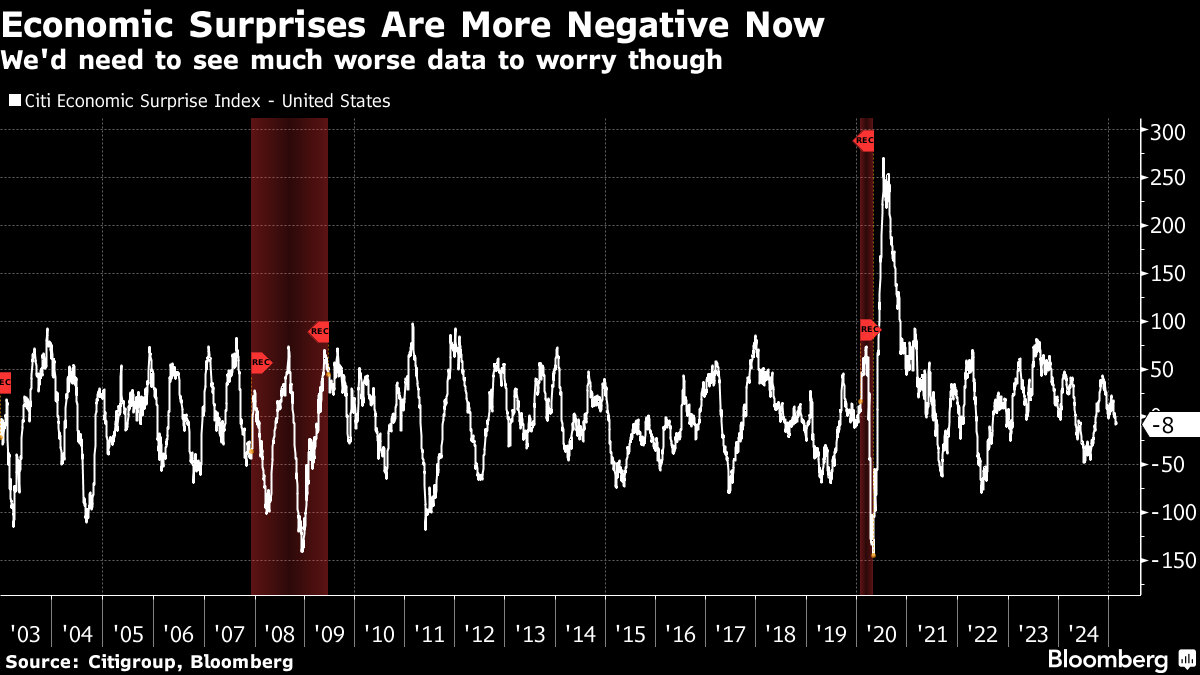

| The Roundhill Magnificent Seven ETF, which allows investors direct exposure just to the seven tech giants leading the market, traded down into official correction territory yesterday. It closed just over 10% lower than the Dec 17 all-time high, with most of the decline coming in the last week on basically no real Mag 7-specific news. What that tells us is that the individual investor bearishness we saw last week translated into losses as negative economic data and headlines hit the tape. You can see the data piece of this by looking at the Citi Economic Surprise Index, which has dipped into negative territory, telling us that we're now getting more negative surprises than positive ones. A litany of headlines about federal government job cuts and tariffs, both of which reduce consumer purchasing power, only added to the downbeat sentiment.  But how bad is it really? So far, not that bad. Yes, consumer confidence has cooled significantly, even showing recession fears. And jobless claims increased due to federal government layoffs. But the Conference Board consumer confidence data aren't "hard" economic figures, they just reflect sentiment. Furthermore, the jobless claims increase was mild. And that was probably the biggest piece of hard macro data the US saw in the last week. That all points to a potential growth slowdown, not yet to a recession, as the longer time series of the Citi Economic Surprise Index shows. Sure, we've reverted to the mean in terms of economic surprises (and even a bit below). But recessions happen when data deteriorate much further. You've got to stay fully invested to beat the index | To wit, last week I noted that, despite increased individual investor nerves, both the S&P 500 and the Nasdaq 100 have been at the top of the post-election trading channel since the inauguration. I take this as a sign that many investors are still holding out for the tax cuts and deregulation promises from President Trump to help markets take the next leg higher. They are looking for confirmation that the tariff, deportations and especially job cut policies from the Trump Administration won't do a lot of damage to the economy. We learned last night that those tax cuts can soon proceed. And markets have already started moving back up. If you're a fund manager measured against an index benchmark, it's hard to be bearish or raise lots of cash in those circumstances, even after a 10% fall. Until we see something more concretely ominous, it will pay to remain optimistic about the US equity market. |

No comments:

Post a Comment