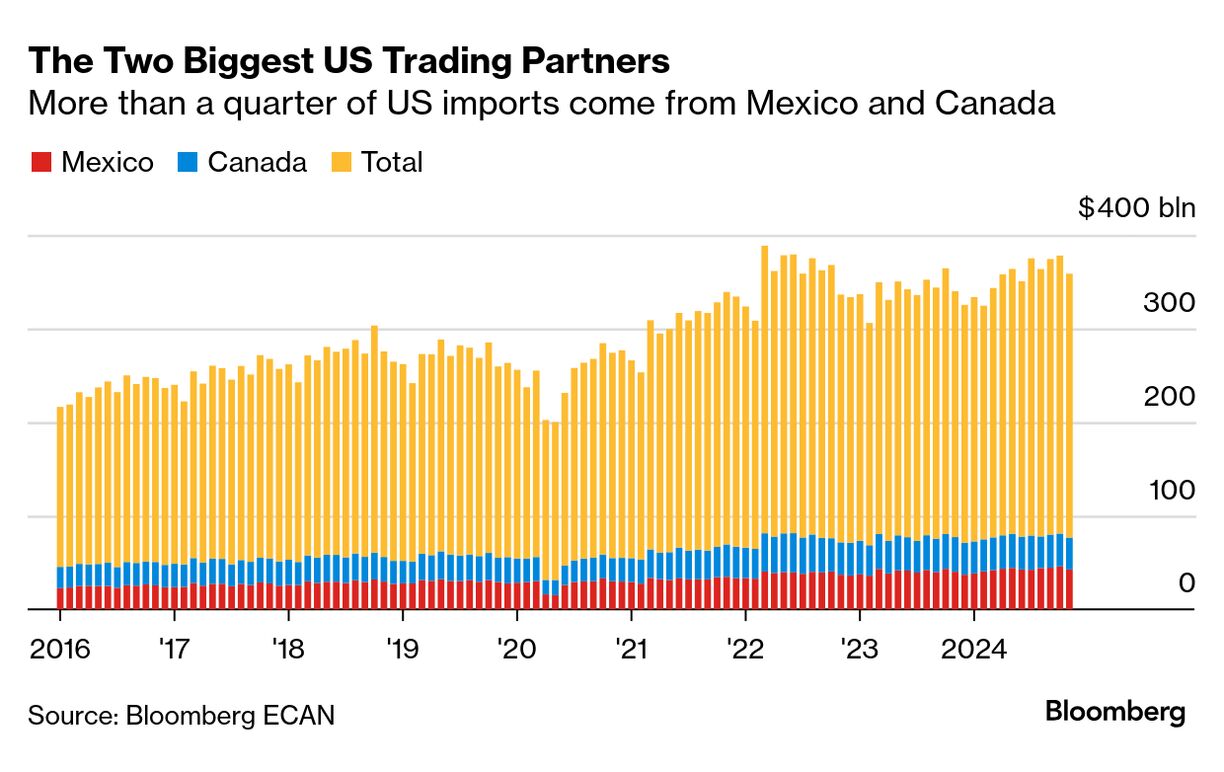

| Hello and happy Sunday. We're bringing you this special edition of Supply Lines after President Donald Trump announced that he's going ahead with 25% tariffs on Mexican and Canadian imports, and a 10% import tax on Chinese goods. The story continues to develop with retaliation and reaction heading into Monday. Here's the latest: New tariffs on goods from the US's largest trading partners — Mexico, Canada and China — will take effect starting Tuesday under plans President Donald Trump announced on Saturday. Officials in Ottawa and Mexico City signaled they'll retaliate against their 25% tariffs. China pledged a legal fight at the WTO against a 10% levy. There's little time for talks to minimize the fallout from a trade war. The market reaction will be swift when stocks, bonds and currencies start trading in Asia early Monday. (Follow all the news on our live blog.) Meanwhile, economists are racing to revise growth and inflation forecasts. Trump's move adds fresh headwinds to the outlook for global growth, for profits of companies suddenly facing higher import taxes and for financial markets adjusting to new trade flows. Paul Ashworth, chief North American economist with Capital Economics, called it "just the first strike in what could become a very destructive global trade war." Responses from industry are pouring in: - The US aluminum industry called on Trump to exempt Canadian imports of the raw metal

- MEMA, which represents vehicle suppliers across North America, expressed "profound concern" about tariffs

- Jake Colvin, president of the National Foreign Trade Council, urged the USMCA partners to "intensify their discussions to deescalate the situation and quickly find a path forward to rescind these tariffs and avoid retaliation"

China, meanwhile, is probably breathing a sigh of relief with just a 10% tariff, according to Josh Lipsky, senior director of the Atlantic Council's GeoEconomics Center. Currency Cushion "Beijing has a trick up its sleeve: currency devaluation," Lipsky wrote in an online post over the weekend. "Watch to see how the yuan moves this week. It's likely that most of this increase can be absorbed through exchange rates — and that's one reason why Beijing's rhetoric will be sharp but its economic retaliation will potentially be more muted." Plenty of uncertainty remains. How long might tariffs stay in place? How generous will the Trump administration be in granting requests for exclusions this time around? Will consumers empty store shelves of items ranging from avocados to lobster? Is Europe next? Among the other big unknowns: whether the global trading system — which has weathered multiple supply shocks over the past eight years — can withstand the disruptions of a new one. Because the uncertainty, based on some anecdotal information, is only mounting: Full Coverage: Click here to read the White House's executive order signed Saturday. |

No comments:

Post a Comment