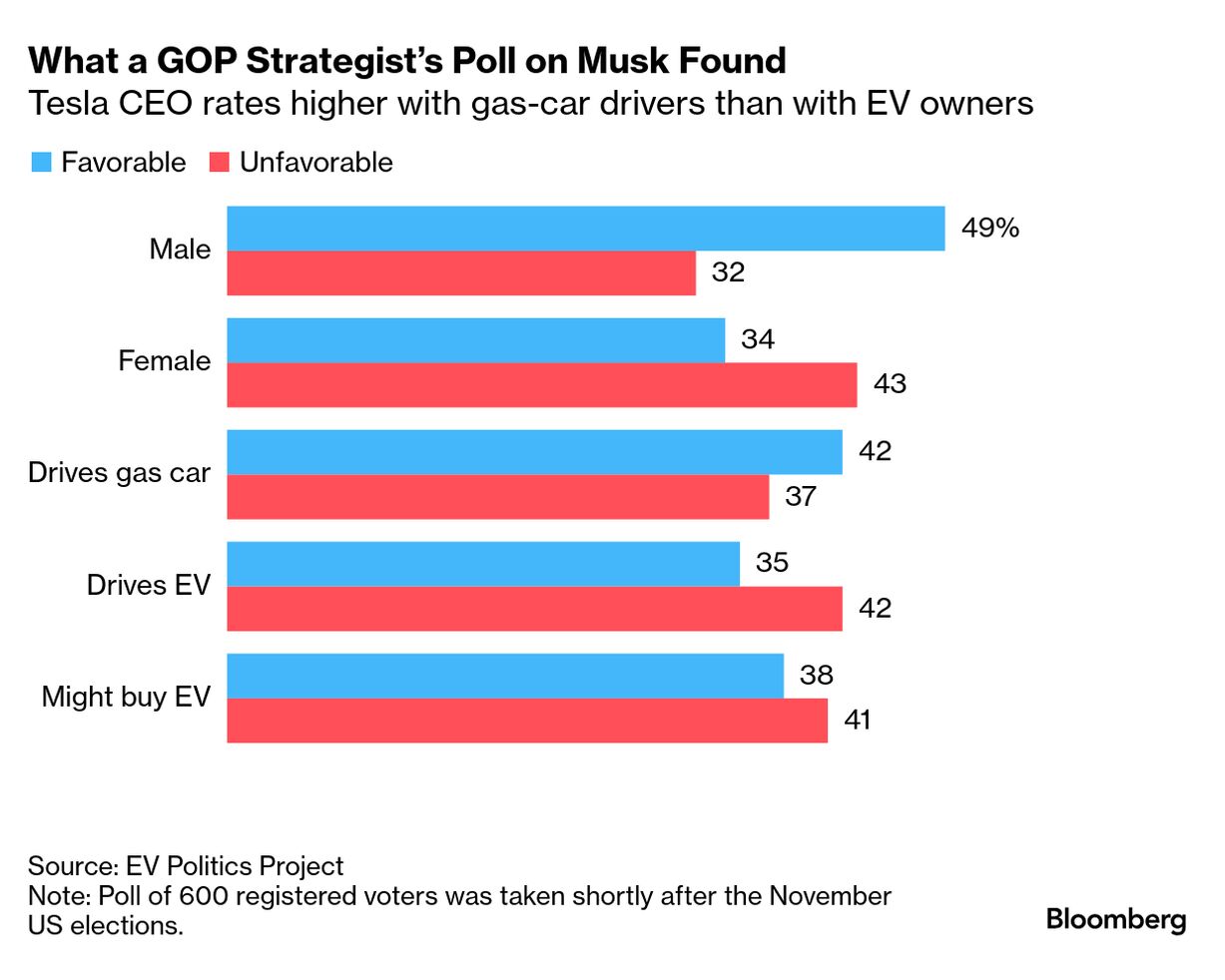

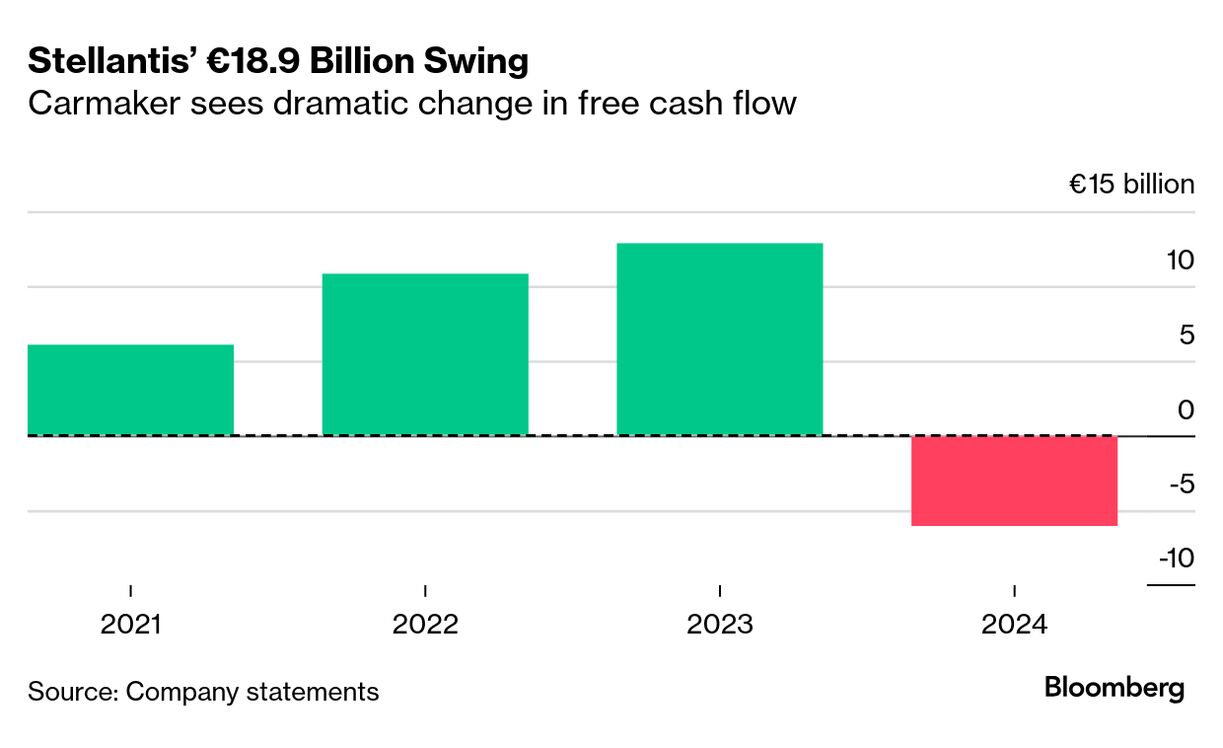

| Thanks for reading Hyperdrive, Bloomberg's newsletter on the future of the auto world. Read today's featured story in full online here. Tae Helton, a car aficionado who lives minutes from Tesla Inc.'s flagship California factory, bought one Tesla for the family fleet and nearly purchased a second one last year. After Elon Musk made gestures resembling a Nazi salute at an inauguration event for President Donald Trump last month, he wants nothing to do with the brand. "The pride and the good feeling I had driving in it is gone for me," Helton said of the Model 3 he's driven only around 2,500 miles. The politically moderate 49-year-old plans to pay off his car loan early and trade in the sedan before year-end.  Tae Helton with the Tesla Model 3 he plans to trade in Photographer: Mike Kai Chen/Bloomberg Helton has company among Tesla customers and consumers. The EV maker's sales fell 45% across Europe in January, following its first annual decline in global deliveries in over a decade. The company is showing particular signs of strain in places where its CEO is inserting himself in politics in ways that run counter to Tesla's stated mission and values. In California, Tesla sales fell 12% last year as Musk attacked leaders of a state that played a pivotal role in the carmaker surviving its tumultuous early years and becoming one of the world's most valuable companies. In Germany — where registrations plummeted 41% last year and 59% in January — the billionaire emphatically supports a far-right party that denies the harm of carbon dioxide emissions. And in the UK — now Europe's biggest electric-vehicle market — Musk has aligned with politicians who want net zero targets scrapped and have cast policies aimed at boosting EV adoption as a "war on drivers." "Tesla's biggest challenge in 2025 isn't technology — it's perception," says Jacob Falkencrone, global head of investment strategy at Saxo, the Danish bank with more than €105 billion in client assets. "Elon Musk's political baggage is now weighing on sales, brand loyalty and investor confidence."  An anti-Elon Musk sticker at a Tesla store in San Francisco. Photographer: Mike Kai Chen/Bloomberg Musk's polarizing behavior is nothing new, nor are indications that many of his customers have soured on him. In 2023, Bloomberg News surveyed more than 5,000 Tesla owners, and sentiment on the CEO took the biggest plunge among all the topics consumers had been asked about four years earlier. But the backlash against Musk has gone to another level this year. At Tesla's factory outside Berlin, activists projected footage of Musk's gesture onto the façade of the building in a stunt viewed millions of times on X, his platform formerly known as Twitter. Tesla showrooms have been vandalized in the Netherlands, Colorado, Oregon and Washington. Weekend protests have been staged at dozens of the company's stores across the US. "I don't know if there's ever been a greater destruction of brand equity in this short amount of time," said Tom Price, a resident of Berkeley, California, who showed up to a demonstration in the city with a Don't Drive DOGE sign. "Tesla has become a four-wheel billboard for the immolation of our democracy."  Tom Price at the protest in Berkeley, California, on Feb 15. Photographer: Dana Hull Musk is polling poorly among Brits, Germans and Swedes, with a survey in the latter country also finding increasingly negative attitudes toward Tesla. Model Y registrations in Sweden fell 48% last month, while Model 3 sales dropped 31%. Pew Research found a majority of Americans view Musk unfavorably, while Quinnipiac University says a preponderance of voters think he has too much power to make decisions affecting the US. A Republican strategist advocating for bipartisan EV adoption in the country found Musk is now more popular with people who drive gas cars than he is with those driving electric. "I used to be adored by the left," Musk said during a joint interview with Trump by Fox News' Sean Hannity that aired last week. "Less so these days." Tesla management told investors last month to expect its vehicle business to return to growth this year, though they avoided offering specific figures. Three months earlier, Musk said he saw potential for a 20% to 30% sales jump. There are reasons to be optimistic Tesla can sell more cars this year, despite the slow start. Some of its early-year sales weakness is tied to changing over production lines for its most popular vehicle, the Model Y, which has been redesigned. Updating all four of the factories assembling the sport utility vehicle will result in several weeks of lost output this quarter, CFO Vaibhav Taneja said last month. Tesla also has told investors that more affordable models are on track to go into production starting in the first half of this year, though they've offered little detail about the vehicles. Helton, the Model 3 owner who was keen to buy cars built near his home in the Bay area — including by friends working at Tesla's factory — made tentative plans to purchase another one of the company's vehicles from the first test drive his family took last year. While he'd observed some "red flags" about Musk when he ordered the sedan in May, he wasn't inclined to hold it against the whole company. After Musk ratcheted up his political activities, the human resources professional grew reluctant to double-up on the Tesla brand. His family decided to lease a Hyundai Ioniq 5 instead. "I always felt like if my vote didn't impact what I was wanting, the other way I can vote is through the vote of my wallet, whether it's Tesla or anything else," Helton said. "I've been voting with my wallet lately." — By Kara Carlson Stellantis expects profitability to remain lackluster this year as the automaker struggles to revive flagging sales while searching for a new chief executive officer. The manufacturer is guiding for a mid-single digit adjusted operating income margin in 2025, compared with 5.5% last year. The forecast issued Wednesday is a far cry from the double-digit returns Stellantis was projecting in early 2024.  One of Saglev's luxury electric vehicles in Lagos. Photographer: Andrew Esiebo/Bloomberg On an untarred road in Nigeria's upmarket neighborhood of Victoria Island in Lagos, a modest-looking car dealership has been drawing attention. The showroom floor of Saglev, an independent electric vehicle dealer, showcases several car models unfamiliar names for most Nigerians — Voyah, Nammi and Mhero — all made by Chinese automaker Dongfeng Motor. After gasoline prices began to soar in 2023, EV proponents saw an opportunity to make inroads across Africa's most populated nation. There are now at least 10 dealerships offering two- and four-wheel EVs, mainly from Chinese makers. Efforts are underway to build up a nationwide EV charging infrastructure, and Saglev is even backing a domestic manufacturing facility to build zero-emissions vehicles. |

No comments:

Post a Comment