| Welcome to Next Africa, a twice-weekly newsletter on where the continent stands now — and where it's headed. Sign up here to have it delivered to your email. The Democratic Republic of Congo halted all cobalt exports for at least four months, shaking up the market and rattling companies that mine, trade and process the metal. While President Felix Tshisekedi ordered his government to come up with measures to rein in oversupply a year ago, the ban still caught the industry off guard. The regulator responsible for imposing the restrictions said immediate action was needed because excessive production posed a threat to the country. "Exports must be aligned with world demand," said Patrick Luabeya, president of the Authority for the Regulation and Control of Strategic Mineral Substances' Markets.

A cobalt processing plant in Congo's Katanga province. Photographer: Lucien Kahozi/Bloomberg Cobalt is typically extracted as a byproduct when producing nickel or copper. Congo is by far the biggest supplier, churning out about three-quarters of the mineral used in electric-vehicle batteries. Production from the central African nation soared in recent years as China's CMOC Group – now responsible for more than 40% of global output – swiftly ramped up two large projects. That caused supply to outstrip demand and prices to nosedive. BMO Capital Markets analyst George Heppel expects the cost of cobalt to skyrocket over coming weeks. "The DRC has played its trump card," he said.

The intervention is a gamble, though. Congo risks accelerating a shift toward the use of EV batteries that don't contain cobalt, with manufactures already skittish about their heavy dependence on a single country for the metal. The Congolese government's actions also raise other questions. Can restrictions be effectively enforced? How much of a dent will the suspension of exports make in cobalt inventories held outside Congo? Will exporters simply ship their stockpiles and flood the market once the ban is lifted? And, will Congo's actions lift No. 2 producer Indonesia? The answers – and implications for a government desperately needing revenue in the midst of a losing battle against rebels in the east of the country – will become more evident over coming months. –William Clowes Key stories and opinion:

Congo Suspends Cobalt Exports for Four Months Amid Oversupply

World's Top Cobalt Miner Sees 2025 Output Approaching Record

Congo Wants to Pivot Away From China's Dominance Over Its Mining

China Cobalt Stocks Jump as Congo Exports Ban Sparks "Chaos"

