| For the equity bull market to continue, a very narrow segment of companies needs to continue to perform well even as this stagflation risk creeps in. In 2023, only 27% of stocks outperformed the S&P 500 Index, making it the narrowest market since at least 1995. The trend continued in 2024, with just 28% of stocks beating the index -First Trust Economics, Jan 8, 2025

Another way of saying that less than 30% of stocks outperformed the index is saying that 70% underperformed. Why are we seeing this incredibly narrow but large rally? In two words: Artificial Intelligence. When ChatGPT got onto investors' radar screen, the Fed rate hike-induced swoon in equities ended. And the biggest technology companies, all of whom have significant ties to AI, dominated the market's gains, especially Nvidia. In 2023, these so-called Magnificent Seven stocks were responsible for almost two-thirds of the S&P 500's market capitalization gain. In 2024, the rally broadened somewhat but the Mag 7 still accounted for more than half of the S&P 500's gains. That effectively means either this rally broadens or we need these companies to continue to outperform. AI firms are taking on water as a bulwark for markets | In the most recent earnings results from big tech, Google's corporate parent Alphabet just showed its boosting capital expenditure to $75 billion in 2025 despite an underwhelming performance in its cloud computing unit underpinning that capex. But the fact that both Microsoft and Google have shown weaknesses there indicates the time is approaching when the near limitless spending on AI will come to an end. At Tesla, another Mag 7 company, the results were even worse. They missed on timeline revenue and on income and their guidance was lower than expected. Tesla's stock price rose anyway: The electric-vehicle maker's fourth-quarter earnings fell short of analysts' expectations pretty much across the board. Profit, revenue and margins all missed. Even its sales growth outlook for 2025 was dialed back. Yet, the stock closed up 2.9% on Thursday, as investors shrugged off the disappointing report and instead focused on Musk's upbeat tone on the robotaxi business, humanoid robots and artificial intelligence.

Maybe this has to do with Elon Musk's proximity to Trump. Maybe it's pure irrational exuberance by Tesla's investors. It doesn't matter. Either way it's in line with what we see elsewhere at some of the world's leading tech companies: even before the stagflationary risks from Trump come to play, slowing growth is evident. The Google and Meta results show that the thing that is holding up best for the Mag 7 is advertising. And because ad spending is cyclical, slowing economic growth is a threat to those firms' bottom line — and by extension their share prices and the overall health of this bull market. Nvidia's earnings is where the rubber hits the road this quarter yet again. That won't come until almost the end of February, right when we find out whether the Mexico and Canada tariff delay will be extended or will hit this time. Expect bonds to move first | To sum, while the Trump-induced real economy risks are ongoing, we are seeing slowing growth in the Mag 7 stocks that have underpinned the bull market for two years. That has led the market to trade sideways for the better part of two months. I don't expect market angst about their growth to lead to anything dramatic in the near-term simply because capital expenditure plans are set in stone in that timeframe, as earnings from Google, Microsoft and Meta all show. And therefore I don't expect Nvidia's earnings release to be a negative catalyst for the market either. Instead I expect bonds to be the canary in the coal mine. On Wednesday, immediately following a weak report that is widely foll0wed on the services sector from the Institute for Supply Management (ISM), we saw 30-year bond yields drop 10 basis points to 4.64%. That put them a third of a percentage point lower than January 14th, before Trump took office, the best sign we have that a flight to safety due to fear around the geopolitical and economic environment is outweighing the inflation risk. Where last week I thought upside surprises on economic data and inflation could drive this long bond's yield to 5%, I now think we can go lower as the uncertainty mounts. What that means for investors is threefold: - You can probably start to lengthen maturity. The risks of higher yields from inflation and growth have lessened so much relative to the risk of slowing growth and recession that you're going to want to lock in yields. How far out depends on your inflation risk tolerance.

- Those trades a lot of bond investors have been making, anticipating a further increase in long-maturity bond yields relative to shorter-maturity ones as the economy continues to grow, won't work. Suddenly we are in a place where people want safe assets and risk will get shunned.

- Where the threat to equities in the higher growth pre-Trump environment came from the higher yields demanded from the risk of higher inflation, in today's environment it's about this cycle's endgame with the popping of the AI bubble, something that isn't imminent just yet.

