| Bloomberg Evening Briefing Americas |

| |

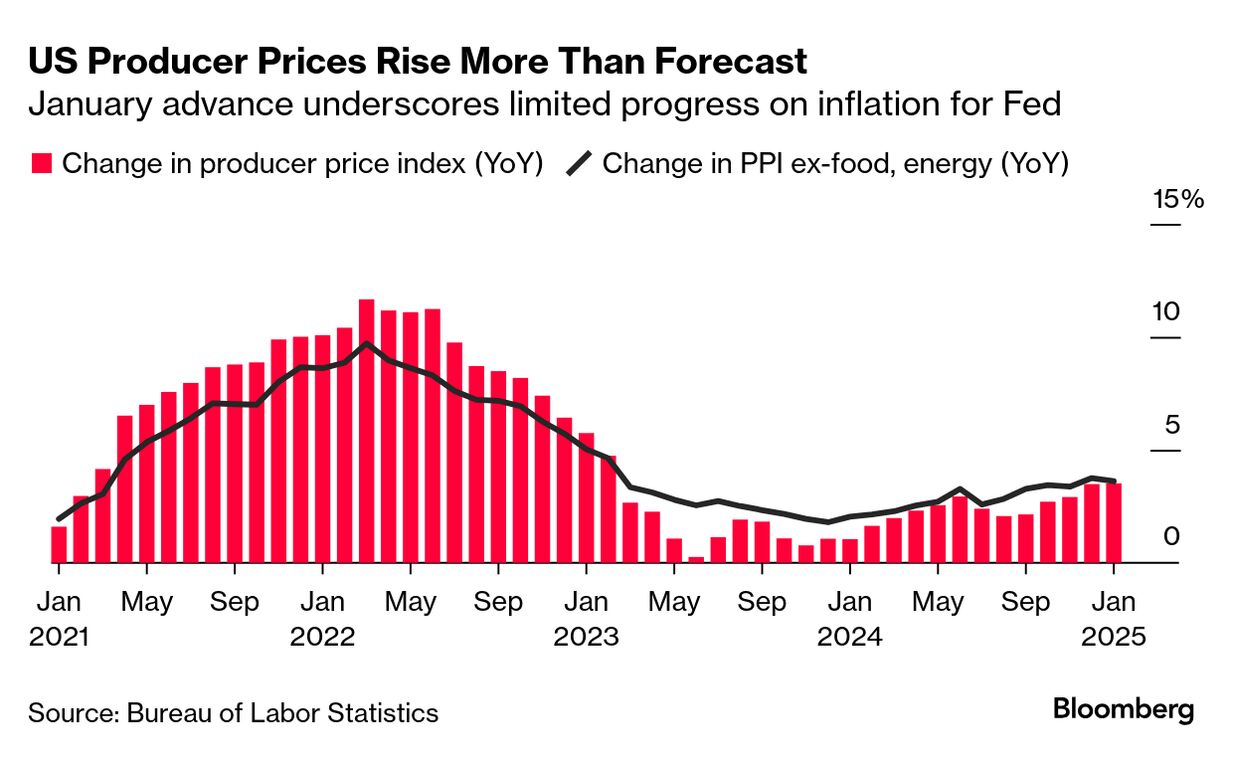

| US wholesale prices rose in January by more than forecast on higher food and energy costs, adding to the growing pile of bad inflation news ahead of more potential tariffs threatened by the Trump administration. The producer price index for final demand climbed 0.4% from a month earlier, and that after an upwardly revised 0.5% increase in December, the Bureau of Labor Statistics said Thursday. The data on wholesale prices comes just a day after a consumer price index report showed underlying inflation at its highest in more than a year. Together, the figures are making the prospect of an interest rate cut this year by the Federal Reserve decidedly unlikely. Some economists are already settling on no rate cuts for 2025, while a few pessimists on Wall Street say any more bad news may prompt the central bank to actually start raising rates again. Fed Chair Jerome Powell told lawmakers this week that inflation expectations "appear to remain well-anchored." Still, Trump's fixation on tariffs has introduced some uncertainty into the economic outlook, as has his failure to address the key issue behind his election last November—inflation. The latest readings on consumer expectations, from the University of Michigan and the New York Fed, suggest Americans are becoming worried about the economy's prospects, and that it's all the tariff talk that's doing it. —Jordan Parker Erb | |

