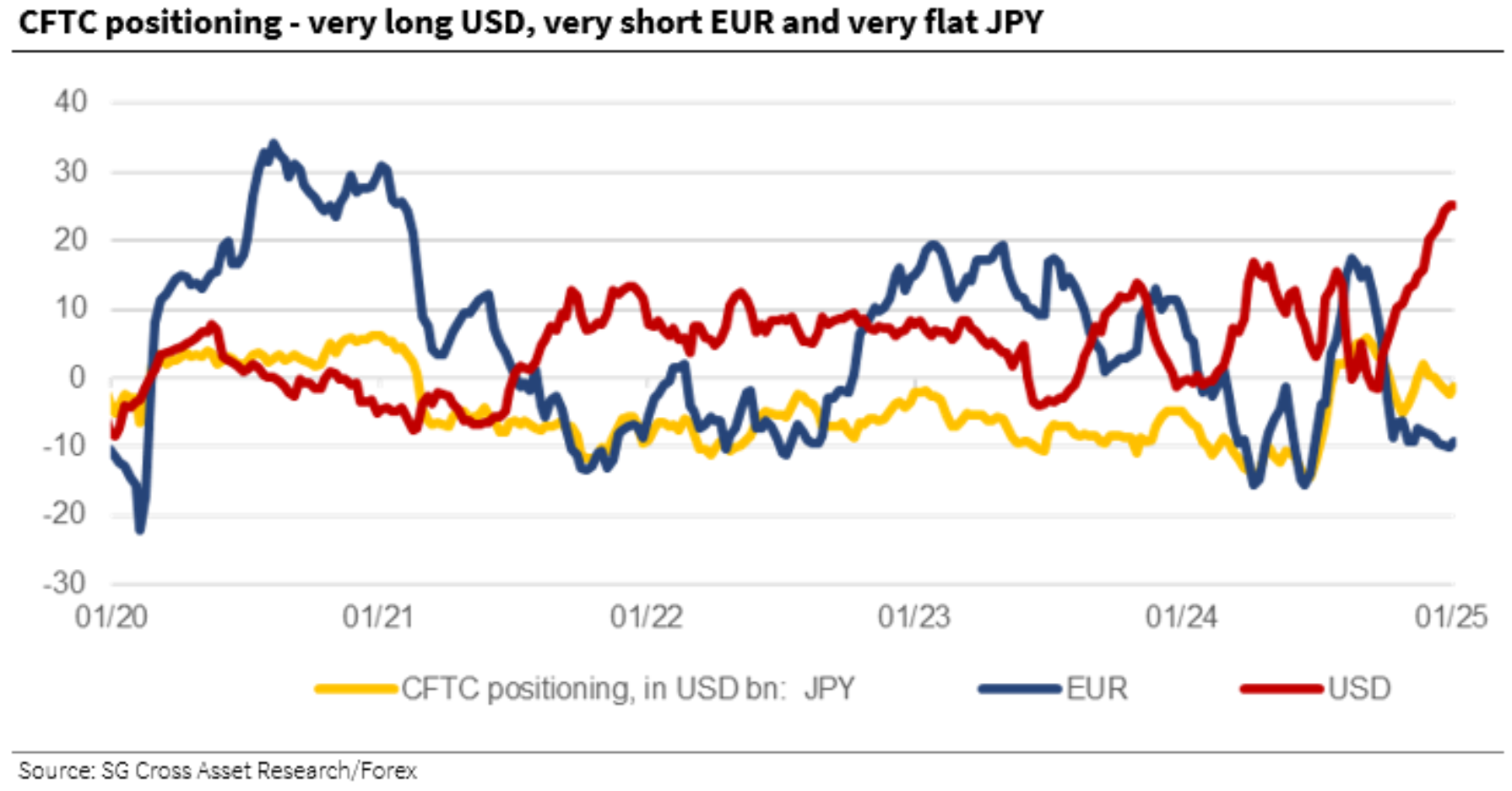

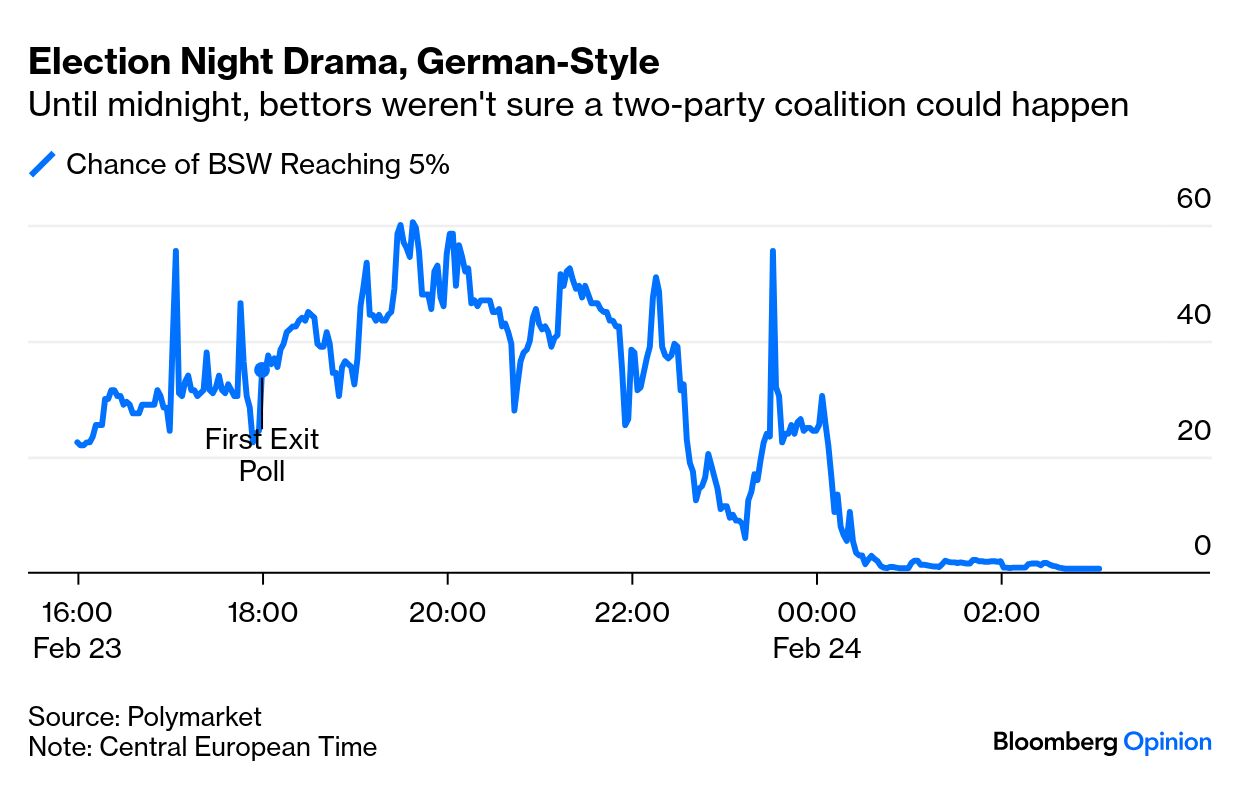

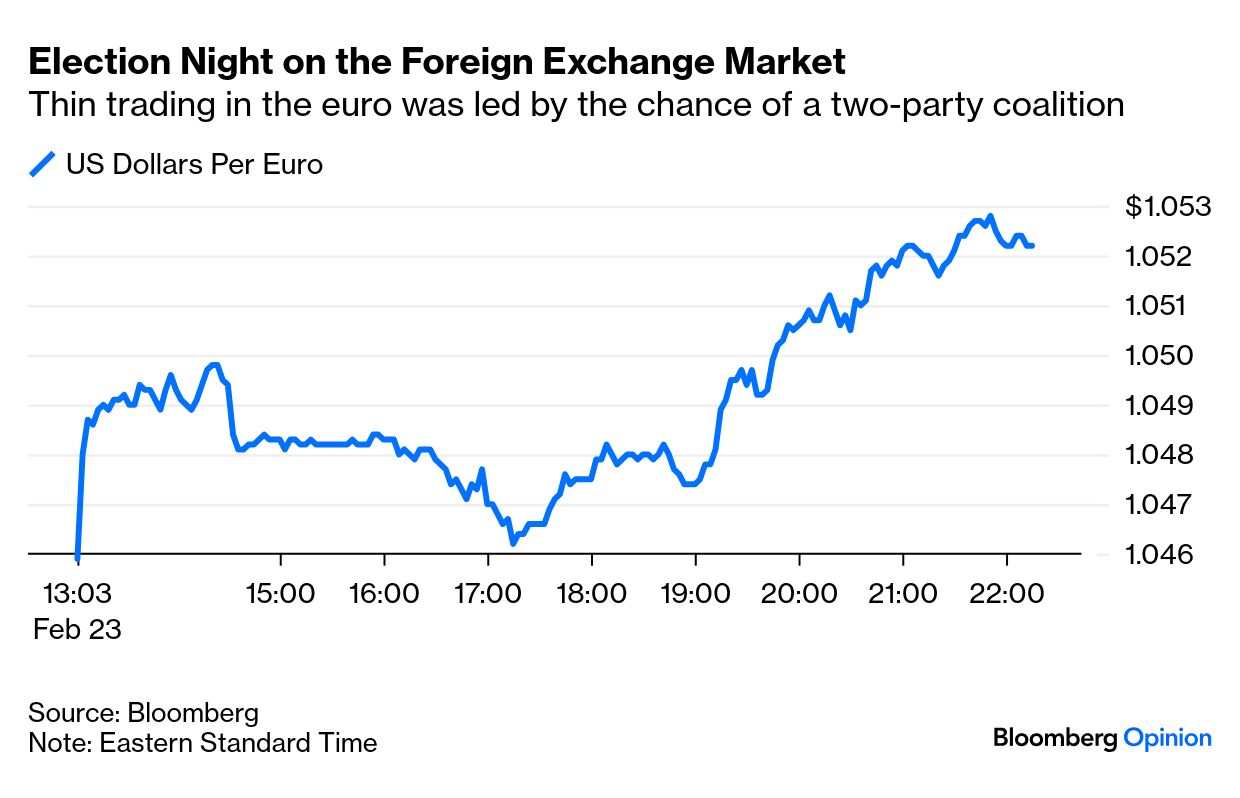

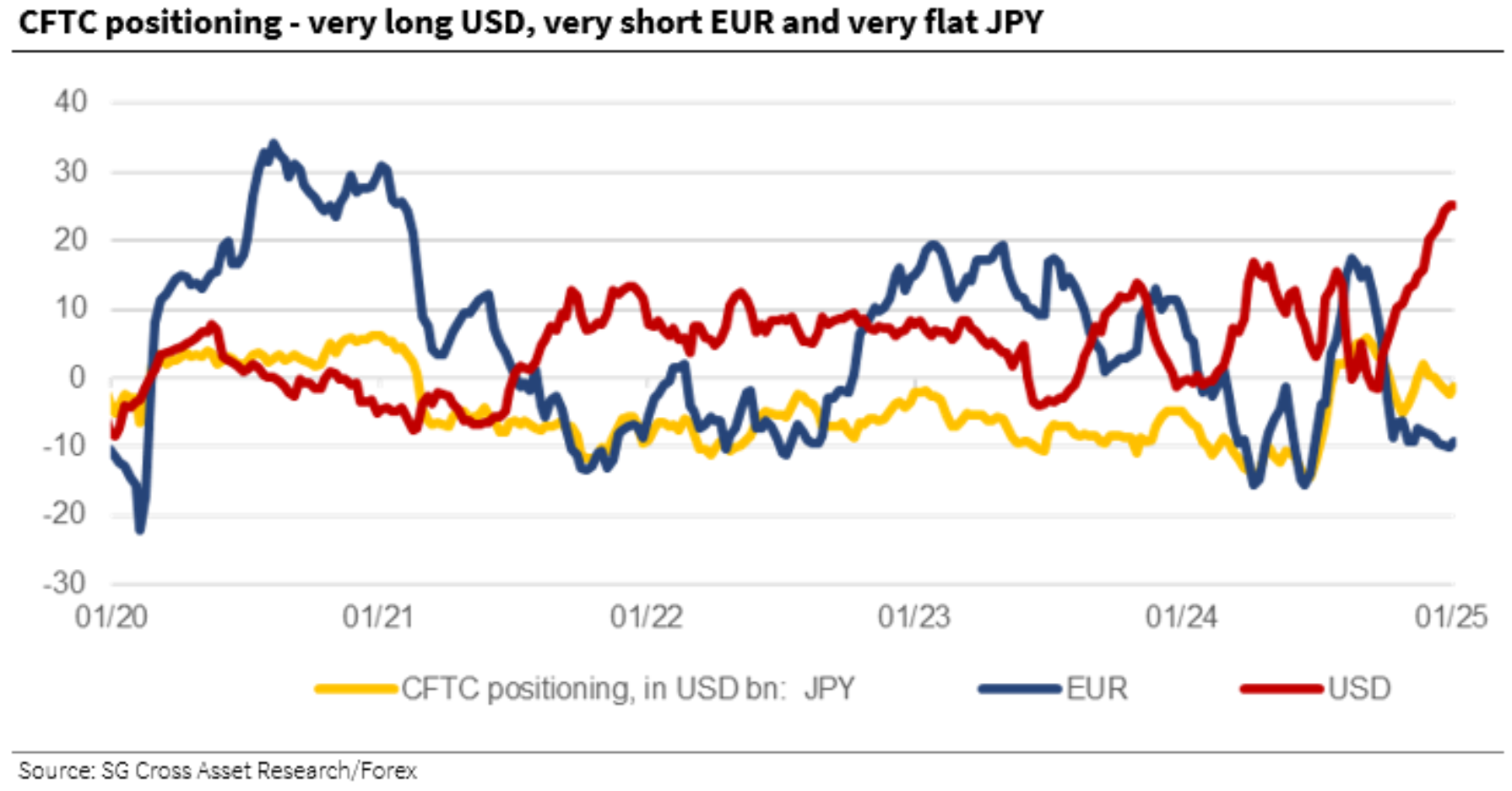

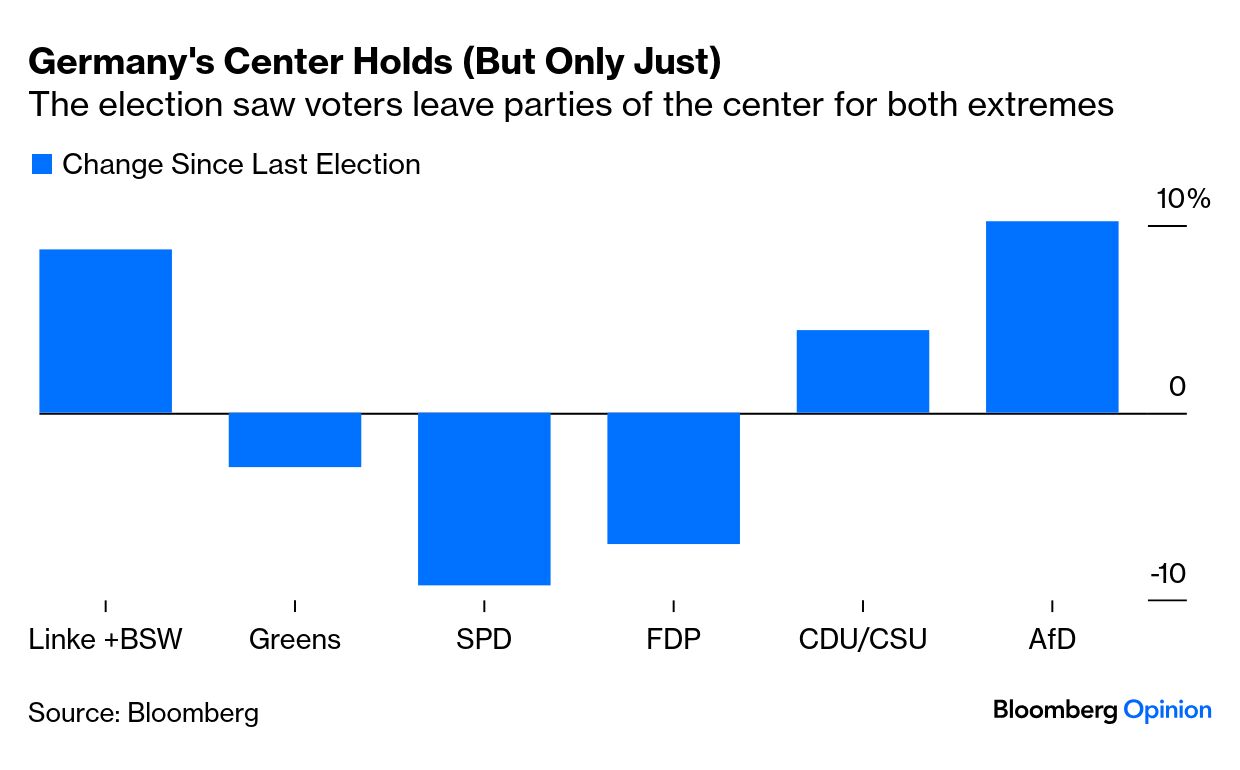

| In politics and economics, as in opera, it's not over until the fat lady sings. In the most famous German saga of them all, Brünnhilde saves her self-immolation until the final scene of Götterdämmerung — Twilight of the Gods — at the end of Wagner's Ring cycle. German politics hasn't reached such a point, and for the bean-counters who allocate money, that is what counts. In the longer term, it's profoundly important that Germany's Social Democratic Party has just suffered its worst-ever defeat, gaining 16.4% of the vote, while the Christian Democrats, with which it has alternated power throughout Germany's postwar history, had its second-worst ever tally with 28.5% — just 44.9% between them. Meanwhile, the Alternative für Deutschland, with just over 20% of the vote, now has the greatest electoral bridgehead for the far-right since the fall of the Nazis. Germany's extremely liberal immigration policies of recent years look ever more like a serious mistake that provoked a deep political realignment.  