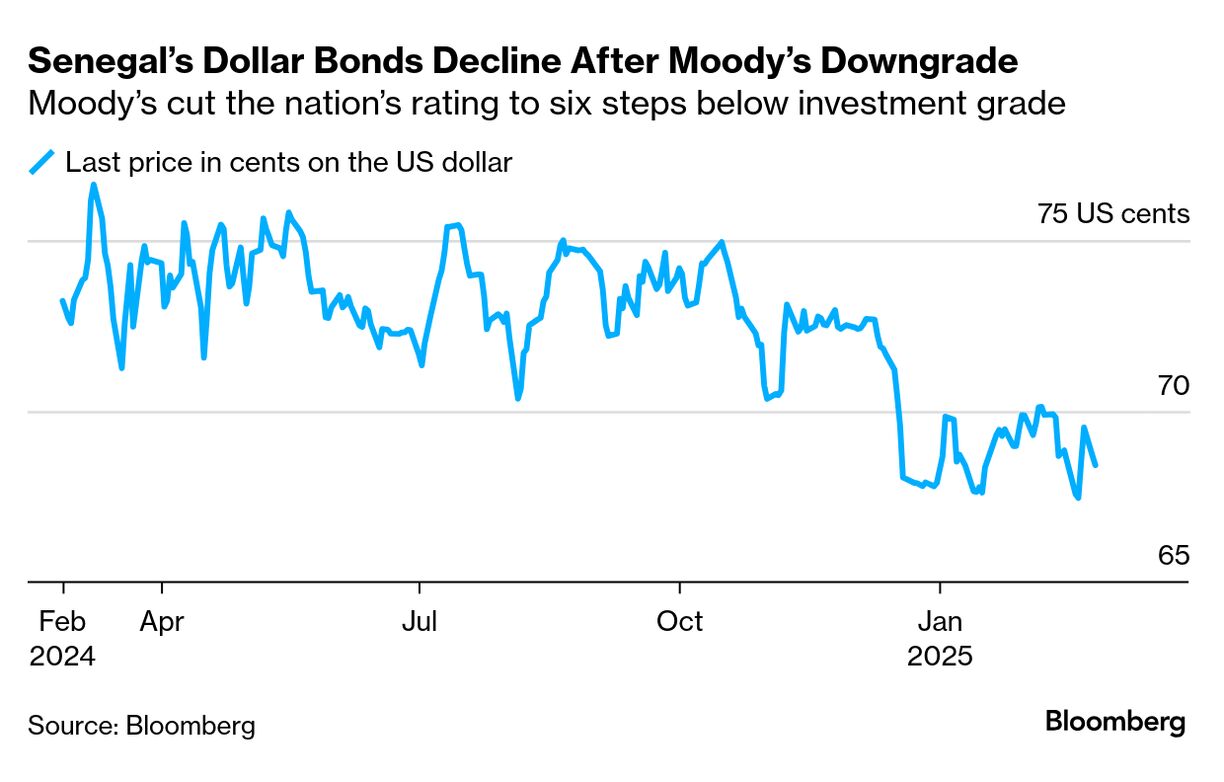

How Rebel Advances in Congo Threaten War With Rwanda: QuickTake The head of South Africa's central bank warned that the global economy may splinter under US President Donald Trump's policy onslaught. "We are seeing trade fragmentation, we are seeing economic fragmentation, and it just raises the level of uncertainty," Reserve Bank Governor Lesetja Kganyago said in an interview ahead of a Group of 20 meeting of finance chiefs in Cape Town. Trump has battered markets with an array of threatened tariffs on steel, aluminum, cars and other products, as well as on specific countries such as China.  WATCH: Kganyago speaks with Bloomberg's Jennifer Zabasajja about the impact of Trump's policies. A Nigerian court ordered that assets traced to the nation's former central bank governor be forfeited after determining they were "proceeds of unlawful activity." Judges in the commercial hub of Lagos ordered that Godwin Emefiele be stripped of more than $5 million and several properties, Nigeria's anti-corruption agency said. Emefiele has been separately charged with fraud and other offenses. He denies wrongdoing. Sudan's gold industry rebounded last year as the government took steps to bolster revenue amid a civil war, including signing mining deals with companies from China, Russia and Qatar. The North African nation produced 65 tons of bullion in 2024, generating some $1.6 billion in government revenue, data from the state-run Sudanese Mineral Resources Company show. The government lowered taxes and fees for small-scale miners and many of them entered the formal market, bolstering official production figures.  Workers crush ore at a small-scale gold milling operation outside Atbar in Sudan. Photographer: Simon Marks/Bloomberg BP's Greater Tortue Ahmeyim project is set to export its first liquefied natural gas cargo from fields offshore Senegal and Mauritania. Preparations for the shipment from the $4.8 billion development are underway, BP's partner Kosmos Energy said. An LNG tanker, the British Sponsor, signaled GTA as its destination on Monday and remained near the terminal, ship-tracking data showed. Kenya Airways is buying bigger cargo aircraft to cater for increased intra-African trade. The partly state-owned airline added two Boeing 737-300s with 44 tons of capacity to its fleet last year and is planning to get even bigger aircraft, Dick Murianki, its director of cargo, said in an interview. The carrier reported its first-half profit in a decade in 2024 and its shares began trading again in January after being suspended for almost five years.  Kenya Airways planes at the Jomo Kenyatta International Airport in Nairobi. Photographer: Patrick Meinhardt/Bloomberg Zimbabwe's market regulator is seeking clarity from the central bank on new rules that require companies to report their financial statements in the nation's gold-backed currency. Governor John Mushayavanhu this month ordered firms listed on the stock exchange to immediately adopt the ZiG for financial-disclosure purposes. "This requirement is consistent with the increase in the number and value of transactions settled in ZiG since its introduction on April 5," he said. The local currency is used in 30% of all transactions in the country, with the remainder done in US dollars. Thank you for your responses to our weekly Next Africa Quiz and congratulations to Sayen Gohil who correctly identified Niger as the country where the military junta decided to extend its rule until at least 2030. Senegal's dollar bonds fell after Moody's Investors Service downgraded its sovereign credit ratings further into junk territory. The West African nation's eurobonds are among the worst performers in emerging markets this month. Moody's lowered the long-term foreign-currency rating by two notches, citing Senegal's weaker public finances following investigations by auditors. Thanks for reading. We'll be back in your inbox with the next edition on Friday. Send any feedback to mcohen21@bloomberg.net. |

No comments:

Post a Comment