What You Need to Know Today | |

| Trump's cabinet picks continue getting the green light. Robert F. Kennedy Jr. was confirmed by the Republican-controlled Senate as the new head of the US Department of Health and Human Services, over the objections of Democrats who said he is deeply unqualified for the position. Kennedy has questioned the safety of vaccines in the face of established science, advocated for raw milk despite risk of illness and the removal of fluoride from water. He will now have influence over the US Centers for Disease Control and Prevention, which makes recommendations for vaccine use and public health, as well as the Food and Drug Administration. Meanwhile, Kash Patel, Trump's pick for FBI director, was advanced by the Senate Judiciary Committee, with his nomination now moving on to the full Senate. Patel's nomination has raised even greater concerns, also based on his lack of experience and previous promises to weaponize the agency against Trump's opponents and "come after" journalists.  Neil Gorsuch, associate justice of the US Supreme Court, left, swears in Robert F. Kennedy Jr., secretary of Health and Human Services on Thursday. Photographer: Jason C. Andrew/Politico | |

|

| Three Senate Democrats assailed Treasury Secretary Scott Bessent for what they call a "lack of candor" about what Elon Musk and his workers are doing with US payment systems. In a letter to Bessent, the senators said the former hedge fund manager provided "inaccurate or incomplete information" regarding the access that Musk's effort had to the critical networks. The letter said employees "had the ability to modify system coding and were planning to use the Treasury systems to help pause payments by other agencies." The Trump administration suffered new legal defeats on Thursday in its campaign to fire workers, redirect Congressional spending and zero-out agencies despite legal and constitutional proscriptions. | |

|

| JPMorgan CEO Jamie Dimon said his bank will cut spending on some diversity programs that he sees as a waste of money, while reiterating its commitment to working with minority groups and diverse communities. Dimon said the plans to cancel some initiatives were about cost rather than pressure from the Trump administration to rescind diversity, equity and inclusion policies. Similar rollbacks across Wall Street and corporate America have been underway since Trump won re-election. | |

|

| More than 350 government web pages related to the LGBTQ community have been deleted from federal government websites, according to a report published Thursday by the Center for American Progress. The since-vanished resources included guides for schools implementing inclusive anti-harassment policies and the Equal Employment Opportunity Commission's LGBTQ resource web page. The sites' removal comes after Trump signed executive orders that seek to ban DEI practices from the federal government, declare there are only two sexes—male and female—and ban transgender women from participating in female sports. | |

| |

|

| |

|

| Qube Research & Technologies is rewriting the rules of the hedge fund industry. Led by former Credit Suisse colleagues Pierre-Yves Morlat and Laurent Laizet, the firm has no staff in New York where most hedge fund big guns reside. It shuns star culture and the trigger-happy hiring and firing of employees. And it shares out rewards. Plus, only one in 10 of its 1,400 workers is a traditional portfolio manager. Despite all this and having remained relatively unknown, QRT has grown into a $23 billion trading powerhouse, all from modest origins as an $800 million spinoff from the Swiss bank. The aim of this novel effort? Accumulate $30 billion of assets. | |

|

| Honda and Nissan nixed talks of a merger, bringing to a swift end a partnership that in theory would have created one of the world's biggest automakers. The companies said they'll continue their strategic partnership with Mitsubishi and collaborate on the in-house development of batteries, autonomous driving, software and electric vehicle technology—but the failed tie-up nonetheless leaves each with unresolved problems. It will be especially impactful for Nissan, which will now have to look elsewhere for a lifeline to salvage its weak financial position. | |

| |

What You'll Need to Know Tomorrow | |

| |

| |

| |

| Enjoying Evening Briefing Americas? Get more news and analysis with our regional editions for Asia and Europe. Check out these newsletters, too: Explore all newsletters at Bloomberg.com. | |

| |

Like getting this newsletter? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and subscriber-only insights. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Evening Briefing: Americas newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment