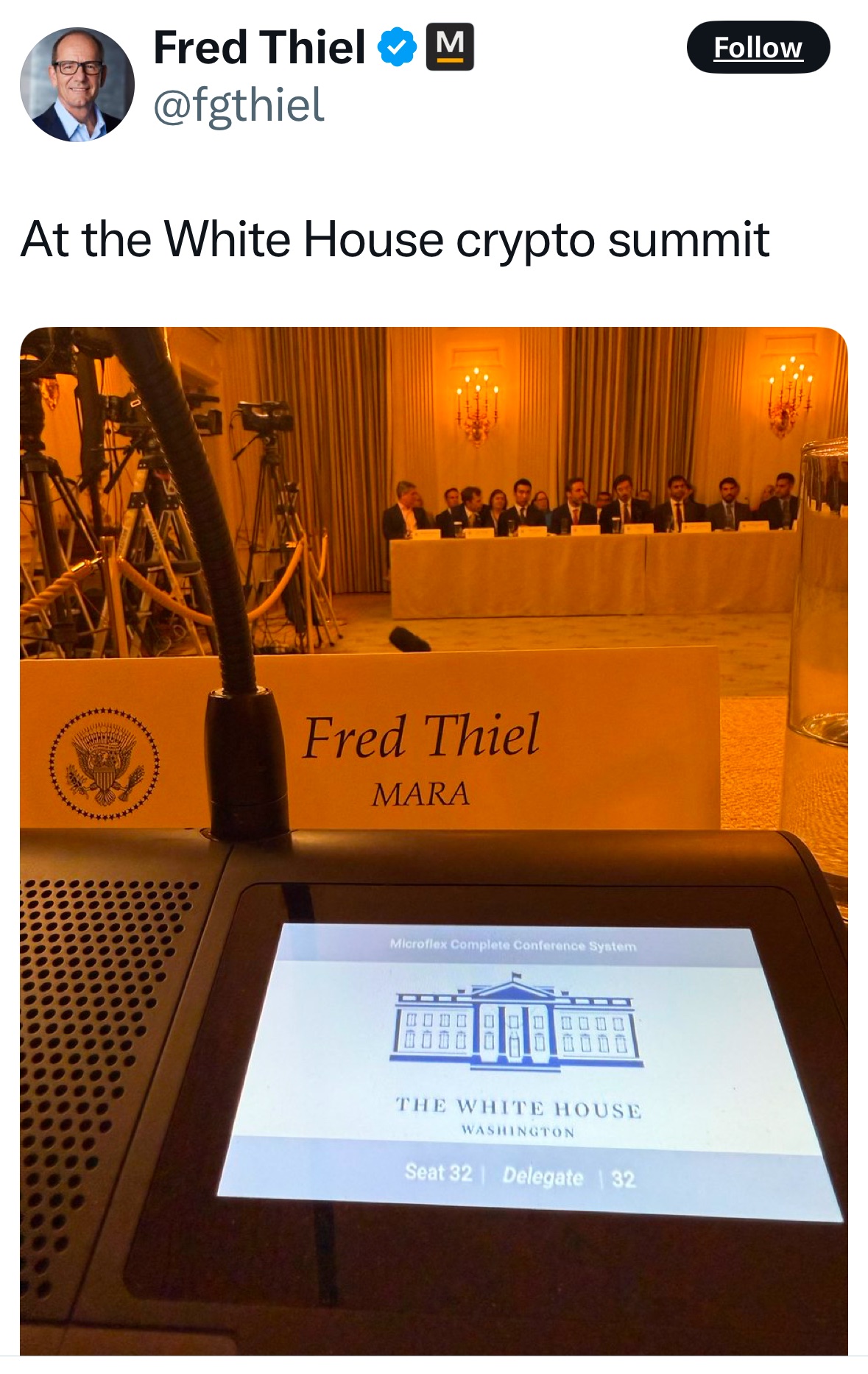

| Considering everything else going on, last week's main event for the cryptocurrency market may seem like a distant memory: A visit to the White House by executives in the industry following President Donald Trump's executive order creating a Strategic Bitcoin Reserve and a national stockpile of other tokens. Crypto aficionados who expected other executive actions during the White House summit may have been disappointed, as evidenced by the ensuing drop in prices. They shouldn't be: Some attendees left the meeting thinking that the talks were only the beginning of the administration's love fest with the industry. The summit hosted about 30 executives, agency heads and politicians for a meeting with Trump and David Sacks, the venture capitalist who is the president's artificial intelligence and crypto czar. They munched on chocolate-chip cookies, listened to piano music and wandered through the East Wing before the meeting, which included a viewing of the FIFA World Cup trophy and speeches of thanks to Trump, according to JP Richardson, co-founder of crypto wallet Exodus. Before journalists were allowed into the State Dining Room and cameras began rolling, all attendees — including Coinbase Global Inc. CEO Brian Armstrong and the billionaire Winklevoss twins — got a chance to talk about the rest of their wish lists for the administration's actions, Richardson added. "Stablecoins were a huge theme from everybody," Richardson said. "Everybody talked about what I care about getting done in government. Everybody went around the room and put it on the table. And there was a lot of gratitude for the Strategic Bitcoin Reserve. There was a lot of acknowledgment about how fast this administration moves." Treasury Secretary Scott Bessent and Commerce Secretary Howard Lutnick then shared their priorities. Bessent said he wants to rescind onerous Internal Revenue Service rules on crypto and to remove obstacles that made it difficult for digital-asset companies to work with the banking sector, according to Fred Thiel, CEO of Bitcoin miner Marathon Digital Holdings. Bessent also talked about supporting dollar-backed stablecoins from American companies, Thiel said in an interview. Lutnick talked about how a majority of Bitcoin mining power should be based in the US, Thiel said. (Right now, about 35% of all new Bitcoin is mined in the country, according to Thiel.) Lutnick also emphasized the need to pursue ways to protect the Bitcoin network from powerful quantum computers in the future, Thiel said. Quantum computing has triggered concern in the industry over its potential to break the encryption that's at the heart of cryptocurrency technology. Representatives for the Treasury and Commerce departments did not respond to requests for comment. As they were leaving, attendees were offered sugar cookies in the shape of the White House, Richardson said. And there was another parting gift: An assurance that they'd be invited back for more talks. "They have said this was one of a series of meetings like this that will be held," Thiel said, adding that the hosts told the visitors: "`We look forward to doing it again.'" |

No comments:

Post a Comment