| When I sent the last update, things were rough—crypto experienced one of its biggest liquidation events and

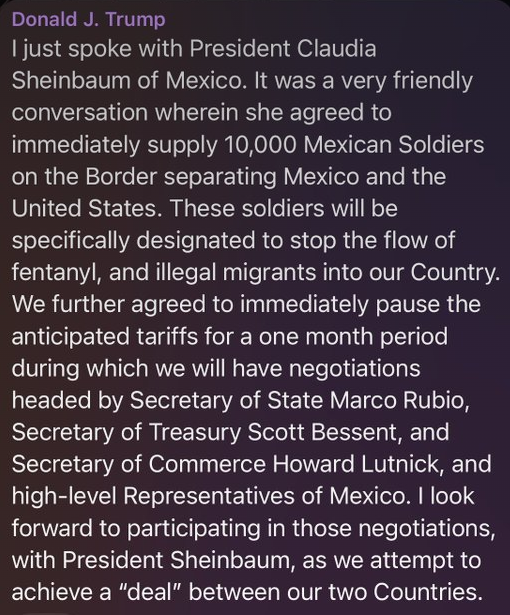

BTC was hovering around 90K. One thing about Trump is that he’s unpredictable, volatile, and has thick skin.

He can just turn around, declare, “We got the ‘best deal’,” close the matter, and move on.

Markets might then sharply recover.

In fact, on the same day that happened, BTC shot to over 100K.

I used to trade TradFi during Trump’s first term, and this is exactly the kind of thing you can expect from him.

A lot of the short-term fluctuations will be driven by headlines, so it’s best not to base your thesis solely on them.

but if you follow the actions and not words closely, you’ll see that a LOT is happening in favor of crypto.

MACRO

I know many of you love to dive into macro and intellectualize where everything is headed—it’s great for party conversation, I’m sure.

but the only two macro variables you really need to track are the US10Y and the USD.

Both are signaling a downward trend, which bodes well for risk-on assets like stocks and crypto.

you can see how the last few times when the positional system turned, how the markets reacted later.  USD  US10Y

Crypto

We had a massive breakdown on HTF—and typically, recoveries from such moves don’t happen overnight.

Markets need time to recover and move up, unless a major catalyst forces everyone to buy in.

In crypto, that could be the US announcing strategic reserves of seized BTC or even considering buying and adding to its reserves.

These events are hard to predict, but they’re easier to react to.

A weekly close above 106K for BTC would signal that the downtrend or chop is over.

In the short term, I think we might see a relief rally toward the 102K region, and then we can reevaluate from there. For those into short-term trades, Scalper remains the best way to play these moves.

In the last update, the scalper signal (both buy and later sell that came) played out pretty well.

see you in the next one. |

No comments:

Post a Comment