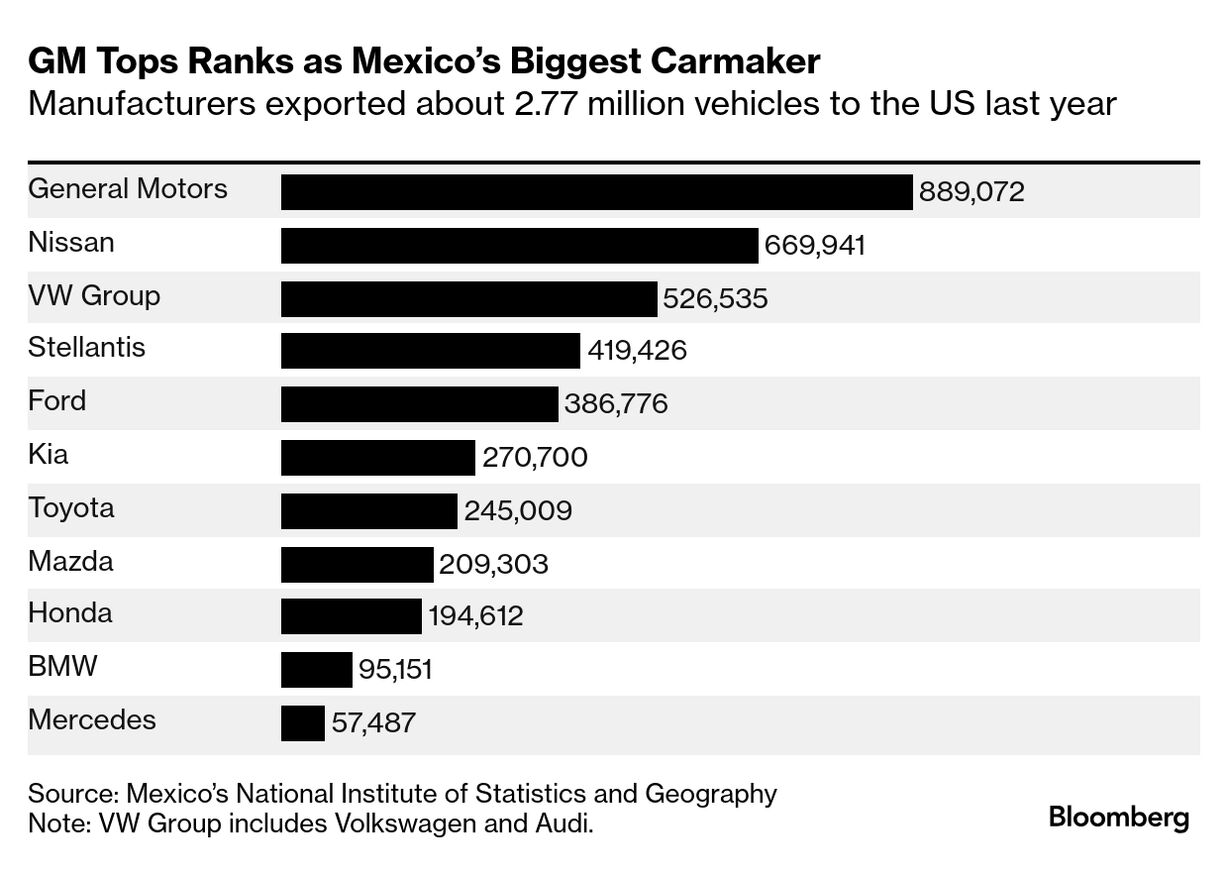

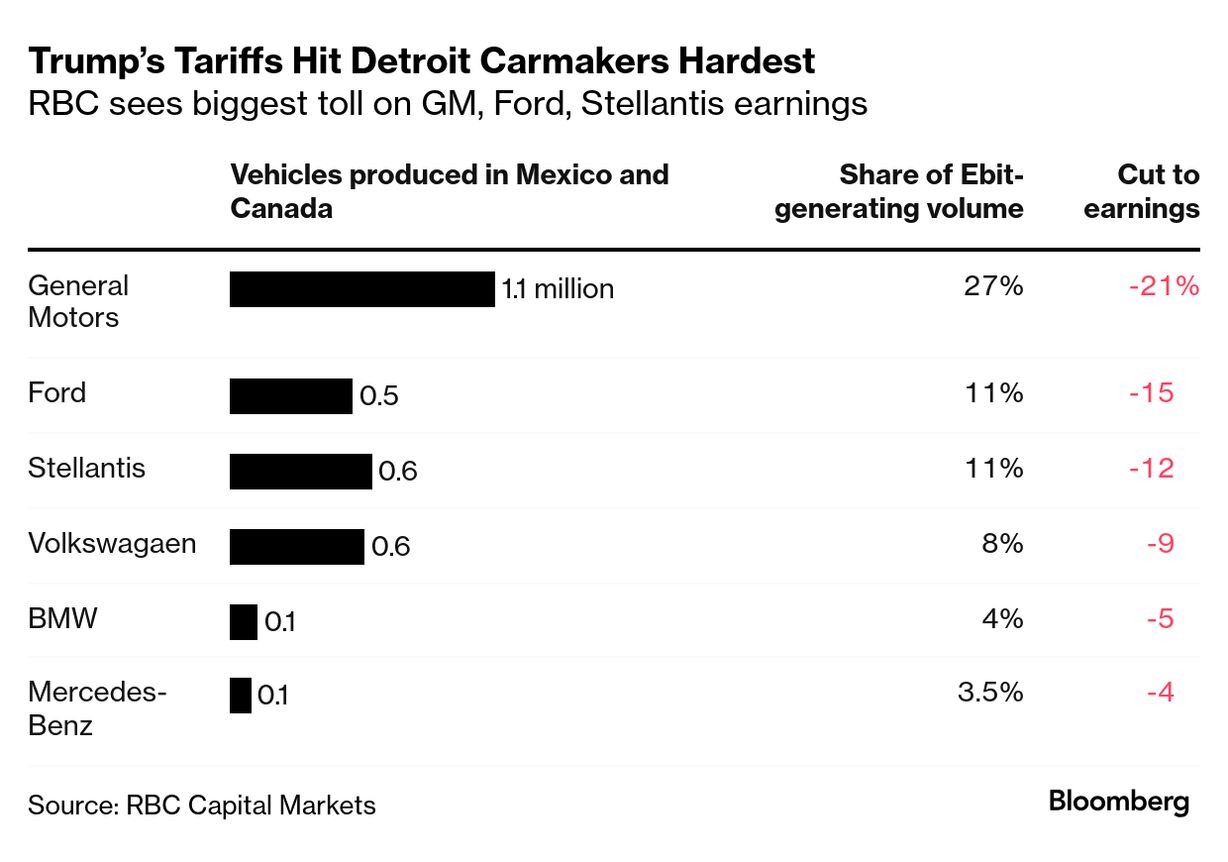

| Thanks for reading Hyperdrive, Bloomberg's newsletter on the future of the auto world. Read today's featured story in full online here. Prepare to Pay $3,000 More | President Donald Trump's tariffs against Canada and Mexico will threaten production at automakers across North America and send record vehicle prices even higher, with about a quarter of a trillion dollars in trade set to be disrupted. Trump on Saturday followed through on his warning to impose 25% tariffs on imports from the two countries, blaming the flow of migrants and drugs over the US borders — as well as large trade deficits — for the move. Barring a surprise, the tariffs are set to take effect at 12:01 a.m. on Tuesday. "The auto sector is going to shut down within a week," said Flavio Volpe, president of Canada's Automotive Parts Manufacturers' Association. "At 25%, absolutely nobody in our business is profitable by a long shot."  GM's complex in Silao, Mexico, where the automaker produces Chevrolet Silverado and GMC Sierra pickups. Photographer: Mauricio Palos/Bloomberg The duties would immediately hit almost one-quarter of the 16 million vehicles that are sold in the US each year, plus the parts and components that go into them — an import market that totaled $225 billion in 2024, according to AlixPartners. Tariffs will add $60 billion in costs to the industry, the consultancy estimates, much of which is likely to be passed on to consumers. Read More: Auto stocks are pummeled around the globe. Automakers in Mexico have been preparing by preemptively importing both more components and vehicles, which may ease the blow in the first few weeks, said Guillermo Rosales, president of the Mexican Association of Automotive Distributors, or AMDA. After that, the outlook is less certain. "Everything depends on the course that the Trump administration takes in this matter," he said. The order "weakens the most