| Bloomberg Evening Briefing Americas |

| |

| US President Donald Trump backed away from his latest threats to start a trade war with America's neighbors. The Republican agreed to delay for one month his threatened tariffs against Mexico and Canada after speaking with Mexican President Claudia Sheinbaum and Canadian Prime Minister Justin Trudeau. Both nations had promised swift retaliation against America if Trump implemented his long-promised 25% tariffs. This morning, markets and even crypto nosedived at the prospect of economic damage across North America. As part of the Mexico delay, which was announced first, the US agreed to help stem the flow of weapons into the nation while Mexico agreed to send 10,000 more troops to the US border to help block fentanyl and migrants, key campaign themes for the 78-year-old Trump. However, fentanyl—unlike bulkier drugs—is difficult to interdict, and illegal crossings at the southern border have already plummeted following severe controls implemented by former President Joe Biden. Relatedly, Trump denied an extension of deportation protections for almost 350,000 Venezuelan migrants fleeing crime, poverty and persecution in the South American country, a move coming after he canceled an 18-month extension for 600,000 Venezuelans issued last month. And finally, in the afternoon, Trump also agreed to delay his threatened tariffs against Canada, in a deal with the kind of non-economic terms that echoed the Mexican agreement. Markets recovered much of their losses by the close of trading. —Natasha Solo Lyons and David E. Rovella | |

What You Need to Know Today | |

| The damage may already be done though. Canadians apparently are not receptive to a rerun of Trump's brinkmanship. In fact, they're angry. Trump's threat to impose 25% tariffs on America's closest ally has provoked a fierce reaction. After he said over the weekend that, after repeated threats, he really meant it this time, the American national anthem was drowned out by jeering fans at a National Hockey League game in Ottawa and at a National Basketball Association game in Toronto. Social media was flooded with calls to boycott US products and Canadians have said they plan to put their winter homes in red state Florida on the block. More seriously, Canada has promised the kind of retaliation that could effectively kneecap the entire US auto industry, triggering massive American layoffs. And finally Ontario vowed to tear up a contract with Starlink, the satellite company led by Trump's multi-billionaire adjutant Elon Musk. Month delay or no, the potential for more retaliation from north of the border is growing.  Flags fly on the Peace Bridge at the Canada-US border in Fort Erie, Ontario, on Monday. Donald Trump's tariff threats against America's closest ally may be doing long-term damage to relations between the two nations. Photographer: Cole Burston/Bloomberg | |

| |

|

| Under fire over his unprecedented exercise of power in his first few weeks in office—some of which has been deemed by legal experts to be unconstitutional—Trump on Monday sought to pour a little water on one of the biggest recent controversies: Musk's access to Treasury systems controlling trillions of dollars in taxpayer expenditures approved by Congress. Trump said he has allowed the Tesla co-founder to monitor America's federal spending before payments are made, but insisted Musk doesn't have the power to stop payments himself without approval. The South Africa native, whose deputies have reportedly been rooting through various government agencies, received access to Treasury payment systems after the top career official in charge of them, David Lebryk, abruptly resigned last week. Those systems include sensitive information on taxpayers, employees, beneficiaries and contractors. Democratic US Senator Elizabeth Warren launched a broadside against Trump's Treasury Secretary, Scott Bessent, asking him in a letter why he "handed over a highly sensitive system responsible for millions of Americans' private data—and a key function of government—to an unelected billionaire and an unknown number of his unqualified flunkies." Here's what Musk and his young assistants are actually doing behind closed doors. | |

|

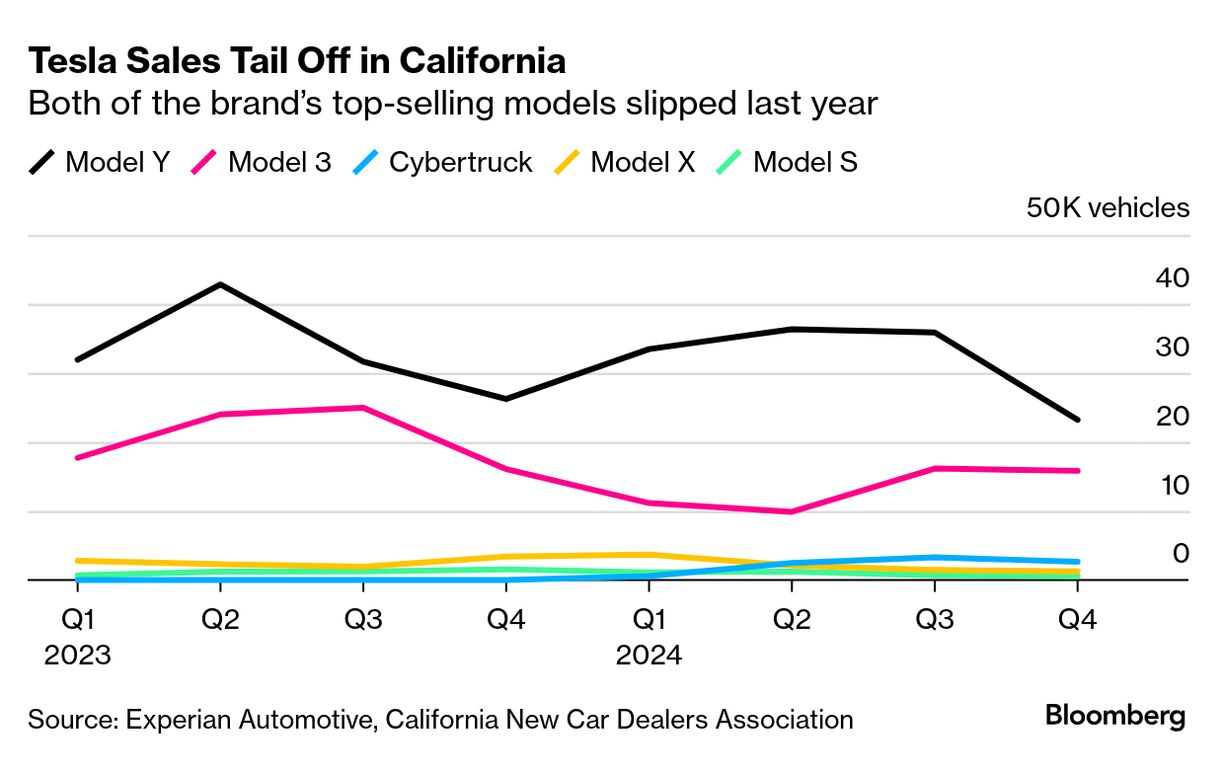

| Things aren't going all that good for Musk in the private sector, either. Tesla registered fewer cars in blue state California in all four quarters of 2024 as sales of its second-most important model plunged 36% for the year. The electric-vehicle maker's sales in by far the biggest EV market in the US fell almost 8% in the fourth quarter and 12% for the year, according to data sourced by the California New Car Dealers Association. Annual registrations of the Model 3 sedan dropped by more than a third. The carmaker has encountered increasingly rough waters with consumers of late, in part due to Musk's leap to the far right and his association with Trump. | |

|

| Vanguard slashed fees for dozens of its mutual and exchange-traded funds in a record move that's likely to send a shockwave through the asset management industry. The Jack Bogle-founded investing giant is lowering expense ratios for 168 share classes across 87 mutual funds and ETFs effective immediately. The reduction is the largest Vanguard has ever undertaken, and amounts to a dramatic challenge to rivals in a business where the firm is already one of the cheapest operators. For many it will conjure memories of the heights of the fee war that found its limits five years ago with zero-fee products and even one fund that offered to pay people to invest. | |

|

| The buzz is building inside Wells Fargo. After a series of crises in recent years, the bank could finally be allowed to grow again. Seven years into a US cap on assets, executives are awaiting a verdict on whether they've done enough to appease the Federal Reserve to get the restriction lifted. By one measure, it has cost the lender more than $36 billion in profits, easily making it one of the harshest corporate sanctions in a generation. Now, up and down the ranks, managers are talking about what would follow. Chief Executive Officer Charlie Scharf has longed to ramp up trading operations. The firm could amass more deposits from corporations, and then lend more money to others. Initiatives, including a credit card in development to challenge JPMorgan's popular Sapphire Reserve, would have more room on the balance sheet to grow. | |

|

| Nippon Steel and United States Steel blamed politics and a failed review process for former President Biden's decision to block their planned $14.1 billion merger, according to a court filing. The companies, which sued over the decision last month, alleged in court filings Monday that the Committee on Foreign Investment in the United States failed to investigate the deal or identify any "credible national security risks" before killing the deal. | |

|

| |

What You'll Need to Know Tomorrow | |

| |

| |

| Inspired Valentine's Day gifts are more than just tokens of your affection. They're an opportunity to create a deeper connection with your loved ones (or so goes the premise of the ultimate Hallmark holiday). It might be a decadent night at home with delicious treats, a game you can play together for the rest of your lives or a fabulous piece of jewelry they'll treasure forever. Spoil them with one of our luxury Valentine's Day gifts. Here are some ways to spend your money for the big day. | |

| |

| Enjoying Evening Briefing Americas? Get more news and analysis with our regional editions for Asia and Europe. Check out these newsletters, too: Explore all newsletters at Bloomberg.com. | |

| |

Like getting this newsletter? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and subscriber-only insights. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Evening Briefing: Americas newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment