| The euro rallied against the dollar, European stocks gained and oil dropped after President Donald Trump said he's kicking off Ukraine peace |

| |

| Markets Snapshot | | | | Market data as of 06:27 am EST. | View or Create your Watchlist | | | Market data may be delayed depending on provider agreements. | | |

Five things you need to know | |

- The euro rallied against the dollar, European stocks gained and oil dropped after President Donald Trump said he's kicking off Ukraine peace talks with Russia's Vladimir Putin. Today's Big Take looks at how much a peace might cost Europe.

- US inflation is back to the forefront of investor concerns after yesterday's surprisingly strong consumer price index. Producer prices are due at 8:30 a.m. in Washington.

- Honda and Nissan ended talks to combine, dashing hopes for a partnership that in theory would have created one of the world's biggest automakers. KKR is considering investing in Nissan, which needs a lifeline given its weak financial position.

- Britain's economy unexpectedly grew at the end of 2024. The pound strengthened, though stocks fell after disappointing earnings from Barclays, Unilever and British American Tobacco.

- Apple's iPhones will use Alibaba's AI technology in China. A local partner could help revive iPhone sales in China, which have suffered as rivals move ahead with AI-enabled smartphones. Alibaba shares are soaring this year on AI optimism.

| |

| |

| The euro's rally on the prospect of Ukraine peace talks is an impressive demonstration of the discount on European assets since Russia's invasion almost three years ago. Given the long and complicated path ahead, the currency market reaction might be only a modest fraction of what actual peace would bring. Of course, monetary policy fundamentals argue for the dollar to strengthen and make a fresh run at parity with the euro. The hotter-than-expected US inflation report yesterday is evidence the Federal Reserve will be keeping its benchmark interest rate higher for longer, while the European Central Bank is still in rate-cutting mode as it tries to revive growth.

The ECB policy rate now is expected to be more than 2 percentage points below the Fed's in the coming year. At the same time, Trump is pursuing dollar-bullish policies. But those considerations have been shunted aside by hopes for peace, and traders are looking past the high price of any agreement for the moment. Bloomberg Economics estimates the military commitments required would likely cost $3.1 trillion over 10 years.

So while European stocks are bouncing today, some investors argue the investment case isn't convincing, especially given the region's lackluster economic growth. Plus, peace talks may stall given Putin's insistence Ukraine must remain militarily weak and politically isolated. All the same, the readiness of traders to respond so enthusiastically is laying out for Europe's leaders how much investors would welcome peace. —Garfield Reynolds | |

| | This is just a slice of our global markets coverage. To unlock every story and stay on top of the stocks you care about with unlimited watchlists, become a Bloomberg.com subscriber. | | | | | | |

| |

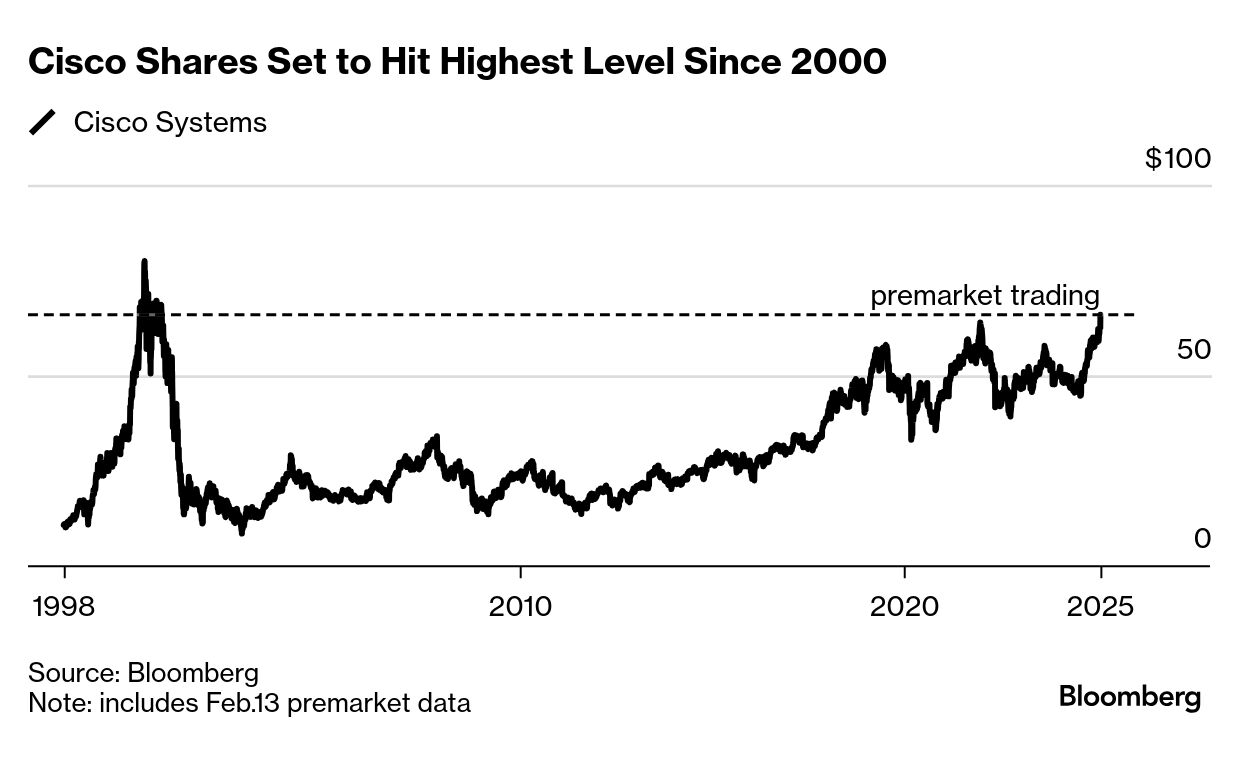

- Cisco jumps 6%. The networking-equipment company boosted its revenue guidance. The stock, a darling of the late 1990s internet bubble, still needs another 20% gain to surpass its March 2000 peak.

- Reddit falls 14% after reporting fewer-than-expected daily active users as Google made a change to its algorithm that hurt search traffic.

- Robinhood jumps 16% after reporting revenue that more than doubled.

- AppLovin rises 28%. The AI-powered advertisement platform gave an outlook above the analyst consensus. The stock, the biggest gainer in the Nasdaq 100 in 2024, was set to hit an all-time high if premarket gains hold.

- Nestle advances 6.7%, the most since 2009 as sales growth edged up from historically low levels.

- MGM Resorts rises 11% on earnings that topped estimates. —Subrat Patnaik

Will the Canadian dollar or Mexican peso suffer more from tariffs? Share your views and take our survey. | |

