg Invest conference. Rubin added: "I have spent my entire career focused on fiscal discipline. We balanced the budget in 1998, the first time in 30 years. I think we knew what the heck we were doing. I don't think these people have the foggiest notion of what they're doing." It's a damning rebuke from the man who worked successfully under President Bill Clinton to bring America's financial house in order. (In addition to working in a Democratic administration, Rubin is also pro-trade, so clearly he has a lot of differences with the Trump team.) Top Republicans have praised Elon Musk for his efforts to slash government costs, but the billionaire and "special government employee" who's leading the DOGE office in the White House is expected to brief House Republicans on Wednesday night, according to Bloomberg Government. GOP lawmakers have faced backlash in their districts, and Democrats are furious. And looming over the tension is the March 14 funding deadline to avoid a government shutdown. Over on Wall Street, where profits are king, there's also a polarized view on DOGE. Although there's a broad agreement that spending should be reined in, there are two main concerns: that DOGE isn't going to make a difference against roughly $2 trillion in annual deficits, and that the frantic nature of the cuts could both damage America's long-term freedoms (in the case of the soft power earned around the world through USAID) and fracture the American economy near-term in a wave of job cuts. "Trump's tariffs and DOGE-mandated job cuts are depressing consumer confidence," wrote Ed Yardeni, a longtime strategist on Wall Street, in a note to clients this week, saying that the odds of a recession are rising. (He's still betting on the resilience of consumers and the economy, to be clear.) Jonathan Lewinsohn, a co-founder at Diameter Capital Partners, showed more optimism. His firm is a multibillion-dollar credit investor that recently purchased debt in Musk's X, which the banks took years to offload. Diameter thought it got a great value. That experience gave Lewinsohn a glimpse of what he expects from DOGE. X performed "incredible cost-cutting that allows for the company to be highly profitable on much lower revenue," he said in a Bloomberg Television interview on the sidelines of the Invest conference. "I would never assume that X has anything to do with the federal government, but I think what you're seeing is a similar approach to come in, really cut things, maybe ask questions later." On the topic of the US Agency for International Development, Lewinsohn said he thought Musk's team targeted an area that hasn't historically polled well among Americans. When there are so many challenges at home, citizens might be questioning the dollars spent elsewhere, and, he said, it sends a message: "Nothing is sacred." "What's interesting now is it's moved from a 'Should we do this?'—which I think most people probably think reassessing government spending makes sense—to a process question, 'Is this being done correctly?'" Lewinsohn said. "And that's what we're debating, and that's well above my pay grade, I'm a private credit and public credit guy." Follow along for live updates from today's sessions. Related: Five Takeaways From Bloomberg Invest Conference First Day |

No comments:

Post a Comment