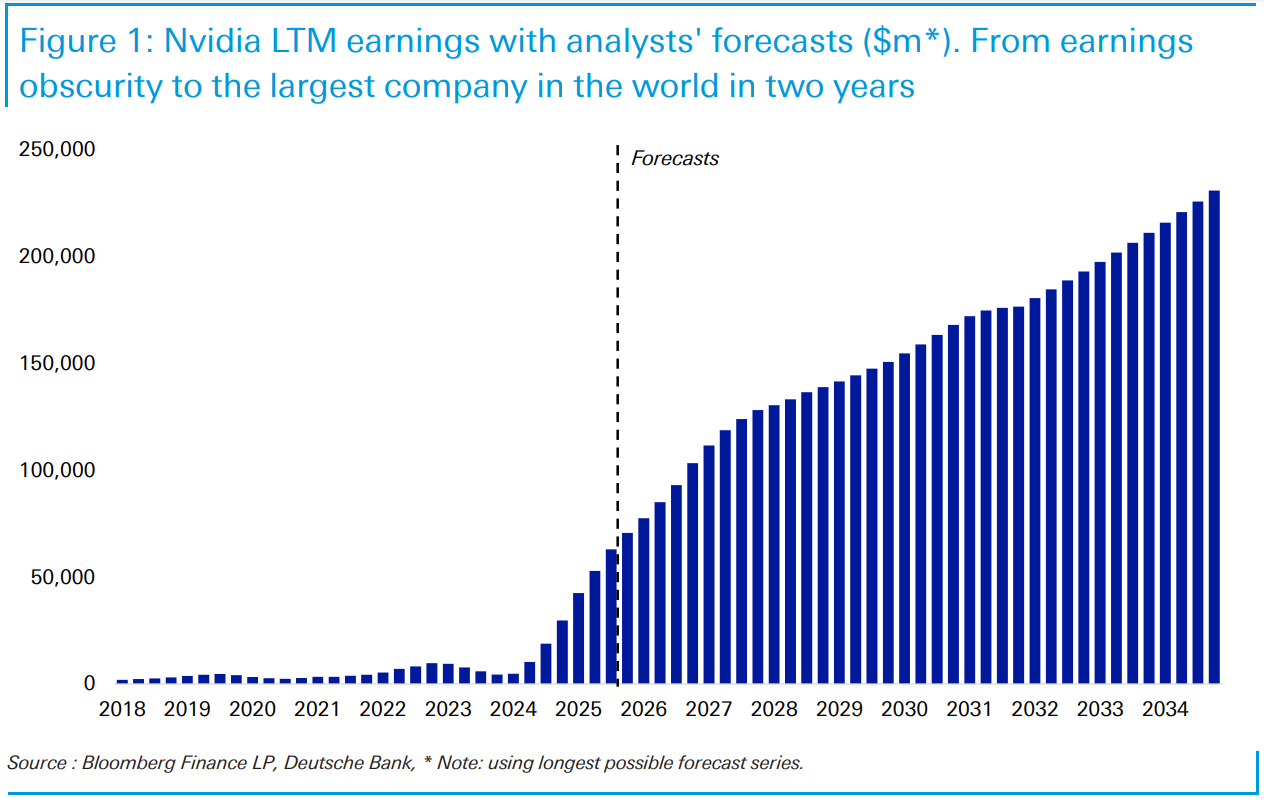

I haven't mentioned the word crisis just yet but... | In reviewing what I just told you, I recognize none of this is terrible for investors. A few weeks ago, I had gone from being bullish on equities because there was economic growth as far as the eyes could see to a bit more bearish than bullish. And while today's piece doesn't seem to be a marked change in viewpoint, it is. In the back of my mind is the sense that this bull market and economic cycle ends in crisis, not a garden variety recession. I've been thinking a lot about the assumptions embedded into a chart like the one Deutsche Bank made in late January on Nvidia's earnings expectations. And the conclusion I've come to is those assumptions are bonkers. Here's a company with a long corporate track record and earnings history, that due to a single theme, AI, is expected to have what looks like limitless growth potential for a decade to come. Look at that chart. It's only in 2024 that the numbers start upward. So one year. And yet, we're supposed to believe that this fantastic trajectory will continue to the tune of tripling Nvidia's earnings in 10 years? That's a bubble. And bubbles pop. I was at Yahoo when the last bubble popped in the early 2000s. All of the discounted cash flow models I wrote for the company showed that when you take expectations of 30% growth a year and turn them into a 20% decline in a single year, followed by stagnation or slow growth, it doesn't just hurt valuation. It crushes it. 80, 90% declines. This is what awaits us. You could make the argument that this is just one company. But it's not. It's the tip of the spear. Nvidia is simply the one company most emblematic of the whole investment climate we live in from the Mag 7 to crypto to private markets. It's all predicated on growth. And we'll keep dancing as long as there's growth. As Chuck Prince then-CEO of Citigroup put it in July 2007 though, "when the music stops, in terms of liquidity, things will be complicated. But as long as the music is playing, you've got to get up and dance. We're still dancing." |

No comments:

Post a Comment