| |

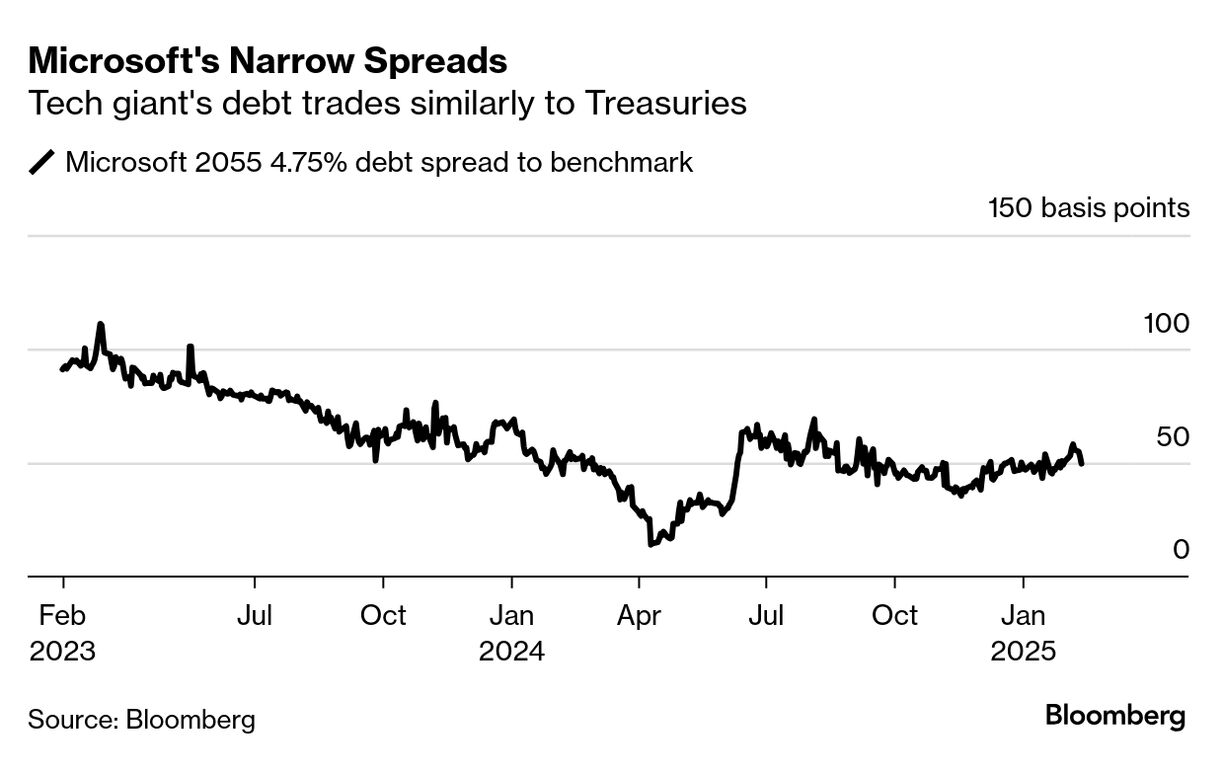

| Microsoft is bigger than most countries' whole stock markets and its bond rating would be the envy of many nations. Now a DoubleLine Capital portfolio manager is raising an uncomfortable question about the software maker and its fortress balance sheet: Is it safer than the US government's? The analysis by DoubleLine's Mariya Entina shines a light on the ascendancy of the corporate sector and the juggernaut status of US technology behemoths at a time of intense hand-wringing in Washington about the nation's deteriorating fiscal picture. "These growing fiscal challenges raise serious concerns about the creditworthiness of Uncle Sam," she wrote in a recent paper. "In contrast, top-rated corporate credits – like Microsoft – are backed by ample cash-generating assets and significant corporate treasury reserves." Thirty-year Microsoft bonds yield about 0.5 percentage point over 30-year Treasuries, data compiled by Bloomberg show. —Katie Greifeld | |

Word from Wall Street | | "It's obvious to be overweight US equities. US exceptionalism is very real when it comes to productivity growth, but in the markets, we have to say a lot of that is already in the price.'' | | Grace Peters Global head of investment strategy, JPMorgan Private Bank | | Click here for the Bloomberg Television interview. | | |

| |

| |

| |

| |

Enjoying Markets Daily? You might also like: | - Breaking News Alerts for the biggest stories from around the world, delivered to your inbox as they happen

- Odd Lots for Joe Weisenthal and Tracy Alloway's daily newsletter on the newest market crazes

- The Everything Risk for Ed Harrison's weekly take on what could upend markets

- Money Stuff for Bloomberg Opinion's Matt Levine's newsletter on all things Wall Street and finance

- Points of Return for Bloomberg Opinion's John Authers' daily dive into markets

Bloomberg.com subscribers have exclusive access to all of our premium newsletters. | |

| |

Like getting this newsletter? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and subscriber-only insights. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Markets Daily newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment