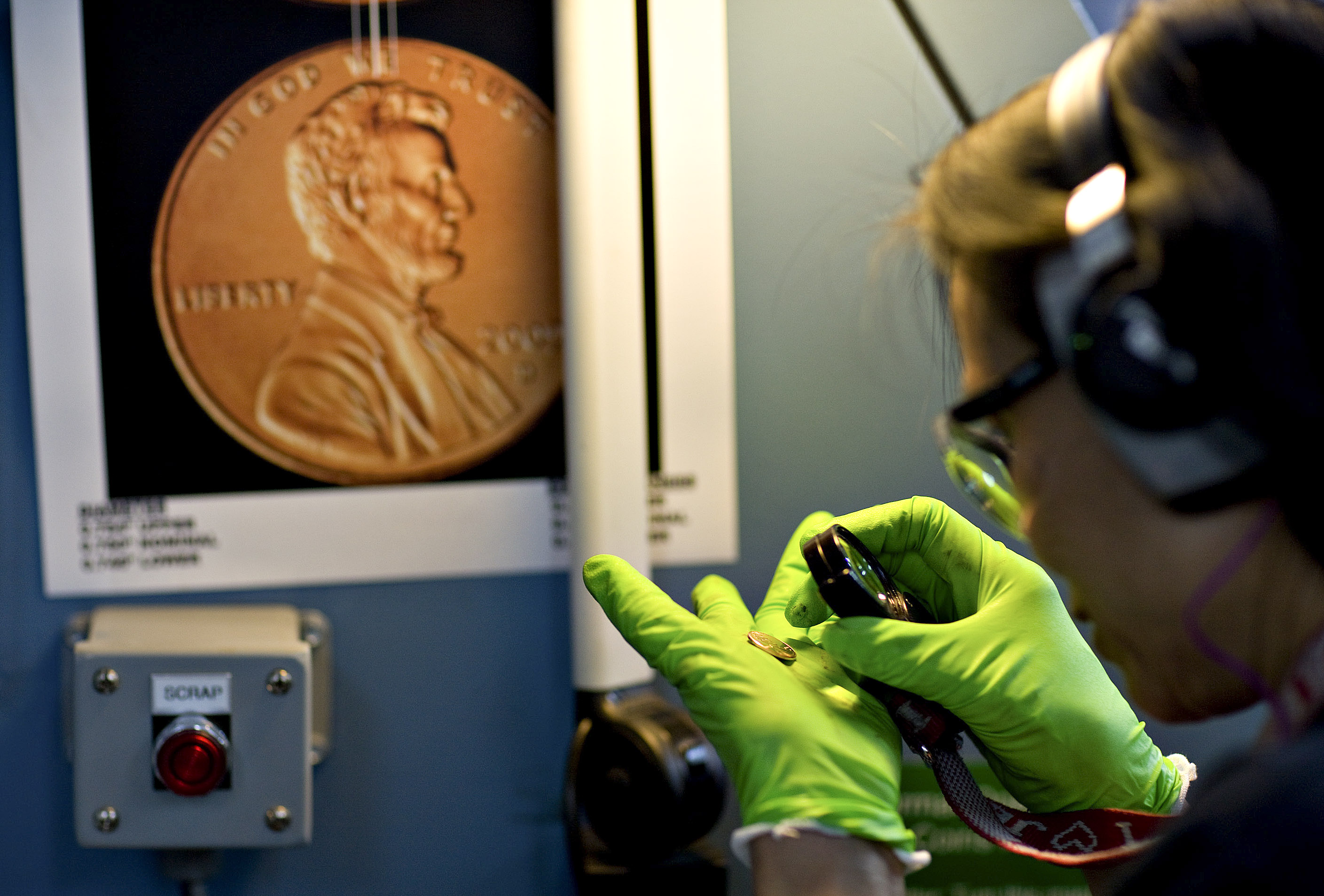

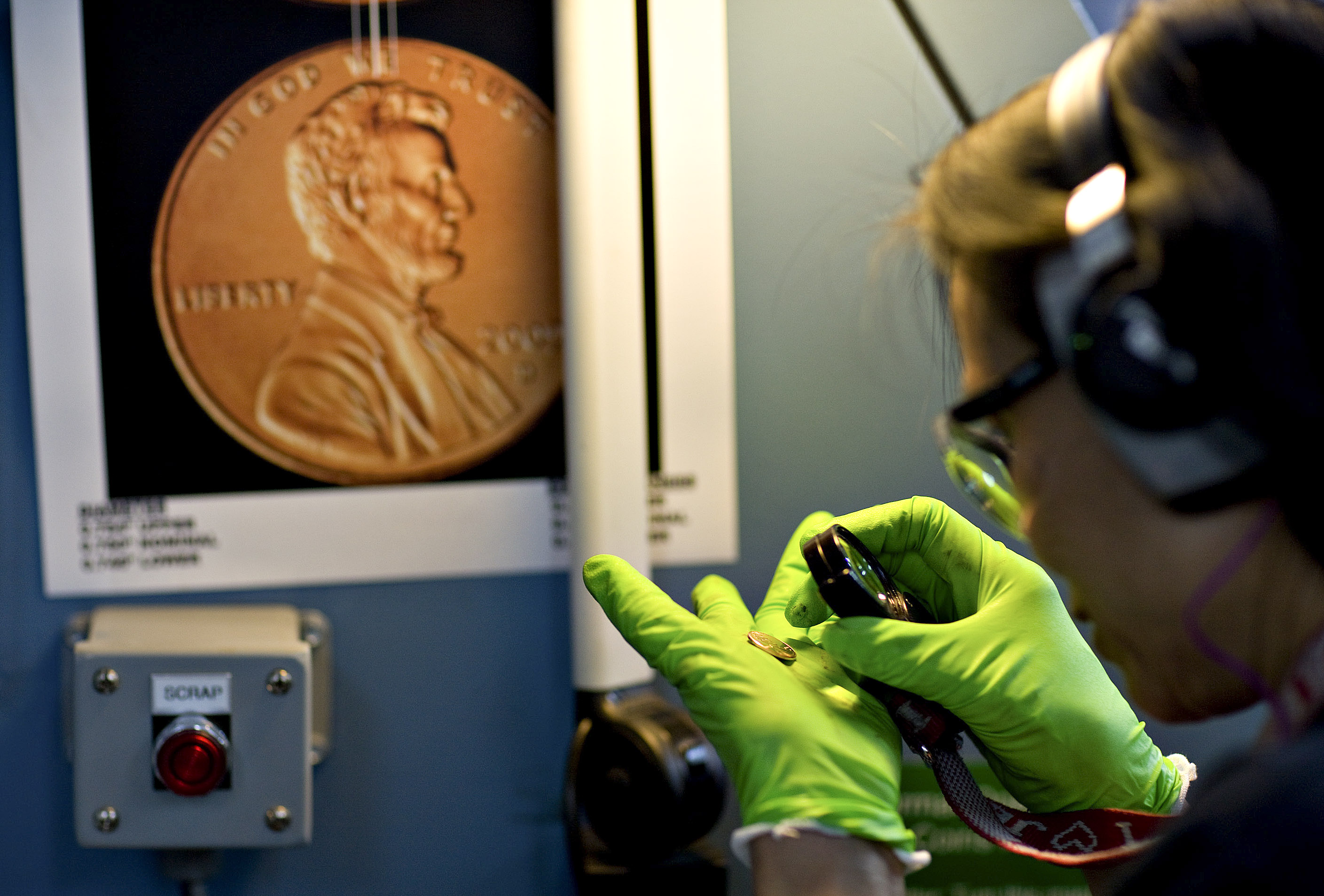

| It's a tough time to make financial sense of what's coming out of Washington. Time will tell how President Donald Trump's flurry of executive orders, policy pronouncements and social-media posts will affect money and markets. But this week it was refreshing to see one group remain calm when something important to them came under attack — penny collectors. I was reporting on the president's order to stop minting pennies, given the more than 3 cents it costs to produce the 1 cent coin. Other countries have gotten rid of their pennies, and both Democrats and Republicans have, for decades, signaled an openness to do the same. However, the subject is divisive and can get emotional, as is the case with many of Trump's diktats. A group called Americans for Common Cents was out this week defending the penny, claiming its end could be inflationary and counterproductive. Cutting the 1 cent coin, they say, could encourage merchants to round to multiples of five of 10, and encourage the use of the even more expensive nickel, which costs 14 cents to make. I thought penny super fans — people who love and collect the coin — might make similar points. "Keep the penny," I thought they'd say. "No matter the costs." But what happened instead was surprisingly touching — and a good reminder to keep your emotions in check when it comes to money. "There was this disappointment to see one of my favorite currently circulating coins being discontinued," said Richard Entingh of Grand Rapids, Michigan, referring to Trump's order on the penny. The 30 year old said it's fun to see items he collects in current use but understands monetary systems have to evolve. "I collect ancient Roman coins too, but I'm not out here pulling for the denarius or the sestertius to make a comeback either," he said. Change can be hard, especially when it comes to money. Already some have rushed to buy pennies, suspecting they might increase in value. But Entingh is keeping a level head, saying he won't be quick to add anything to his collection. And if he does, it would be a single roll of pennies in the last year they were minted. Nothing major. Speaking with a few other collectors, I was reminded of how money can be more than a number on a screen. The physical representation can be sentimental, harkening to when older family members were teaching us about the value of things. It can also come to represent and connect back to deep-seated beliefs about thrift and even things like self-control.  Photographer: Matthew Staver "I remember my grandpa counting out the dollars and cents for me after doing some yard work," Bill Chetney of Dallas told me. The 35 year old recalled looking for the tiny statue of Lincoln in the Memorial that features on the back of some coins. (I used to do that, too.) And he also told me about one of his earliest jobs, working as a teller for Bank of America. At the end of the day, Chetney had to "balance out his box" of all the different coins and bills in different denominations from customers. Sometimes he'd come across an Eisenhower or a Susan B. Anthony dollar coin, and managers would let staff swap them out as long as they replaced them with their more common counterparts. In the back of Chetney's mind he'd always think, "Maybe I could retire if I were just to find this one penny." (Some rare 1 cent coins are worth upwards of $1 million.) Like Entingh, though, Chetney thinks the penny's time is up. "It definitely hit me on an emotional level," he said about hearing the president's pronouncement. "But then on a rational level, I knew that the penny really did have to go." That's the point I'm trying to make here. Over the next four years, politicians are going say a lot of things that may make you feel emotional, either in a good way or a bad way. Many of these things may be specifically designed to elicit such responses from you. They will no doubt involve issues with much more at stake than a single cent. But the model of these penny super fans is pretty helpful: Pay attention. Let yourself feel what you're going to feel. Talk to people about it. But once you've done all that, take your emotions out of the calculus. Figure out what's actually happening and act accordingly. — Charlie Wells P.S. Send questions about your own financial dilemmas to bbgwealth@bloomberg.net. We may get expert answers for you, and feature your question and the answer in an upcoming newsletter. CVS shares climbed the most in more than 25 years. Fourth-quarter results signaled improved performance for a company whose insurance and drugstore businesses have been struggling. Lower-than-expected costs in the Aetna insurance unit helped drive CVS's profit above estimates, as the company spent a smaller percentage of premium revenue on medical expenses than analysts expected. Shares closed up 15% Wednesday in New York, their biggest gain since October 1999. The pound rose. Britain registered unexpected economic growth at the end of 2024. Gross domestic product climbed 0.1% in the fourth quarter, an acceleration from the flat performance in the third quarter. It was better than the 0.1% fall expected by economists and the Bank of England. The biggest gainers and losers on the Bloomberg Billionaires Index over the past week: Wang Chuan-Fu was the biggest gainer in percentage terms. The founder of BYD, a Chinese maker of electric cars, clocked a 20% gain, bringing his fortune to $25.6 billion. The majority of Wang's wealth is derived from a stake in BYD, which briefly rose to its highest intraday price on record this week. The spike reflected optimism the company will further challenge peers like Tesla through smart-driving strategy. Prajogo Pangestu lost the most in percentage terms. The founder of Barito Pacific, the largest petrochemical company in Indonesia, registered a 31% loss, which took his worth down to $30.6 billion. Pangestu's fortune is derived from his controlling stake in the company. He also owns 22% of Barito Renewables Energy, which is down about 34% this year. LA Home Destroyed in Palisades Fire Draws More Than 60 Offers  Photographer: Jill Connelly/Bloomberg On a cul-de-sac in Los Angeles' Pacific Palisades, what was once a four-bedroom wood-and-stucco house is now a pile of rubble except for two chimneys and a few brick columns. The property went on the market 10 days after flames ripped through the community last month, with an asking price of $999,000. More than five dozen offers later, it's now in escrow for "a good chunk more" than $1 million, according to the agent who listed the property. The demand for the site, which local real estate watchers say is one of the first to sell after the Palisades Fire, is an early indicator of the interest in properties that were devastated by the LA-area blazes. Even as the community reels from the inferno — and fire remains an ever-present risk — it's a prime area that, until recently, was considered a coastal paradise. Read the full story here. Hyatt to Buy Caribbean Resort Owner Playa for $2.6 Billion  Photographer: Playa Hyatt Hotels Corp. struck a deal to purchase Playa Hotels & Resorts NV for about $2.6 billion, expanding its reach into the all-inclusive resort market in countries including the Dominican Republic and Jamaica. Hyatt will pay $13.50 per share, the lodging company said Monday in a statement. Hyatt already owned 9.4% of Playa's outstanding shares. The deal expands Hyatt's portfolio of all-inclusive resorts, a part of the lodging market Hyatt has targeted with the 2021 acquisition of Apple Leisure Group and a subsequent joint venture with Grupo Piñero. Hyatt began investing in Playa in 2013. This week, we're looking for people who have financial questions they want answered by experts. We like addressing a broad range of topics — from questions about your portfolio to property to work and life, as long as money is involved in some way. We may include your questions in an upcoming newsletter. Some of our best journalism at Bloomberg Wealth comes from your own stories and we'd love to hear from you, your friends or clients. Please email bbgwealth@bloomberg.net if you'd like to get in touch. Like Bloomberg Wealth? Here are a few other newsletters we think you might enjoy: Explore all newsletters at Bloomberg.com. - Pursuits for a guide to the best in travel, eating, drinking, fashion, driving, and living well

- Work Shift for exclusive insight and data on the future of work

- Money Distilled for John Stepek's daily newsletter on what market moves mean for your money

- Economics Daily for what the changing landscape means for policymakers, investors and you

- CFO Briefing for what finance leaders need to know

|

No comments:

Post a Comment