| price action has been rough. hope everyone's ok. since we got the HTF breakdown (see positional indicator output below).

its been a scalpers playground (results below).

its been challenging to formulate a big picture buy or hold thesis.

till we get any HTF breakout or a big nuke, scalping these moves likely to be highest risk/reward play.

will send a note when I see either.

'what do you think of markets?' this seemingly innocent question is quiet loaded. At its core, traders generally fall into three categories: - Scalps/Swing (views change every few hours/days)

- Positional (views change every few weeks)

- Thesis driven / Buy&Hold (catalyst driven and change every few months)

more often than not, every single trader has their portfolio split into these categories.

and many a times there will be phases where they contradict each other.

you could have thesis to hold but positional long view while scalping long/short every few hours.

and this is on a single asset. this becomes exponential when you are referring to markets overall and someone reading is extrapolating it to the alts/coins THEY hold.

this alone causes a lot argument on CT. where people are mostly talking over each other.

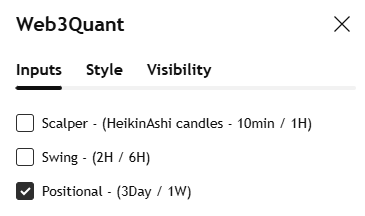

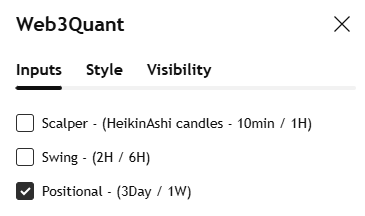

this is why its important to have systems in place that help you navigate the markets from both short and medium term perspectives without ambiguity.

one of the next things I am working on is improving the scalper/swing system even further by combining it to one.

I have already given some timeframe guidelines these work best on.  new improvements will reduce further ambiguity in decision making.

end state being everyone can formulate a clear view on short term trades vs medium term positional holds.

these are the 2 buckets majority fall into.

once signaling decision is taken care of. you can focus solely on sizing.

which IMO determines majority your gains other than selection.

lets see how the web3quant systems have done so far. lets do scalper first.

these are last few signals AS-IS. only selecting high volume coins.

SOL ETH ADA XRP had a interesting pump last Sunday on Trumps tweet on them being potentially included in the reserve. The scalper was long from much earlier. also exited that trade decently.

and has completely sat out / short scalp the carnage since.

SOL/USD Coming to Positional system sat out the entire chop during 2024 summer and got back in right on time in Sept in 60s.

signaled in HTF exit early Jan over 100K.  btc- latest this is how it performed during the last cycle  btc- 2021 cycle  SOL  ETH  XRP  DOGE  PEPE barring pockets of outperformance. Alts this cycle have been anemic.

even here positional system was able to maximize with optimal entry/exit signals.  TOTAL2 TRADFI same positional system on tradFi assets.

dollar. interest rates. stocks. managed to capture the breakout / reversal / downtrend  USD Index  US10Y  QQQ - NASDAQ 100 ETF  NVDA  TSLA lot of folks had this thesis, now that Elon is close to the president, its bullish TSLA.

quiet the opposite has played out. more importantly the system was able to catch it and sat out / signaled short since over 400 levels.

see you in the next one. |

No comments:

Post a Comment