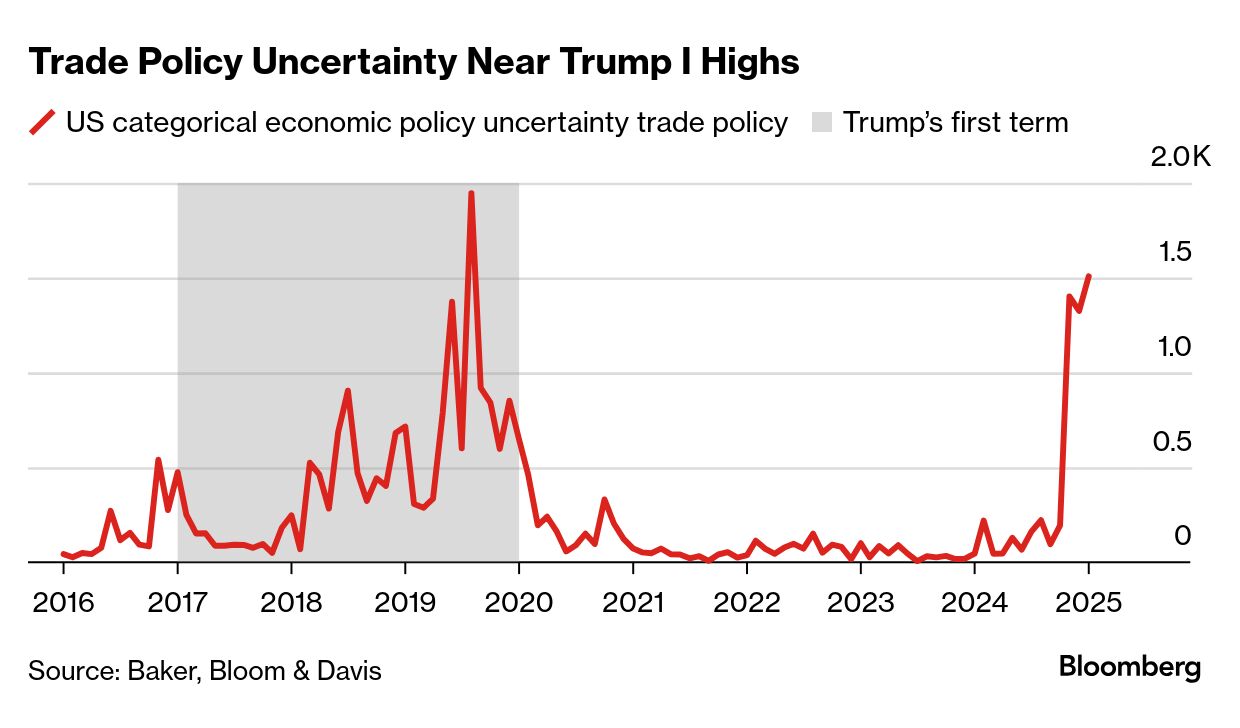

| India isn't in Donald Trump's sights when it comes to tariffs in the way Canada, Mexico and China have been recently, but few countries have moved as quickly to placate the new US president anyway. In a matter of weeks, Prime Minister Narendra Modi has handed Trump a series of concessions on core Trump issues from trade to migration. The latest came over the weekend when India overhauled its own restrictive tariff regime to cut a wide range of duties — including those on large-engine motorcycles like those made by Harley-Davidson, an iconic American export that Trump has long said gets unfair treatment in India. Read More: Modi's Trump Strategy Sees Quick Concessions to Avoid Trade War Modi has also agreed to take back thousands of its undocumented migrants, and offered reassurances it has no intention of backing away from the US dollar as a trade currency. India has much to lose in a US trade war — from the trade and defense benefits it accrues as the US's preeminent partner in South Asia to its billions of dollars worth of US exports. White House Meeting Modi's concessions likely aren't going unnoticed in Washington: The Indian leader is already expected at the White House this month, set to make him one of the first foreign leaders to visit since Trump took office. After two weeks in office, Trump is starting to show his cards to the US's largest trading partners that he's threatened with tariffs for months. On Monday he shelved plans for broad 25% import taxes on Canada and Mexico, after pressuring Colombia the prior week with similar economic damage if it didn't comply with his wishes on migration. On Tuesday, Trump's call for 10% tariffs on Chinese imports did take effect, prompting a swift but measured response from Beijing that markets were starting to digest on Tuesday morning. - After Trump's latest head-spinning announcements, the one certainty with US tariffs is uncertainty. Just-released analysis from Bloomberg Economics showed that the surge in trade policy uncertainty following the election is itself a shock to the global economy. BE's new US model predicts that ongoing elevated uncertainty could knock almost 1% off domestic industrial production by May 2026.

Related Reading: —Dan Strumpf in New Delhi Click here for more of Bloomberg.com's most-read stories about trade, supply chains and shipping. |

No comments:

Post a Comment