integrated industry in North America," Mexico's auto associations said in a joint statement Sunday, putting "the competitiveness of North America as a whole at stake." While Trump's tariffs loom large over Mexico's auto industry, automakers including BMW are plowing ahead. The tariffs will not affect the German manufacturer's plans to invest €800 million in a new battery facility near its San Luis Potosi, Mexico, factory, which will enable local production of next-generation EVs known as the Neue Klasse by 2027. "The BMW Group does not base its long-term strategic decisions on politics or political incentives," the company said. Car components can make their way back and forth across US borders as many as eight times during production, meaning duties could be heaped upon a sprawling industry that relies on materials from all three countries. The average price of a new car may climb about $3,000, Wolfe Research analysts have said, further straining affordability with prices already close to all-time highs. "It is going to be a lot of impact," Aruna Anand, CEO of parts supplier Continental's North American business, said in an interview. "The question is who is absorbing the price and it becomes, are we able to absorb that price or is it going to be shifted to the end consumer?" Since Trump renegotiated the free-trade agreement between the US, Canada and Mexico during his first term, automakers have had to meet higher thresholds for the portions of their parts that are made in North America, but trilateral trade hasn't incurred duties. The president's new tariffs upend the agreement, which is due to be reviewed next year. For automaking hubs like Windsor, Ontario, and Detroit, and across multiple states in Mexico, the effects are likely to be immediate. "We're talking about thousands and thousands of jobs being lost," said John D'Agnolo, the president of a local union representing workers at Ford's engine plant in Windsor. "We'd truly be a ghost town, here in Windsor, if