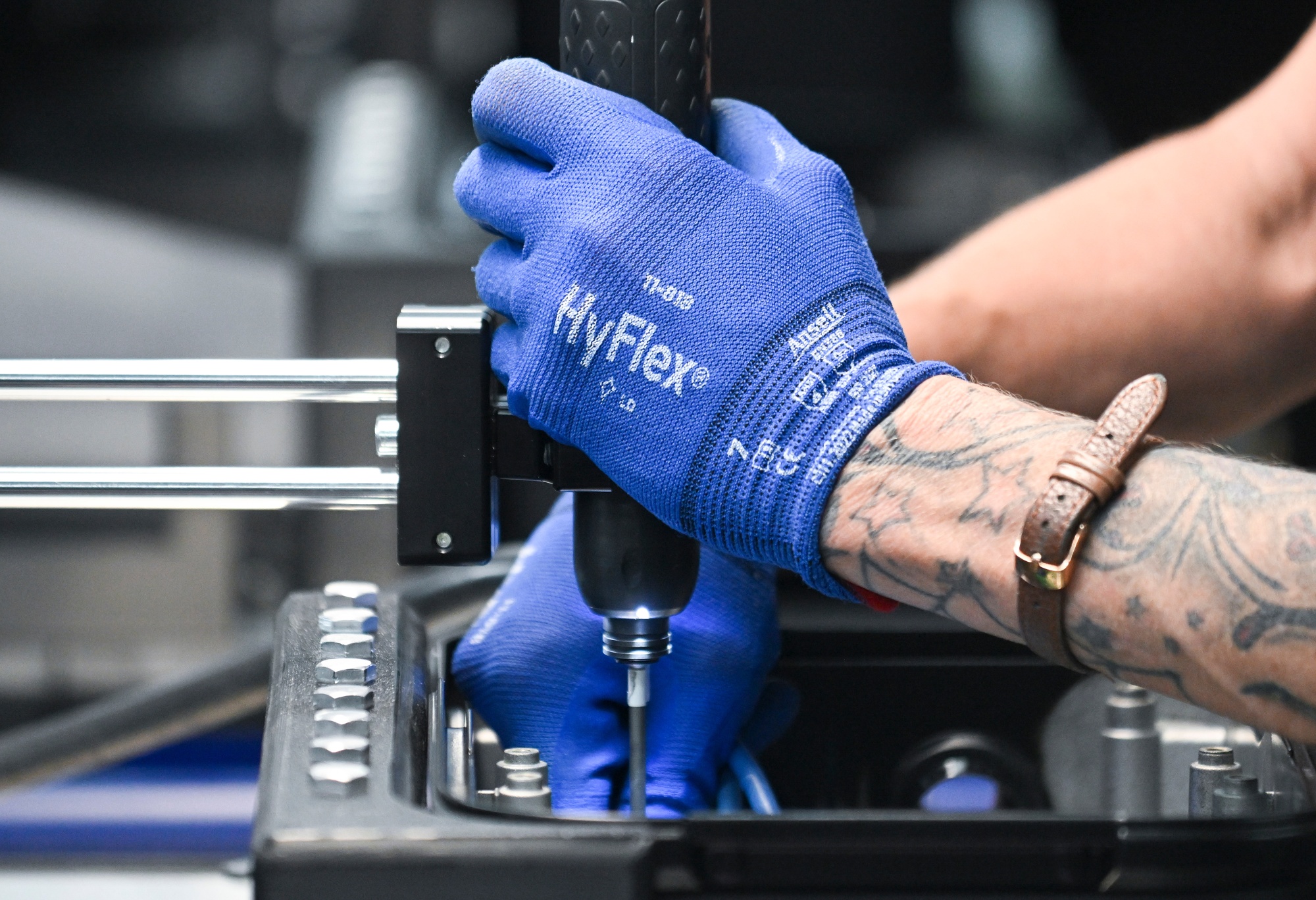

| By Danielle Bochove The trade war between the US and Canada threatens to throw a wrench into the prospects for decarbonizing both economies — though it may offer some longer-term opportunities for Canada, especially in the area of electric vehicles. Bilateral tariffs on steel and aluminum are already in place, and industry is bracing for more US levies on April 2. President Donald Trump had said tariffs on auto imports from Mexico and Canada would go into effect on that date, but officials recently indicated that sectoral tariffs will be excluded from this round and could come later. Applying tariffs to this highly integrated supply chain — which often sees parts cross the border multiple times during assembly — would likely raise prices significantly. Yet the tariffs may have less of an impact on North American electric cars and, longer-term, may offer Canada some opportunities. Traditional gasoline-burning vehicles contain more border-crossing parts than EVs, according to BloombergNEF research, which notes that auto tariffs may drive up those prices more, providing a leg up to EVs. "The overall impact is interesting because the tariffs might actually be a good thing for electric vehicle production, relative to ICE production," said Antoine Vagneur-Jones, head of trade and supply chains for BNEF.  A worker assembles Flo Home EV chargers at the company's assembly facility in Shawinigan, Quebec, Canada. Photographer: Graham Hughes/Bloomberg Late to the EV party, Canada has so far produced few electric models and only a modest number of plug-in-hybrids. The country hopes to build a domestic ecosystem for the production of electric cars and batteries, leveraging its supply of critical metals and minerals as well as its abundant clean power. It's invested tens of billions of dollars to encourage EV and battery makers to set up shop, with Ford Motor Co., Stellantis NV, General Motors Co., Volkswagen AG, Honda Motor Co. and Northvolt AB striking deals in Ontario and Quebec in the last five years. The sector was facing steep challenges before Trump. Canadians have been slow to switch to EV models. As things stand, ICE cars still need to be profitable to subsidize the production of EVs in Canada, says Andrew McKinnon, director of policy for Accelerate, which represents members of the Canadian EV supply chain. "You need to save the traditional auto industry before you can save what it's going to become," he said. But Ollie Sheldrick-Moyle, clean economy program manager for Clean Energy Canada, argues that there are steps Canada could take to reduce the impact of Trump's tariffs. If Canada could mine, refine and use more of its critical minerals, it would boost the efficiency of the homegrown EV industry. Breaking down economic barriers between provinces, adopting more customer incentives and expanding trading relationships beyond the US would also help, says Sheldrick-Moyle. Meanwhile, as the US seems likely to scrap other climate-friendly policies and tax credits, there is potential for Canada to provide a home for stranded clean-tech investment dollars. US trade policies could also encourage further electrification on Canada's grid, especially if Canadian (and Mexican) exports of power transformers and grid equipment to the US diminish, as BNEF analysis suggests may happen. "We can produce abundant affordable power within our own borders and use that to power the needs of families every day," Sheldrick-Moyle said. In his first speech as prime minister, Canada's Mark Carney announced plans to pursue new trade corridors with "reliable" partners and forge a single Canadian economy out of 13 provinces and territories. He also vowed to make Canada "a superpower in both conventional and clean energies." Carney will now be pitching this vision for Canada on the campaign trail after he called on Sunday for a national election on April 28. What does the trade war mean for Canada's other manufacturing sectors benefitting from the green transition? Read the full story on Bloomberg.com. |

No comments:

Post a Comment