Hildegard Behrens at the Metropolitan Opera. Photographer: Johan Elbers/Chronicle Collection/Getty In the shorter term, though, the message for markets was: the center held. The AfD did a little worse than polls had predicted, on the highest electoral turnout since Germany reunified. Electoral mathematics, with several smaller parties failing to meet the 5% threshold needed for representation in parliament and so seeing their votes reallocated among the others, mean that a coalition of SPD and CSU will be able to govern. This is not like neighboring France, whose legislature is deadlocked, or the Germany of the last three years, where confidence in a weak three-party coalition has steadily eroded. There was never any chance that other parties would let the AfD into government. The election-night drama turned on whether the the BSW, a smaller hard-left grouping, would reach the 5% threshold, forcing a third party in the coalition. At the time of writing, it appeared to have failed. This is how the odds on that moved during the German night, according to the Polymarket prediction market: With one exit poll putting BSW at 5% and another at 4.9%, this was the subject of greatest suspense. For an idea of how big a deal this was for the currency markets, here is how the euro performed against the dollar over the same timespan: Friedrich Merz, almost certainly the next chancellor, hopes to have a coalition together by Easter — which would be fast by German standards. He also said that the "absolute priority will be to strengthen Europe as quickly as possible so that we can achieve real independence from the USA step by step." That means spending more on defense, which sounds good to Mr. Market. Beyond defense, the auguries now look good for a sharp turn in German economic policy toward more spending. If this coalition fails to deliver, the AfD will have a great shot at government at the next election. The two main parties have a shared interest in trying to show that Germany's traditional way of doing things can still work — albeit now with more cash to splash around. Thus the base case is that Germany has a coherent coalition that can be trusted to behave in relatively market-friendly ways. An epochal and for some very alarming contest has translated into strength for the euro. That's in part because the market entered the election with the strongest long positioning in the dollar since the start of the pandemic, and almost as bearish on the euro as it ever gets, as illustrated here by Kit Juckes of Societe Generale SA. Any non-bad news, in these circumstances, was going to help the euro:  Societe Generale SA In a bizarre turn of events, foreign exchange strategists even seems keen for left-wing representation to make itself heard and push for most spending. This is from Bob Savage, strategist at BNY: No matter the composition of the next government, moving away from fiscal restraint to ramp up public investment is the policy