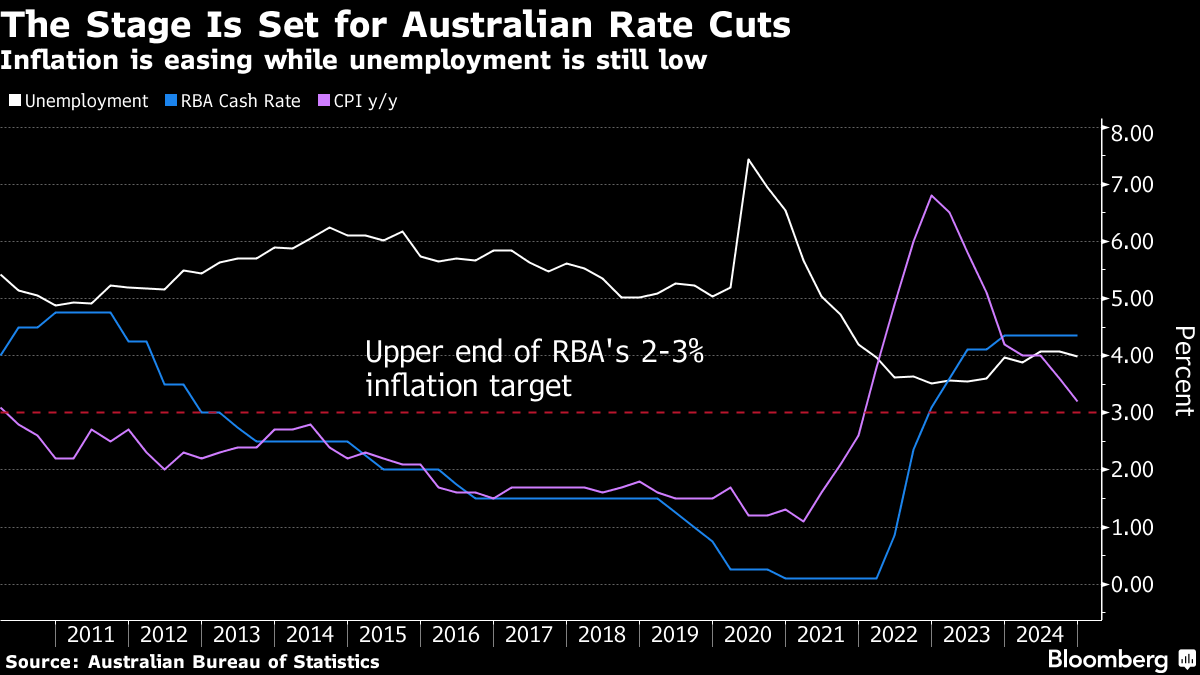

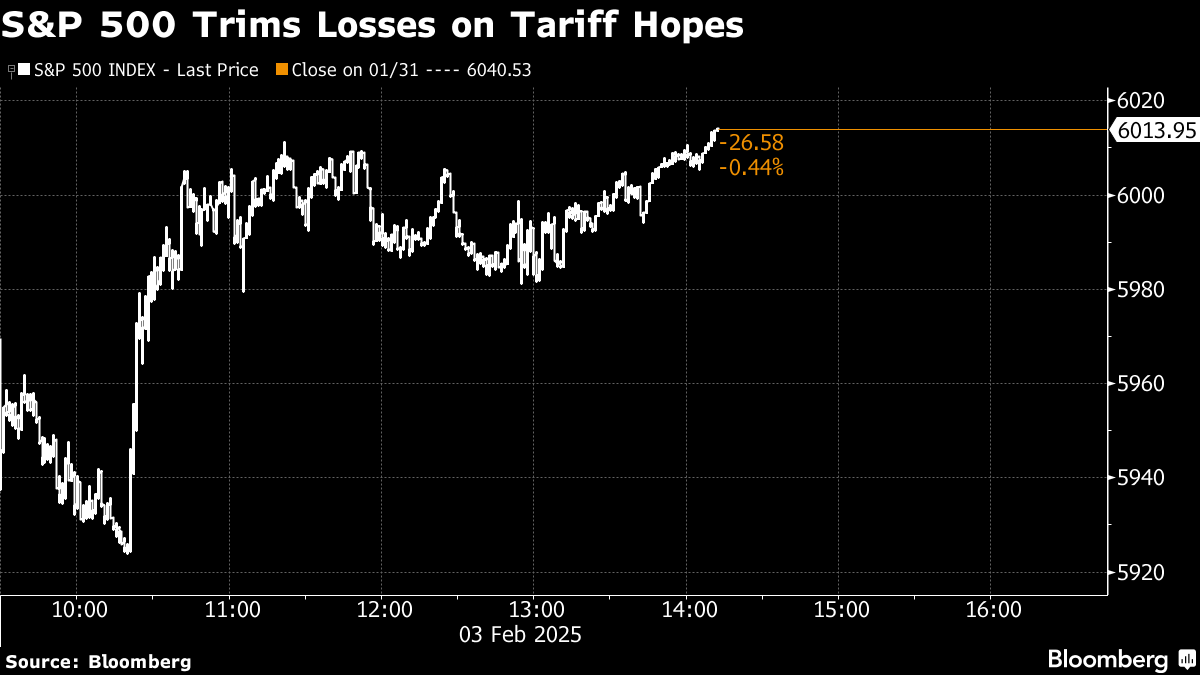

| Australian retail sales fell by much less than expected in December, likely reinforcing the Reserve Bank's confidence that the economy remains on a narrow path toward a soft landing. Sales slid 0.1% from the prior month, compared with a forecast 0.7% decline, data showed Monday. Economists and financial markets widely expect the central bank to finally embark on an easing cycle on Feb. 18. Barrenjoey has added a Hong Kong office to its growing international footprint as the Australian financial services firm boosts its offering in equity sales, research and trading. The new outpost brings the equity team closer to its Asian customer base, said Head of Equities Chris Williams. The move marks Barrenjoey's second office outside Australia, after opening operations in Abu Dhabi last year. Australia is expected to remain resilient to global trade fractures, according to economists at Citigroup Inc., even as US President Donald Trump unleashes tariffs on Canada, Mexico and China. Australia's political ties with Washington, and its direct exports to the US only accounting for 3% of total shipments in 2023 are among reasons Trump 2.0 will not be a "calamity," Citi's Australian economists Josh Williamson and Faraz Syed said in a note. Gina Rinehart, Australia's richest woman, increased her donations to the center-right Liberal National opposition by more than 200%, as the country's billionaires bet big on both major parties ahead of a national election that is due by May 17. Joining Rinehart in making donations to the center-left Labor Party and the Liberal National Coalition were pro-Trump billionaire Anthony Pratt and real estate billionaire Harry Triguboff. New Zealand Prime Minister Christopher Luxon said the government is considering changes to tax settings in this year's budget, including the corporate tax rate. Asked Tuesday if the government is going to make changes to the company tax rate, Luxon told Newstalk ZB radio: "We're open to looking at all our tax settings that encourages growth," adding this would be for the May budget. How stupid is Trump's trade war, asks Bloomberg Opinion's John Authers. Markets didn't want to believe that Trump really meant broad tariffs, because they're such a plainly bad idea, Authers writes. |

No comments:

Post a Comment