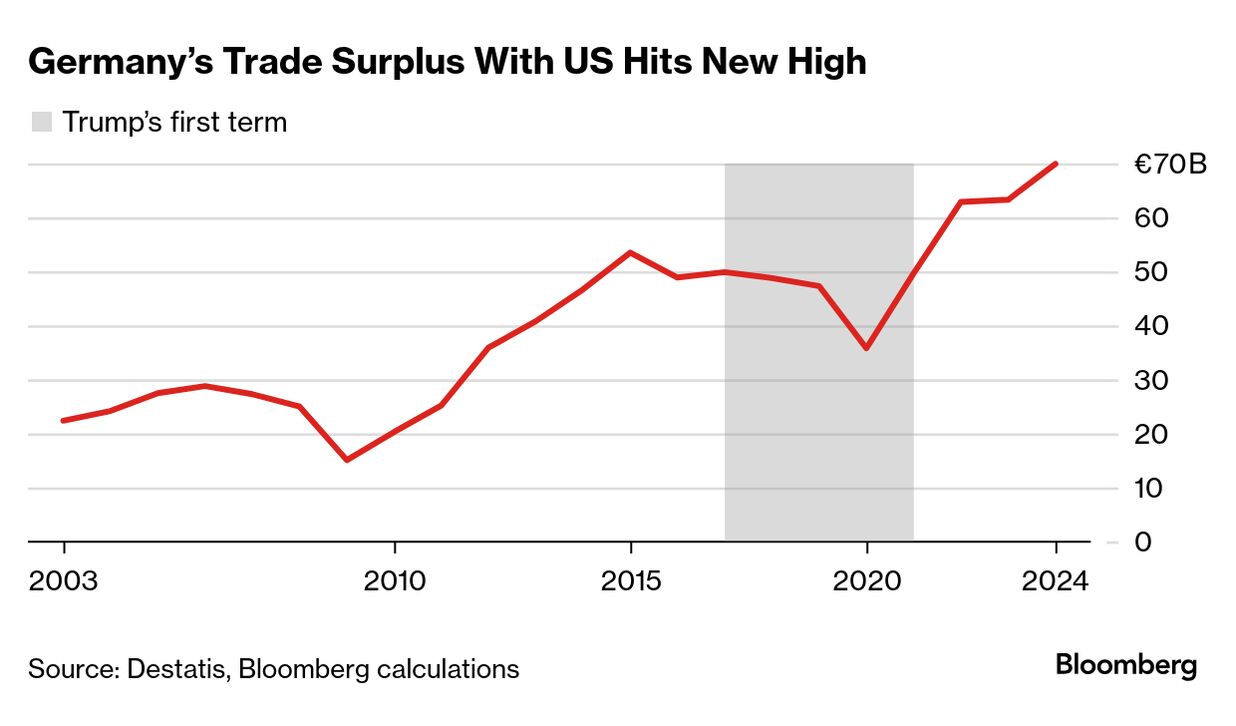

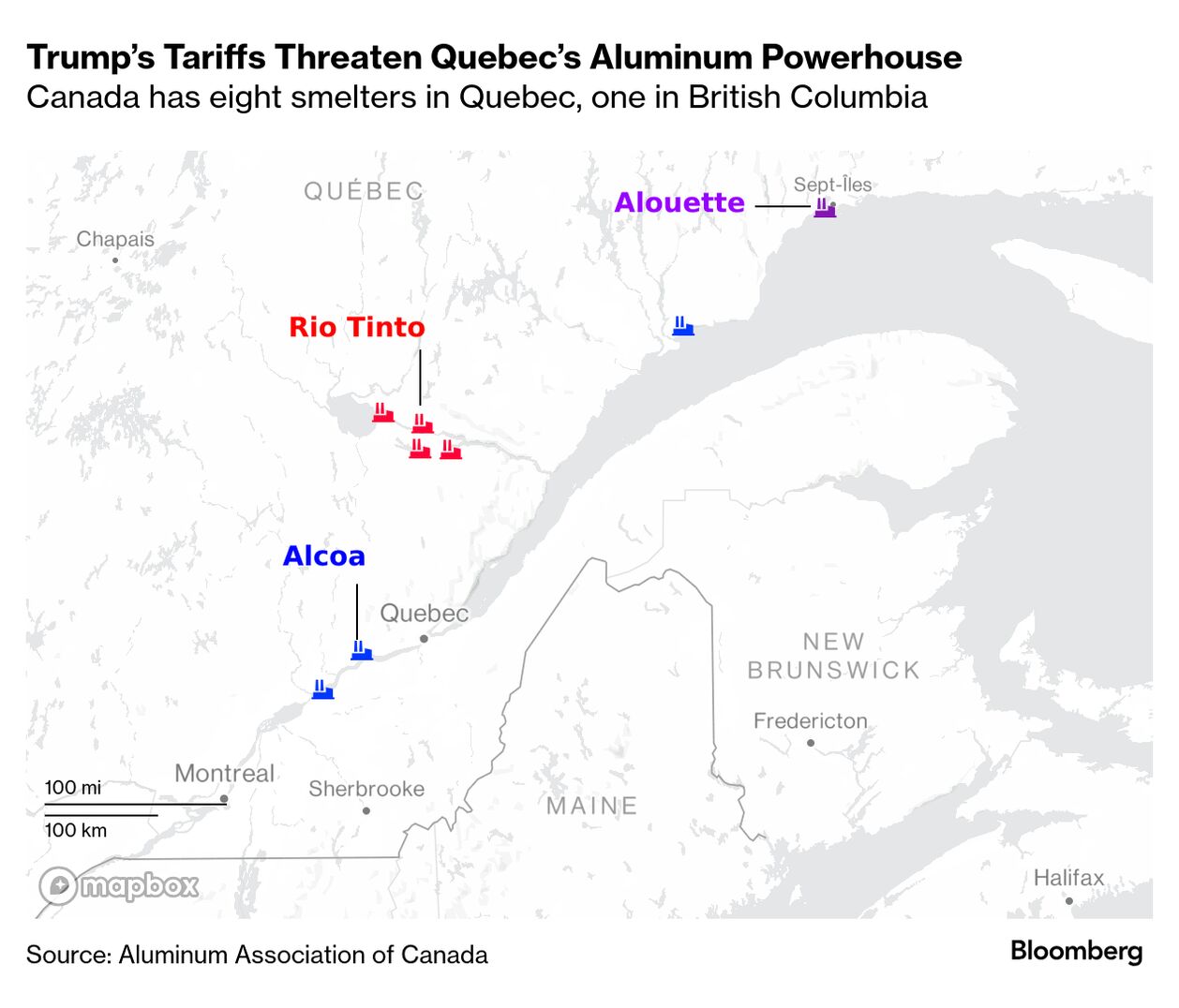

| No one in Hamburg is sure just what the impact of President Donald Trump's US tariffs will be on Germany's largest seaport. But they all agree that the outlook isn't great, as we report here this week. "For us, tariffs and anything that prevents global trade from flowing is of course not a good thing," said Rolf Habben Jansen, CEO of Hamburg-based container shipping line Hapag-Lloyd, whose company headquarters offer a view of the port's gantry cranes. The city-state of Hamburg grew up around its port from the 12th century, and the bustle of ships and container vessels on the Elbe River today is testament to its long dependence on international commerce. Yet that maritime industriousness also puts Hamburg on the front line of the trade war that Trump seems intent on instigating. Hamburg handles two-thirds of the goods that flow through Germany, an exporting powerhouse that is the world's No. 3 economy for all its present stutters. Like the country at large, the port city is steeling itself for what may be to come. German federal elections on Feb. 23 add to the uncertainty that's lapping at the port, which lies 100 kilometers from the North Sea. To be sure, there's no outright panic over Trump's announcement of 25% tariffs on steel and aluminum from March 12, nor his 10% blanket levies on China which triggered retaliatory measures from Beijing. The mood from Hamburg is more one of trepidation at the prospect that these are merely the opening salvoes of a wider conflict that hurts the European Union and drags down the global economy. Read More: EU Cars and Machinery Risk Falling Prey to Trump's Trade Tariffs The "optimistic" scenario is that trade flows are diverted, that international commerce adapts and finds a way through, "like water," said Hamburg Chamber of Commerce head Malte Heyne. But it's equally possible that overall trade goes down, spreading the pain, to Hamburg and elsewhere. Related Reading: —Alan Crawford in Berlin Click here for more of Bloomberg.com's most-read stories about trade, supply chains and shipping. |

No comments:

Post a Comment