imperative... We doubt there will be enormous differences in the general direction of travel for Germany's fiscal outlook, but if the CDU/CSU's coalition partners can advance direct spending gains rather than prioritize efficiency gains first, which is Merz's preference, markets will favor any acceleration in fiscal expansion.

To release the "debt brake" and allow more borrowing than is currently permitted by the German constitution, the new coalition may well need the support of the hard-left Die Linke to reach the required 66%. Remarkably, the market now has its hopes pinned on the hard left. A Word From Political Scientists | In any discussion of German politics, it's hard to escape the shadow of Adolf Hitler. His ascent to total power, without a majority of the electorate, continues to skew perceptions. But it makes more sense to compare Germany to more recent history, and to avert the gaze from the hard right. Germany's hard left has two main parties. Add them together and the dynamics are clearer. Treating Die Linke and BSW as one entity, this is how votes changed since the 2021 election. They are arrayed from left to right in line with their ideological position: There is a shift to the right, but it's more about voters abandoning the center and looking for alternatives on either side. Like other countries, Germany is polarizing, abandoning the status quo for populist offerings of both left and right. Different electoral systems lead to varied results. The UK's election last year saw record parliamentary delegations for the Greens, the anti-immigration Reform Party, and a faction of independents positioned to the left of Labour — but the UK system gifted a huge parliamentary majority to Labour. In France, a similar fracturing delivered a mess. The parallel Germany wants to avoid is with Greece in 2012, when it held a parliamentary election in the middle of the crisis over its sovereign debt, and voters punished the traditional big two parties. They split their protest votes between an array of hard-left and hard-right options, allowing the two big parties to limp on in coalition. Alexis Tsipras' hard-left Syriza movement had to wait until 2015 for that coalition to collapse and win an election. By that time, the rest of Europe was over the worst of the crisis and able to hang tough when Tsipras demanded an end to austerity. The result was an economic disaster for Greece. That is the realistic worst-case scenario that Merz must now try to avoid. Adam Tooze, a Columbia University historian and expert on Germany, commented: What matters now in Germany are not cyclical issues but structural questions. What are at stake are basic strategic issues. What the voters are putting in question is what, for want of better words, one must call the "social contract."

