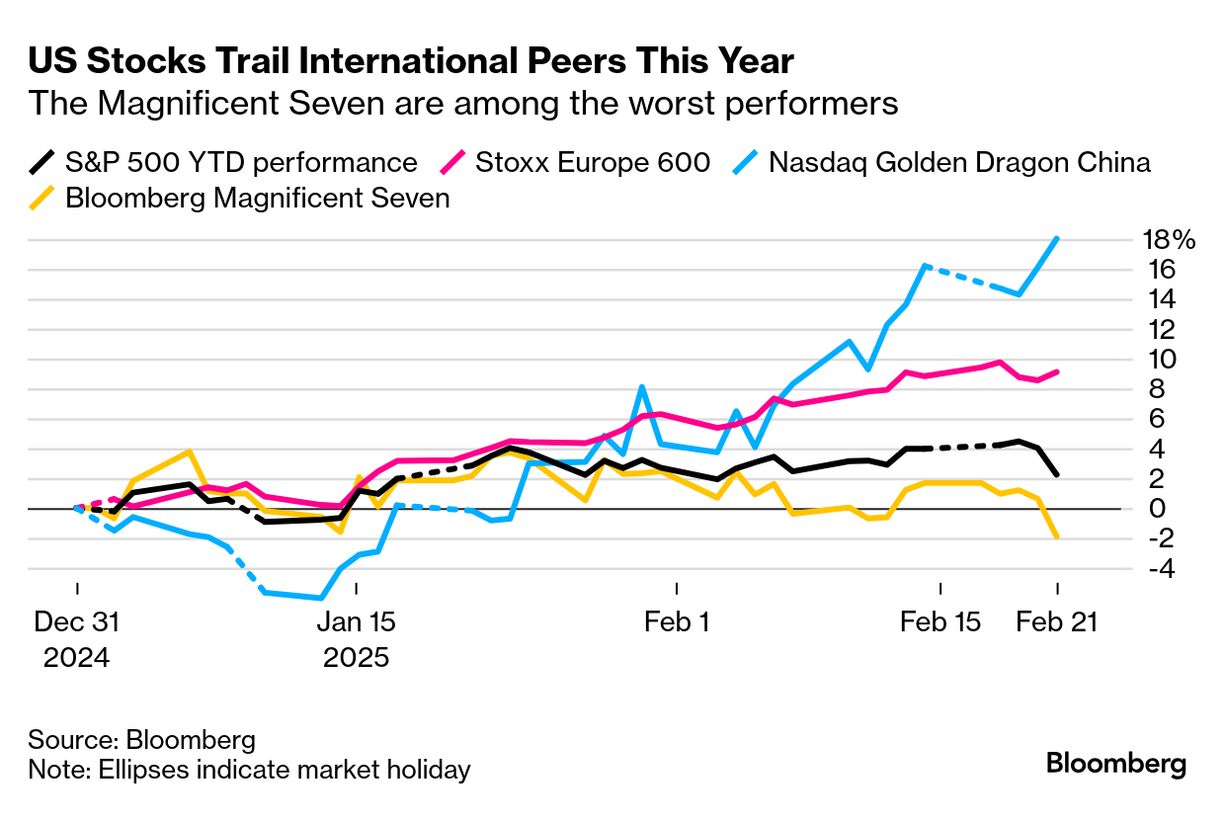

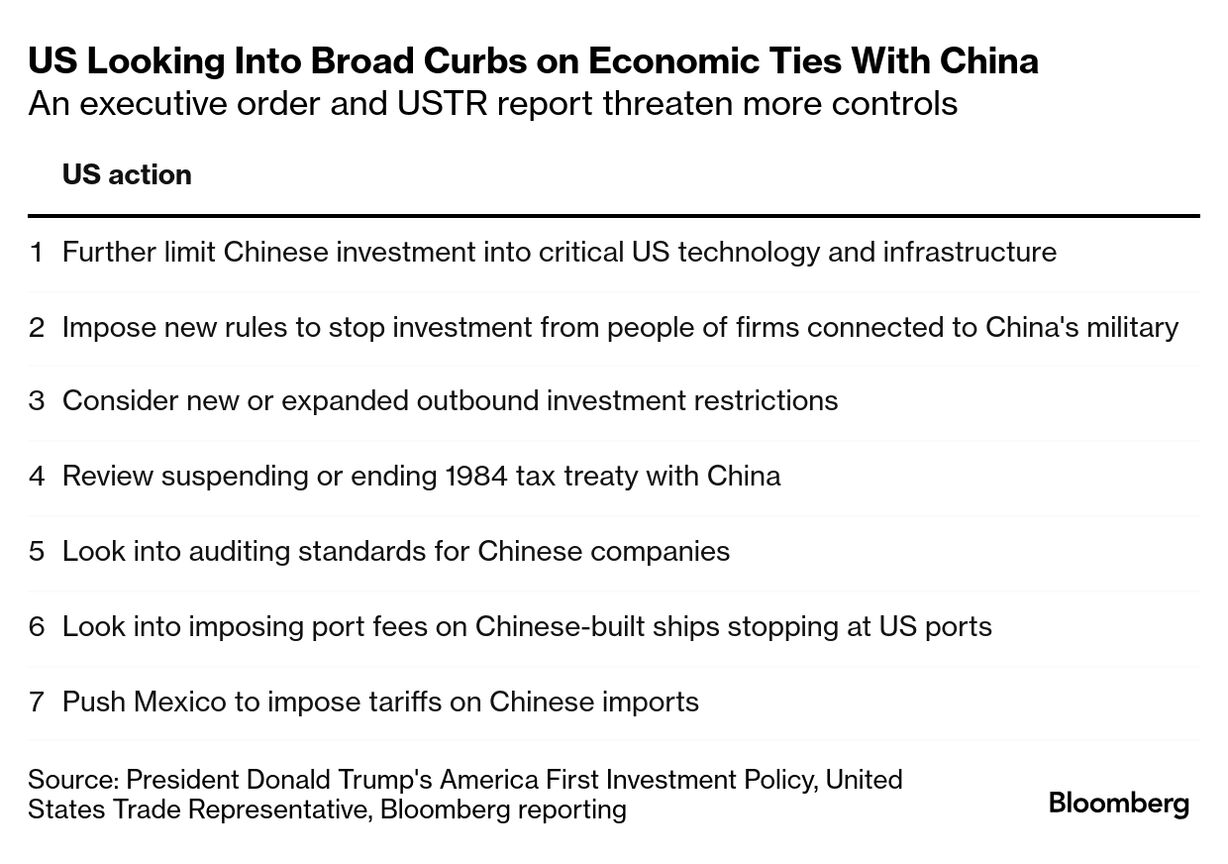

| Stocks stabilized after a late-week rout, with traders gearing up for Nvidia Corp.'s earnings and key inflation data this week. More than 300 companies in the S&P 500 advanced Monday — despite a slide in most big techs — as the US benchmark reclaimed its 6,000 mark. The US benchmark has gone 35 sessions without posting consecutive declines of more than 1% — its longest such streak since late December. President Donald Trump deepened Washington's split with allies over Ukraine, withdrawing the US's condemnation of Russia's 2022 invasion at the United Nations and among Group of Seven nations. Trump said on social media he's in "serious discussions" with Russian President Vladimir Putin on ending the war. He also said Ukrainian President Volodymyr Zelenskiy may travel to Washington as soon as this week to sign a deal over natural resources. Apple, seeking relief from US President Donald Trump's tariffs on goods imported from China, will hire 20,000 new workers and produce AI servers in the US. The company plans to spend $500 billion domestically over the next four years, which will include work on a new server manufacturing facility in Houston, a supplier academy in Michigan and additional spending with its existing suppliers. The UK has imposed sanctions on 10 China-based companies it says are enabling Russia's defense industry, as part of its largest package of economic measures against Vladimir Putin's regime since 2022. The fresh sanctions, which also apply to some firms in Thailand and India, target those who support Russia's military regime and the supply networks it relies on, The Trump administration has taken aim at China with a series of moves involving investment, trade and other issues that risk worsening ties between the countries. In recent days, President Donald Trump has rolled out a memorandum telling a key government committee to curb Chinese spending on tech, energy and other strategic American sectors. The US also proposed fees on the use of commercial ships made in China. JPMorgan Chase & Co. is dramatically ramping up its direct-lending effort, setting aside an additional $50 billion to capture a bigger chunk of the fast-growing market. The firm has teamed up with a group of co-lending partners, which have allocated nearly $15 billion more to the effort as well. Starbucks is eliminating 1,100 corporate jobs in a move aimed at increasing efficiency and quickly enacting changes to revitalize the company. The cuts represent about 7% of the global employee base working outside of company-owned stores. |

No comments:

Post a Comment