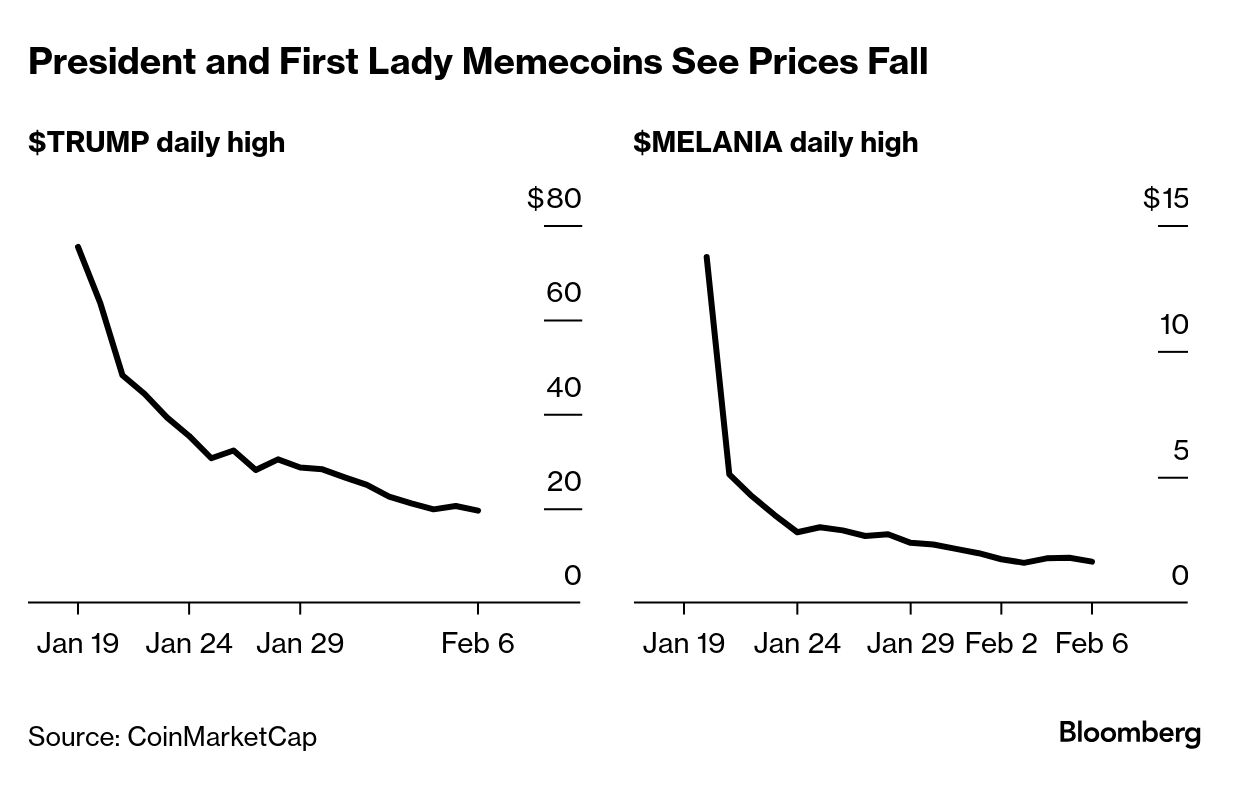

| Once again, crypto luminaries headed to Capitol Hill. Only this time, the political winds were at their back. Congressional hearings this week provided a stage for crypto executives to plead their cases that what the industry has dubbed "Operation Chokepoint 2.0" systemically debanked crypto companies and political adversaries during former President Joe Biden's administration. The crypto industry's disdain toward financial regulators during the Biden administration echos the "drain the swamp" rhetoric that has been a defining feature of President Donald Trump's approach to government.

In the build-up to one of this week's hearings, crypto exchange Coinbase Global Inc. shared a video on X accusing the FDIC of lying to the public about its perceived efforts to pressure banks to stop servicing crypto companies. The CEO and co-founder of Anchorage Digital, Nathan McCauley, testified to the US Senate Banking Committee that despite holding a federal charter, his business' banking partner unexpectedly closed the company's account in June 2023 and that dozens of potential replacements turned his business away. In tandem, President Trump has taken up the cause of perceived political debanking. During an appearance last month, he accused some big banks of not doing business with conservatives. A cache of letters released by the FDIC earlier this week, prompted by a court order, provided a view into the requests the regulator made of banks doing business, or seeking to do business, with crypto firms. To move ahead with crypto-asset activity, the FDIC asked banks to provide project implementation plans, risk assessments for crypto-related services, due diligence of third-party vendors and details surrounding the distribution of responsibilities and qualifications of those involved, among other things.  Source: @jkwade

In many cases, the FDIC requested that the banks delay crypto-related product launches or expansions until a review was completed. The incoming administration has signaled that it views this approach as too onerous. "For example, certain types of experimentation with new technologies should not require time-consuming engagements with examiners or extensive approval processes," acting chairman of the FDIC Travis Hill wrote in a statement.

Yet it's important to remember how we got here: The supervision of crypto-related activities picked up following the collapse of FTX exchange and several other crypto companies in 2022 and the failures of crypto-friendly banks Silvergate and Signature in March 2023. In the case of Signature, only 18% of the bank's deposits were from virtual-currency businesses, but the perception that it served the digital-asset industry combined with a high concentration of uninsured deposits were likely both at play when it was swept up in the panic following the liquidation of Silvergate and the failure of Silicon Valley Bank. "The job of banking regulators is to ensure banks don't fail by making unsafe and unsound decisions," American University law professor Hilary Allen said. "They had genuine concerns about the safety and soundness of banks catering to fintech and crypto industries and in many regards they were proven right in March 2023 when banks like Silvergate and Signature that were exposed to the crypto industry ended up failing."

The pendulum obviously has swung dramatically when it comes to Washington's regulatory treatment of crypto. Only time will tell if and when another crypto disaster causes it to swing back. |

No comments:

Post a Comment