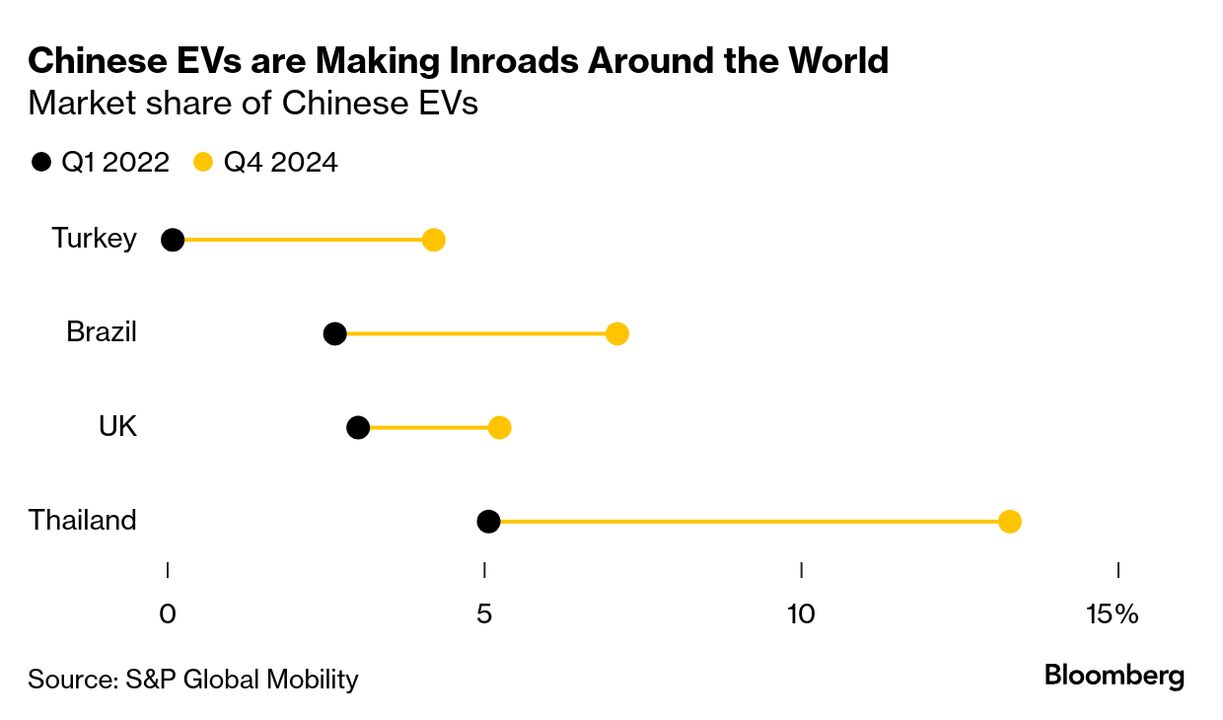

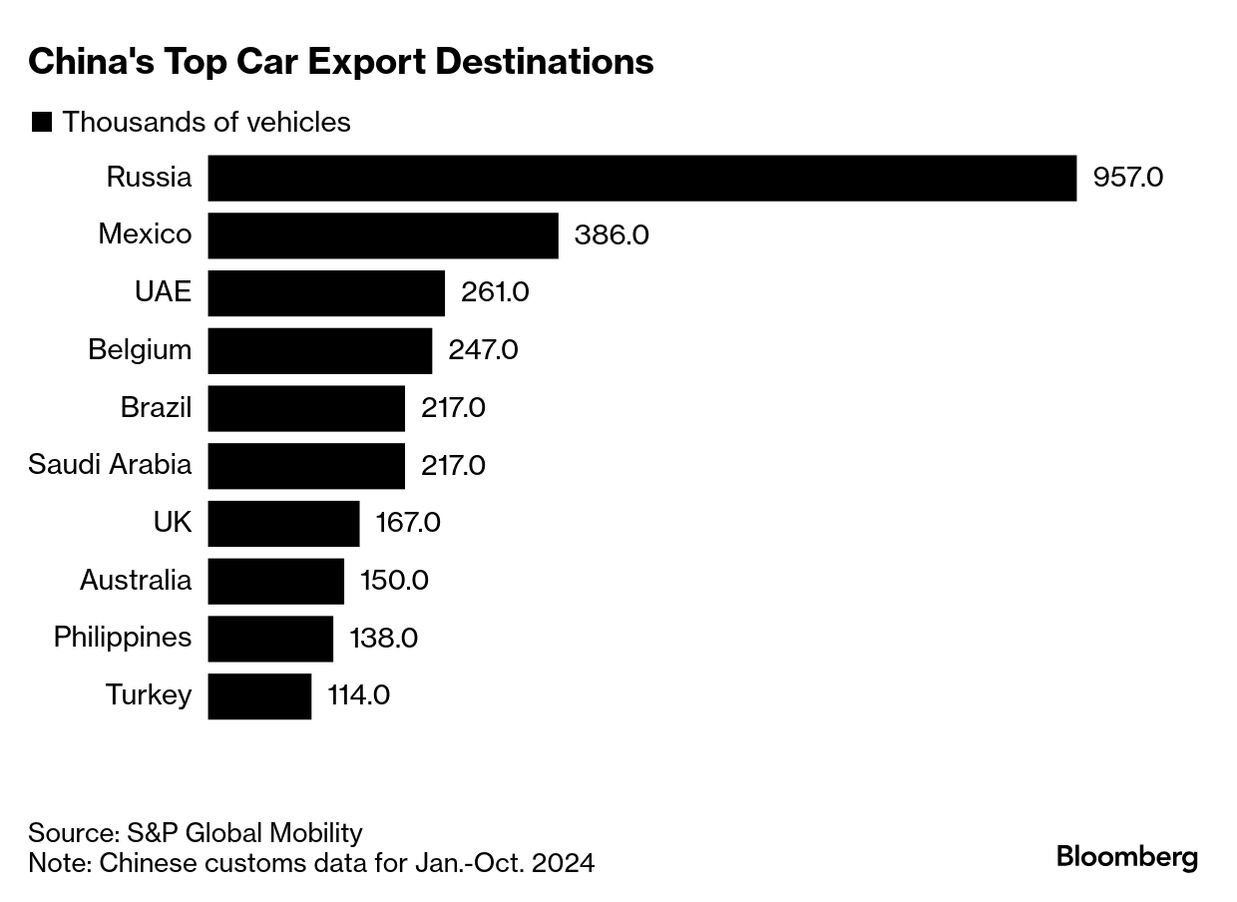

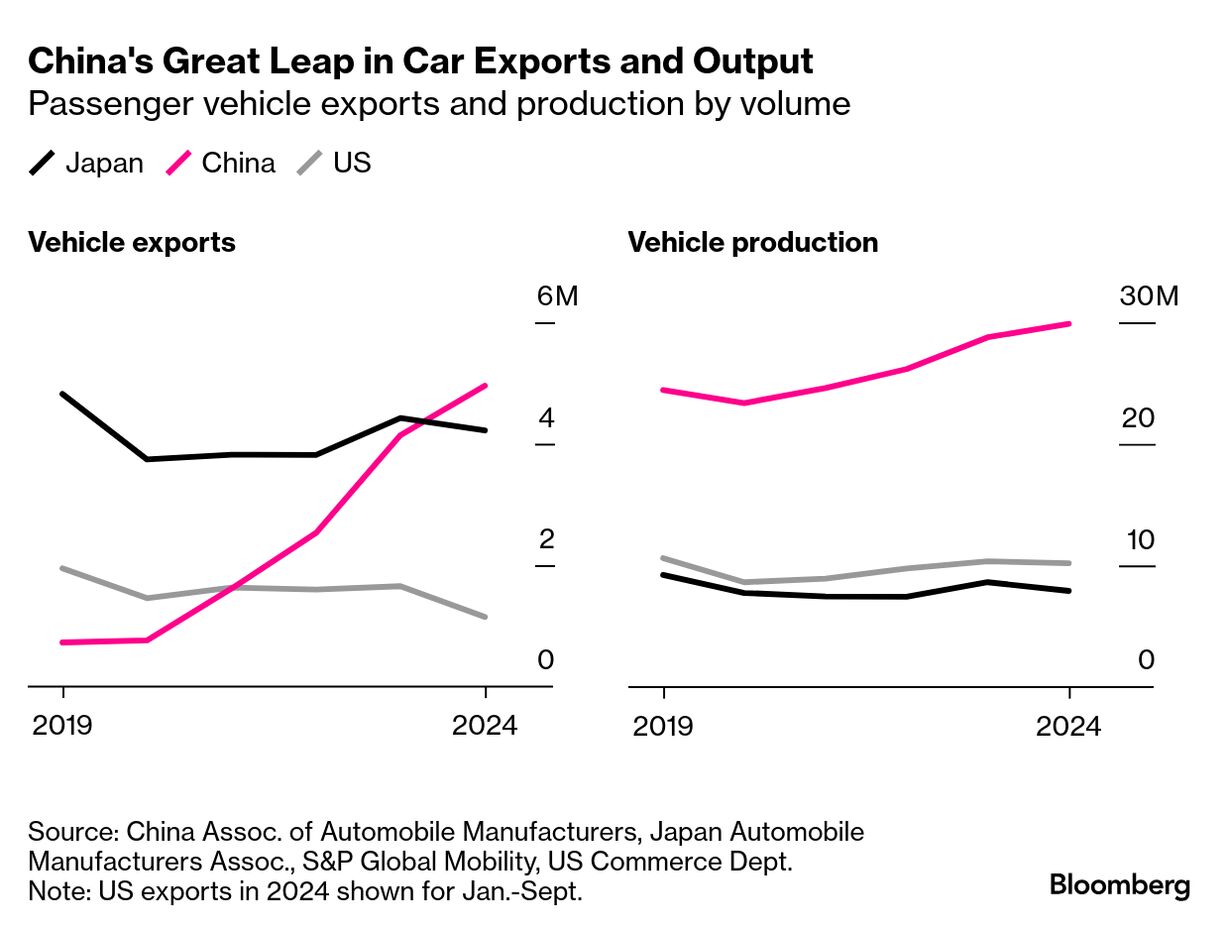

| Thanks for reading Hyperdrive, Bloomberg's newsletter on the future of the auto world. Read today's featured story in full online here. Donald Trump wants to keep Chinese carmakers out of the US, but that won't stop them from taking over the rest of the world. They already are. From Bangkok to Johannesburg to Sao Paulo, the streets are increasingly jammed with inexpensive compacts, crossovers and SUVs made by companies like Great Wall, BYD, Chery Automobile and SAIC Motor. While the Trump administration is expected to shield the US's Big Three from Chinese rivals at home, and Canada and the European Union have placed tariffs on Chinese-made electric vehicles, buyers in emerging markets have welcomed Chinese cars and trucks with open arms — posing a new threat to growth-hungry global automakers.  BYD electric vehicles rolling off the automaker's production line in Nikhom Phatthana, Thailand, in July. Photographer: Valeria Mongelli/Bloomberg Oscar Mabuela, a 29-year-old web designer living in South Africa, is the sort of customer that auto executives in faraway cities like Detroit, Tokyo and Wolfsburg have long