we lost this type of business." On the campaign trail, Trump said his protectionist policies would bring manufacturing jobs back to the US, raise revenue and lower the country's trade deficit. Analysts have warned shifting production could take years. GM, the largest US carmaker, has said it wouldn't move production unless the company can be sure it makes long-term sense. "We are working across our supply chain, logistics network, and assembly plants so that we are prepared to mitigate near-term impacts," CEO Mary Barra told analysts on Jan. 28. "What we won't do is spend large amount of capital without clarity." Automakers are likely to cut production almost immediately once tariffs are implemented, said Michael Robinet, vice president of forecast strategy for S&P Global Mobility. If they carry on making the same volume of vehicles, he said, they risk shipping them into the US to sit on dealership lots while consumers try to wait out the duties. "Automakers and suppliers would hold off on building high-tariff products," Robinet said. "We expect production and sales would go down." — By Jacob Lorinc, David Welch and Amy Stillman  US President Donald Trump and Elon Musk watching the sixth test flight of SpaceX's Starship rocket on Nov. 19. Photographer: Brandon Bell/Getty Images North America Tesla sales plunged 63% last month in France, the European Union's second-biggest EV market. The manufacturer registered only 1,141 cars in January, the fewest since August 2022. Tesla underperformed the overall industry and total EV sales, which dipped 6.2% and 0.5%, respectively. CEO Elon Musk has inserted himself in European politics to an unprecedented degree in recent months, throwing his support behind the far-right Alternative for Germany party and taking on UK Prime Minister Keir Starmer and his Labour government. It's unclear to what degree that's starting to take a toll on demand for Tesla cars in the region. For More on Musk: |

No comments:

Post a Comment