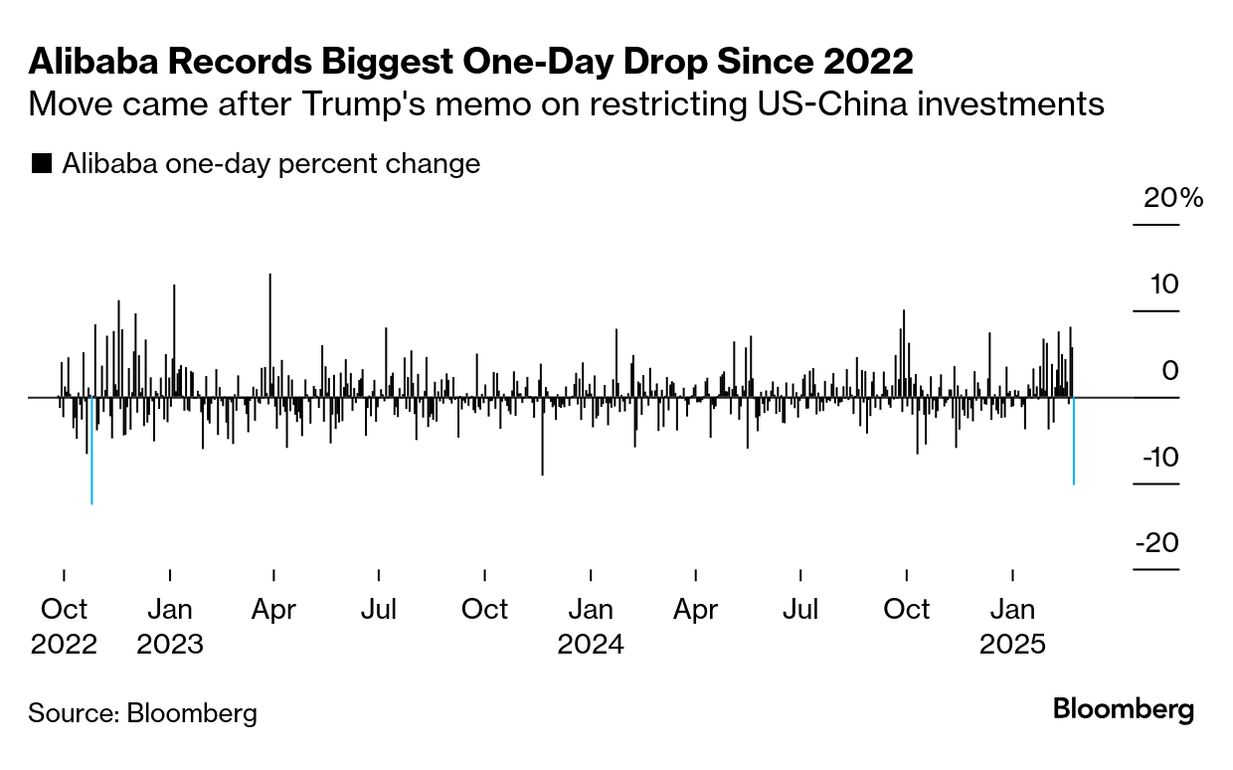

| Whisper it, but signs are starting to emerge across global financial markets that the weight of Donald Trump's multi-pronged policy agenda is becoming a bit too much to bear. Stocks sank today in Asia, while 10-year Treasury yields slipped to the lowest in more than two months. Bitcoin is also down. Behind the latest pickup in investor pessimism was Trump's declaration he will go ahead with tariffs on Canada and Mexico as well as ordering curbs on Chinese investment. Also not helping the mood is the deepening split with the US and its allies over Ukraine. Meantime, Elon Musk's Department of Government Efficiency continues its hunt for Washington jobs and spending to slash. There's signs of skepticism from markets (see below) and investors are trying to quantify what the purge means for the Federal Reserve's interest-rate path. Anna Wong of Bloomberg Economics estimates that DOGE delivering $100 billion of cuts would be enough to push down the consumer price index by 0.2 percentage point. A more-aggressive $600 billion in cuts would equate to 0.8 point. In either scenario, the Federal Reserve will then need to cut more than otherwise, she reckons. "Underestimating Elon = underpricing rate cuts in 2026," says Anna. Bank of America strategist Michael Hartnett said there's "suspicion" building about the S&P 500's trajectory as the risks mount. The benchmark is down only 2.6% from its latest record last week. A drop of another 6%, though, might prompt steps from the administration to counter the slide, Hartnett said in a Bloomberg Television interview today. Meantime, the US economy is starting to look iffy. An index from Citigroup shows data is undershooting forecasts by the most since September. A University of Michigan report last week showed consumers' long-term inflation expectations rising to the highest level in three decades, pushing overall sentiment down for another month. And Mark Cudmore of Bloomberg's Markets Live reports conversations with clients suggesting the narrative has shifted from wondering when the Trump administration will boost the economic outlook to worrying it's starting to damage the economy. So, what's next? The Dallas Fed publishes services data later today, while Nvidia's earnings report on Wednesday takes on even more significance. — Simon Kennedy |

No comments:

Post a Comment