coveted. Shopping for a new car this year, he considered a Volkswagen Polo hatchback, one of the top-selling vehicles in the country — but got cold feet over fears of hijacking or theft. Instead, he bought a recent model year gasoline-powered Haval Jolion Super Luxury SUV from Great Wall for 350,000 South African rand ($19,300). A brand new 1.5-liter Jolion starts at $25,000, less than an equivalent 1.0-liter VW Polo's $27,500 sticker price. "I get to have all the tech that are extras on known brands," Mabuela said. He isn't alone. Buyers like Mabuela have helped Chinese automakers grab market share at astonishing speed. In South Africa, China-made vehicles account for almost 10% of sales, about five times the volume sold in 2019. In Turkey, Chinese brands claimed an 8% share in the first six months of 2024, up from almost none in 2022. In Chile, they've accounted for nearly a third of auto sales for several years running. China sends more vehicles abroad than any other country, and its passenger car exports surged nearly 20% to 4.9 million in 2024 alone, according to the China Association of Automobile Manufacturers, from less than 1 million in 2020. "Chinese automakers have pushed into lots of global markets with high quality and competitively priced vehicles," said Abby Chun Tu, a Shanghai-based auto research analyst at S&P Global Mobility. "It's the same strategy that worked for South Korean and Japanese brands, but they also have the advantage of advanced software and lots of features — even in their mass-market models." While leaders in the US and Europe have long been concerned that China could become a dominant seller of EVs, the Chinese automaker association's data show gas-powered vehicles accounted for nearly 80% of total vehicle exports last year. Many underdeveloped markets don't have charging stations or a reliable enough electrical grid to support fully electric models. But Chinese automakers have found in those places a ready market for gas-powered cars that they can no longer sell at home in large volumes. Global market share for Chinese automakers outside their home country is expected to climb to 13% in 2030 from 3% today, according to AlixPartners. Including China, that worldwide share jumps to 33%, and in Africa and the Middle East it's projected to hit 39% by then. At a conference in February hosted by investment firm Wolfe Research, the heads of Ford Motor and General Motors acknowledged the competitive pressure being brought to bear in developing markets.

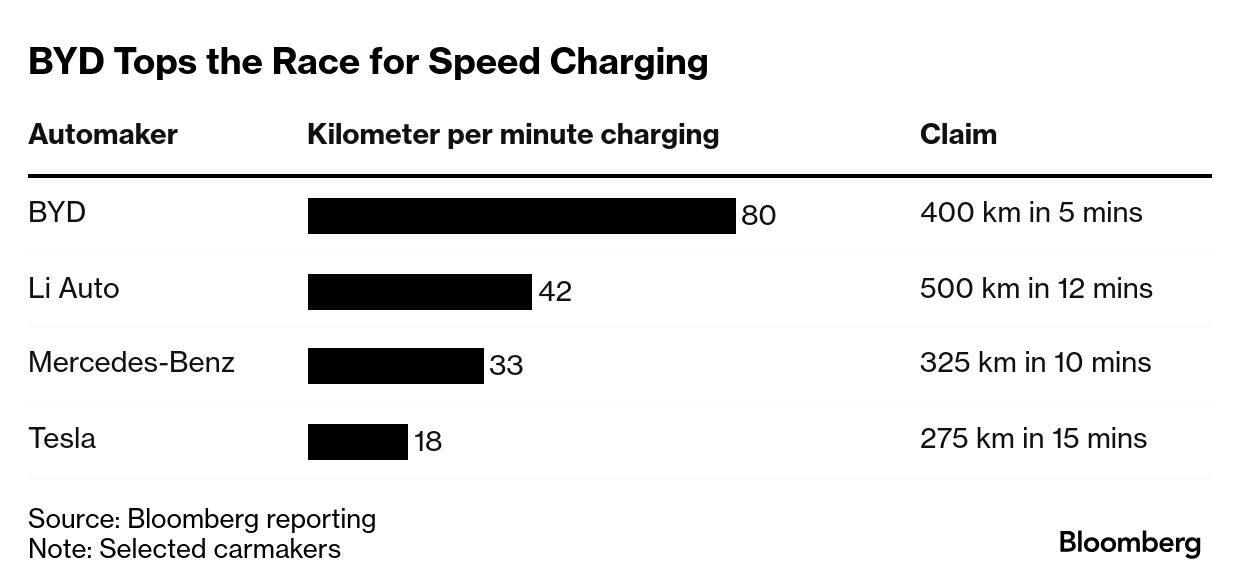

"Our operations overseas are very fit, but the Chinese are coming to those markets now, globalizing the supply chain," Jim Farley, Ford's CEO, told investors. "In emerging markets like India, especially South America, they're being dominated by the Chinese," he said, referring specifically to China-made EVs. Ford has ceased vehicle production in Brazil, where its former factory has been acquired by China's BYD. The carmaker has drawn a line in the sand, however, for its business in South Africa and Thailand, with plants that produce hundreds of thousands of Ranger pickups annually. "We have to think about future-proofing that," Farley said. GM also views the Chinese as a serious threat, but CEO Mary Barra is picking her battles. The Detroit-based carmaker has opportunistically exported models made by its own Chinese joint venture to emerging markets like Brazil. Barra says working with Chinese automakers on some products allows GM to better compete in markets "where the Chinese are very present." Toyota and other Japanese carmakers, which spent decades building up gas-powered vehicle production investment and infrastructure in Southeast Asia, have meanwhile been slow to adapt to policy changes in Thailand, long known as "the Detroit of Southeast Asia." Thailand cut import taxes on EVs, added buyer subsidies for them and gave out big tax breaks for investments in plants. As a result, EV sales skyrocketed by more than 600% in 2023 from the previous year to 73,568 units, seizing almost 9.5% of total passenger car sales, according to the Federation of Thai Industries. EV sales dipped slightly to 66,732 last year, but their share of overall vehicle purchases rose to just under 12%. Chinese brands' share in the country has grown to 13.3% as of the last quarter of 2024, up from just 5.5% two years earlier, according to S&P Global Mobility. More telling: China's share of Thailand's EV market in that same timeframe has mushroomed to 71%, up from 22% in 2022. On the first day of the 11-day Bangkok Motor Expo in late November, Toyota, Ford and Honda shared floor space with BYD, Great Wall, SAIC Motor's MG and Geely, which was making its debut in the Thai market. Wiyawit Petra, a 57-year-old businessman, said BYD's global reputation, local manufacturing footprint and low prices have opened him up to the idea of trying something different. "I've driven Toyota and Honda all my life, but I want open my heart to something new now," he said during the expo, eying a BYD plug-in hybrid Sealion 6 SUV. "It's also affordable, so it's worth the risk." — By Chester Dawson, Rachel Gamarski, Mpho Hlakudi, and Patpicha Tanakasempipat BYD shares jumped to a record high after the Chinese automaker unveiled a lineup of electric vehicles it says can charge almost as fast as it takes to refuel a gasoline car. The automaker's stock closed up more than 4% in Hong Kong following its announcement of a new battery and charging system capable of providing around 400 kilometers (249 miles) of range in five minutes. The manufacturer will start selling vehicles with the new technology next month. For More on Chinese Carmakers: |

No comments:

Post a Comment