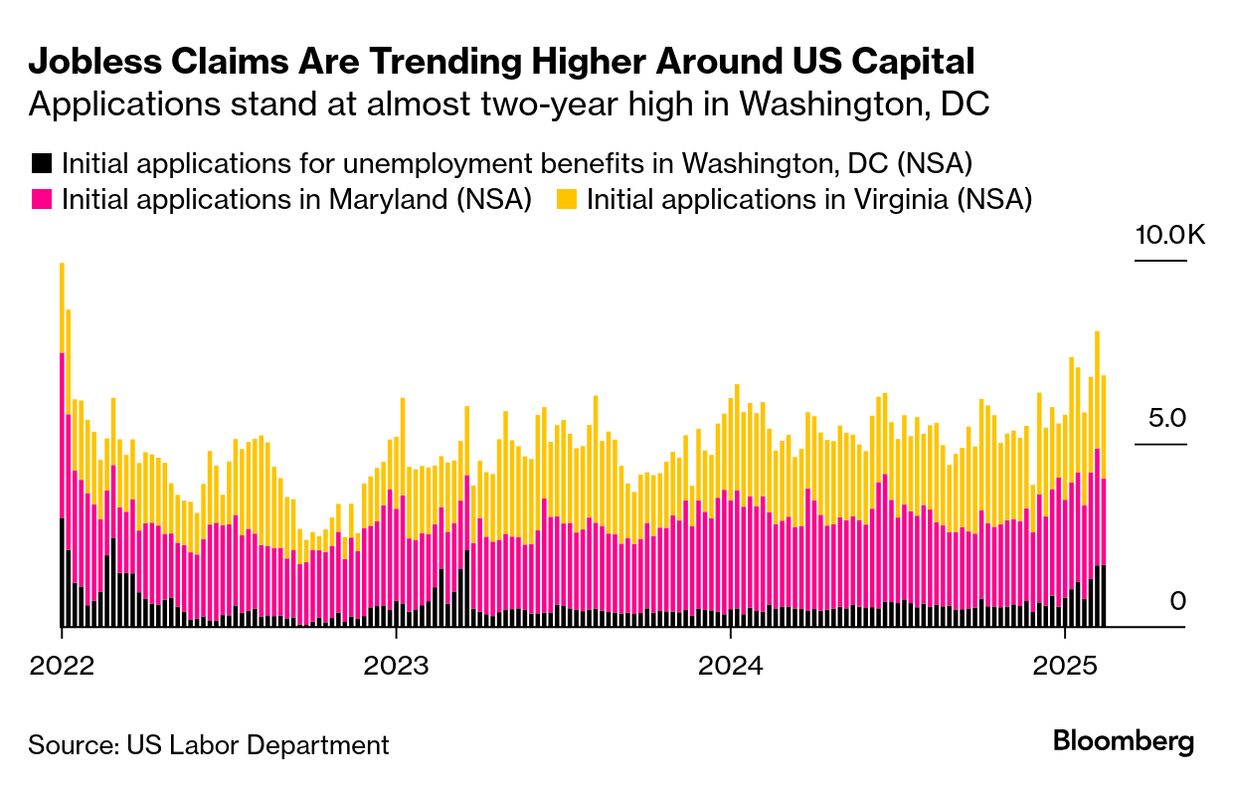

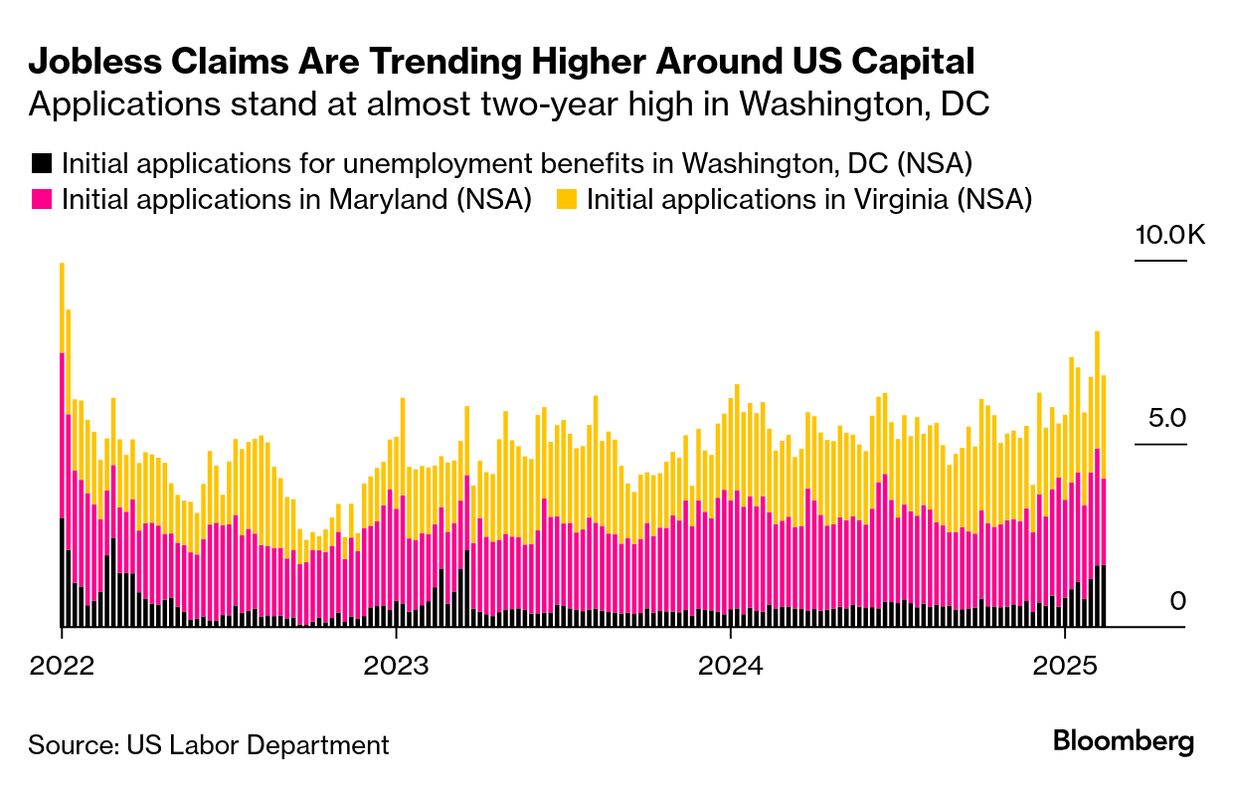

Writing a new social contract to replace one that worked for decades is an immense task — particularly for the two parties that created the old contract. It must happen against the background of the shocking collapse of German post-cold war assumptions that the country could rely on the US for cheap defense and Russia for cheap energy. In Greece — which could be excused a little schadenfreude — the technocratic coalition failed in its almost impossible task. In the long-term, that now confronts Germany. In the short term, its economy just dodged a bullet and it's time to buy. DOGE-ing Labor Market's Ripples | The Federal Reserve's rate-cutting cycle is on an extended pause. Rising inflation expectations and the economic policy uncertainty ignited by Trump 2.0 ensure that. The two-year breakeven inflation rate — forecasts implied by the gap between fixed and inflation-linked bond yields — is back above 3%, for the first time in two years. Full employment, the other leg of the Fed's dual mandate, has fared better since fears of a deterioration triggered September's jumbo cut of 50 basis points in the fed funds rate. All else equal, Trump's pro-growth agenda should ease worries about a weakening labor market. But there is the issue of the president's other mandate, which is leading to thousands of other federal workers losing their jobs. To date, the job cuts arising from the Elon Musk-led Department of Government Efficiency haven't moved the needle much, but there are early signals in jobless claims data in the DC, Maryland, and Virginia tri-state area where federal workers are concentrated:  The signals emanating from Musk — who now wants all federal employees to justify what they did last week — suggest that even more aggressive cuts are to come for the workforce of nearly 3 million. Whether this shifts the underlying employment data significantly depends on the scale of the job losses. But it doesn't help that hiring rates were trending downward even before DOGE got to work, with workers facing increasing difficulty finding a job. As Federal Reserve Chair Jay Powell puts it, the labor market is at a "sustainable level" but cannot afford more cooling. Apollo Global Management's Torsten Slok worries that the more Musk moves things around, the more likely he breaks something: Total employment in the United States is 160 million, with 7 million unemployed. Also, about 5 million people change jobs every month. In that context, 300,000 federal jobs lost is not much. However, studies show that for every federal employee, there are two contractors. As a result, layoffs could potentially be closer to 1 million. Such a rise in the unemployment rate is likely to have consequences for rates, equities, and credit.

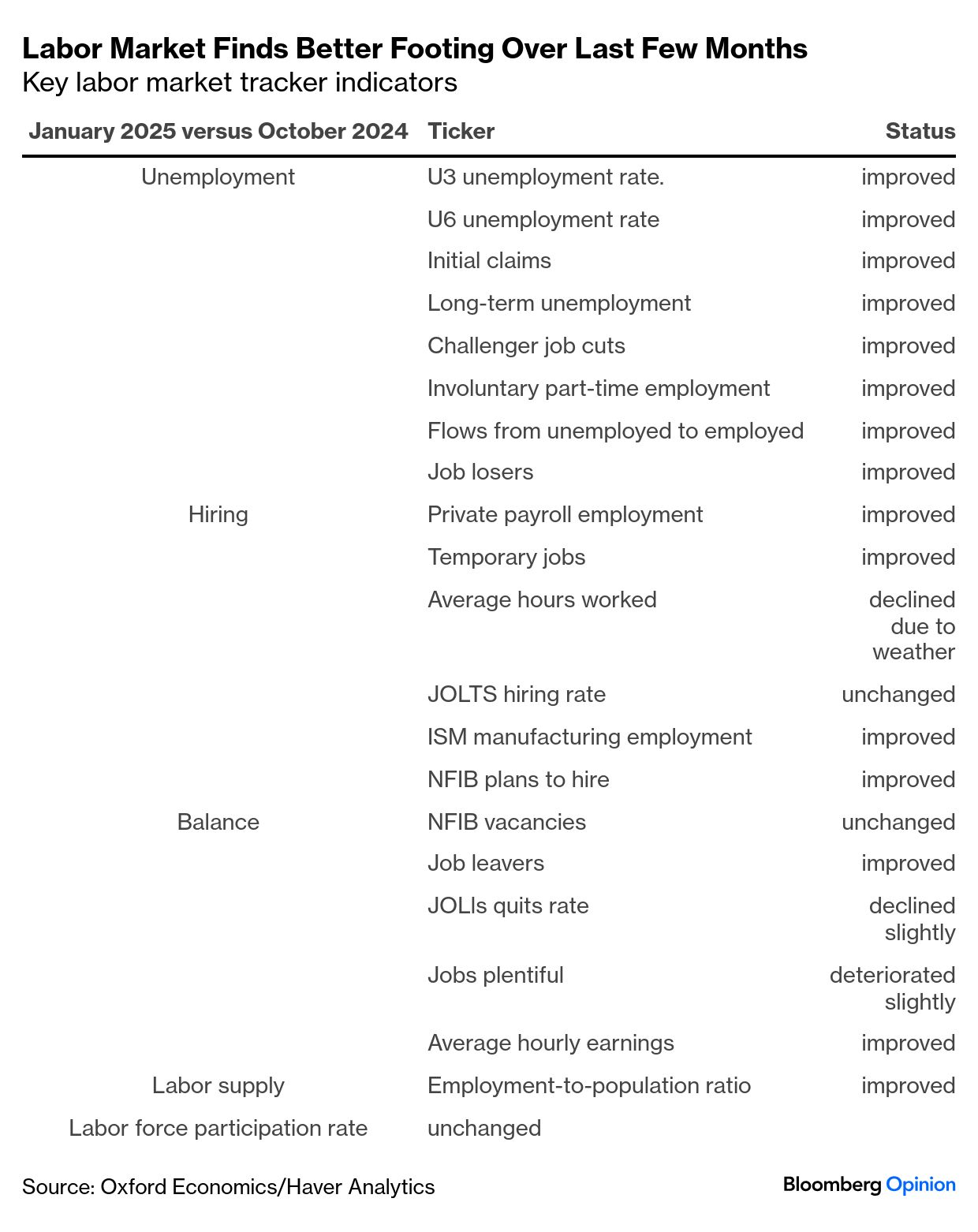

This at least means that the labor market is less likely to be the source of inflationary pressures. Oxford Economics' labor market tracker concludes that the January data left the jobs market on a stronger footing than three months earlier: However, Nancy Vanden Houten, lead US economist at Oxford Economics, admits that Trump's policies pose risks to its forecast. Layoffs of federal workers and the spillover effect, including on contractors and support industries, present a near-term risk. However, she argues that federal layoffs are unlikely to impact the broader labor market: We outlined four scenarios for a reduction in the size of the federal workforce. Even under the most extreme scenario, where federal employment is reduced by nearly 400,000 to 2 million — to which we assign a low probability — the impact would be a 0.16ppt increase in the unemployment rate. Most of the impact from the estimated 77,000 federal workers who accepted the Trump administration's deferred resignation offer won't be visible in the employment data until the fall. These workers will be paid through September, and we expect they will continue to be counted in the monthly establishment payroll statistics.

There could be quirks. The deal could translate into a drop in the number of hours worked, and if the workers can get private sector jobs in the interim, they might appear on both government and private-sector payrolls. In the longer term, Musk's idea is that they will find "more productive" jobs in the private sector. Shorter-term, the risk is skewed toward DOGE's cuts weakening the jobs market a bit. — Richard Abbey Here are some more ladies singing (they're not necessarily fat but you certainly need to be fairly well-built for these arias) at the end of operas: Tosca throwing herself off a wall; Isolde dying over Tristan's corpse; Madam Butterfly ending it all over her betrayal by Pinkerton; and Aida already entombed, dying in her lover's arms. Thankfully, it's not time for anything quite this dramatic in Germany. Have a great week everyone. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: - Max Hastings: Trump World Displays the Tragedy and Folly of a King's Court

- Daniel Moss: Central Banks Bring Some Normality to Asia

- Jonathan Levin: Buffett Offers a Recipe for What Makes America Great

Want more Bloomberg Opinion? OPIN . Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment